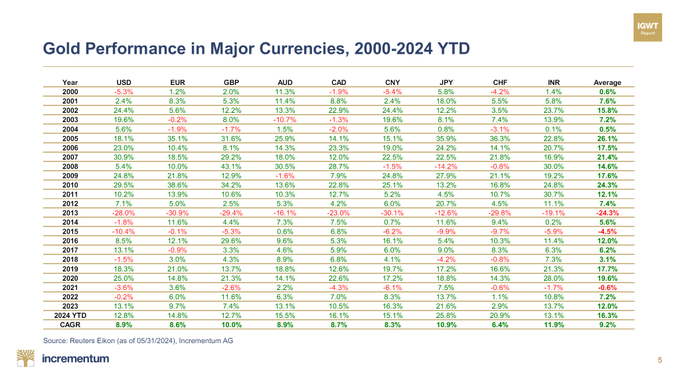

Gold has shown remarkable performance over the last 24 years. In US dollar terms, gold has a compound annual growth rate (CAGR) of 8.9%. This strong performance is consistent across various currencies: 8.6% in euros, 10% in British pounds, 8.9% in Australian dollars, 8.7% in Canadian dollars, 8.3% in Chinese yuan, 10.9% in Japanese yen, 6.4% in Swiss francs, and 11.9% in Indian rupees. These figures highlight gold as an asset class that investors should not ignore.

Consistency of Returns

Gold’s returns have been consistently positive. Over the past 24 years, there have been only three down years. One year saw a severe drop of 19%, while the other two had mild declines of 5.9% and 1.7%. However, there were also years with substantial gains, such as 30.7% and 28%. This level of consistent performance is remarkable and often overlooked by many market participants.

Gold vs Nifty

In India, gold has performed at par with the Nifty index, both yielding a CAGR of 11.9%. Despite this, some argue that selling gold incurs a 20% tax with indexation. However, this concern can be mitigated by using Section 54F, which allows you to sell gold and buy a residential house without paying tax. This highlights how holding gold can be beneficial for long-term wealth creation.

Diversification and Asset Allocation

The focus on equities by mutual fund managers and analysts has often led to the neglect of real estate and gold. This approach has done a disservice to investors by not promoting a diversified and asset-allocated portfolio. Recent market volatility shows how vulnerable equities can be, reinforcing the need for hedges in your portfolio. Proper asset allocation is essential to mitigate risks and ensure stability.

Market Liquidity and Perception

Market performance is heavily influenced by liquidity. While we often discuss price-to-earnings ratios and other metrics, it ultimately comes down to liquidity. The equilibrium between buyers and sellers determines the price. Therefore, having a diversified portfolio with assets like gold can provide a hedge against market fluctuations and liquidity changes.

Changing Geopolitical Environment

The perception of gold is changing, driven by geopolitical factors. Countries like China, Russia, and even the Reserve Bank of India are increasing their gold reserves. The Reserve Bank of India has bought 100 tons of gold and plans to buy more. This shift underscores gold’s importance as an asset class in the current geopolitical climate. Investors, whether retail, high net worth individuals (HNIs), institutions, or governments, are recognizing this trend, and so should you.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com