Many people are skeptical about the idea of including gold in their investment portfolios. This is understandable, as not everyone has the same perspective on investments. However, let’s take a closer look at the years 2022 and 2023 to understand why gold might be worth considering.

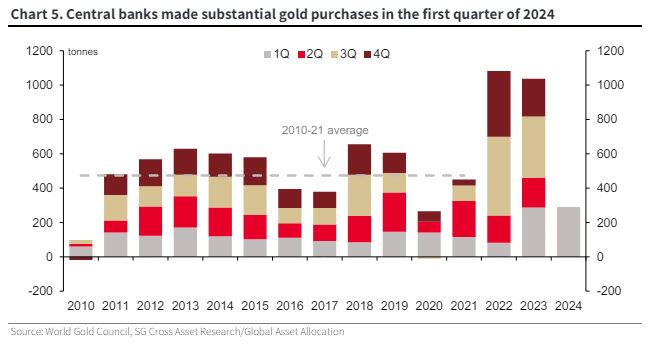

Central Banks Are Buying More Gold

Over the past decade, central banks have purchased an average of 400 to 570 tons of gold per year. Yet, in the last two years, these purchases have nearly doubled, with central banks buying almost 1,000 tons each year. In the first quarter of the current year alone, they have already bought almost 200 tons. This significant increase in gold purchases by central banks is a strong signal that something is changing in the global financial landscape.

Why Are Central Banks Accumulating Gold?

The shift in central bank policy towards accumulating more gold suggests that they are preparing for potential economic changes. Ignoring this trend might be unwise. Many investors dismiss gold, focusing solely on their stock portfolios. However, understanding the broader economic environment is crucial. The increased gold buying by central banks indicates that they are hedging against potential risks in the global economy.

Keeping an Open Mind

It is important to stay informed and adapt to changing circumstances. Dismissing gold without considering the reasons behind these central bank actions can be a short-sighted approach. Preparing your investment portfolio to withstand possible economic downturns is a rational decision. Diversifying your investments by including some gold can provide a safety net.

Potential Gold Price Projections

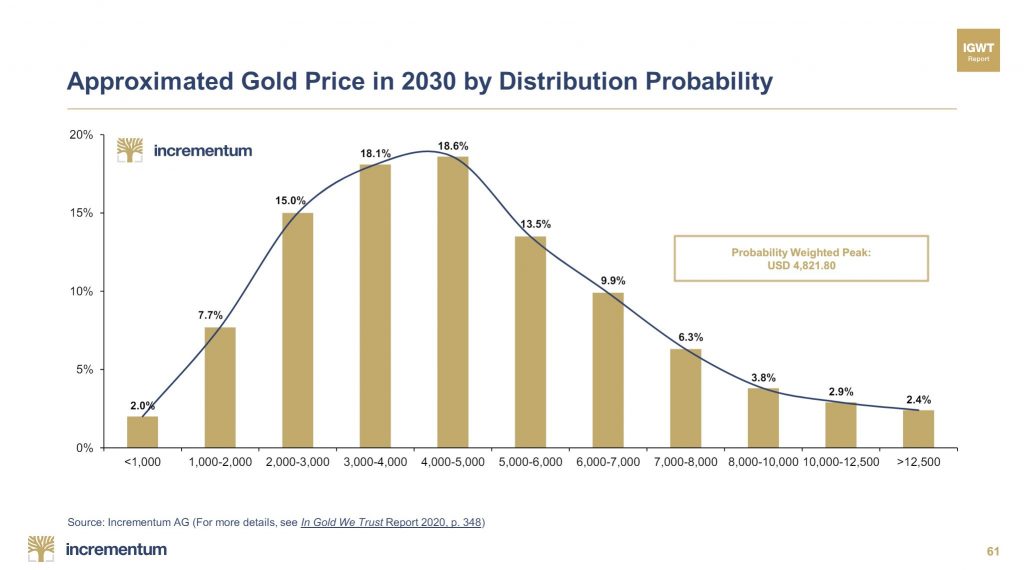

Looking at future projections, the potential for gold prices to rise significantly over the next decade is considerable. By 2030, gold prices are expected to fall within the range of $4,000 to $5,000 per ounce. This projection suggests an annual return of nearly 10%. Considering currency depreciation, this return could translate to about 12-14% per year in Indian Rupee terms. Such returns on an investment that also acts as insurance against economic turmoil make gold a compelling addition to your portfolio.

Gold as an Insurance Policy

Investing in gold can be compared to buying insurance. If the global economy faces severe challenges, gold prices could skyrocket to $10,000 or even $20,000 per ounce. Even if such drastic changes do not occur, reaching the projected range of $3,500 to $4,000 per ounce still offers a healthy return. This dual benefit of protection against economic downturns and potential for solid returns makes gold a rational investment choice.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com