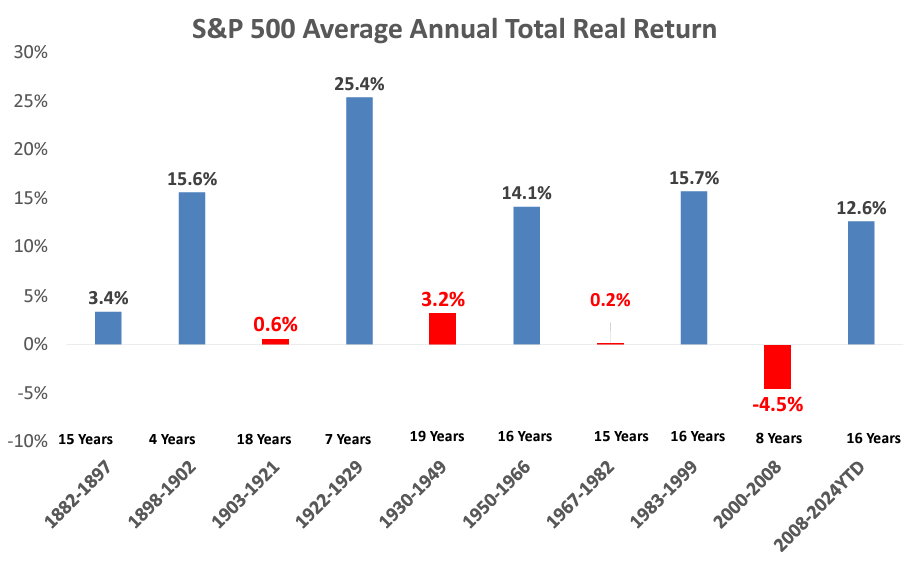

Long Periods of Low Returns in the Stock Market

When we look at stock market data from the past 140 years, it’s clear that the journey has not always been smooth. For example, the S&P 500 index has seen long stretches where returns have been far from exciting. From 1903 to 1921, over 18 years, the average annual real return was just 0.6%. Similarly, between 1930 and 1949, the return was only 3.2%. Even more recent periods, such as from 2000 to 2008, had an average return of -4.5%. These numbers show that markets can go through long periods without delivering high returns.

Good Returns Are Not Always Consistent

While there are periods with better performance, like from 1950 to 1966 with a return of 14%, and from 2008 to the present with 12% returns, these are still not what one would call “out of the park” results. The key takeaway is that achieving consistently great returns over the long term is challenging. It’s common for markets to go through phases of minimal growth or even decline. Investors need to be prepared for these slow periods and not assume that the market will always generate high returns.

How to Manage Market Pain Points

During these long periods of low or negative returns, it’s essential to find ways to reduce the pain points of being in the market. There are different strategies that can help, such as following a specific investment approach, setting up a Systematic Investment Plan (SIP), or even trying to time the market if one has the skill. While market timing can be tricky and risky, it might work for some experienced investors. Overall, the goal should be to find ways to improve returns rather than just passively hoping the market will perform well.

The Risk of Doing Nothing

One of the worst strategies is to simply buy stocks and then “sleep on it.” Many investors believe that doing nothing and waiting for the market to go up will lead to great returns. However, history shows that this approach often leads to long periods of disappointment. If earning good returns was as easy as buying stocks and doing nothing, everyone would be rich, and no one would bother with active strategies. The reality is that markets require careful attention, and investors need to take steps to manage their portfolios actively.

Active Management for Better Results

Investors who are serious about improving their returns must remain engaged and alert. While passive investing can work during certain periods, it’s crucial to know when to make adjustments. Whether it’s rebalancing a portfolio, moving into different asset classes, or following market trends, being active helps to avoid the long, flat periods that the market sometimes goes through. By staying involved, investors can potentially make better decisions and avoid the frustrations that come with simply waiting for the market to recover.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com