Reading time 5 mins

With over a few decades of my experience in the markets, I found that a LONG ONLY portfolio was very good from a gradual wealth creation point of view, but did not provide me with answers to these following questions :

What happens if in the future the markets do not do, what they did in the last 20 years?

What if the India growth engine slows down for a considerable duration?

What is the way to hedge my long only portfolios?

What will keep me motivated in down years ?

What can be an income generating strategy besides my long only investments generating low dividend yields and capital gains in much longer duration?

I found the answer to these and many such questions in a strategy I developed late last decade post the 2008 crisis and called it STAIRS. The strategy was then run as a managed futures strategy for clients in my own NSE brokerage house. Later, after I gave up the brokerage business, I ran STAIRS on my own account intermittently and have been running it regularly and also offered it as an advisory service since last year.

STAIRS is a directional Index Signalling System. It runs on a combination of Nifty and BankNifty instruments. It will tell you at any point, what is the current view on the two indices – Long or Short. It is a always-in trade position strategy with some leverage. The signal is generated based on trend following techniques and the position size can be adjusted to desired level of risks to be assumed. The signal can be used with plain futures or one can self-design a layer of additional intelligence for better entry exits or position sizing. One can also design an options strategy to run along.

With STAIRS, I discovered the immense flexibility of hedging my long only portfolios which are mostly invested in the strategies at weekendinvesting.com (which is highly correlated to the markets). STAIRS has provided me with an uncorrelated strategy that only has absolute returns as its focus. Allocating even 10/15/25 pct of your overall equity exposure to such a non-correlated strategy has the ability to bring about an immense improvement in performance and volatility to your overall portfolio.

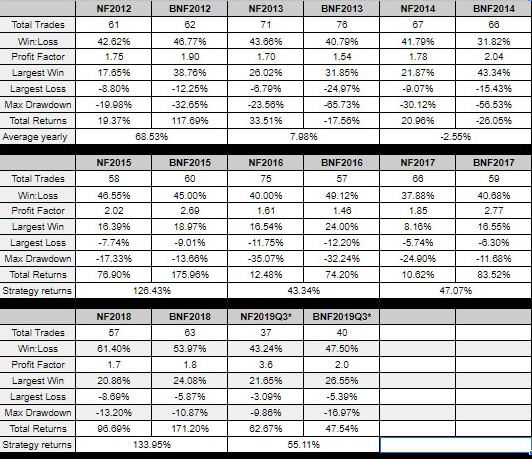

Below is the returns that STAIRS has generated pre-tax in the last many calendar years.

(Current year up-to Aug 9th 2019 has been annualized, leverage used 3X)

While the performance has been nothing short of spectacular (for me), there have been years of deep draw-downs as well especially in Bank Nifty. Various combinations of Nifty and Bank Nifty can be chosen (50% each or 75% Nifty 25% BN etc) or preferred leverage of your choice ( 1.5X, 2X 3X etc) can be done to fit the strategy to your liking. Some may want to play more aggressively than 3x leverage as well, as exchange allows up-to even 7x leverage.

What is evident from the above historical statistics is that it is a slow system. Slow is good in trading (like investing) as it means low churn, low costs and low slippages. On average, there are only about 60 trades a year or about 5 index turns a month. The frequency of turns here again will be dependant on trending vs non-trending periods. In Feb and July 2019 for instance, in Nifty, the trade went on without break for four and three weeks respectively. These two trades resulted in gains of more than 36% of the total 62% so far. So there will be many small losers and few large winners. There may also be long spells of whiplashes and draw downs that can unnerve the most confident souls.

The clear advantage of this strategy (if one does not want to see it in isolation) is best seen in conjunction with a long only strategy.

