The quarter was a heady one to summarize it in one word. We started Q3 at +34.01% and had no clue what was in store for us in Q3. To my pleasant surprise the strategy outperformed my wildest imagination and ended Q3 at +86.63%. The benchmark indices Nifty 50 and CNX500 performed at +14.79% and +18.71% for the same period respectively.

The strategy saw a max drawdown of around 7% by mid Dec which was fully recovered by the end of December 2017.

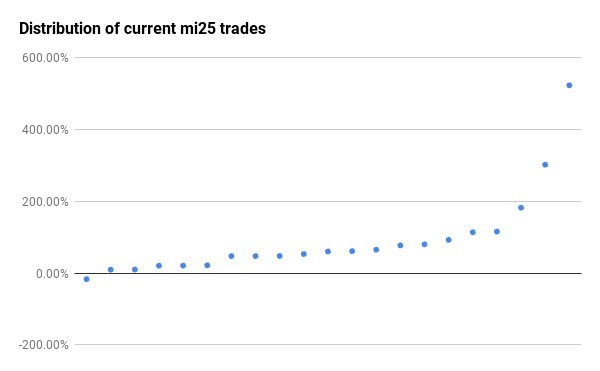

The distribution of the current constituents remained highly skewed, dominated by one stock GOACARBON which is up 522% since the start of the FY. The stock is a testimony to the Mi25 core principle of letting winners run until they don’t.

Q3 saw very minimal changes in the portfolio mix with only 4 exits from the portfolio:

| MBECL |

| MURUDCERA |

| TRIDENT |

| GITANJALI |

The notable addition to the Mi25 portfolio was ZENTEC during Q3 which is now up almost 80% in less than 8 weeks.

Needless to say, this kind of a heady performance cannot be expected to be repeated often. The new users of Mi25 must keep a sober expectation in the short term even while longer term strategy out-performance confidence has gone to a new high. If you are coming in with a medium to long term view, I see no reason to be be afraid of the dizzying heights reached recently. I draw tremendous confidence from a simulation of the Mi25 strategy that came out of the 2008 drawdown of near 30% in less than 12 months.

I do wish to take this opportunity to thank each and every Mi25 family member for having faith in me and to have enjoyed the ride of 2017 alongside. I wish you and your families a Very Happy New Year 2018!

Sir I am having bit of worry in buying this product bcos right now market is purely liquidity driven and can fall anytime soon, in such case how would this strategy select stocks as stock will be far low from their highs.

you can enter when you feel comfortable.

Dear Sir,

Please guide me how to trade I am new bigginer in this wold. Belongs from lower middle class family. I am working in TCS Noida, My monthaly income is 60 K, I want to earn money to improve life of our family who still lives in village with very limited facilities.

Please give me opportunity to join your MI 25 Family. You make sure I will return your fee with God prayers to keep you healthy.

Thank,

please register your interest at http://www.weekendinvesting.com

Hi, just saw your interview and impressed looking forward to get information on shares from your blog .. thanks in advance.

Good morning Mr.Jain,

Would like to join Mi25.Wher can I get more details on the program.

Thanks,

Sudhir Nair

https://weekendinvesting.wordpress.com/payments/

Please guide me how to trade I am last 3 years, but i have lost my money in this market. Belongs from lower middle class family. I am working in private company, My monthaly income is 20 K, I want to earn money to improve life of our family who still lives in village with very limited facilities.

Please give me opportunity to join your MI 25 Family. You make sure I will return your fee with God prayers to keep you healthy.

mi20 launch mid Feb

Dear Alok

I have already registered my interest. Could you please let me know by when can you accommodate me.

Thanks

Arindam

Please hold for a response in the next few days.

Hi alok

Quite impressed with ur work … can i start with a port folio of 5 L INR

Regards

Yes you can.

Hello Mr. Jain,

It is quite surprising that how I could not find you, though I am a small investor since 2005, making atleast rupees 6 lacs of loss in stock market, obviously in unscientific and crude methods.

I am an M.Tech. from Delhi IIT in 1992 passout batch. You must be doing your graduation then in the institute.

I am very interested to invest say rupees 10 lacs in the Mi25 strategy of investment. I shall have a medium time goal of about 3 years.

I am already in MF also and getting an sober return of 25 to 30%.

Now my question is, should I invest in stocks or remain in MF portfolio considering that Rs. 10 lacs is a lot of money for me.

Also want to know the yearly maintenance fees of the portfolio. With warm regards, Supriya Sarkar

Please register your interest at the “new user registration” tab on http://www.weekendinvesting.com

Can people working in govt sector follow your investment strategy ? Is there any restriction on govt servant which can prevent them from investing in market based on your strategies? Plz enlighten us

Thank you

Pls ask your office HR

would like to join your Mi25

Please register your interest at the “new user registration” tab on http://www.weekendinvesting.com

How much is the minimum amount one can invest in Mi25

No min , 5-10 L recommended

Recommended 5-10L but no minimum really.