As an investor, it’s easy to get caught up in the excitement of a successful stock that keeps rising. It’s natural to assume that the upward trend will continue indefinitely, leading to significant gains in the future. However, history has shown us time and time again that stocks can be unpredictable, and without a proper exit plan, investors can suffer significant losses.

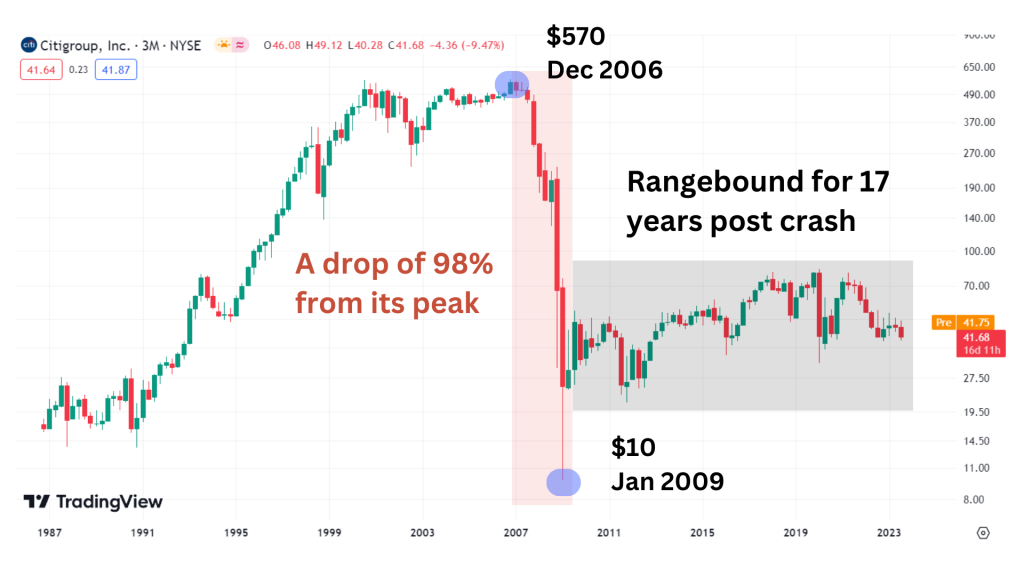

Let’s take a look at the example of Citigroup, one of the largest global banks, over a 20-year period from 1986 to 2007. During this time, the stock price skyrocketed from $17 to an impressive $570, resulting in a phenomenal ~3400% gain creating big wealth for it’s investors.

Imagine being an investor in 2006 or 2007, looking back at the past 20 years of continuous growth. It’s easy to become overly confident in the stock’s performance, assuming it would continue to rise and potentially reach $1,000 or even more.

However, this kind of unwavering belief in a stock’s invincibility can be dangerous. Stocks, even the most successful / popular ones, can experience significant drops, and recovering from such downturns might not be as easy as anticipated. Cognitive biases can make it difficult for investors to acknowledge the possibility of their stock declining in value.

