Overview !

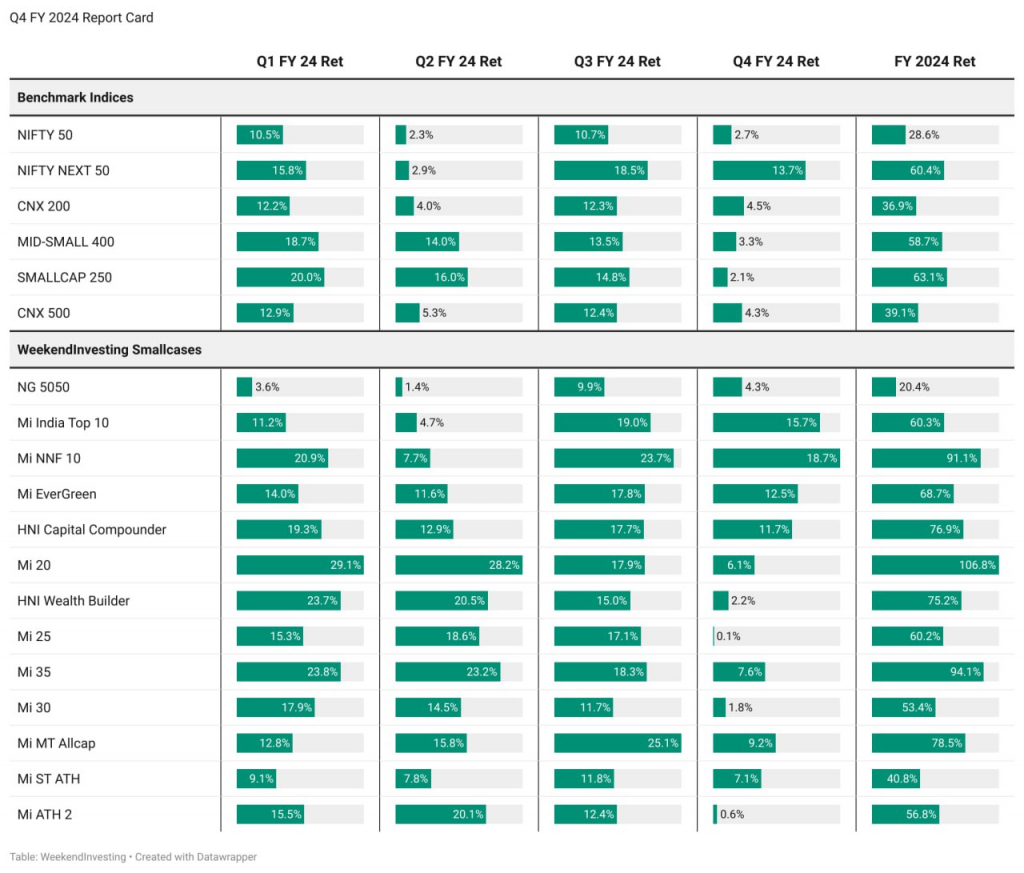

Q4 FY24 was a subdued quarter in relation to the heady moves seen in the past three quarters but was still very much in the green. The index rallied in two out of three months of this quarter and made an All Time High at 22526, nearly 700 points higher than the highest point of last quarter.

The global narrative of potential 2 or 3 interest rates cut in 2024 continues and is causing more tailwinds for all markets. It is not sure given that inflation has not budged at all whether this will be possible. Even Energy and oil prices have been heading higher and hence there is a mixed concoction of tailwinds and headwinds in combat.

The Indian market is now looking at the election outcome post the next quarter and the establishment of the third term of the current government is an expected outcome so no major surprise is likely to be delivered here. The surprise if at all may come from overseas investors who may pump in more money on this confirmation. India remains the fastest growing large economy in the world and the markets are front running that reality ahead of times.

Nifty gained over 2.7% this quarter and the surprise was the big move in the Nifty next 50 stocks at 13.7% ! Small Cap 250 and Midcap400 index were more subdued at 2.1% and 3.3% respectively.

For Q4FY24 within Weekendinvesting strategies notably, India Top10 was up 15.7%, Mi NNF 10 at 18.7%, and Evergreen at 12.5 %. All other strategies performed in line or beat the respective benchmarks.

Our belief in the concept of BBC (Bhav Bhagwan Che), a Gujarati saying which means that “Price is God” helps us follow the markets in a non-discretionary manner and we allow the markets to do the talking. This has been our sole mantra in the last nearly 8 years that we have been offering these services to tens of thousands of Weekendinvestors. Our 100% non-discretionary approach at times can lag the markets when markets make trend changes but over time, we have seen this perform much better than many other styles of investing. The historical CAGR returns experienced by clients and the resulting thousands of testimonials are proof to this claim.

The forecast for next few quarters as it stands today is that of continued optimism given the political and economic strong position and the potential of the culmination of hiking interest rates.

At Weekendinvesting, we will continue to walk our established chosen path of following our strategies to the Tee. All our strategies have a self-healing and self-correcting approach and will come around strongly after any drawdown period that we may face. The whole setup is like a high probability winning machine provided you give the strategies adequate time to heal if the market undergoes some damage.

This last quarter we have taken many new initiatives at Weekendinvesting.

– We had the third Weekendinvesting Hangout meet in Mumbai which was well received. We intend to meet in a new city every quarter or even earlier.

– We have now started the WI Chat Service on the weekendinvesting.com website that any new user coming to the website can ask direct queries from. The Weekendinvesting App now has more than 10,000 users who use it for its super content and a free educational US strategy available there.

– The online appointment system that was added in the App is being used extensively where you can have a one on one google meet based video call with our team to discuss anything.

– Our new daily newsletter that goes out to a large audience has gained traction and we have a good engagement with our audience there.

– We had the second successful launch in the exclusive HNI segment with HNI Capital compounder which was well received.

– In the coming quarter, we intend to plan to upgrade our content delivery through YouTube and other channels also to meet our target to educate youngsters on the importance of saving, investing and having a planned approach.

We strongly believe in the long-term India story and we believe that momentum strategies will continue to do very well in this India scenario of continuity of growth and liquidity flows. All we need to do is to ensure that we are riding the winners when it is favourable to us and defending our position when it isn’t. The key to success here is discipline and sticking to the proven strategy.

Q4 FY 2024 Video Review !

