Market Cap Comparison: Nvidia, Microsoft, Apple, and Russell 2000

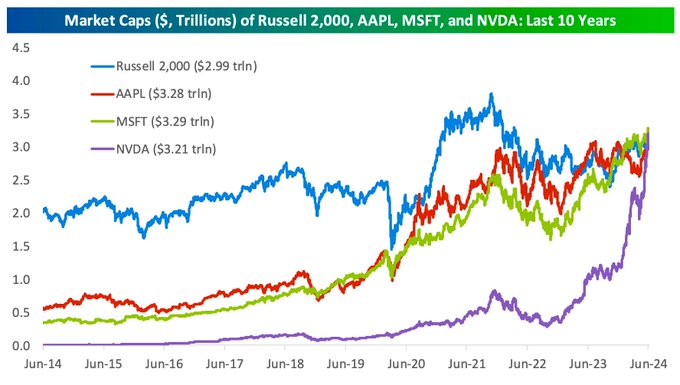

Let’s look at the market caps of Nvidia, Microsoft, Apple, and the Russell 2000. All four are currently around $3 trillion. Over the past ten years, Microsoft and Apple have steadily grown from about half a trillion to $3 trillion, a six-fold increase. Meanwhile, the Russell 2000, representing small caps, has risen from $2 trillion to $3 trillion, with fluctuations between $1.5 trillion and $3.6 trillion.

The Rise of Nvidia

Nvidia’s growth is particularly remarkable. Ten years ago, Nvidia’s market cap was a fraction of Microsoft or Apple. Even as recently as the COVID-19 pandemic, Nvidia’s market cap was under $100 billion. In just four years, it has soared to $3 trillion. This is a 30-fold increase, whereas the entire Russell 2000 has only doubled since the COVID-19 bottom.

The Importance of Leadership Stocks

The significant growth of Nvidia highlights the importance of having leadership stocks in your portfolio. Index investors, who invest in the S&P 500 or Russell 2000, may achieve steady returns. However, the exceptional growth of leading stocks like Nvidia can far surpass index returns. It is crucial to find strategies that allow you to capitalize on the strongest stocks in an index.

Non-Discretionary ETFs vs. Discretionary Investing

Non-discretionary ETFs, such as the FAANG ETF or top ten ETFs in the US, have performed well by focusing on leading stocks. On the other hand, discretionary investing, where decisions are influenced by personal bias, can sometimes lead to missed opportunities. For example, despite the success of tech companies, Ark Investment’s discretionary approach led to significant losses.

The Role of Market Sentiment

Nvidia’s exponential growth demonstrates that past performance is not always a reliable predictor of future success. The market’s ability to sense and respond to changes in a company’s prospects is crucial. Relying solely on past results can be misleading, as it may not account for the company’s current trajectory. Market prices, driven by sentiment and future expectations, are better indicators.

Strategies for Successful Investing

To achieve superior returns, it is essential to adopt strategies that minimize emotional bias. Non-discretionary investing, which relies on market signals rather than personal judgment, can help you make better decisions. Emotional attachment to stocks can hinder your ability to buy or sell at the right times. By following a systematic, unbiased approach, you can maximize your portfolio’s potential.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com