HNI Capital Compounder – Quick Recap

HNI Capital Compounder is a meticulously crafted core strategy that can be your ideal companion for your long term – steady compounding journey. Designed exclusively for HNIs looking to invest between 25 lac and 1 cr, it aims to unlock the hidden alpha within the large and mid cap universe.

Guided by two unwavering principles at its core – CAPITAL PRESERVATION & WEALTH CREATION, HNI Capital Compounder leverages a nimble rotational momentum style of investing.

This low churn – non discretionary strategy always remains invested in the strongest 20 strongest stocks from the CNX 200 index, a SAFE & POTENT BLEND of established large-cap leaders and emerging mid-cap champions. This potent mix ensures you capitalize on the momentum of both market maturity and future potential.

This portfolio undergoes a weekly rebalance schedule, ensuring underperformers are swiftly replaced with promising new winners. This meticulous approach allows you to stay ahead of the curve and navigate market fluctuations with ABSOLUTE PEACE AT ALL TIMES

HNI Capital Compounder is built for the long term, aiming to consistently outperform its benchmarks in both bull and bear markets.

The strategy believes in harnessing the collective strength of the CNX 200 universe, unlocking its true potential for your steady wealth creation.

Go through this intro blog to read more about why you should consider this strategy and who this is for

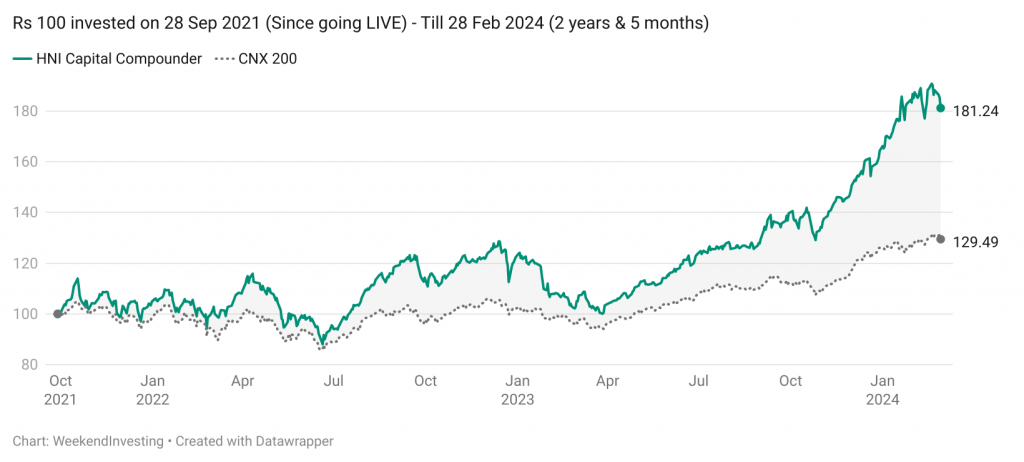

Rs 100 invested in HNI Capital Compounder (v) CNX 200 index

Since going LIVE on Smallcase (28 Sep 2021) HNI Capital Compounder has recorded superb gains of 81% in a period of 2 years and 5 months compared to 29% on the CNX 200 index

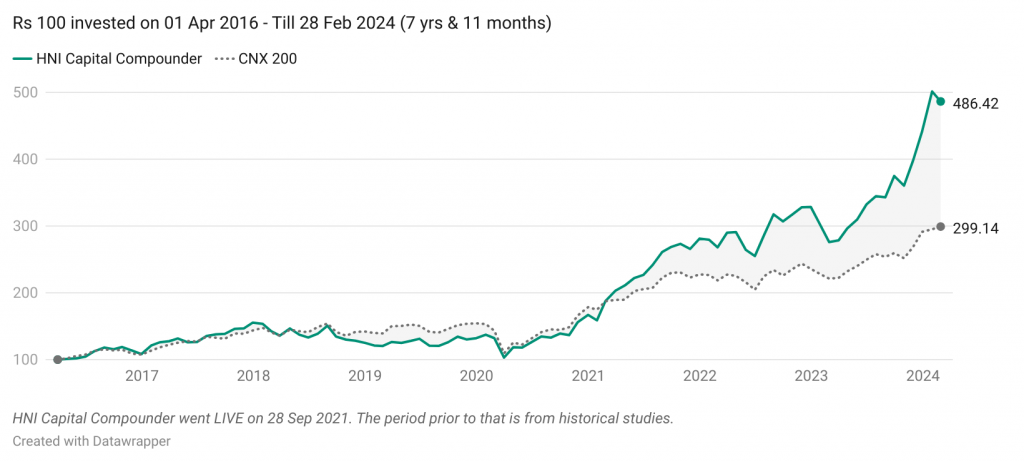

If you look at the performance since 01 Apr 2016, Rs 100 would go on to become Rs 486 by investing in the HNI Capital Compounder as against Rs 299 on the CNX 200 index.