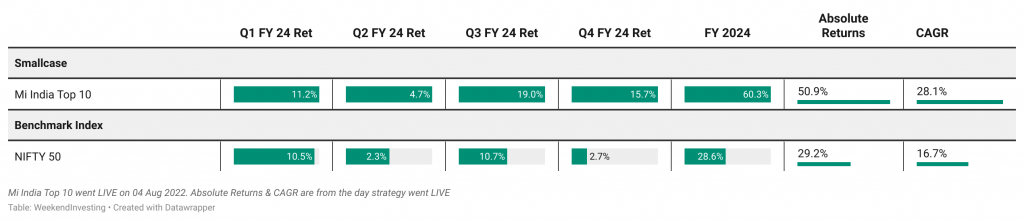

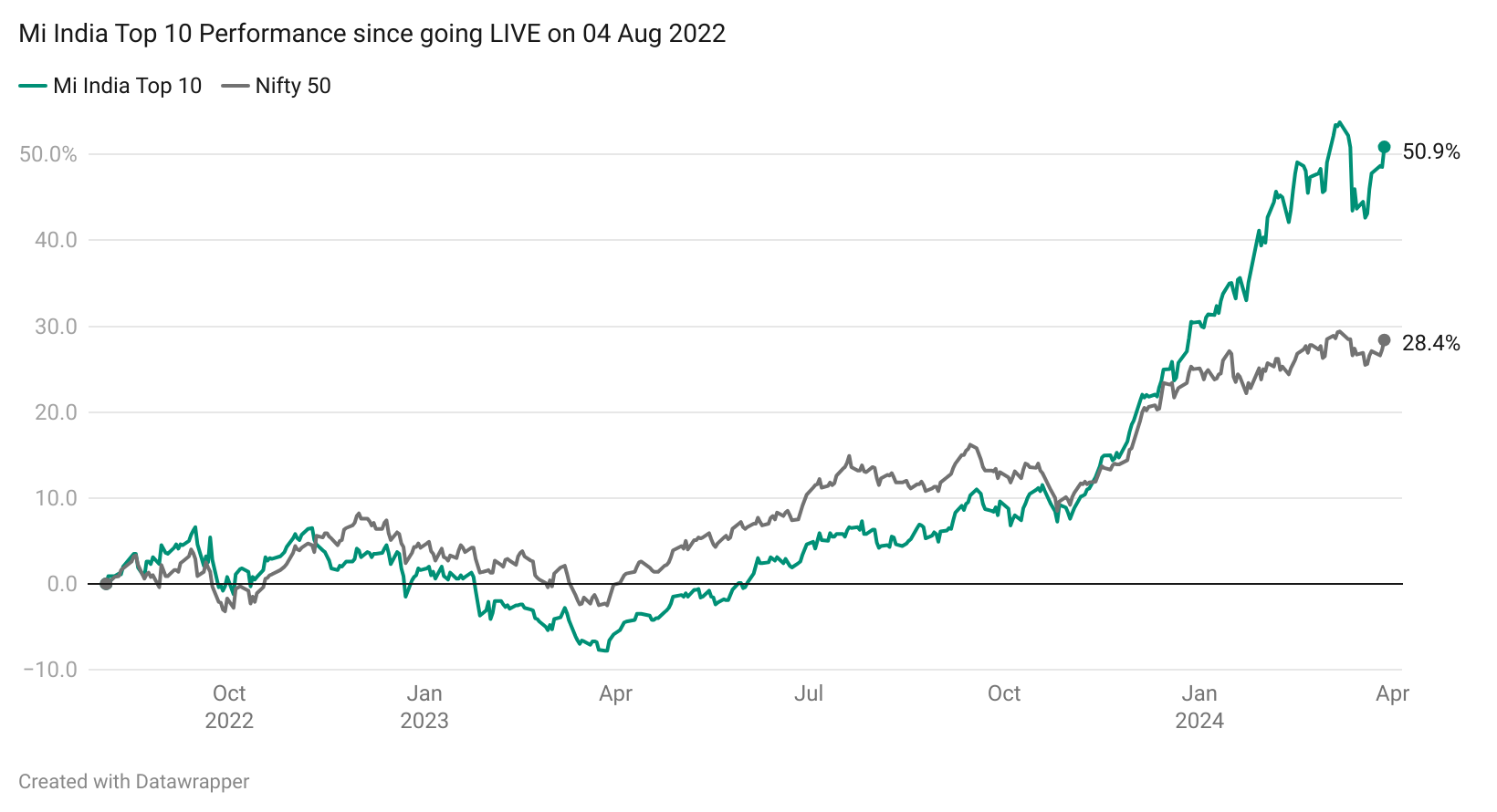

Mi India Top 10 Review

Mi India Top 10 is a Low Churn – Monthly Rebalanced – Rotational Momentum strategy that invests in Top 10 trending stocks from the robust Nifty 50 Universe. Nifty 50 is India’s premier benchmark index for stocks that are ranked as Market Cap of 01st to 50th on the NSE and is rebalanced twice a year. This strategy does not go to cash like other strategies in a downturn but attempts to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month.

This strategy has been a revelation in FY 24 having outperformed it’s benchmark, the Nifty 50 across all quarters. Q2, Q3 & Q4 were particularly exceptional with more than 2x the performance of the benchmark which is an outcome of being bias free as far as the weightage allocation is concerned & allowing winners to run while dumping losers early. .

In FY 24, Mi India Top 10 has recorded a fantastic performance of 60% compared to 28% on the Nifty 50.

The strategy was lagging Nifty 50 since launch all the way till Nov 2023 post which we got to witness a very special rally that has resulted in a very healthy lead against its benchmark.

The strategy also hit a small milestone of achieving 50% gains at the end of Q4 FY 24 (since launch) compared to 28% on Nifty 50.

The CAGR of Mi India Top 10 stands at a very respectable 28% compared to 16% on Nifty 50.

Mi India Top 10 Intro Video | Mi India Top 10 Blog Post

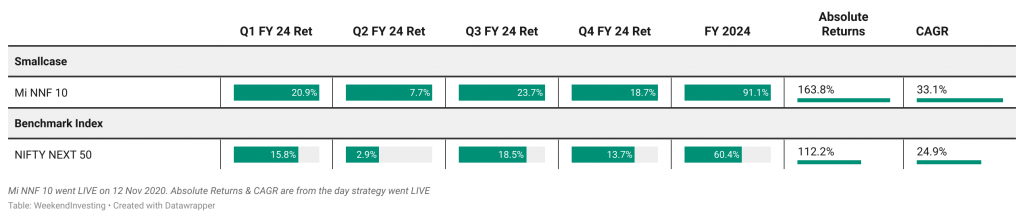

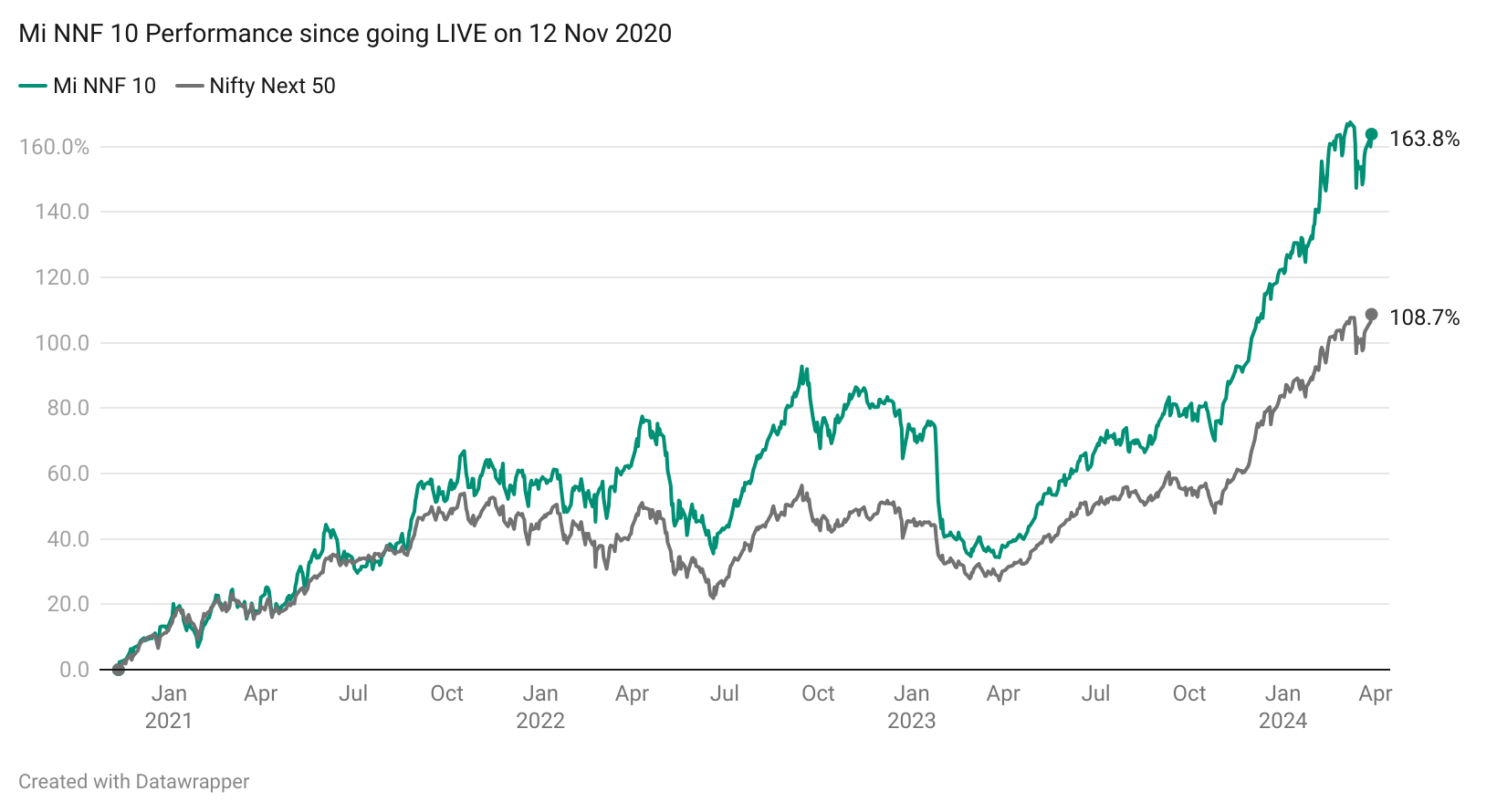

Mi NNF 10 Review

Mi NNF10 is a rotational momentum strategy based on the Nifty Next 50 large cap index. It is a great substitute for capital that seeks investing in the indices. Nifty Next 50 is an index for stocks that are ranked as Market Cap of 51st to 100th on the NSE and is rebalanced twice a year. These large cap stocks have a higher volatility than the Nifty stocks. This strategy does not go to cash like other strategies in a downturn but this strategy is able to extract some more beta from this group by staying with the strength within this group. The strategy allocates 10% weight at the beginning of each month to its ten constituents and rebalances it each month.

