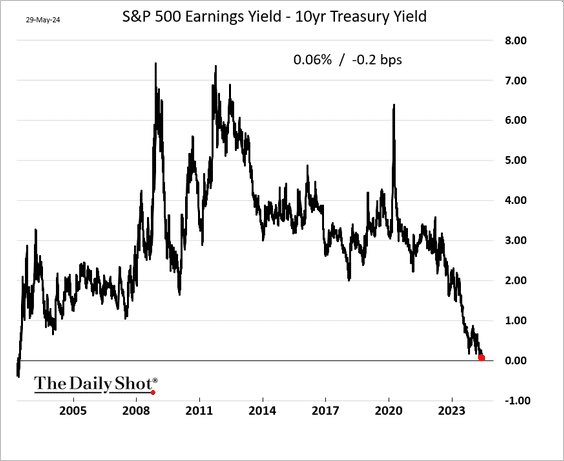

This interesting chart highlights the S&P 500 earnings yield compared to the ten-year Treasury yield. Recently, as Treasury yields have gone up, the gap between what you earn in the S&P 500 and the Treasury yield has decreased. Now, it is nearly zero. If the Treasury is yielding 4.55%, that is about the same yield you get from the S&P 500.

Comparing Risks and Yields

From an investor’s point of view, why take a lot of risk in the S&P 500 if you get the same yield from a Treasury bond? This is an important question, especially when the yields are almost equal. People in the US watch this gap closely. A higher gap usually means it’s a better time to invest in stocks.

Historical Trends and Good Entry Points

In the past, when the gap was high, it was a good time to enter the market. For example, during the 2008 financial crisis, the gap went from 1% to 7%. That was an excellent time to invest in equities. Similar situations happened in the 2011 fall and during the Covid-19 pandemic, where the equity premium was above 6%. These were great times to invest. But now, with the premium near zero, it signals that stocks may not be the best investment right now.

Election Impact on Market

The US presidential election is coming up in November, which might extend the market rally until then. After the election, the market will reflect the outcome. Right now, with no premium for buying the S&P 500 over the ten-year Treasury yield, investors need to be cautious.

The Indian Market Context

In India, the situation is different. The ten-year bond yield is around 8.5%, while the Nifty earnings yield is between 11% to 12%. This still gives a nice premium gap for the index compared to the ten-year bond return. Whenever markets run hard, money flows into the market. When markets fall and people lose hope, money moves quickly into fixed deposits (FDs) and Treasuries, making the perceived gap nearly zero.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com