The WeekendInvesting App !

The highlight of the past week has been the launch of the Weekend Investing app, now available on Google Play and App Store. The app has been received with great enthusiasm, with over 3,000 users already joining. We encourage all weekend investors to download the app, as it provides numerous benefits and features that can enhance your investment experience.

By joining the app, you will receive immediate notifications for urgent messages from us. Additionally, all our content, including YouTube videos and Twitter posts, can be accessed in one place. This ensures that you stay up to date with relevant and valuable information. Moreover, the app allows you to interact with our team, ask questions, and provide feedback. It offers a seamless and convenient channel for communication between investors and our support team.

One of the key advantages of the app is access to exclusive educational content and strategies tailored specifically for weekend investors. We offer educational US strategies, trend analysis posts, market psychology insights, and much more. By leveraging these resources, you can enhance your investing knowledge and make informed decisions. Furthermore, the app provides opportunities for online and offline meetups exclusively for WeekendInvesting subscribers, allowing you to engage with fellow investors and expand your network.

A unique feature of the app is the ability to book a one-on-one call with the Weekend Investing team. This personalised support ensures that you receive prompt assistance and have your queries addressed directly. Additionally, a chat feature is available to provide immediate solutions to any questions or concerns you may have. The aim of the app is to facilitate seamless interaction and provide phenomenal support to all weekend investors and app users.

Benchmark Indices & Sectoral Performance

After weeks of decline, we finally witnessed a positive movement in the market, particularly on Friday, when the Nifty showed a significant upward trend. However, it’s important to note that the market is still not completely out of the woods. Although it has moved away from the danger zone around the 19,300 mark, further consolidation may be expected before a sustained upward trend.

Sectoral Performance

In terms of sector performance, real estate has emerged as a clear winner, with a significant 5.8% increase. The sector has been showing strong growth, indicating a real estate upcycle. Historically, real estate cycles tend to be long-lasting, lasting several years with intermittent down cycles. Therefore, this sector presents promising opportunities for investors.

Metals have also bounced back, driven by the Chinese focus on boosting their economy. With a 5% increase, the sector has already recorded a remarkable 24% growth in the current financial year. This renewed momentum in metals opens up potential investment prospects.

In addition, the auto sector has displayed positive growth, with Maruti leading the pack with a 3.7% increase this week. The sector has experienced a substantial 30% growth this financial year, indicating robust performance. Public Sector Enterprises (PSEs), including companies like BHEL, HAL, and Concor, have also witnessed a significant surge, with a 3.3% increase this week and 25% growth throughout the financial year. Similarly, commodities have shown minor gains.

However, defensive sectors, such as Pharma and FMCG, have lagged due to reduced market exposure to high-risk investments. When market rotation occurs from defensive to aggressive sectors, these defensive stocks often experience temporary setbacks. Nevertheless, Pharma has achieved an impressive 24.9% growth this financial year, positioning it among the top performers.

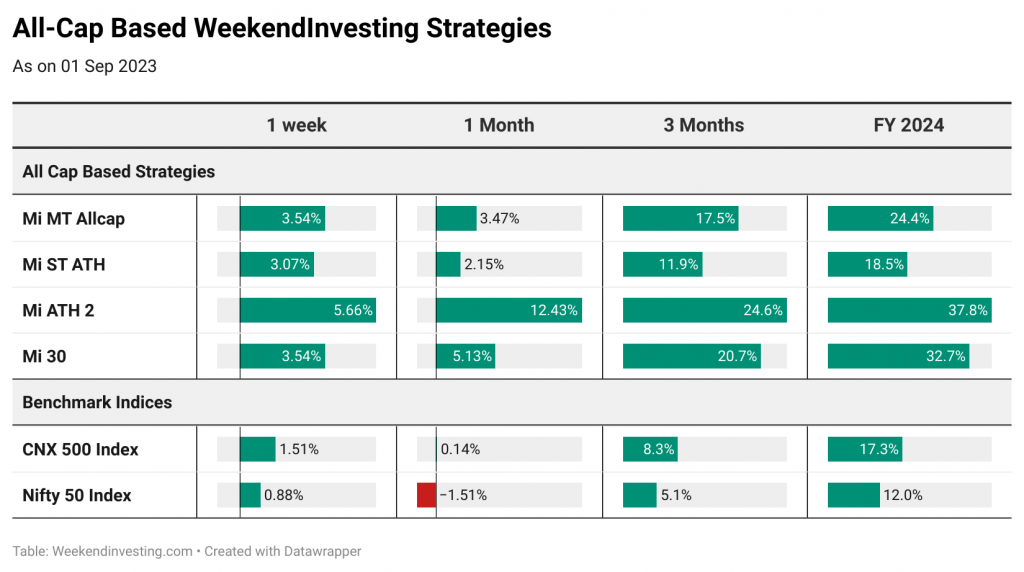

Weekend Investing Strategies: Performance Overview

Mi ATH 2 has demonstrated exceptional performance this week, with a remarkable 5.7% increase. In this financial year, the strategy has achieved an impressive growth rate of 37.8%. This niche strategy has made a remarkable comeback after a difficult initial period.