Mi NNF 10 signs off from FY 24 with a fantastic 91% gains compared to 60% on the Nifty Jnr Index. The strategy ended the FY 24 with outperformance across all quarters resulting in a massive overall lead against its benchmark. To sum things up, this kind of a performance from a large cap strategy is something that we did not expect too.

The strategy has thus far clocked 163% compared to 112% on the Nifty Jnr Index since going live on 12 Nov 2020.

The strategy performed in line with its benchmark till about Oct 2021 post which we saw a gradual outperformance all the way till Oct 2022. The strategy did well to bounce out of a correction and has once again taken a strong lead over its benchmark.

The CAGR of Mi NNF 10 stands at a solid 33% compared to 25% on the Nifty Jnr index.

Mi NNF 10 Intro Video | Mi NNF 10 Blog

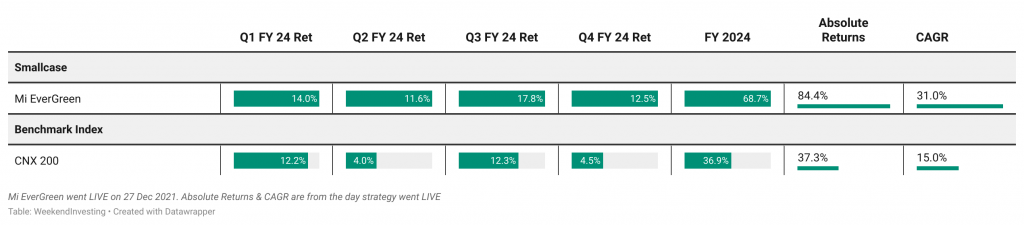

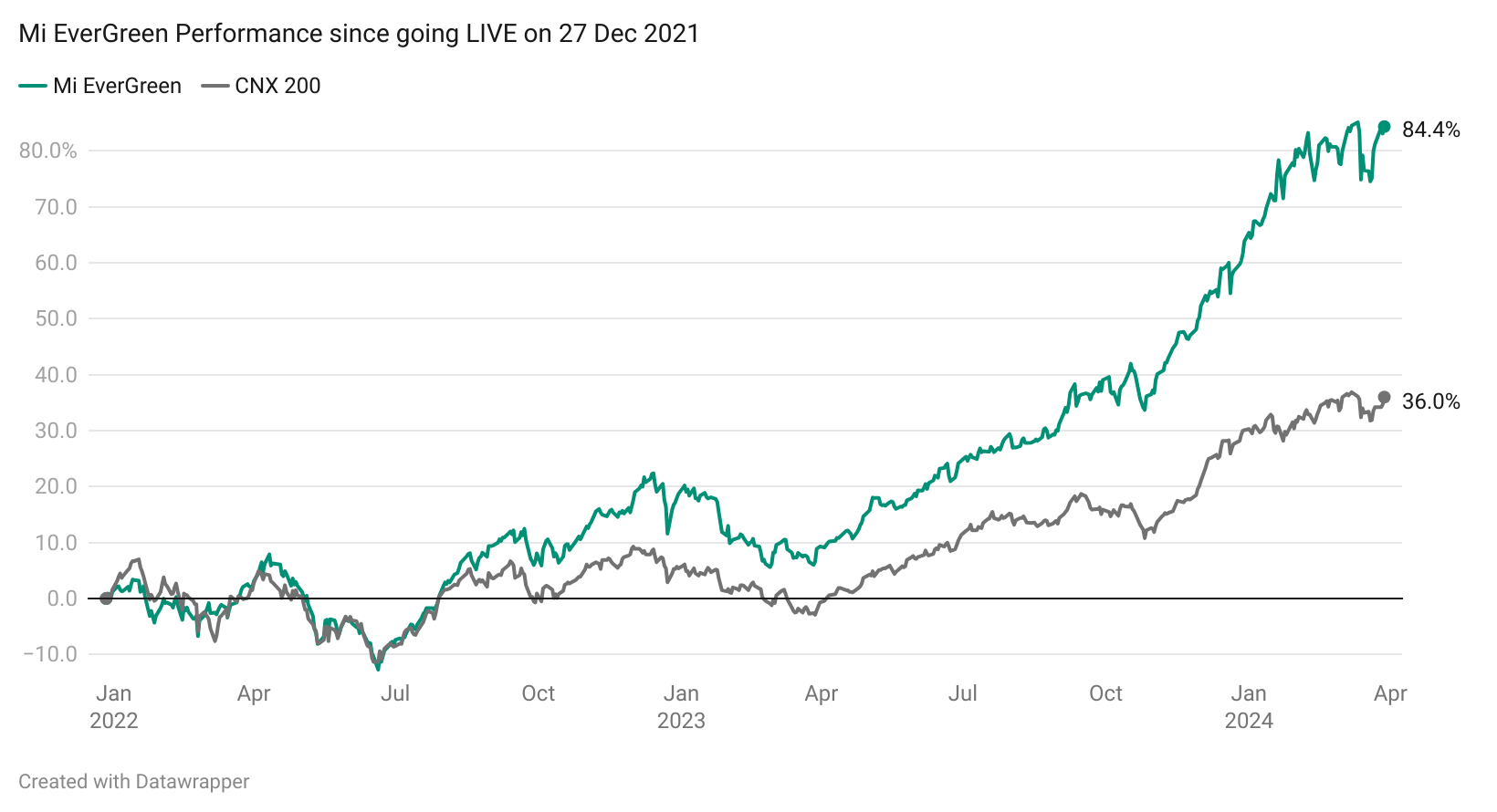

Mi Evergreen Review

Mi Evergreen is a dynamic strategy which aims to outperform the underlying benchmark CNX200. This index comprises 200 large and mid-cap names which are the top-quality stocks in the markets. This product is suitable for use in all stages of the market cycles as it is designed to invest in the strongest stocks in the pack at any point. Additionally, there is a permanent hedge of Gold available here.

Mi Evergreen has been extremely consistent in FY 24 outperforming its benchmark, the CNX 200 index across all quarters. In Q4 FY 24, the strategy recorded gains of 12.5% while the CNX 200 clocked only 4.5%.

The strategy’s FY24 performance stands tall at 68% gains compared to 37% on CNX 200 index.

Mi Evergreen has been impressive right since start with a fantastic all round performance. The strategy performed in line with its benchmark for the first 6-7 months but started to gradually outperform. FY 24 has been a complete revelation further strengthening its lead to a wider margin.

Mi EverGreen’s fixed 25% allocation to GOLD also comes in quite handy in controlling the overall volatility of the portfolio. The strategy’s CAGR stands at a solid 31% compared to 15% on CNX 200 index (a 2x beat)

