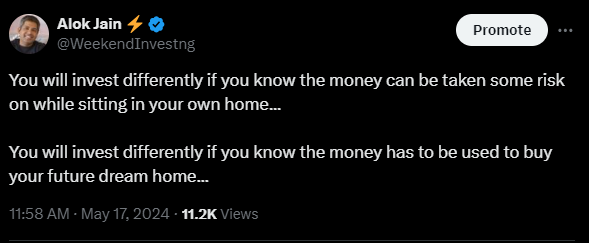

When thinking about investing, your goals significantly influence your strategy. If your goal is to buy a house in the future, your approach to investing will be different compared to someone who already owns a home. This difference is rooted in psychology and behavior. For instance, if you aim to save up for a house, you might take fewer risks with your investments. You want to grow your money steadily to reach that goal without losing it along the way.

The Psychology of Investing with a Goal

Investing to buy a house involves careful planning. Your state of mind can affect your investment decisions. If uncertainty makes you anxious, you might avoid high-risk investments. Instead, you may choose a safer, more gradual approach to building your savings. This cautious strategy ensures that you don’t lose the money you are setting aside for a significant purchase like a house.

High Risk vs. Cautious Investing

When aiming to buy a house, there are two main paths. One is to take high risks, hoping for big gains. This might work, but it’s risky. The other way is to invest steadily and carefully over a long period. This means making thoughtful decisions with your investments, knowing that the money is meant for an essential goal. It’s important to remember that housing prices can rise while your investments grow, making it a moving target to hit.

Investing After Buying a Home

Once you have purchased your home, your investment strategy might change. With your primary goal achieved, any surplus money can be saved for retirement or other long-term goals. This situation allows you to take on more risk with your investments since you have already secured your home. You might feel more comfortable investing in stocks or other higher-risk assets because your most significant goal is already met.

Common Investment Fears

Many people are cautious about investing in the stock market due to fear of losing money. This fear can prevent them from making sound investment decisions. As a result, they might stick to safer investments like bank fixed deposits, real estate, or gold. However, these investments might not offer the same growth potential as equities. Overcoming this fear is crucial to make better investment choices and achieve long-term financial goals.

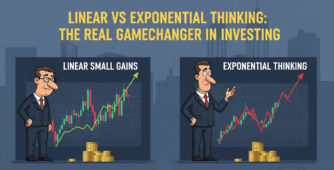

The Importance of a Balanced Approach

Finding a balanced approach to investing is essential. While it’s important to be cautious, being overly conservative can also limit your growth. Investing in index funds, for example, can provide steady growth over time. However, the market can have periods of stagnation where it doesn’t grow for several years. It’s important to be prepared for these scenarios and have a diversified investment strategy.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com