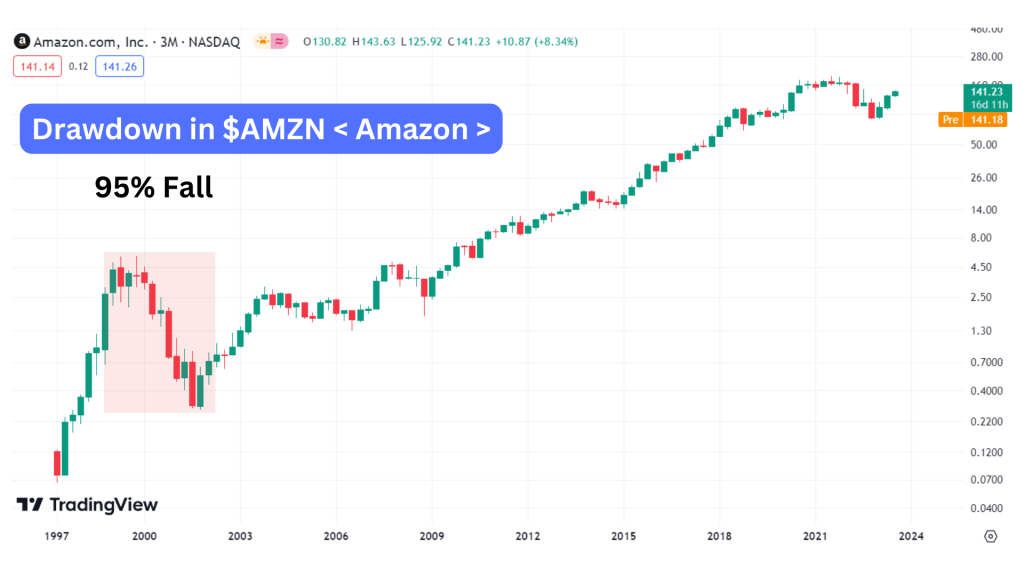

Consider the scenario where the stock goes from $200 to $80. Many investors might be inclined to brush it off, believing that the stock will bounce back, especially if it has done so in the past. We can look at examples like Amazon and Apple, two of the greatest stocks which experienced drawdowns of 70% to 80% before recovering. This kind of mindset can lead investors to adopt a buy-and-hold strategy, assuming that stocks will eventually rebound.

Back to Citi Group’s story – –

Fast forward to 2007, and the situation changes drastically for Citibank. The stock, which once reached $570, plummets to a mere $10 within a span of two years. Investors who had built concentrated portfolios with a significant allocation to Citigroup are now facing a 98% loss in the value of their investments. Their unwavering belief in the stock’s perpetual rise had backfired dramatically.

This scenario is not limited to Citigroup; it applies to stocks in any context worldwide. There are countless examples of once highly-regarded companies experiencing significant declines in their stock prices. No stock is immune to unforeseen events or market downturns. It’s simply a matter of time, luck, and an individual’s presence in that particular stock as to whether they will experience such pain or not.

Believing that any stock is infallible undermines the purpose of investment planning. It’s comparable to walking on a road and assuming that you will never get hit by a car. You can never eliminate the probability of a stock declining in value. As an investor, it’s crucial to have adequate protection in place and develop an exit plan.

Importance of having an exit plan !

Developing an exit plan involves multiple strategies to mitigate potential losses. Asset allocation and diversification are key components of this plan. By spreading your investments across various asset classes and sectors, you reduce the risk of relying heavily on a single stock or industry. This diversification helps safeguard your portfolio from the decline of a single stock having a catastrophic impact on your overall wealth.

Additionally, setting predetermined exit points based on certain conditions or events can protect you from catastrophic losses. Establishing thresholds for when to sell a stock, regardless of emotions or predictions, helps investors make rational decisions and secure profits or limit losses. Even if adhering to an exit plan means sacrificing potential higher returns, the focus is on preserving your capital and remaining active in the market.

Let’s fast forward to the period from 2009 to 2023, a span of 14 years. If someone had been sitting on the Citigroup stock at a price of $570, they would still be waiting, with the stock trading at $41 and down 90% from its peak. This example emphasizes the difficulty of recovering from a significant loss without a well-executed exit plan. It’s essential to avoid being trapped in a prolonged decline that could potentially erode the majority of your investment.

Having an exit plan in place is not a fail-safe method, and investors may still experience losses. However, it remains the best defence mechanism available. In a sense, it is similar to buying insurance for yourself. Planning your investments, diversifying your portfolio, and knowing when to cut your losses can ultimately help you stay in the game and preserve your capital.

Download the WeekendInvesting App

If you have any questions for us. please write to us on support@weekendinvesting.com. You can also get on a 1-1 meeting with us should you need more clarity about the strategies or processes.