Mi EverGreen Intro Video | Mi EverGreen Blog Post

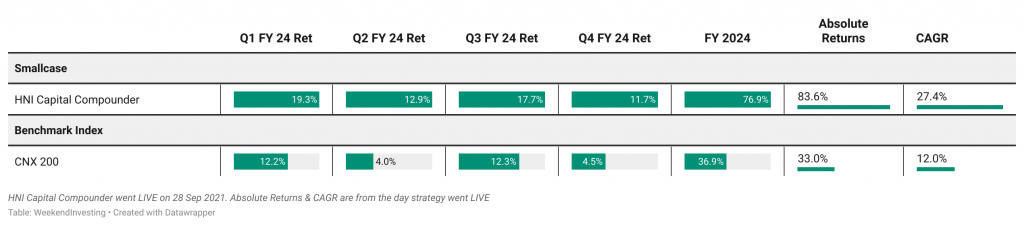

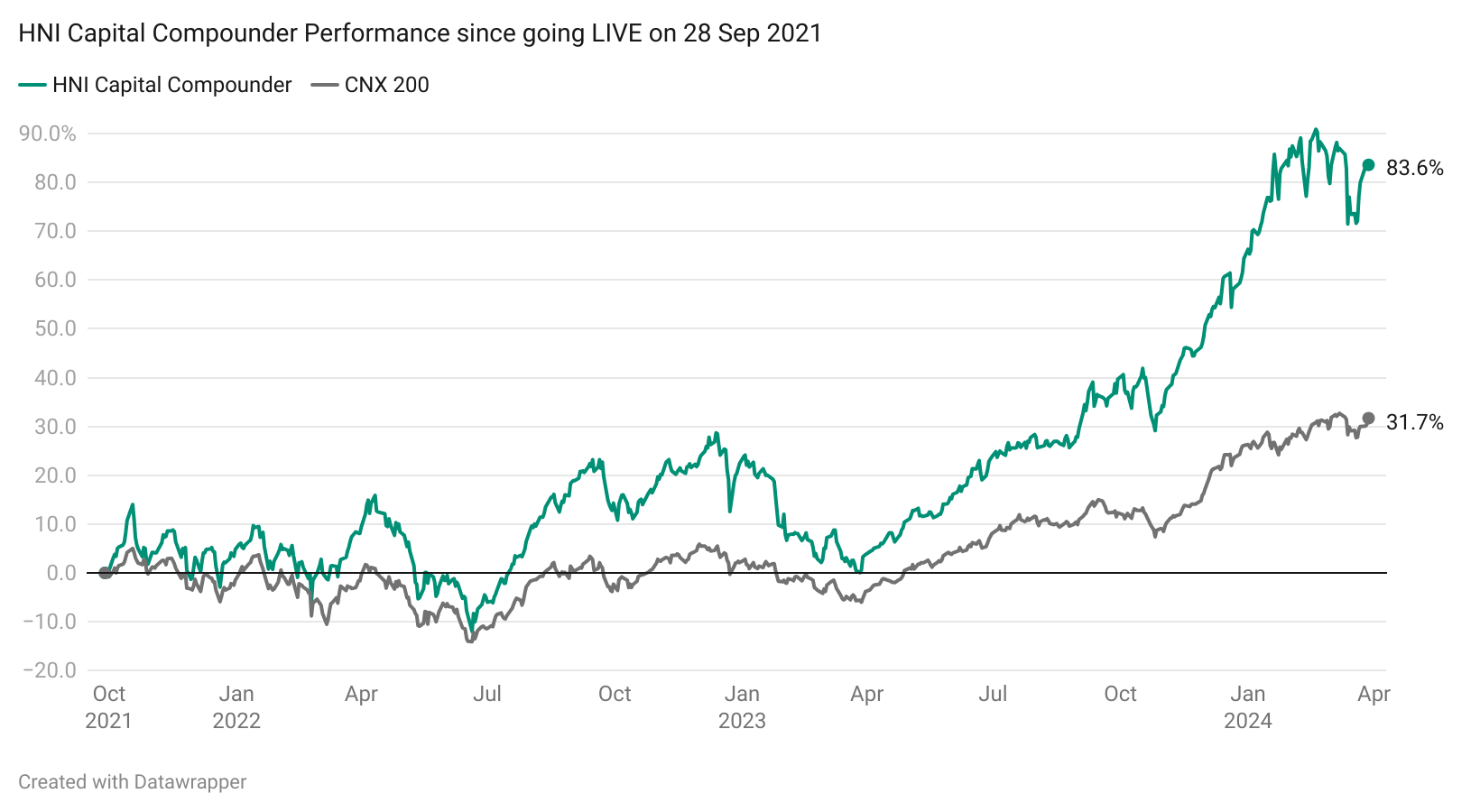

HNI Capital Compounder Review

HNI Capital Compounder is a CNX 200 based rotational momentum strategy that invests across the 20 strongest stocks from its universe. This is the second strategy to join our HNI Segment that was created back in Nov 2023. The primary objective of the strategy is to try and extract some alpha from the robust CNX 200 universe which is a very potent blend of established large-cap leaders and emerging mid-cap champions.

HNI Capital Compounder has achieved great performance in FY 24 outperforming its benchmark, the CNX 200 index across all quarters like all other strategies discussed above. FY 24 tally stands at a decent 76% compared to 37% on the CNX 200 index.

Since going LIVE on 28 Sep 2021, the strategy has recorded gains of 83% compared to 33% on its benchmark.

The strategy had a rocky start as markets faced a momentum draught for a considerable period of time but picked up as soon as markets started trending around Jun 2022. But the real performance kicked in around Apr 2023 which saw the strategy widening its lead over its benchmark.

The CAGR since start stands at a very healthy 27% compared to only 12% on CNX 200.

HNI Capital Compounder Intro Video | HNI Capital Compounder Blog Post

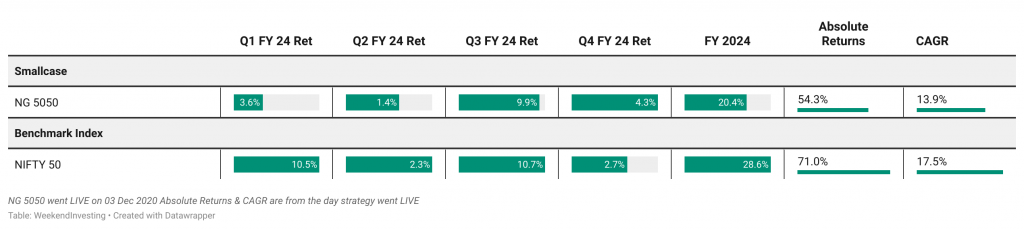

NG 5050 Performance

This portfolio invests in Nifty and Gold ETF in equal proportion and balances the weights every month. It is designed as a FREE alternative to market instruments that despite having higher risk are unable to deliver appropriate returns.

The strategy highlights the high inverse correlation between Nifty and Gold and how combining the two can result in a very low volatility outcome with superior returns than most low risk strategies. The strategy allocates equally to the two asset classes and rebalances it at the end of each month.

NG 5050 had a very good Q4 FY 24 showcasing its sheer ability in offering stability when the markets are a bit volatile. 2.4% gains on Nifty 5o perhaps would not highlight the kind of volatility we witnessed but the strategy has shown us its purpose by posting gains of 4.3% in the same period riding on the good performance of gold.

In FY 24 , NG 5050 returned a very healthy 20%.

The aim of the strategy remains to offer a stable low risk option beating inflation and the strategy continues to deliver quite well on those terms.

This free strategy has quietly gone about its job of aiming to provide inflation beating returns at lower risk. We believe, a 14% CAGR for a strategy with this objective is surely a decent outcome.