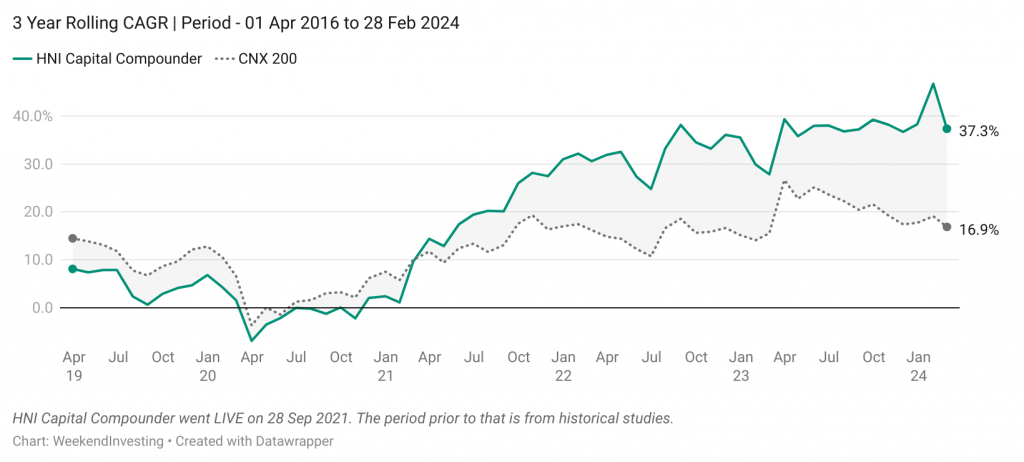

3 Year Rolling CAGR

3 year rolling CAGR indicates the latest CAGR at any given point in the timeframe provided in the chart. So, in Apr 2023, if the 3 year rolling CAGR is 40%, it means that the one would have experienced a CAGR of 40% if you stayed invested in the 3 year period culminating in Apr 2023 (Apr 2020 to Apr 2023).

The strategy trailed its benchmark till about Apr 2021 post which there was no looking back. The gap has widened considerably and the current 3 year CAGR stands at a superb 37% compared to only 17% on CNX 200.

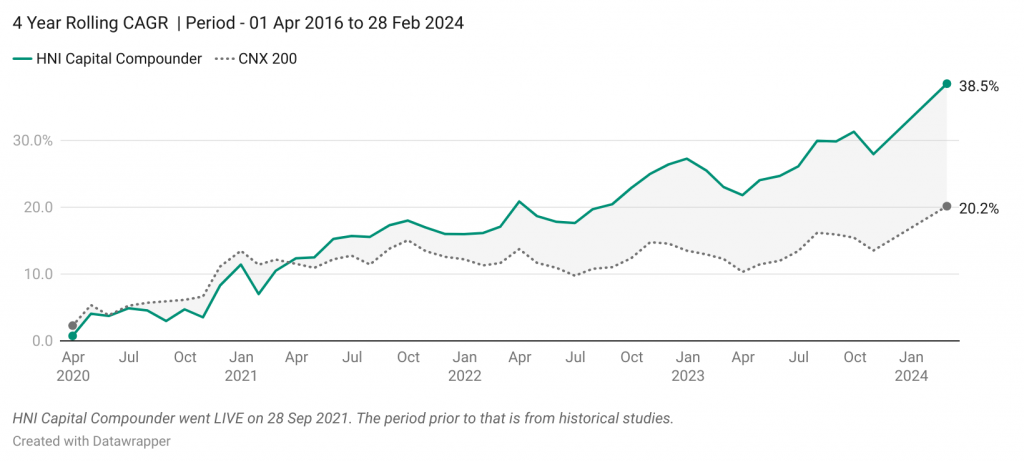

4 Year Rolling CAGR

The 4 year rolling CAGR paints a much better picture to also illustrate the importance of taking a long term view along with the strategy’s superior outperformance.

The 4 year CAGR by end of Mar 2020 is at the lowest point owing to the COVID crash that coincided around that time but the performance started to improve dramatically post COVID and the gap has continuously widened.

The current 4 year CAGR is 38.5% on the HNI Capital Compounder compared to only 20% on the benchmark, the CNX 200 index.

