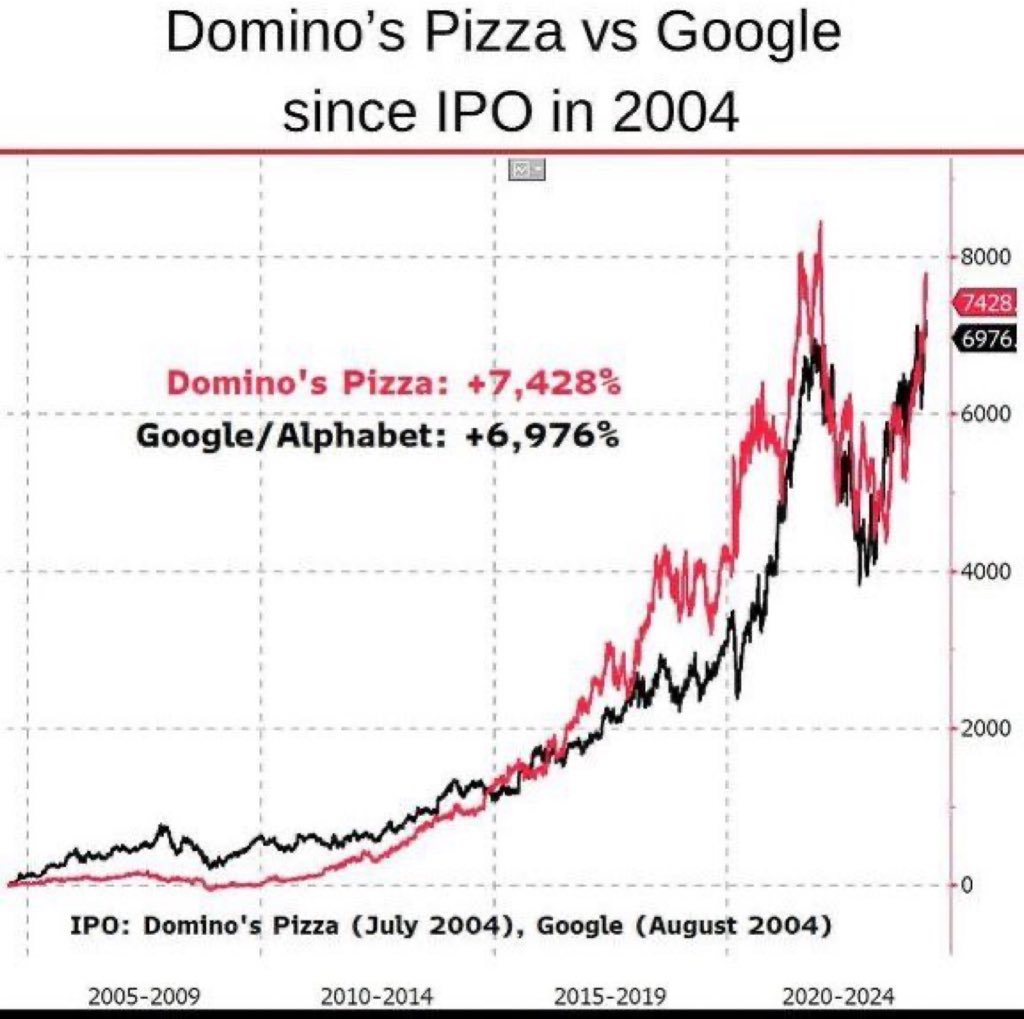

Stock Performance Surprises: Domino’s Pizza vs Google

It might come as a shock to many, but over the last 20 years, Domino’s Pizza has outperformed Google (now known as Alphabet) in stock performance. If someone were to ask which of these two companies had done better in the stock market, most people would likely say Google. After all, Google is a tech giant, and its products are used by millions every day. However, the reality is that Domino’s, a simple pizza company, has delivered better stock performance during this period. This surprising comparison teaches us some important lessons about investing.

Breaking the Narrative: Simplicity Can Win

One of the key takeaways from this comparison is that we often let narratives shape our investment decisions. Google, being a high-tech company, is naturally seen as a stock that would outperform most others. It’s in the news, it’s innovative, and it plays a huge role in modern life. On the other hand, Domino’s operates a simple business model—making and delivering pizzas. There’s nothing particularly glamorous or cutting-edge about it, yet it has managed to outshine Google in terms of stock performance. This shows that even businesses that may seem simple can offer incredible growth potential.

Don’t Underestimate Simple Businesses

Domino’s success story demonstrates that simplicity doesn’t mean a company can’t outperform high-tech giants. Domino’s strategy of consistently delivering pizzas to customers, optimizing their delivery systems, and expanding globally has helped the company grow steadily. Investors may overlook such companies because they don’t have the same “wow” factor as tech firms, but over time, these companies can provide significant returns. This is a lesson for investors to remain open to all types of businesses, not just those that seem innovative or high-tech.

Being Neutral Towards Businesses

One of the key messages from this stock comparison is the importance of staying neutral when selecting stocks. Instead of getting emotionally attached to certain companies or industries, it helps to look at the actual stock performance. In a momentum-based portfolio, for instance, it doesn’t matter if the company makes pizzas or provides search engine services. If the stock is performing well, it belongs in the portfolio. This is the beauty of following stock prices rather than being swayed by what the company does or its industry reputation.

The Danger of Past Performance Bias

Another valuable lesson from this comparison is the risk of relying too much on a company’s past performance. Many investors fall into the trap of avoiding stocks that haven’t done well historically, assuming that poor past performance will continue. But this is not always true. Some companies, like Domino’s or even turnaround stories like Suzlon, can surprise investors by making a strong comeback. If investors remain open-minded and willing to look beyond a company’s past, they may spot opportunities that others might overlook.

Agnostic Investing Helps Stay on Course

Remaining agnostic towards what a company does or how it has performed in the past can be a powerful investing strategy. This approach ensures that investors don’t miss out on potential opportunities just because they seem unlikely. Following stock prices and market momentum rather than getting bogged down by company narratives or past performance helps investors stay on course. This mindset can lead to discovering hidden gems in the stock market, much like Domino’s Pizza’s remarkable stock performance compared to Google.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com