You open your newspaper along with a fresh hot cup of tea early in the morning & you find an article which says

“91% of large cap funds fail to beat their benchmarks in seven-year horizon”

You have invested some money in large cap based strategies and quickly try to scroll your eyes down to check if your strategy has also featured in that list.

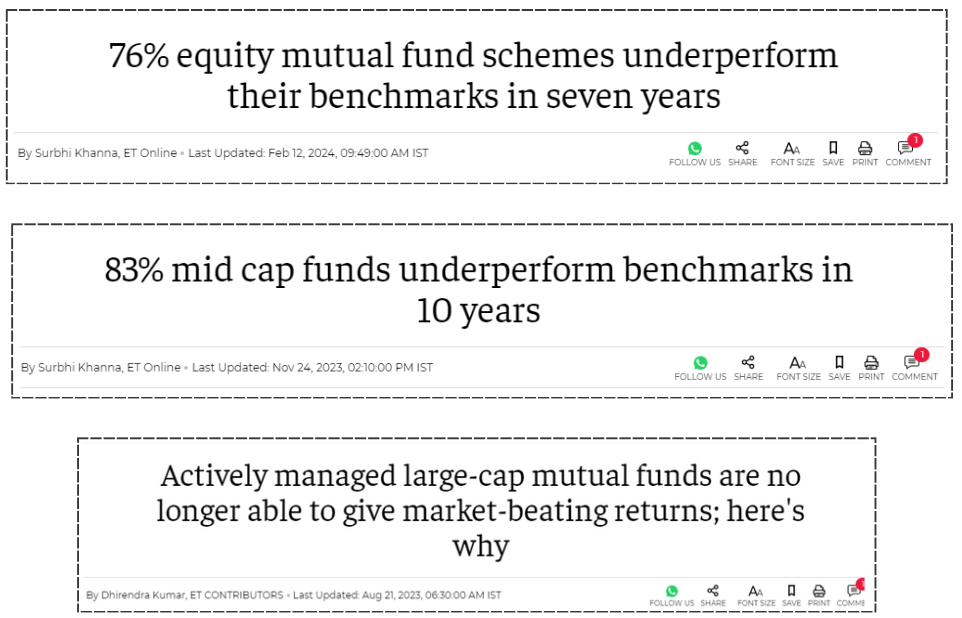

This is a very common sight in today’s financial newspapers, magazines, news channels and online portals. We come across many many such posts on how financial products are unable to beat their own respective benchmarks even over the longer term

Some folks may not even be tracking their performance and that can be even more concerning.

The real problem is that –

You have been diligently investing your hard earned money in many of these underperforming financial products hoping that they’d create enormous wealth over a long time frame.

You may have seen a bunch of financial calculators online and perhaps you would’ve decided to plot your SIP projections for next 20 years assuming a certain % of XIRR.

The result – –

MYTH TO BUST

Investors with larger capital naturally tend to gravitate towards large caps assuming (or rather hoping) that their money will be invested in safer – highly quality stocks that have amassed phenomenal wealth over long periods of time but seldom understand the troubles surrounding cyclicality of the markets.

The stock that may have generated a remarkable CAGR of 25% over 30 years might stagnate over the next few years. Let us take a few such examples of some of the popular names that may have tested the patience of many investors.

Case (a) – HDFC BANK

Case (b) – RELIANCE

Case (c) – ASIAN PAINTS

Case (d) – HINDUSTAN UNILEVER

What may have done really well in the past may not continue to do well in the future and that is a fact one should be willing to accept. While HDFCBANK, HUL & ASIANPAINTS were all flat for the last 3 years, one could argue that we might perhaps have to continue showing patience especially since these highly popular names have created big wealth for many.

Wait – But what about the opportunity cost of your capital ?

What if these stocks continue to erode going ahead ?

The intention may not be to question the credibility of any stock but given the irrational nature of markets, anything can happen anytime !

This begs us to ask you the next question – There were some other fascinating stocks that had done exceptionally well during the same period. Was your strategy able to identify an ride those winners ?

Ultimately – You are investing your hard earned money & you need to give yourself the best chance of making that money work for you.

What if you could invest in a Large & Mid cap based strategy that

Has performance comparable to (or better than) a Smallcap index ?

Can help you achieve gradual peaceful compounding to reach your financial goals ?

Presenting – The HNI Capital Compounder

HNI Capital Compounder is a meticulously crafted core strategy that can be your ideal companion for your long term – steady compounding journey. Designed exclusively for HNIs looking to invest between 25 lac and 1 cr, it aims to unlock the hidden alpha within the large and mid cap universe.

(-) Weekly Rebalanced

(-) Diversified portfolio of 20 strong stocks

(-) High quality CNX 200 universe

(-) Core focus on capital protection & gradual wealth creation

But – Smallcap like performance in a Large & Mid cap based strategy ?

HNI Capital Compounder has already been put through a real run for more than 2 years in the market. The strategy went live on 28 Sep 2021 but was not open for new subscriptions.

