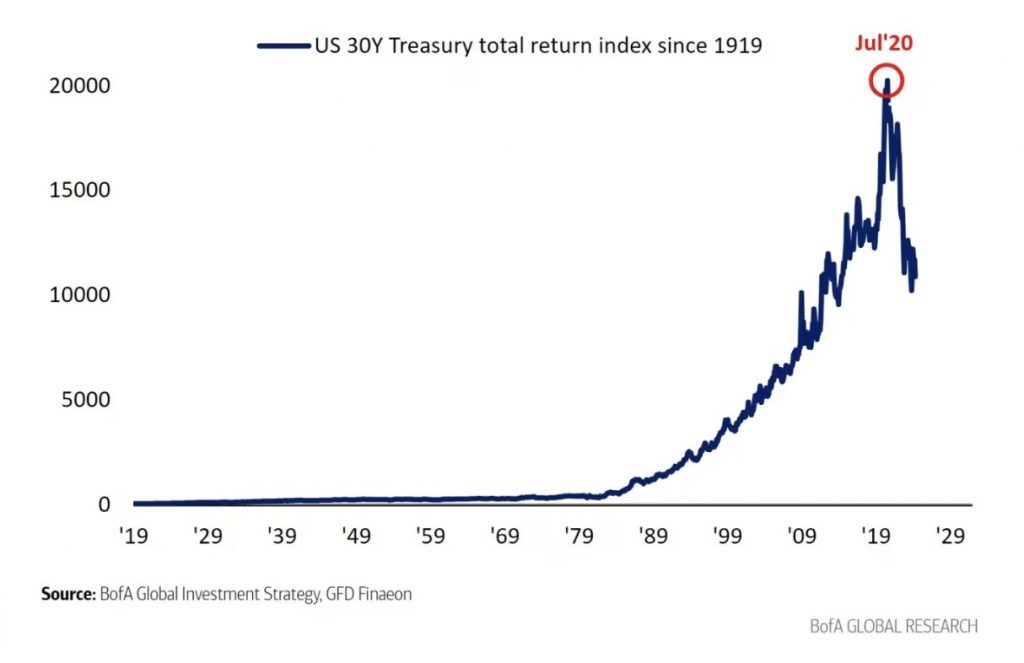

A fascinating chart from Bank of America Global Research shows the total returns of US 30-year treasury bonds over the last 40 years. Since the 1980s, there have been phenomenal returns as interest rates continually dropped. When interest rates go down, bond prices go up, leading to higher returns. However, something significant happened post-COVID. The interest rate cycle, which had been declining for 40 years, hit bottom and started rising. This shift caused bond returns to decrease, marking a major change in the financial landscape.

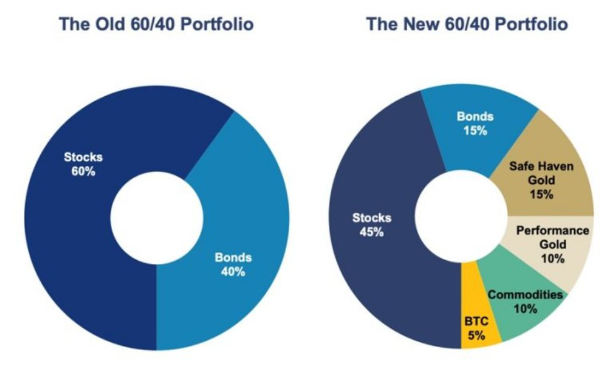

The End of the 60/40 Portfolio?

For decades, the standard allocation for large institutions, family offices, and big funds was the 60/40 format: 60% stocks and 40% bonds. This model worked well as bonds provided stability and returns when stocks were volatile. However, since July 2020, the bond component has been struggling. Many fund managers, who have never seen such prolonged losses in bonds, are now facing a new challenge. With interest rates rising and bond returns falling, the traditional 60/40 portfolio may no longer be viable.

Rising Interest Rates and Bond Market Losses

The current economic environment suggests that interest rates are unlikely to drop significantly in the near future. Even minor decreases in interest rates are expected to be temporary, as inflation remains a significant concern. When interest rates drop, inflation can surge, causing central banks to raise rates again to keep inflation in check. This situation leaves the bond market in a difficult position, with trillions of dollars invested in bonds facing potential losses.

New Approaches to Portfolio Allocation

Given the challenges with bonds, many new managers are exploring different portfolio allocations. A common new approach includes 45% stocks, 15% bonds, 25% gold, 5% bitcoin, and 10% other commodities. This diversified strategy aims to reduce reliance on bonds and take advantage of other assets’ potential growth. This shift reflects the understanding that the 40-year period of reliable bond returns may be over, and a more flexible, dynamic approach is necessary.

Monitoring Trends and Adjusting Allocations

A rigid portfolio structure can be risky in the current economic climate. Investors need to be flexible and monitor the trends of each asset class in their portfolios. For example, if bonds are underperforming, it may be wise to reduce their allocation and increase investments in better-performing assets like gold or stocks. This strategy helps prevent significant losses from one asset class and allows the portfolio to adapt to changing market conditions.

The Importance of Diversification

In conclusion, the financial world is facing a challenging period with rising interest rates and declining bond returns. Investors need to be cautious and ensure their portfolios are well-diversified. Relying too heavily on any single asset class can lead to significant losses. By diversifying and continuously monitoring market trends, investors can better protect themselves from unforeseen market shifts. Remember, the key to successful investing is flexibility and a willingness to adapt to changing conditions.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com