Lets assume we are running a long only index (nifty only) portfolio. Now lets see the impact of allocating a 15% component of STAIRS to it. (85% invested in Nifty)

| NIFTY | STAIRS 3x | 85-15 Portfolio | |

| 2012 | 27.70% | 68.53% | 33.83% |

| 2013 | 6.76% | 7.98% | 6.94% |

| 2014 | 30.11% | -2.55% | 25.21% |

| 2015 | -3.12% | 126.43% | 16.31% |

| 2016 | 3.01% | 43.34% | 9.06% |

| 2017 | 28.65% | 47.07% | 31.41% |

| 2018 | 3.15% | 133.95% | 22.77% |

| 2019* ann | 3.90% | 94.47% | 17.48% |

| CAGR | 11.80% | 57.80% | 20.00% |

Over a nearly 8 year period, the returns from the index (not incl dividends) are 11.80% while that from the strategy are 57.8%. Adding just a 15% component of the strategy to the portfolio mix makes the overall returns extremely attractive at 20% !

Now lets take another case of a more aggressive player and say we have a 100% small cap portfolio. Lets mix 25% of STAIRS to this portfolio (75% smallcap) and see the results

| NSE SMALLCAP 100 | STAIRS | 85-25 Portfolio | |

| 2012 | 36.85% | 68.53% | 44.77% |

| 2013 | -8.30% | 7.98% | -4.23% |

| 2014 | 54.97% | -2.55% | 40.59% |

| 2015 | 7.23% | 126.43% | 37.03% |

| 2016 | 2.25% | 43.34% | 12.52% |

| 2017 | 57.32% | 47.07% | 54.76% |

| 2018 | -29.08% | 133.95% | 11.68% |

| 2019* | -25.20% | 94.47% | 4.72% |

| CAGR | 7.47% | 57.80% | 23.50% |

Over a nearly 8 year period, the returns from the small cap index (not incl dividends) are just 7.47% while that from the strategy are 57.8%. Adding just a 25% component of the strategy to the portfolio mix makes the overall returns extremely attractive at 23.5% !

There can be various other ways you can run this strategy, in isolation or in conjunction with your existing portfolio. The strategy is simple, but it is not easy. You will need to follow the signal diligently. It will take just under 5 min a day of your time, that too only 5 times a month on average and at only specified times of the day. The biggest hurdle however, will be your own mind. Can you control your mind to stick to the strategy and stay disciplined in tough draw-downs? As they say, there is no gain without pain. And the markets anyways are giving a lot of pain even in non leveraged portfolios, so why not get good gains along with those pains 🙂

The best way to approach this is to follow the STAIRS strategy for some time and familiarize your self. All details can be found here at STAIRS2profits.com

Subscribe to the FREE End of Day channel (we update all trade dates and regular results here. This channel has 3200 plus users already and we will be making it a closed group soon). Follow the strategy and assess if you will be able to follow and keep the discipline.

Once confident, jump in with a Quarterly or Annual subscription. Also read about our unique service guarantee that comes with the annual plan. Once you make some initial 20-30% gains, gradually increase positions one step at a time. Over a few years you will swear by its advantages. Many of current hundreds of users have sent in testimonials that relay the success they have achieved. So can you!

If you have any questions just email : alok@weekendinvesting.com

STAIRS2profits.com and weekendinvesting.com are advisory products run by Alok Jain

Alok is a SEBI registered investment advisor with a market experience of more than 23 years. Past performance is no guarantee for future performance. Investment or trading in markets using equities and derivatives can result in significant capital loss.

Hello Alok,

Good day. Hope are keeping well.

Please send some more details of stairs , I am looking to trade the index going forward.

Thanks, KK

>

Hi. Please go through the site at STAIRS2profits.com and send in your queries via email if any. Tks.

Hello Alok,

I do not have a credit card(I have only debit from HDFC and Axis), how can I pay for the stairs subscriptions.

Make the online payment by Credit Card [kindly save your card for recurring payment]

>

We can send you a pay link . Please read the additional charges in the FAQ. and then send a mail mentioning the preferred plan.