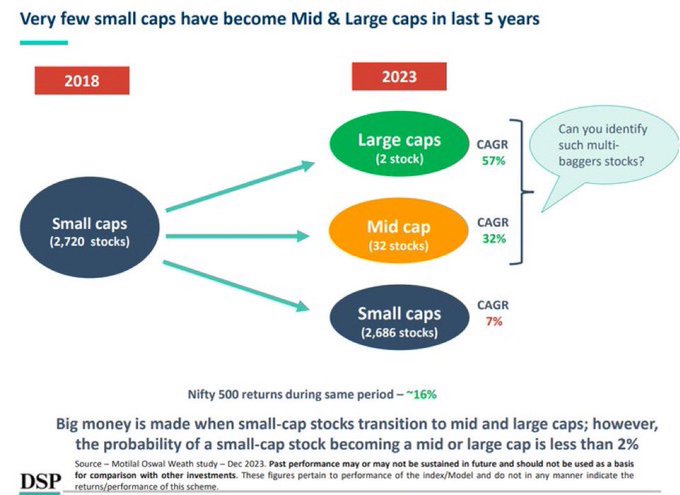

Recently, an intriguing image surfaced on Twitter, capturing the attention of many investors. This image, derived from a study conducted by the DSP group using Motilal Oswal data, sheds light on the performance of small-cap stocks over the past five years. Surprisingly, the findings reveal that most small-cap stocks exhibited a modest Compound Annual Growth Rate (CAGR) of 7%, with only a handful transitioning into mid caps or large caps with significantly higher CAGRs.

The Small Cap Conundrum

The revelation that a substantial portion of small-cap stocks fail to deliver noteworthy returns underscores the importance of adopting a discerning investment approach. While small-cap indices may struggle to impress, it’s crucial to evaluate individual stock picks against broader benchmarks like the Nifty 500. This comparative analysis helps identify the outliers amidst the small-cap universe, which often experiences volatile market cycles.

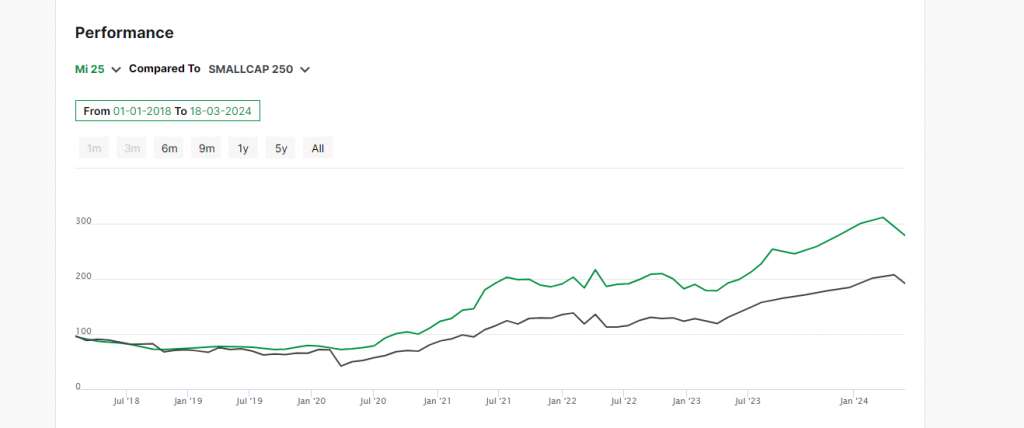

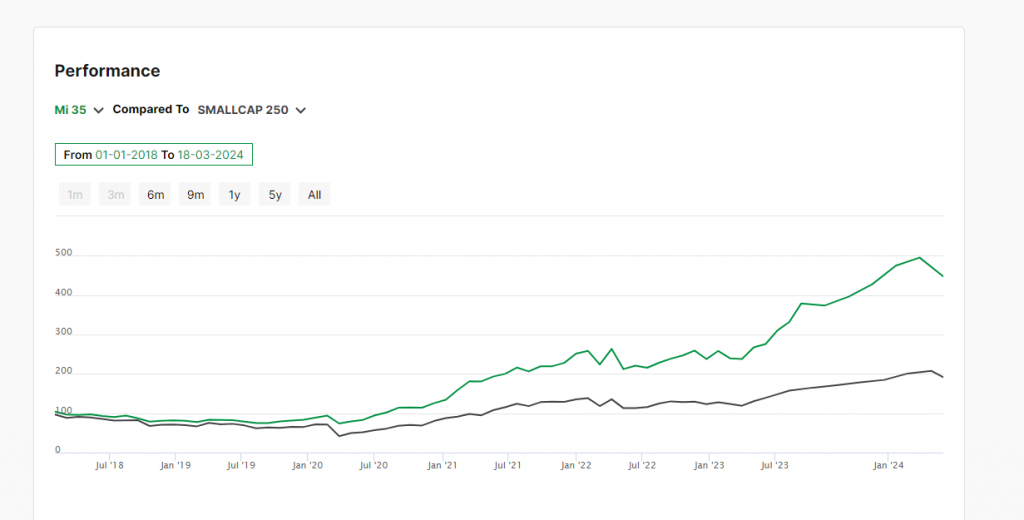

To navigate the complexities of small-cap investing, having a robust methodology is paramount. Strategies like Mi 25 and Mi 35, designed specifically for small-cap stocks, have demonstrated remarkable success over the years. These strategies, which focus on selecting top-performing small-cap stocks, have consistently outperformed traditional small-cap indices, delivering substantial returns to investors.

Mi 25’s performance

Mi 35’s Performance

In a universe teeming with thousands of small-cap stocks, the key lies in cherry-picking the winners. Despite the vast number of small-cap stocks, a handful of high-performing ones can significantly impact overall returns. By concentrating on stocks with strong momentum, investors can enhance their portfolio’s performance and mitigate the risks associated with small-cap investing.

Achieving success in small-cap investing requires a long-term perspective and a disciplined approach. By adhering to a rule-based investment strategy or employing a non-discretionary selection process, investors can capitalize on lucrative opportunities within the small-cap segment. Over time, this focused approach can yield superior returns and position investors for financial success.

If you have any questions, please write to support@weekendinvesting.com