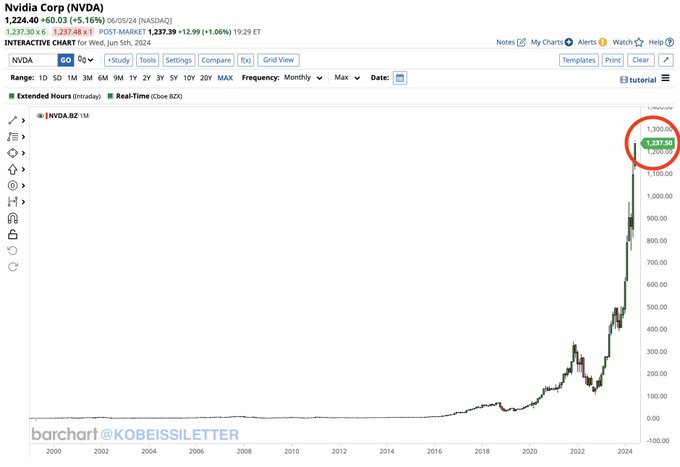

Nvidia’s Impressive Growth

Nvidia Corp is a name everyone is talking about right now. This stock has been the fastest-growing one in the US. Just recently, Nvidia crossed the $1,200 mark, pushing its market cap to an astounding $3 trillion. It is now the second-largest market cap company in the world, right behind Microsoft and ahead of Apple. With annual revenue of around $60 billion, Nvidia’s market cap is quite surprising. The company’s price-earnings ratio is about 300, showing how much excitement and potential the market sees in this stock.

Market Frenzy and Potential

Nvidia’s market cap increased by $1.8 trillion just this year. To put that into perspective, this increase is more than half the size of India’s entire market cap. Nvidia’s growth shows how the market can sometimes get very excited about a stock. This excitement isn’t necessarily a bad thing. It just means that traditional ways of evaluating a stock, like price-earnings ratios or revenue multiples, might not apply here. Trend followers, those who ride the winners until they stop rising, have greatly benefited from Nvidia’s surge.

The Power of Trend Following

In one experimental US portfolio, Nvidia was held from $244 to $1,237. This highlights the importance of letting winning stocks run. You don’t need to predict which stock will change your portfolio’s fortunes. Instead, allow all winners to continue rising. Out of 20, 30, or 40 stocks, you never know which few will make a significant impact. In recent times, public sector enterprises, banks, defense, and energy stocks have performed unexpectedly well, proving this point.

Embracing Market Wisdom

It’s crucial to avoid being overly confident about knowing which sectors or stocks will perform. The market often knows more than individual investors. Following the market’s trends can lead to substantial gains. While it’s true that stocks that rise quickly can also fall, you can manage this by setting exit points. If a stock starts to fall, you can exit at various levels to protect some of your gains. The key is to follow your strategy and not let fear of missing out or regret cloud your judgment.

Handling Market Volatility

Stocks that rise significantly can also experience drops. When this happens, it’s essential to stay calm and stick to your strategy. Even if a stock falls from one circuit to another, having a plan to exit at specific points will help you retain some gains. The regret of not riding a winning stock further can be more damaging than losing some gains. By following your strategy and being prepared for market changes, you can make money and avoid negative energy from missed opportunities.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com