We have come up with two cases two help you understand the performance of the strategy when pit against two benchmarks, CNX 200 (which happens to be the strategy’s actual benchmark) and Smallcap 250 (just to get some perspective on whether a larger cap strategy can match the performance of a Smaller cap index)

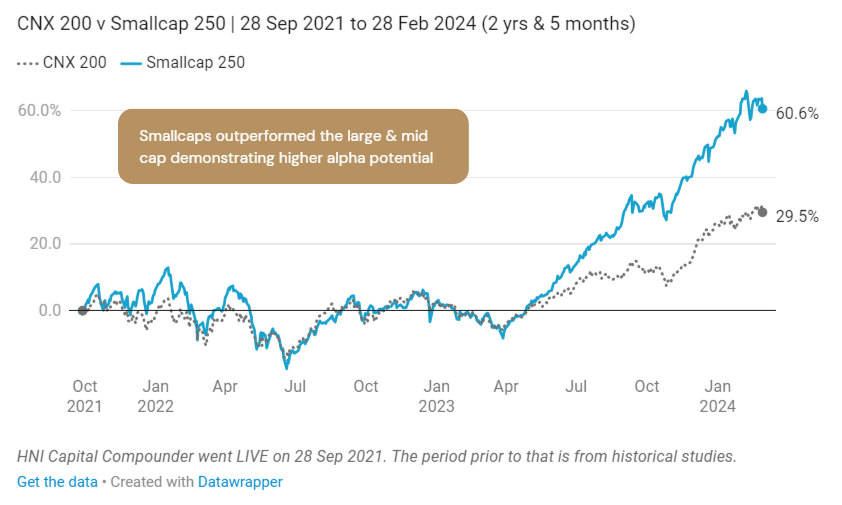

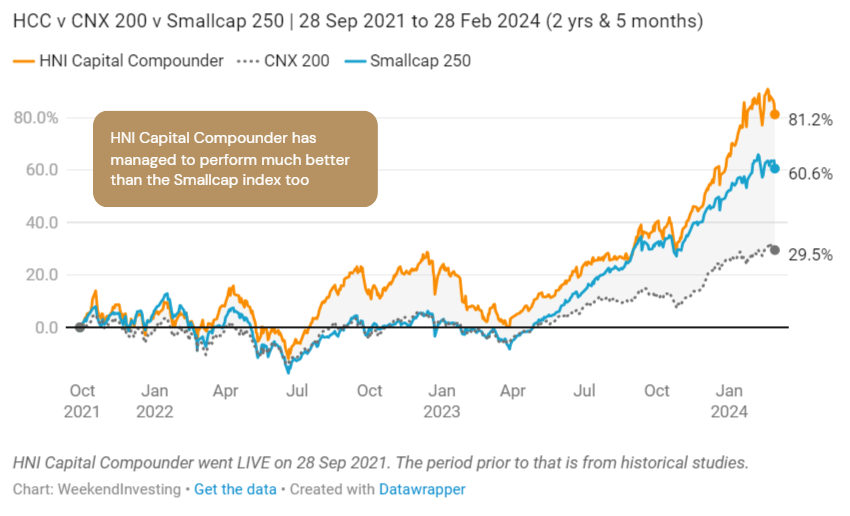

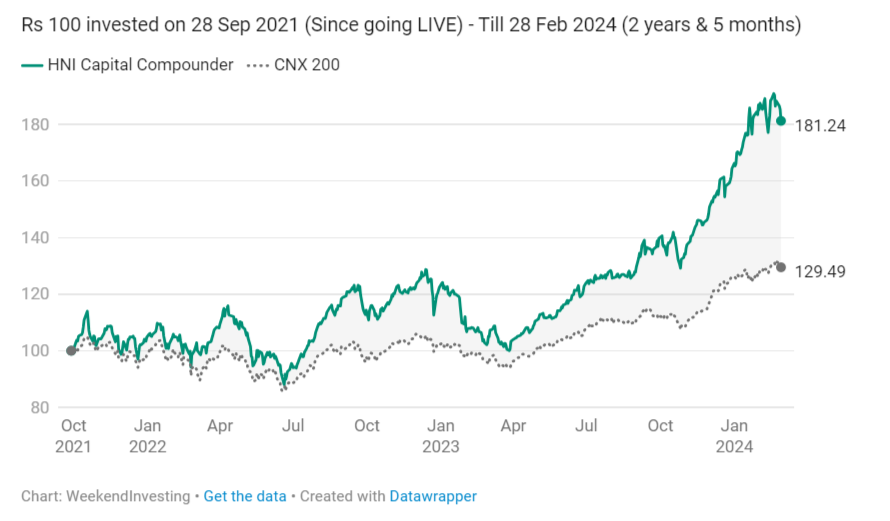

Case (a) : Period – 28 Sep 2021 to 28 Feb 2024 (2 years and 5 months)

This is the period since HNI Capital Compounder went live on Smallcase (28 Sep 2021).

When we compare the CNX 200 index & Smallcap 250 index during this period, the latter has taken an obvious lead especially post Apr 2023 owing to the extra alpha that the lower cap segments possess during uptrends.

Now, what if we add HNI Capital Compounder to this chart ?

