Understanding Market Perceptions

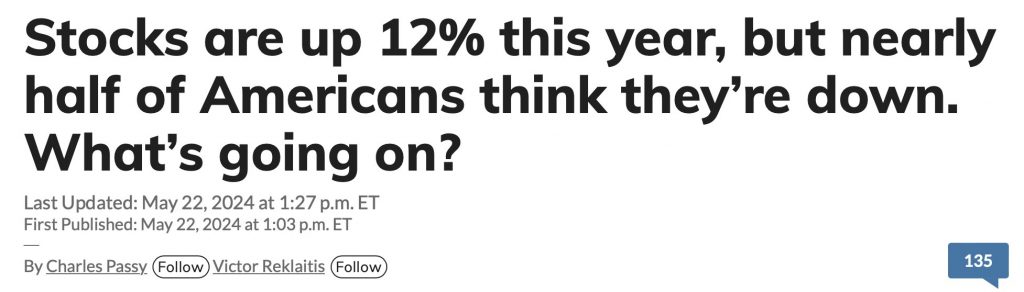

A recent survey in the US revealed that half of the Americans surveyed believe they are losing money this year, even though the stock market is up by 12% as of May 22. This surprising result shows a clear disconnect between market performance and individual perceptions. It’s important to explore why this happens and what it means for investors.

Polarized Market Performance

Over the last few years, major indices like the S&P 500 and Nifty have become highly polarized. While some stocks have performed exceptionally well, others have lagged behind. For example, within the Nifty 50, some stocks are up by 40-50%, while others have declined. This polarization means that even if the overall market is up, investors holding underperforming stocks might feel like they are missing out.

The Horse Race Analogy

Imagine a race with 50 horses. After a few rounds, 20 horses lead the race, 20 are in the middle, and 10 are lagging. If your portfolio consists of those 10 lagging horses, you will feel like you’re falling behind, even though the overall race is progressing well. Similarly, in the stock market, holding underperforming stocks can make you feel like you’re not benefiting from the market’s overall gains.

Sector Rotation and Market Sentiment

Many investors avoid certain sectors, such as public sector banks, public sector enterprises, real estate, and pharma. However, these sectors can sometimes outperform, leading to a situation where portfolios lacking these sectors miss out on gains. Sector rotation, where money moves from one sector to another, is a common market phenomenon. Structured investing set ups like momentum investing can help navigate these shifts by moving between sectors without emotional attachment.

Staying with the Winners

To succeed in a polarized market, it’s crucial to identify and stay with the top-performing stocks. This involves continuously evaluating which stocks are leading and which are lagging. By focusing on the top performers, you can enhance your portfolio’s performance. This strategy requires a systematic approach, as it’s essential to regularly adjust your holdings to reflect changing market conditions.

Outperforming the Index

Although no strategy works 100% of the time, consistently aligning your portfolio with the top performers can help you outperform the index over many cycles. This method has shown positive results over the past eight years, across various strategies. The key is to avoid emotional attachment to underperforming stocks and to be willing to shift your investments as market conditions change.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com