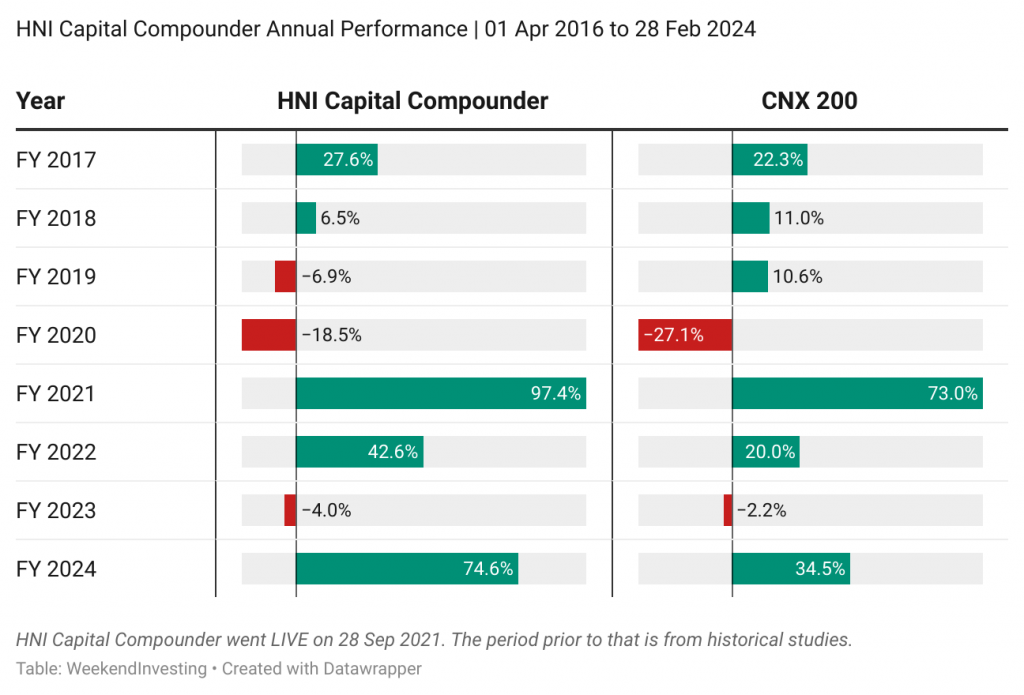

Annual Returns Comparison

We would like to highlight the stability shown by the strategy during FY 20 dropping 18.5% compared to 27% on the CNX 200. This demonstrates the strategy’s ability to outperform the benchmark when the markets are weak as well.

FY 21 and FY 22 were superb especially the latter with an almost 2x beat while FY 23 was quite flat. The strategy has come back very strongly in FY 24 clocking 74.6% compared to 34.5% on CNX 20o (yet another 2x beat).