The strategy has clocked a superb 81.2% thus taking a handsome lead not only against its own benchmark (CNX 200 at 29.5%) but also a lower cap benchmark like the Smallcap 250 index at 60.6% gains.

This establishes strong credentials of the strategy to be very nimble in extracting alpha from its parent universe to churn out a stunning performance that is even better than a Smallcap index despite being a large and mid cap based strategy.

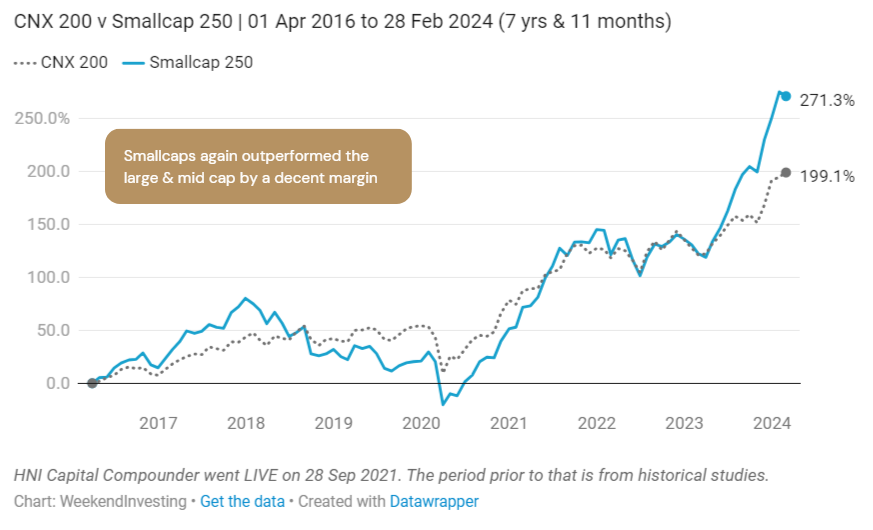

Case (b) : Period – 01 Apr 2016 to 28 Feb 2024 (7 years and 11 months)

While the strategy went live in Sep 2021, let us also quickly check similar comparative performance when we consider the start date as 01 Apr 2016. Why this date ? WeekendInvesting began on this day and we have performance metrics of all our strategies plotted from Apr 2016 to maintain uniformity and help with comparisons too if need be.

Note : The period indicated prior to 28 Sep 2021 is from historical analysis.

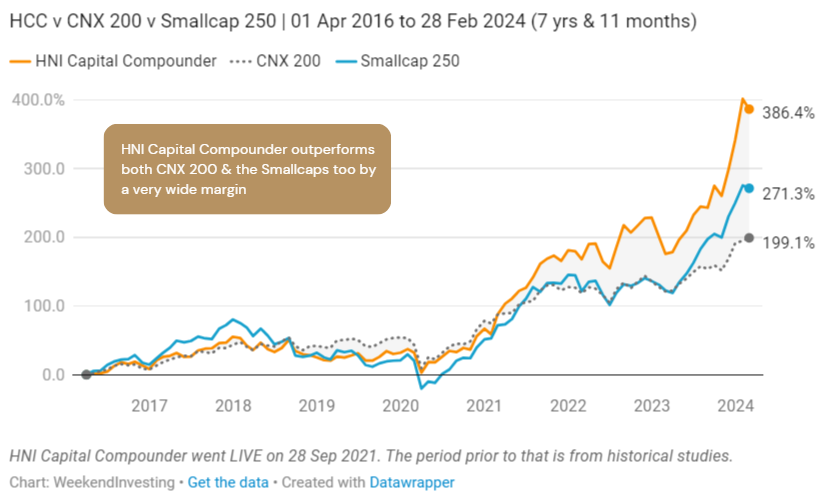

Smallcap 250 index once again beats the CNX 200 index clocking a healthy 271% compared to 199.1% on the latter. Let us now superimpose HNI Capital Compounder’s performance onto this chart

The strategy has handsomely beaten the Smallcap index too by recording 386% gains in the 8 year period. This is approximately 5x on your starting capital in a period of 8 years.

Objective of HNI Capital Compounder

This strategy’s singular aim is to outperform its benchmark, the CNX 200 index during both uptrends and downtrends.

Six core principles of HNI Capital Compounder

(-) Two absolute core focus areas : CAPITAL PRESERVATION & WEALTH CREATION

(-) RISK MITIGATION wired into the design of the strategy to aim for outperformance in both uptrends and downtrends

(-) A SAFE & POTENT BLEND of established large cap leaders and emerging midcap champions

(-) WEEKLY REBALANCE SCHEDULE to stay ahead of the curve and navigate market fluctuations with ABSOLUTE PEACE AT ALL TIMES

(-) NO DISCRETION to ensure you always remain invested in the 20 strongest.

(-) BUILT FOR THE LONG TERM, aiming to consistently outperform the benchmark in both bull and bear markets.

HNI Capital Compounder – Performance at a glance

Check out this blog for detailed metrics of the strategy

Book a discovery call with Team WeekendInvesting to know more about HNI Capital Compounder