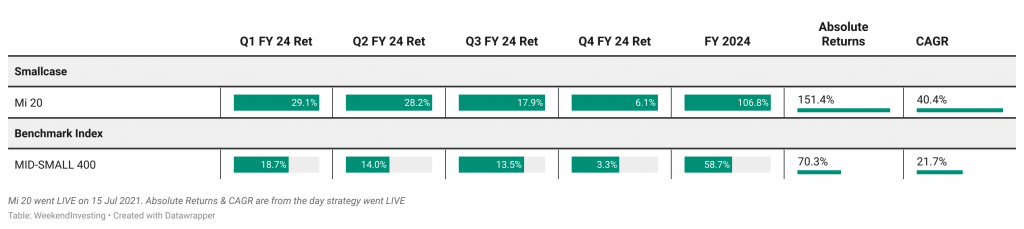

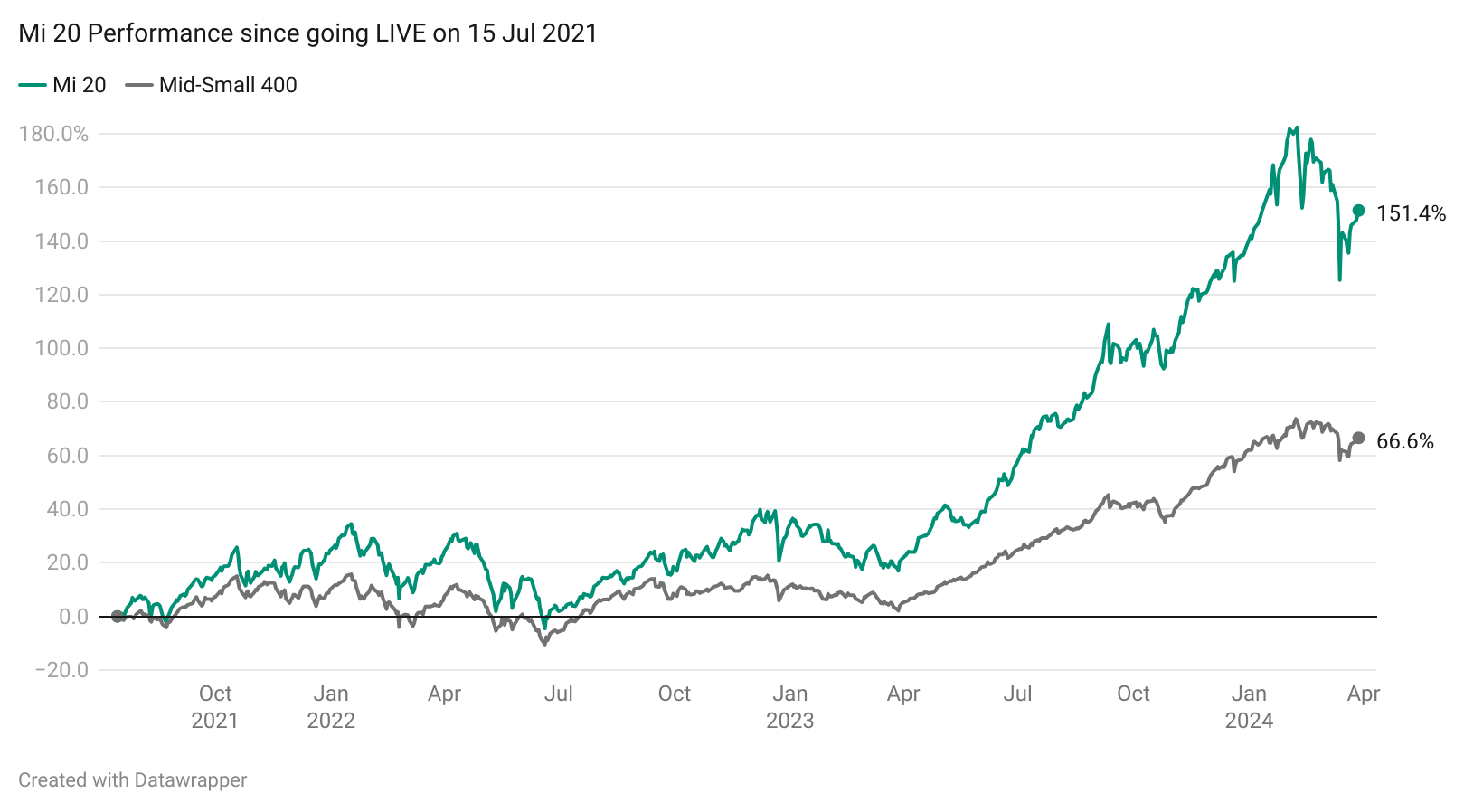

Mi 20 Performance

Mi 20 is a portfolio of up to 20 stocks that aims to create sizeable alpha with trending stocks from the Mid-Small Cap 400 Index using the principles of Rotational Momentum. The strategy is rebalanced weekly and allocates 5% to each new entrant. The strategy is only available in the smallcase format.

Mi 20 emerges as the top performer for WeekendInvesting in FY 24 with an outstanding gain of 106% compared to 58% on the mid-small 400 index. The strategy has shown exceptional consistency throughout FY24 outperforming its benchmark across all four quarters quite handsomely.

Overall, since going live on 15 July 2021, the strategy has recorded an absolute return of 151% compared to 70% on the mid-small 400 index.

Mi 20 simply took off from FY 24 and has been a going through a blockbuster run ever since. There was a bit of correction towards the fag end of FY 24 but a timely recovery ensured that the downward trend was arrested to close out FY 24 on a high.

The strategy’s CAGR is currently at an exceptional 40% compared to 21% on the mid-small 400 index.

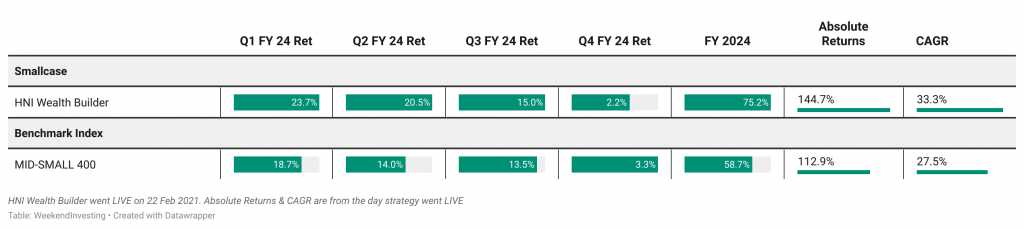

HNI Wealth Builder Performance

HNI Wealth Builder is an up-to 50 stock weekly rebalanced portfolio that follows momentum trends among small cap and mid cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 2% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the benchmark index by a wide margin despite the large diversification.

HNI Wealth Builder was the first strategy to be inducted into our HNI Segment back in Nov 2023. This strategy has performed superbly in FY 24 with 75% gains compared to 58% on the mid-small 400 index. Barring Q4 FY 24, all other quarters saw the strategy outperforming its benchmark by a good margin to achieve overall outperformance in the FY.

The strategy had performed pretty much in line with its benchmark till about Mar 2023 post which we witnessed a sharper rise in the former leading to overall absolute gains of 144% since 22 Feb 2021 compared to 108% returns observed on the latter.

The CAGR since launch on Smallcase is at a solid 33% so far compared to 27% on mid-small 400 index.

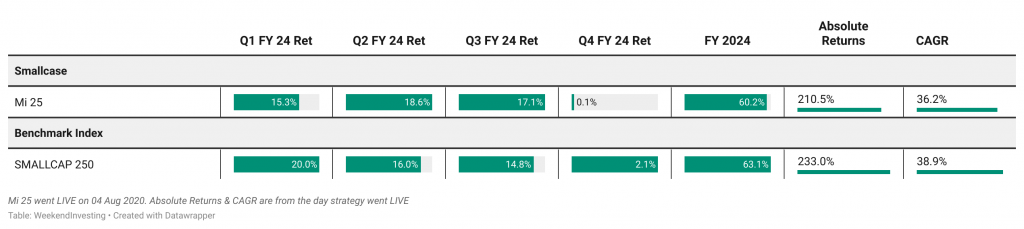

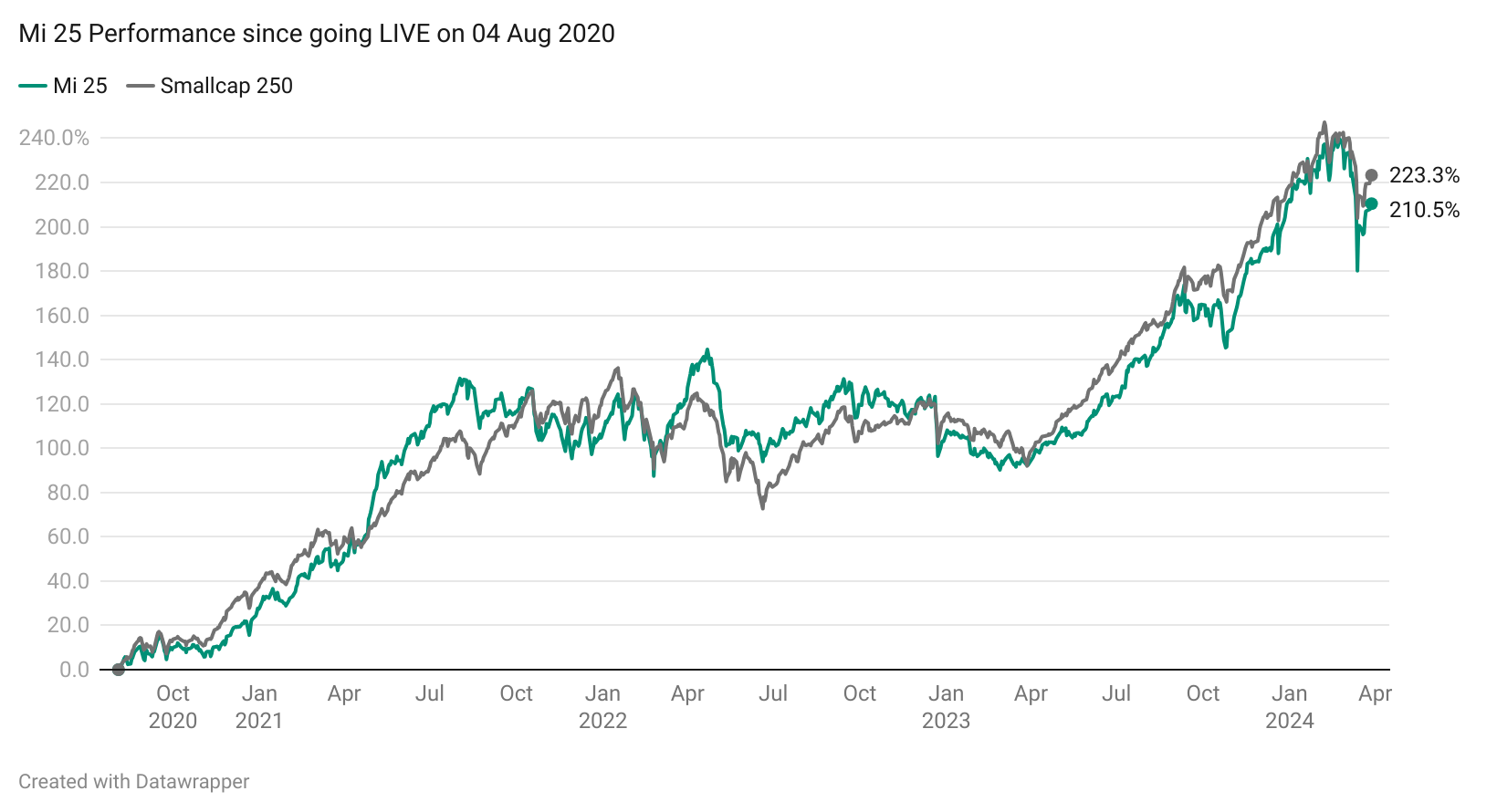

Mi 25 Performance

Mi 25 is an up-to 25 stock weekly rebalanced portfolio that follows momentum trends among small cap stocks only. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 4% per stock in the portfolio. This is one of our very popular portfolios and it has consistently outperformed the smallcap index by a wide margin.

