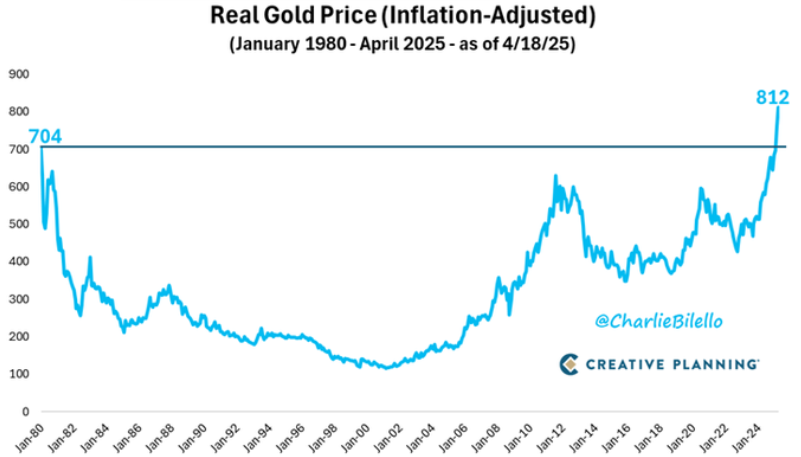

Looking at Gold Through the Lens of Inflation

Gold is often seen as a strong asset, especially during uncertain times. But when we look at its price over the last 45 years—from 1980 till today—and adjust it for inflation, the picture is surprising. In real terms, gold has barely moved. It may seem shocking, but inflation-adjusted charts show that gold is only about 10–12% higher than where it was in 1980. This means that despite the noise and excitement about rising gold prices, the actual growth isn’t as large as many think.

The 1980 Peak Was an Extreme

It’s also important to note that the 1980 price used for comparison came after a massive rally. That was a time of extreme economic conditions and panic buying of gold. So, yes, it may be a cherry-picked point. But even if we look from other peaks—like in 2011 or 2012—the inflation-adjusted gains are still very modest. Gold has gone up only about 20% in real terms since then. This shows that while gold has held its ground, it hasn’t exploded the way some believe.

The Journey of Gold Is Still Long

Looking ahead, the journey of gold is likely still very long. It may feel like prices have moved up a lot in the short term, but when we see the bigger picture, there is still room for more. Of course, short-term corrections can happen. Prices may dip slightly before moving up again. But overall, the trend remains strong, especially if economic or geopolitical uncertainties continue.

Gold as a Steady Portfolio Support

Gold is not about fast returns. It is about slow, steady support to your portfolio. That’s why it makes sense to maintain a good allocation. You don’t have to go all-in. If prices rise too much, reduce your allocation a bit. If prices fall, increase it again. This simple balancing act can help gold act as a strong pillar in your long-term financial planning.

Don’t Rush, Stay Patient

The key is patience. Just because gold prices seem high today doesn’t mean the journey is over. In real terms, gold has not even broken out meaningfully yet. So stay calm and let gold do its work quietly in your portfolio.on.

The Momentum Podcast

Ever lost money in the market and thought of quitting?

Meet Sudheer, a software engineer at Infosys who went from options losses and scams to investing ₹30K/month smartly through momentum strategies.

In this episode of the Momentum Podcast by Weekend Investing, Sudheer shares:

✅ Early mistakes & recovery

✅ How YouTube & smallcases reshaped his mindset

✅ Balancing equity, gold & market noise

✅ Insights from Andhra’s investing culture