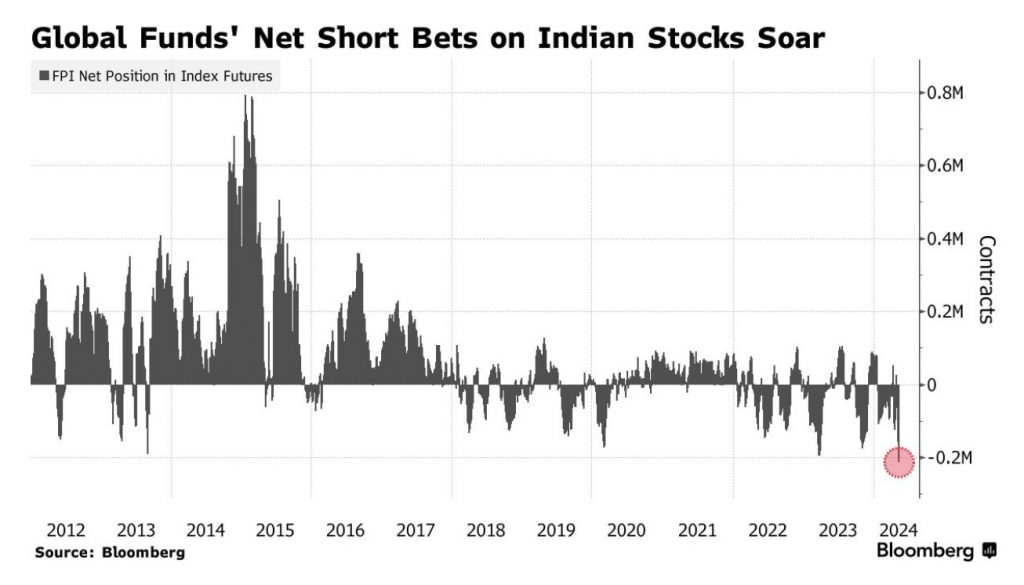

Today, there is some great news that should bring joy to investors. Global funds have placed their highest ever net short bets on Indian stocks. This data spans the last twelve years, and the number of contracts is at its steepest point, indicating extreme short positions. Although one reason for this might be the reduced lot size by Nifty, it is still a significant number.

Historical Context of Short Positions

Looking back at history, extreme short positions were observed during the COVID-19 pandemic in 2020. After these shorts, the market rallied significantly. Similar extreme positions were seen at the beginning and end of 2023. In both instances, the market gained more than 10% following these shorts. This pattern suggests that extreme short positions by global funds often precede strong market gains.

Short Positions as a Market Cushion

Regardless of the exact size of these short positions, they provide a cushion for the market. If the market starts to fall, these shorts may begin to cover, providing upward pressure and stabilizing the market. If the market continues to decline and shorts increase further, it could change the dynamics, but the current scenario suggests strong support from these positions.

Domestic Institutions’ Positioning

Domestic mutual funds and institutions in India typically do not engage in shorting. This provides an additional layer of stability, as they now have a good cushion in the event of a market downturn. This is especially positive when the market is at or near an all-time high. The presence of these short positions by global funds indicates a protective layer that can help mitigate potential declines.

Resilience of the Indian Market

Despite the substantial shorting by global funds, the Indian market has remained resilient and continued to rise. This resilience demonstrates that global funds are losing their grip on the market. They intended to short the market, but it has not responded as expected. Most of these shorts are likely below the current market rates, meaning if they begin to cover, the market could experience significant upward momentum.

Future Market Scenarios

If a negative market event occurs, the short positions will act as a cushion, supporting the market and preventing a steep decline. From all angles, the current situation is favorable for the Indian market. The built-up short positions by global funds will provide crucial support when needed, ensuring stability and potential for growth.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com