Mi 25’s performance was in line with that of its benchmark, the Smallcap 250 index in FY 24. Q4 FY 24 saw the strategy clocking muted returns compared to 2% on the benchmark. Overall, in FY 24, Mi 25 returned 60% as against 63% on the Smallcap 250 index

The strategy may not have put on a spectacular show but has performed in line with its benchmark. The best part of this strategy is its dynamic cash allocation system which shifts money into debt instruments when the markets in a bearish trajectory.

The CAGR at present stands at 36% compared to 38% in the Smallcap 250 index.

Mi 25 Intro Video | Mi 25 Blog Post

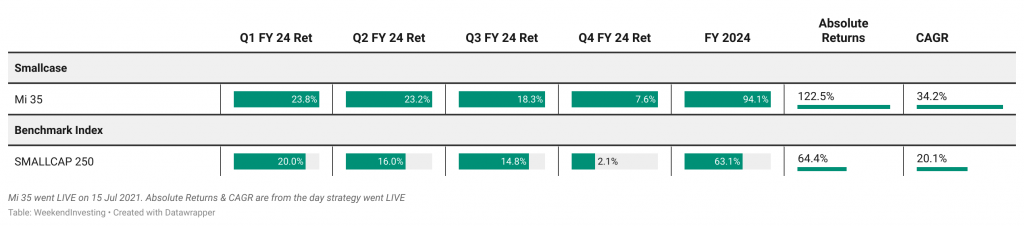

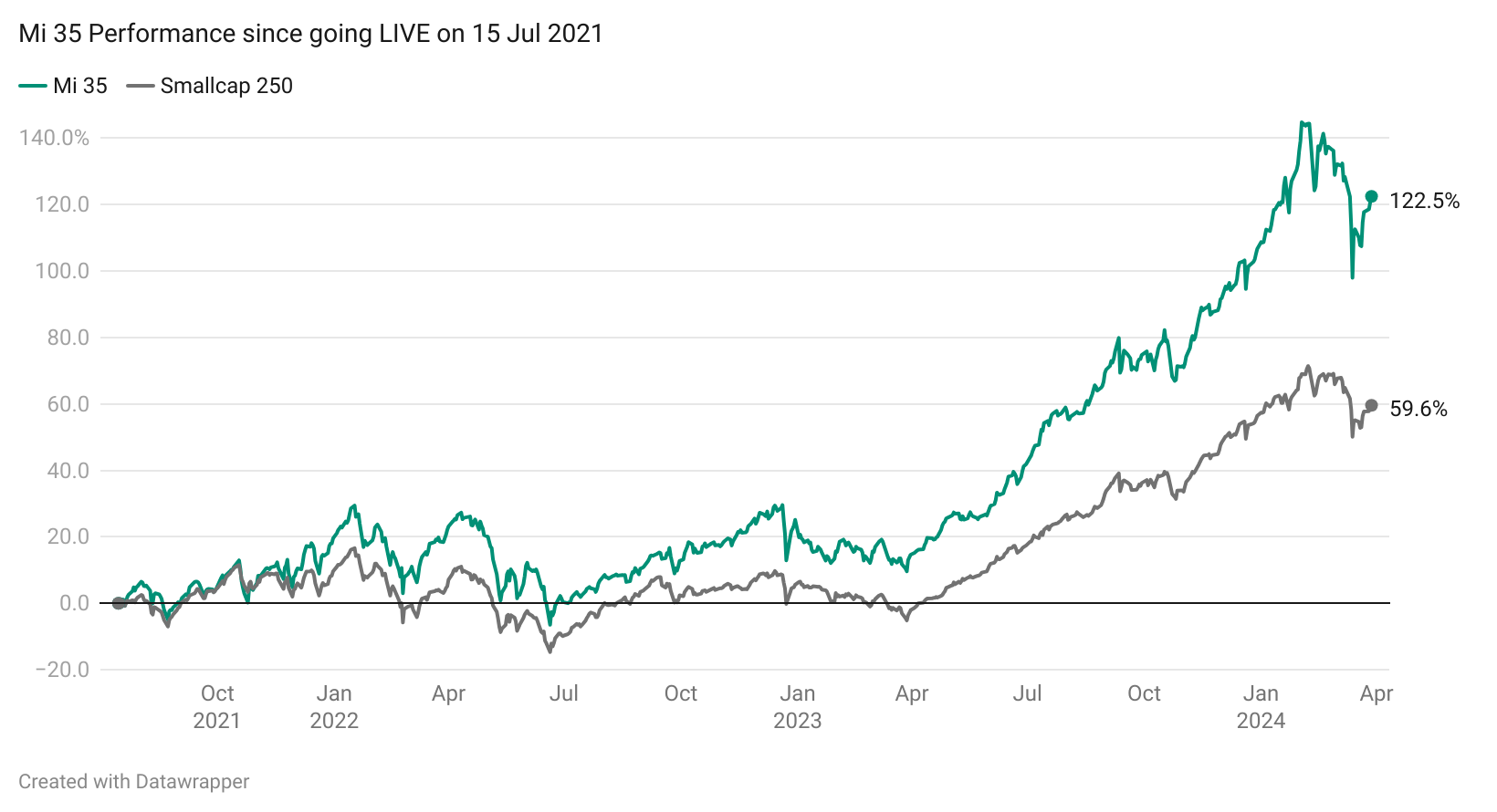

Mi 35 Performance

Mi 35 is a dynamic strategy which aims to outperform the underlying benchmark Smallcap250 index. These are the 251st -500th stocks in the market place. This product is suitable for use in all stages of the market cycles as it is designed to remain invested in the strongest 35 stocks in the pack regardless of market conditions.

Mi 35 has done splendidly well in FY 24 with gains of 94% compared to 63% on the Smallcap 250 index. The strategy has achieved a very good outperformance across all quarters in this FY. Particularly in Q4 FY 24, the strategy returned 7.6% compared to only 2.1%clocked by its benchmark.

Since going live on 15 Jul 2021, the strategy has recorded absolute gains of 122% compared to 64% on Smallcap 250 index.

The strategy has always been very nimble in rotating between the strongest stocks in its universe. It’s lead has widened considerably since the start of FY 24.

Mi 35’s CAGR currently stands at a very strong 34% compared to only 20% on the Smallcap 250 index

Mi 35 Intro Video | Mi 35 Blog Post

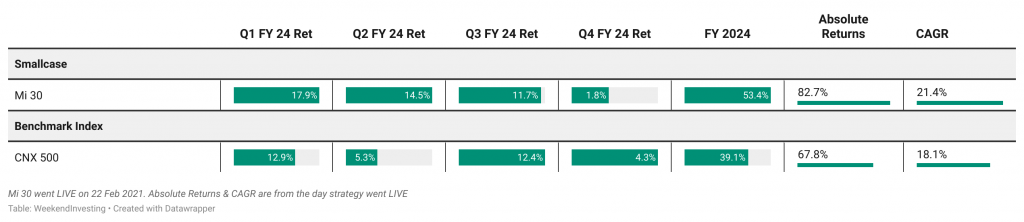

Mi 30 Performance

Mi 30 is an up-to 33 stock weekly rebalanced portfolio that follows momentum trends among constituents of the CNX500 index. The CNX500 index comprises the largest 500 stocks in the NSE universe. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 3% per stock in the portfolio. This is one of our very popular all cap portfolios and it has consistently outperformed the underlying index by a wide margin.

Mi 30 is a slow moving – conservative – multicap vehicle for those who are seeking such characteristics in a portfolio. The strategy has posted very healthy gains of 53% compared to 39% on the CNX 500 when you look at the FY24 performance.

