The Relationship Between Gold and the US Dollar Index

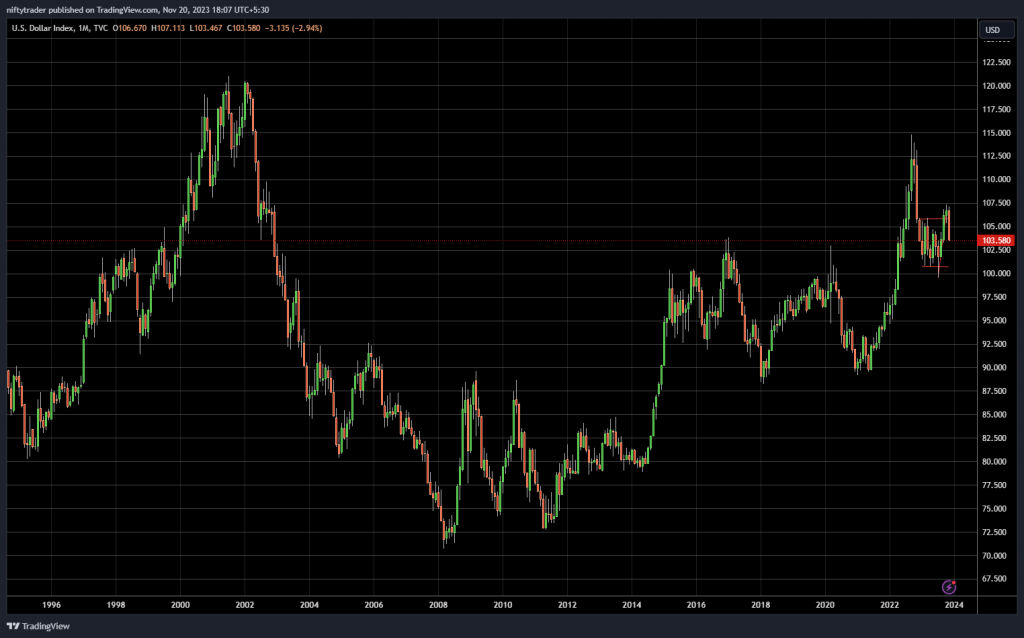

The US dollar index is a significant indicator of the strength or weakness of the US dollar when compared to a basket of six other currencies. When the US dollar index moves up, it suggests that the dollar is gaining strength against other currencies. On the other hand, when the index moves down, it means that the dollar is weakening in comparison to other currencies. Over the past few decades, there have been three major movements in the US dollar: a strengthening phase until 2001, a weakening phase from 2001 to 2008, and a strengthening phase from 2008 onwards.

Historically, there has been an inverse relationship between the US dollar index and the price of gold. As the US dollar strengthens, the price of gold tends to decrease, and when the US dollar weakens, gold prices tend to rise. This correlation is due to the fact that gold is seen as a safe haven asset and a universal store of value. Investors often turn to gold as a hedge against inflation and economic uncertainty.

However, in recent years, there has been an interesting deviation from this traditional relationship between gold and the US dollar index. Despite the US dollar index moving up, the price of gold has also been steadily rising. This suggests that the long-term relationship between gold and the US dollar index may be breaking down.

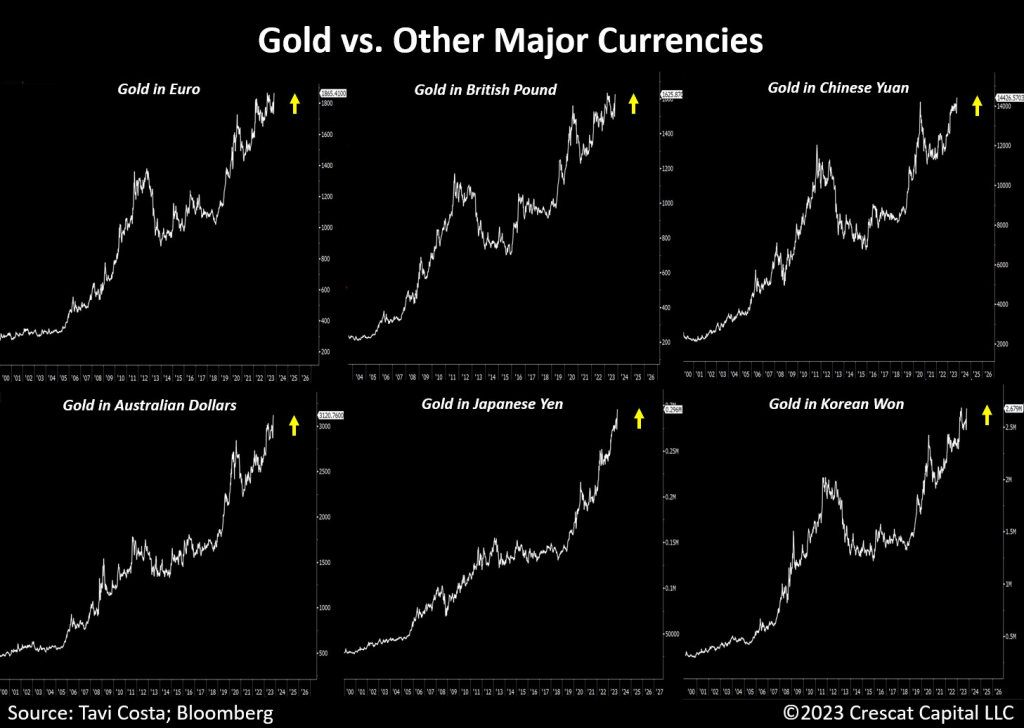

When we look at the performance of gold in various currencies, it becomes evident that gold is experiencing a breakout in almost all currencies. A chart by Tavi Costa from Crescat Capital shows the price of gold in euros, British pounds, Chinese yuan, Korean won, Japanese yen, Australian dollar, and Indian rupee. In each of these currencies, gold has been on the rise. This phenomenon cannot be ignored by the conventional media or financial pundits.

Gold’s performance in different currencies highlights its role as a hedge against currency devaluation and economic instability. While holding gold in US dollars may not provide substantial benefits, holding gold in currencies that may weaken against the US dollar can be an interesting opportunity to look at.

For example, individuals with assets denominated in Indian rupees may find gold to be an attractive addition to their portfolios. Since gold is internationally priced, it serves as a hedge against potential devaluation of the Indian currency. In countries like Venezuela, Argentina, Turkey, and Sri Lanka, where political or geopolitical factors have led to sharp currency devaluations, gold has proven to be a reliable asset.

Central banks around the world have also been accumulating gold in recent years. This suggests that they recognize the importance of gold as a safe store of value and a potential backing for their currencies. While the current fiat system has served its purpose, it may be nearing its end as central banks seek to diversify their reserves and protect themselves against currency devaluation risks.

If you have any questions, please write to support@weekendinvesting.com