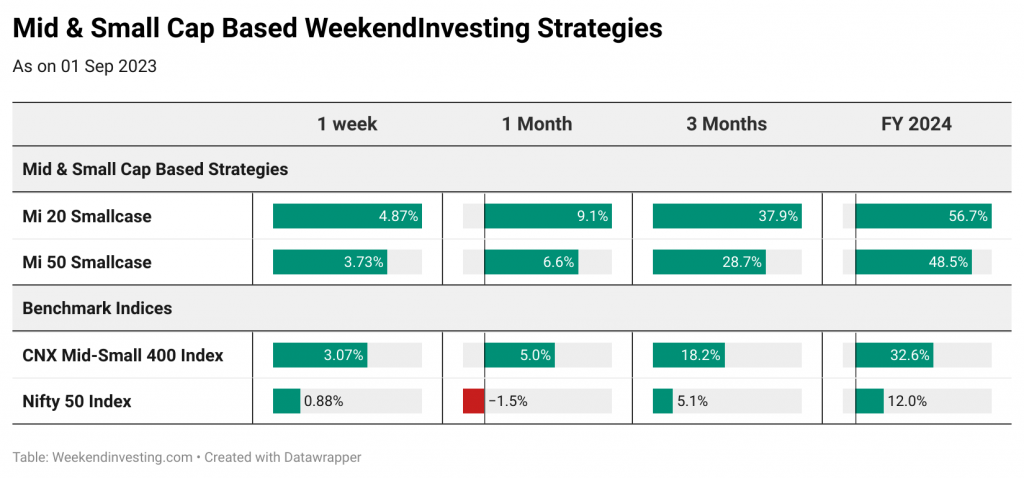

Another top-performing strategy is Mi 20, based on the mid and small-cap 400 index. With a 4.9% increase this week, it has shown a significant growth rate of 56.7% for the financial year. This strategy has consistently outperformed others and presents an attractive option for investors.