The strategy did underperform in Q4 FY 24 but a healthy lead generated across rest of the quarters ensured an overall beat on the CNX 500 index.

Mi 30’s performance was pretty much in line with the CNX 500 index till the beginning of FY 24 but a solid performance thereon has ensured a decent lead for the strategy against its benchmark.

The strategy’s CAGR stands at a respectable 21% compared to 18% on the CNX 500 index.

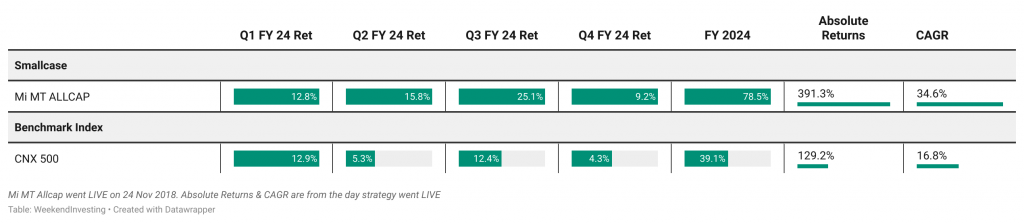

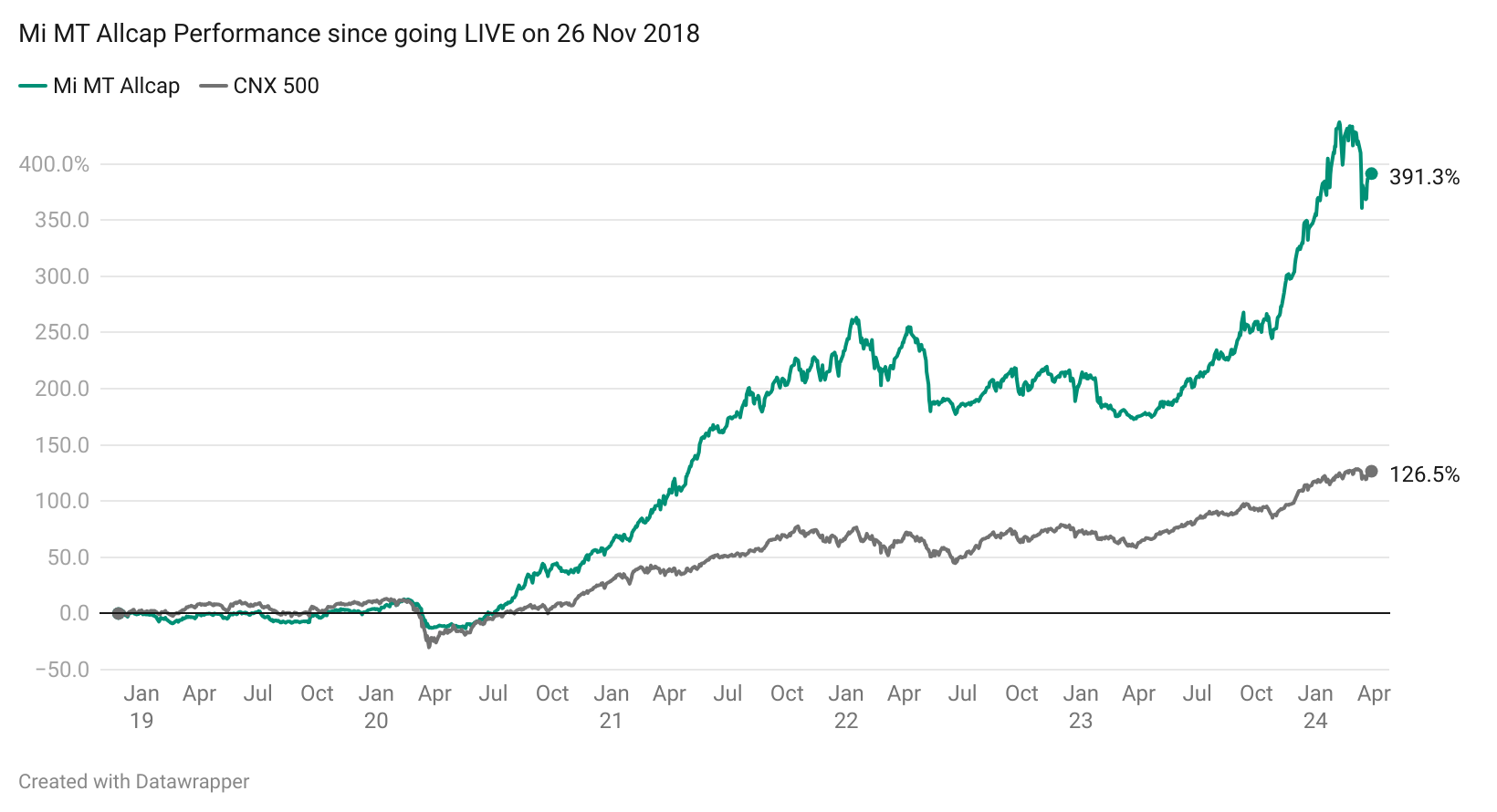

Mi MT Allcap Performance

Mi MT Allcap is a 20 stock weekly rebalanced portfolio that follows momentum trends among all listed NSE stocks. These stocks are filtered for average min volume and market capitalization above 1000 crores only. The stocks that are picked are allocated an exposure of 5% per stock in the portfolio. This is one of our longest running portfolios and has also consistently outperformed the benchmark index by a decent margin.

Mi MT Allcap staged an incredible comeback especially after a difficult period between Jan 2022 and Apr 2023. This FY saw the strategy clock a superb 78% compared to 39% on the CNX 500 index.

In Q4 FY 24, Mi MT Allcap did quite well to return handsome gains of 9.2% compared to 4.3% on the CNX 500 index.

Since going live on 24 Nov 2018, the strategy has clocked an astounding 391% compared to only 129% on the CNX 500 index.

This chart probably speaks for itself. The strategy has seen two exceptional uptrends. The first one from Apr 2020 to Jan 2022 & the second one has begun in Apr 2023 and is still going strong.

The current CAGR on Mi MT Allcap stands at a superb 34% against 17% on the CNX 500 index.

