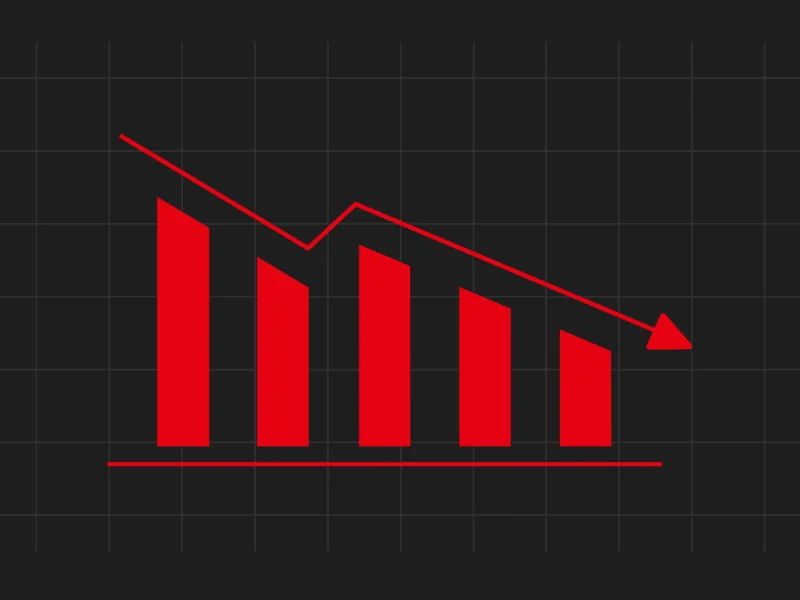

The Case of Just Eat Takeaway.com

This article explores a fascinating case study of Just Eat Takeaway.com (TKWY). Over the past five years, the company’s revenues have skyrocketed by a staggering 1500%. However, despite this impressive growth in revenue, the stock price has plummeted by 87%. This seemingly contradictory situation highlights the importance of looking beyond basic financial metrics when making investment decisions.

The Myth of Hidden Information

Many investors believe that by diligently studying a company’s financial statements, they can uncover hidden gems and achieve superior returns. However, the reality is that most publicly traded companies operate in a transparent environment. The information contained within financial statements is readily available to everyone.

The Power of Market Discounting

The stock market is incredibly efficient at processing information. By the time you discover a company’s impressive growth figures or promising future prospects, it’s highly likely that this information is already reflected in the stock price. Investors anticipate future earnings and growth potential, and these expectations are factored into the current price.

The Importance of Price Action

While financial statements offer valuable insights, they don’t tell the whole story. It’s crucial to pay close attention to the stock price itself. In the case of Just Eat Takeaway.com, the plummeting stock price despite surging revenue suggests that investors are concerned about factors beyond just top-line growth. There could be worries about future profitability, industry competition, or other risks.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com