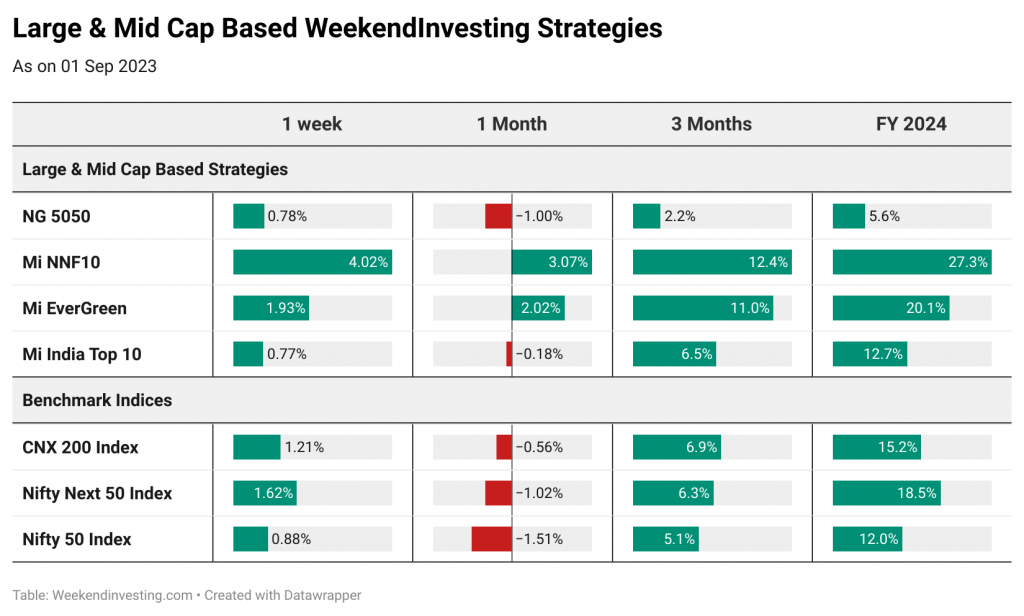

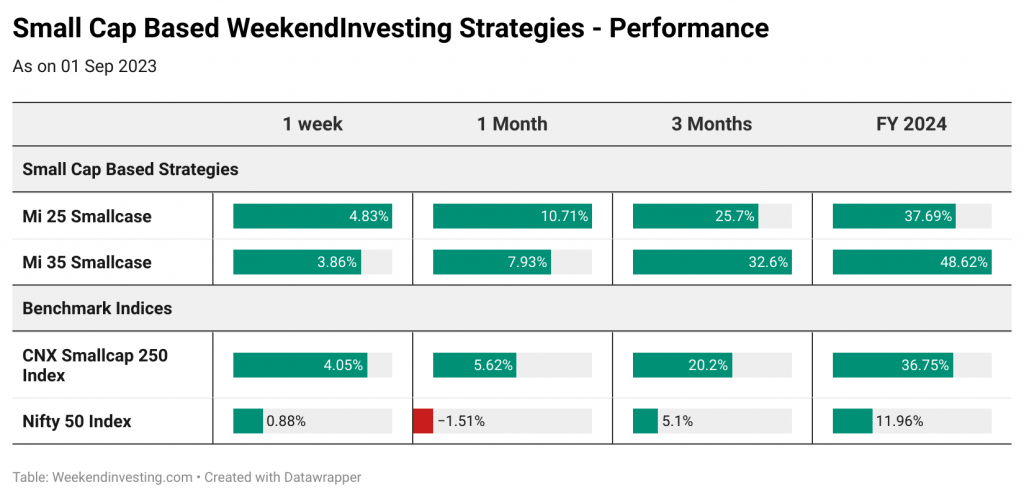

Other strategies, including Mi 25, Mi NNF 10, Mi 35, Mi 50, Mi MT All Cap, Mi Evergreen, and NG 50 50, have also recorded positive growth rates, ranging from 3.1% to 3.9% for the week. These strategies offer diversified investment options tailored to different investor preferences.

In conclusion, the market has shown signs of recovery after weeks of decline. Specific sectors, such as real estate, metals, autos, and public sector enterprises, have witnessed significant growth. It is a favourable period for investors as various strategies, especially the Weekend Investing strategies, have achieved impressive performance.

We encourage your participation and feedback on the Good, Bad, and Ugly weekly report format. We value your input and strive to provide the most relevant and insightful content. Please share your thoughts and suggestions with us. Additionally, for more detailed updates and insights, download the Weekend Investing app, which offers exclusive content, personalised support, and a seamless investing experience.

Thank you for your continued support, and we look forward to more exciting developments in the market in the coming weeks and months.

Spotlight – Mi ATH 2

Mi ATH 2 has demonstrated exceptional performance this week, with a remarkable 5.7% increase. In this financial year, Mi ATH 2 has achieved an impressive growth rate of 37.8%. This niche strategy has made a remarkable comeback after a difficult initial period.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

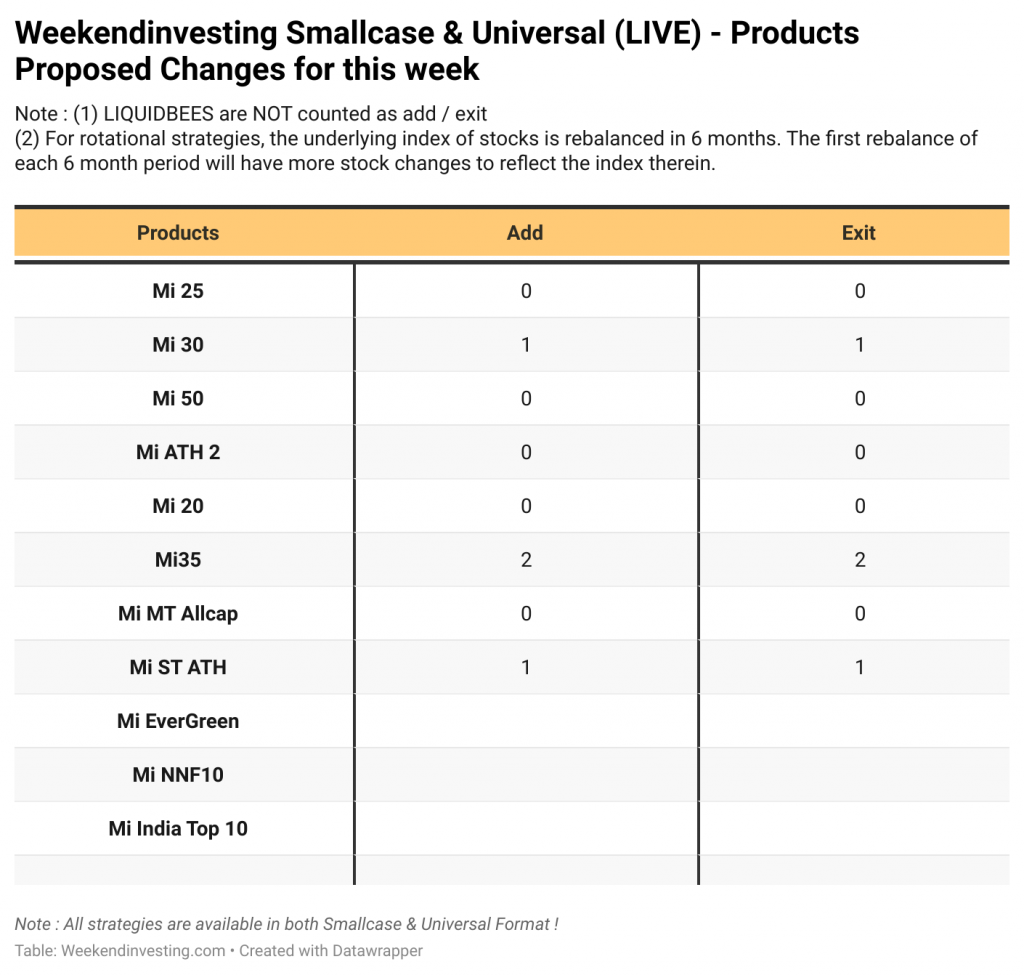

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s edition !