In the world of financial markets, there are various ways to measure and compare the performance of different stock segments. One interesting measure is the ratio of large caps to small caps, which provides valuable insights into the dynamics of the market. In this article, we will analyze the contrasting trends of large caps and small caps in the US and Indian markets and explore the factors behind these divergent patterns.

Understanding the Large Cap and Small Cap Ratio

To grasp the significance of the large cap to small cap ratio, we must first define these terms. The S&P 500, commonly referred to as S&P 500, is an index consisting of the 500 largest publicly traded companies listed on US stock exchanges. It serves as a benchmark for the overall performance of the US stock market. On the other hand, the Russell 2000 is an index that includes 2000 small cap stocks representing a broader spectrum of the US market.

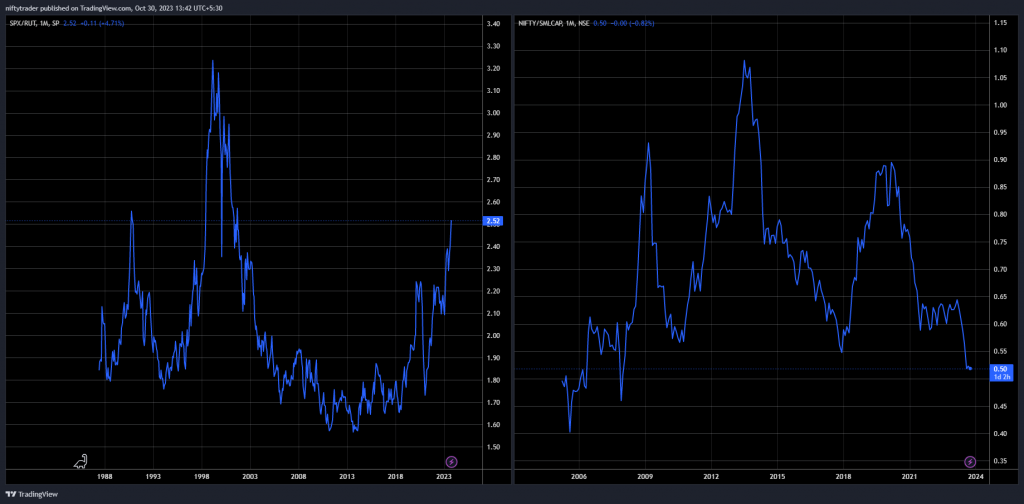

When we divide the S&P 500 by the Russell 2000, we obtain a ratio that reflects the relative performance of large caps and small caps. By tracking this ratio over time, we can observe how the dominance of one segment affects the other.

US Market: Large Caps Taking the Lead

Looking back at historical data, we find that in 1999 and 2000, small caps experienced a significant decline, while large caps were outperforming. This trend continued until around 2013 when the ratio reached a bottom and started to increase rapidly. Currently, the ratio stands at 2.52, approaching the highs observed in the 1990s.

This fascinating phenomenon in the US market indicates a clear disparity. Large caps are surging ahead while small caps are struggling to keep up. The question arises: why are large caps attracting more attention from investors?

One possible explanation lies in the flow of institutional money. It is likely that a considerable amount of institutional investment is shifting towards large caps in the US market. In contrast, smaller companies may not be receiving the same level of attention, possibly due to a decline in domestic investments.

Another factor that could be contributing to the preference for large caps is the valuation of these stocks. Large caps are already richly valued, making them less attractive to additional institutional investment. Simultaneously, domestic investors might not have sufficient surplus funds to invest in large caps, resulting in stagnation in this segment.

Indian Market: Small Caps Take the Stage

The scenario is strikingly different when we shift our focus to the Indian market. Since 2013, small caps in India have been performing well, while large caps have struggled relatively. However, it is important to note a significant event in recent history – the small cap crash of 2018. Small caps experienced a sharp decline, while large caps remained relatively stable until March 2020.

Following the COVID-19 outbreak, both large caps and small caps in India faced a downturn. However, unlike in the US market, small caps have been making a strong comeback. In fact, small caps in India have already surpassed the previous bottoms recorded in 2010 and 2018.

This contrasting pattern between the US and Indian markets suggests that different factors are at play in each market. In India, the primary driver of small cap growth seems to be domestic investments. Although institutional money has withdrawn a significant amount from the Indian market, domestic investors are pouring funds into small caps. This influx of domestic money into the small cap segment has propelled its performance.

The Impact of Growing Middle Class and Disposable Income

The distinct behaviour of the large cap vs. small cap segments in the US and Indian markets can be attributed to various factors, with the dynamics of the growing middle class being among the most influential. India, with its burgeoning middle class and increasing disposable income, is witnessing a shift in market behaviour. As the population’s purchasing power grows, more individuals have surplus funds to invest. This has led to a surge in domestic investments in small caps, driving their performance.

On the other hand, the US market appears to be experiencing a different dynamic. While institutional money may favour large caps, the absence of additional investment and a decline in domestic investments could be the reasons behind the underperformance of small caps.

It is fascinating to observe the contrasting polarities in the large cap vs. small cap segment between these two markets. As the US market leans towards large caps, the Indian market shows a clear preference for small caps.

If you have any questions, please write to support@weekendinvesting.com