Mi MT Allcap Intro Video | Mi MT Allcap Blog Post

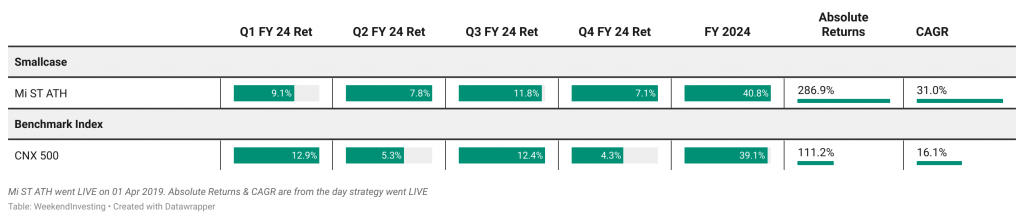

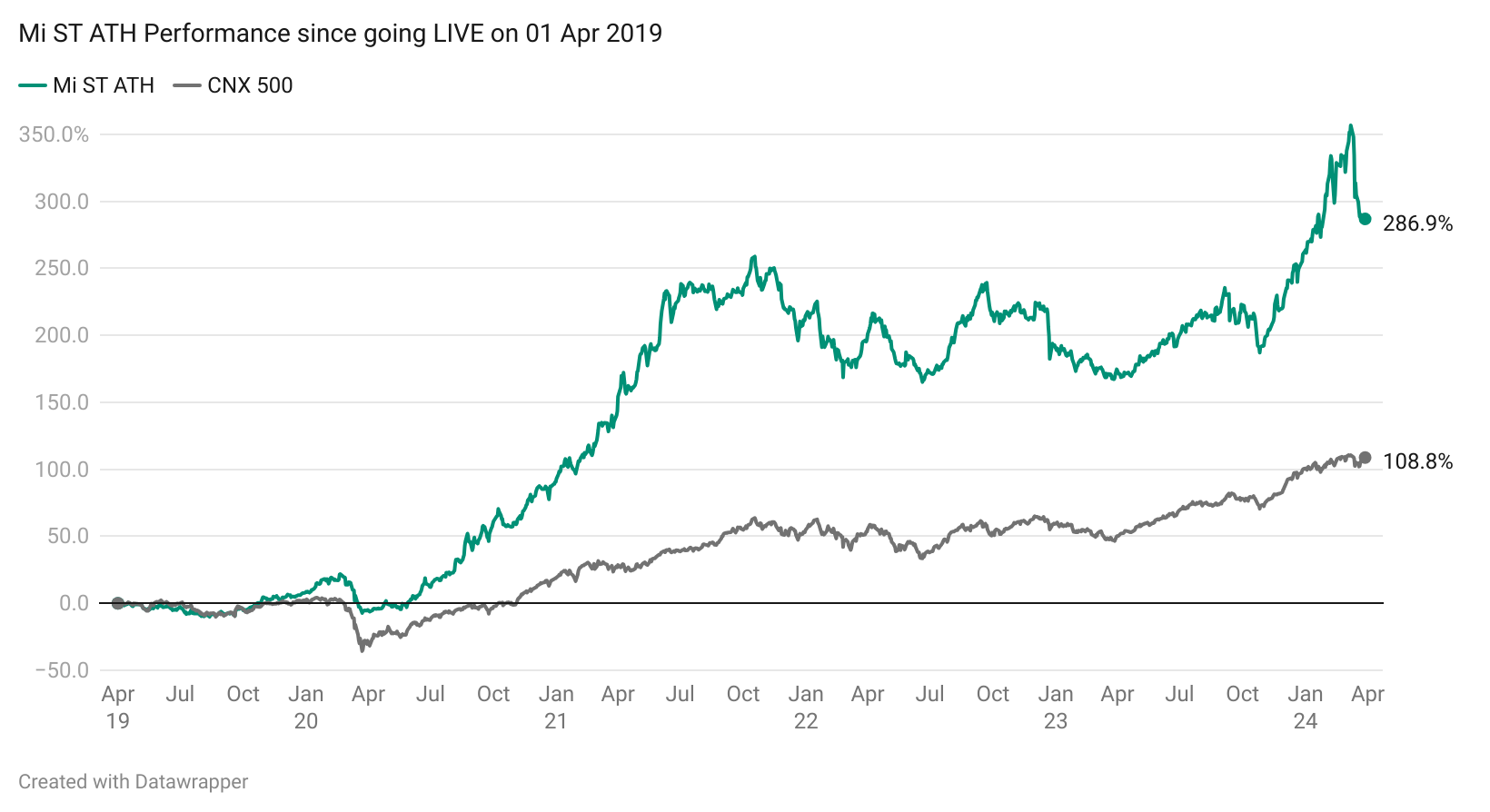

Mi ST ATH Performance

Mi ST ATH is an up to 10 stock portfolio that follows the short term momentum trends among all listed NSE stocks above market capitalization of INR 1000 cr and chases stocks hitting All Time Highs or multi year highs. The strategy is nimble footed and can have a higher churn.

Mi ST ATH may not have turned up as well as we may have expected it to but nevertheless, the performance is still in line with that of its benchmark, the CNX 500 index. In Q4 FY 24, the strategy returned an impressive 7% compared to 4.3% on the CNX 500 index .

In FY 24, Mi ST ATH has clocked 40% compared to 39% on the CNX 500 index.

Like Mi MT Allcap, this strategy also had a difficult phase between Oct 2022 and Apr 2023 post which we can observe a sharp uptrend. One should take a minimum of 5 year perspective with such satellite portfolios for better outcomes.

The current CAGR is at a very decent 31% compared to 16% on the CNX 500 index.

Mi ST ATH Intro Video | Mi ST ATH Blog Post

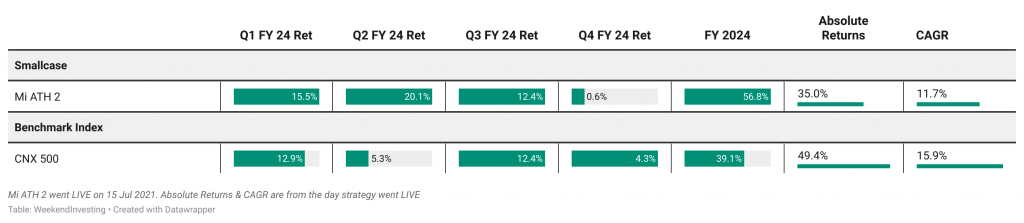

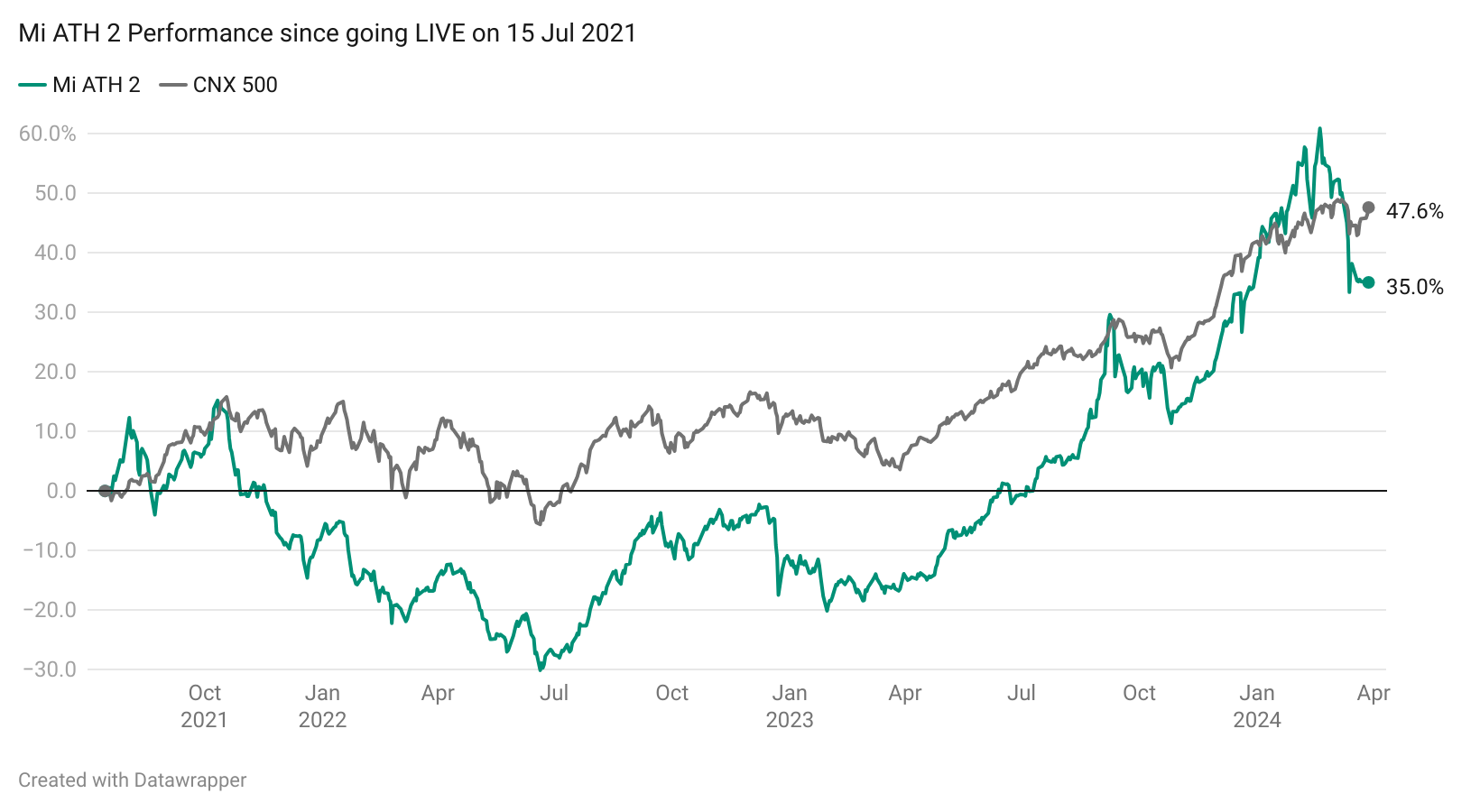

Mi ATH 2 Performance

Mi ATH 2 is a high risk , up to 10 stocks strategy that aims to create sizeable alpha by chasing stocks near their all time or multi year highs from the all listed NSE stocks above Market Cap of 500 crore. The strategy is nimble footed as it seeks to minimize losses by quickly exiting stocks that fail to trend up.

Mi ATH 2’s performance in FY 24 has also been decent if not great with returns of 56% compared to 39% on the CNX 500 index.

The strategy did quite well in the first three quarters but fell a bit short in Q4 FY 24 underperforming its benchmark.

This is a high risk strategy capable of extracting alpha especially during strong momentum markets. While the performance since start may not be as well as one may have expected it to be, we strongly believe investors should continue to remain patient and take a long term outlook.

Mi ATH 2 Intro Video | Mi ATH 2 Blog Post

That’s a wrap on Q4 FY 2024 report.

If you have any questions , please send us an email to support@weekendinvesting.com