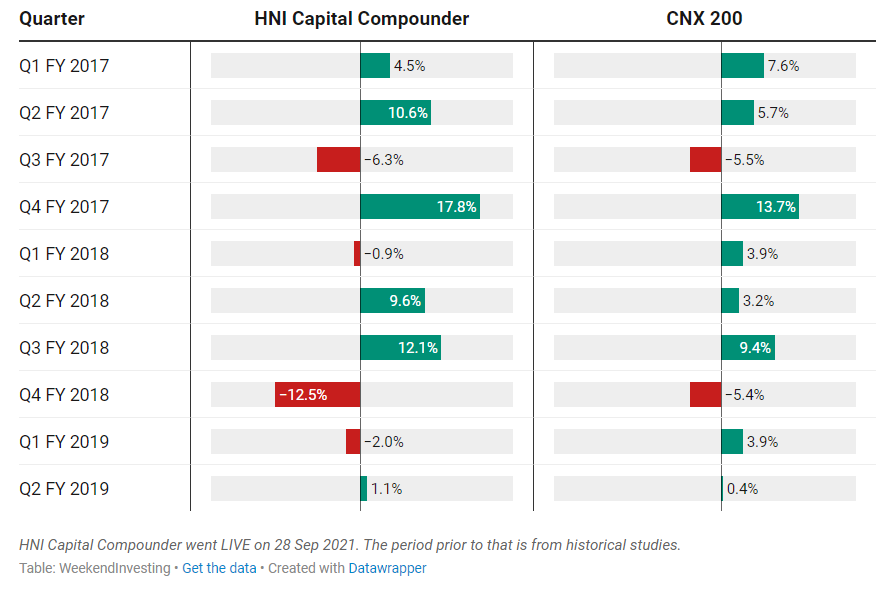

Quarterly Returns Comparison

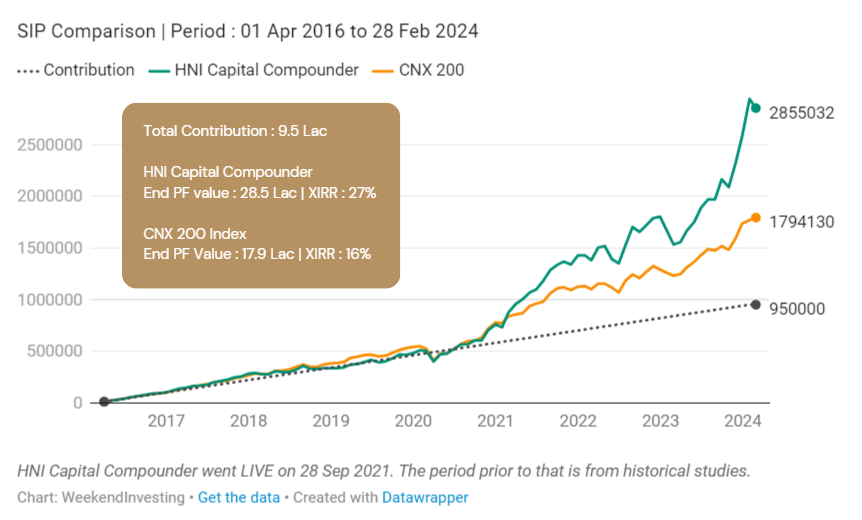

SIP Returns Comparison

If you would have done a monthly SIP starting from Apr 2016 to Feb 2024, your total current portfolio value on the HNI Capital Compounder will be 28.5 lac (XIRR of 27%) compared to 17.9 lac on the CNX 200 index (XIRR of 16%).

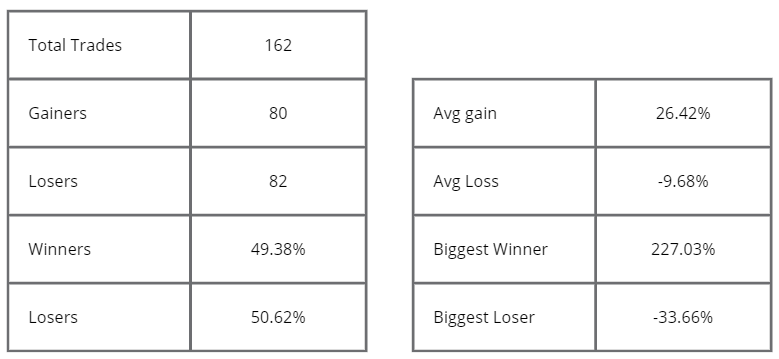

Win – Loss Metrics

Despite having equal number of winners and losers, HNI Capital Compounder’s ability to ride winners for long and dump losers early provides a solid edge against the benchmark. This is visible in the average gain / loss metric. Every winning stock gets you 26% on an average basis compared every losing stock that takes 9.6% away on average.

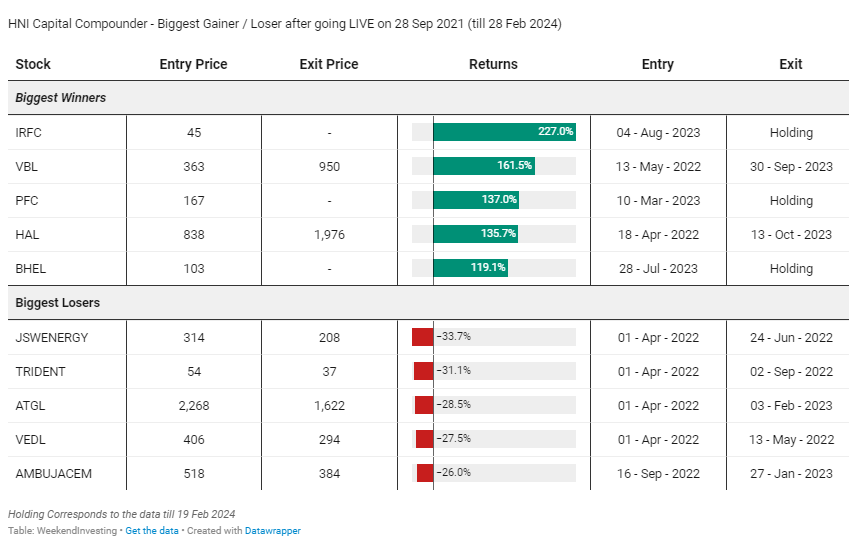

Top Gainers / Losers of HNI Capital Compounder

Stock stories from HNI Capital Compounder

Stock #1 : IRFC – 227% gains

Stock #2 : VBL – 161% gains

Stock #3 : HAL – 135% gains

Stock #4 : BHEL – 119% gains

Book a discovery call with Team WeekendInvesting to know more about HNI Capital Compounder