S&P 500 Seasonality in Presidential Election Years

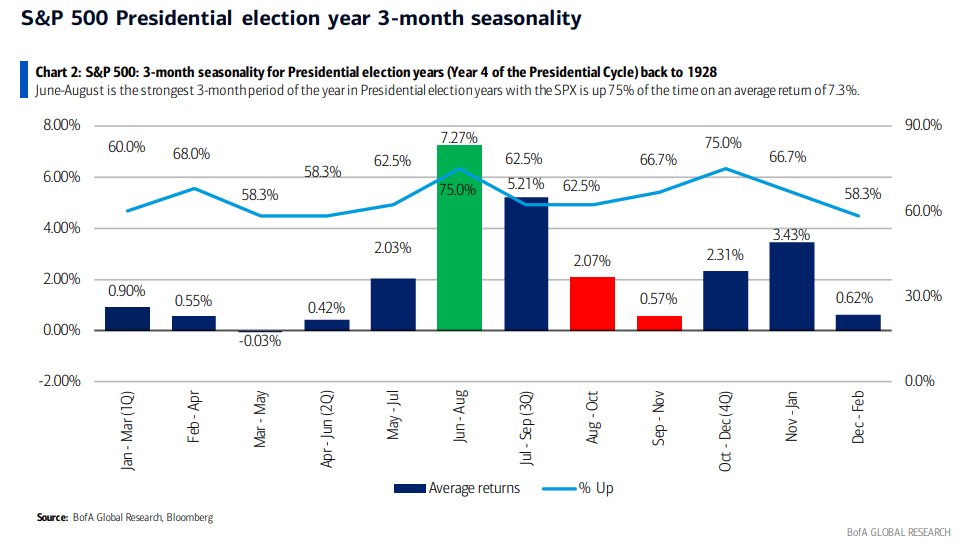

A recent study by Bank of America Global Research, using data from Bloomberg, reveals interesting insights about the S&P 500’s performance during U.S. presidential election years. With the current year, 2024, being a U.S. presidential election year, it’s worth looking into these findings to understand potential market trends.

Presidential Election Year Trends

The study examines the average returns for different three-month periods during presidential election years, dating back to 1928. This extensive data set covers nearly a century, providing valuable insights. One standout finding is that the period from June to August in a presidential election year typically yields the best returns. Historically, the S&P 500 gains an average of 7.2% during this time frame. This pattern has been observed in 75% of the election years studied, making it a significant trend to consider.

June to August: A Promising Period

June to August stands out as the most profitable three-month period in presidential election years. With a 75% probability of a 7% rise in the S&P 500, this period offers a strong likelihood of positive market performance. This trend suggests that the U.S. stock market often experiences a notable uptick as the presidential election approaches, driven by various factors such as investor sentiment and political developments.

Impact on Global Markets

A healthy U.S. market, particularly during this promising June to August period, can have a positive effect on global markets. As the U.S. stock market rises, it often boosts investor confidence worldwide, leading to gains in other markets as well. For investors in India and other countries, a robust U.S. market can provide a favorable environment for growth and investment opportunities.

Looking Ahead: Budget Outlook

In addition to the presidential election, other significant events will shape the market in 2024. One key event is the budget outlook expected in July. The formation of the government in June will also play a crucial role in determining economic policies and market conditions. These factors, combined with the historical trend of a strong June to August period, suggest a potentially positive outlook for the market in the coming months.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com