Buy or Rent a Home: A Common Debate

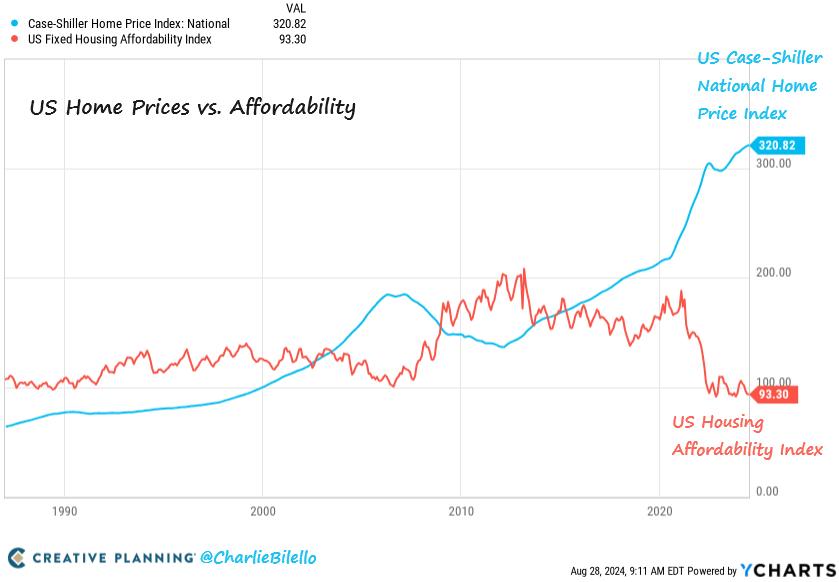

The debate between buying a home and renting one is something many people face. Some argue that renting is better, especially for those with jobs that require frequent relocation. However, when we look at housing affordability over time, the data tells a different story. In many countries, such as the US and UK, the gap between home prices and affordability has widened. While salaries may increase, they often only keep pace with inflation, not with rising home prices.

The Declining Affordability of Homes

Over the past few decades, the affordability of homes has continued to decrease. Your salary might rise from ₹50,000 to ₹1,00,000 or even more, but home prices are also rising at the same or faster rate. This means that as time passes, it may become more difficult to buy a house in your preferred location. Even though your income increases, your ability to purchase a home doesn’t improve as much as you might expect. This is a growing concern for those hoping to buy their first home.

Investing in Stocks vs. Buying a Home

Some people believe that investing in the stock market and buying a home later is a better option. While this approach may sound good, it comes with risks. Stock market returns can be unpredictable, and there may be periods of underperformance, especially when you need the funds for a home purchase. Additionally, stock picking requires knowledge and discipline. What happens if you lose your job and can’t invest regularly? Or if you are caught in a long bear market when you’re ready to buy a house?

Benefits of Buying a Home Early

A safer option could be to buy a home early in life, even if it’s small. Taking a home loan has its advantages, such as tax benefits and a forced savings structure. With a home loan, you must pay your EMI every month, creating a sense of financial discipline. In contrast, when investing in the stock market, you may feel tempted to hold back during market downturns or take money out when markets are high, leading to missed opportunities. The housing market offers stability, something the stock market cannot always guarantee.

A Balanced Approach to Investing

In recent times, many influencers and financial experts have advised against investing in homes or gold. However, there should be a balanced approach to building wealth. Especially in households with two incomes, one income could be dedicated to a home loan while the other is used for investments. This strategy ensures that you are growing both in real estate and other financial assets. While opinions on this matter may differ, having a well-rounded financial plan that includes real estate can provide security and long-term growth.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com