It’s the 18th of August 2023, and we find ourselves in a bit of a dilemma in the markets. Throughout the week, we have tested and retested the 19,300 level multiple times, but it seems that we have yet to break through with any significant momentum. However, despite this uncertainty, it’s important to note that we are still performing well compared to other major markets around the world. The Indian market continues to see strong flows, which helps counterbalance the current headwinds facing us.

There are two main factors contributing to these headwinds. Firstly, the continuously rising US yield, which is nearing the highs of 4.3%. There is talk of another raise coming soon, which adds to the pressure. On the other hand, the Chinese market is experiencing its own challenges, with the largest real estate company filing for bankruptcy and deflationary trends becoming evident. The US is raising rates while China is cutting them, leaving us caught in the middle and uncertain about our next steps.

Taking a slightly longer view, let’s look at the rally we had from 17,000 to 20,000 points. After rallying for nearly 3,000 points, it is only natural to expect a correction. However, the correction we have experienced so far is relatively small, at just 2.5% from the top. If push comes to shove and we face a really bad outcome in the coming weeks, we could potentially see a further correction all the way till 18800 odd levels. Nonetheless, it’s worth noting that stocks are already showing signs of being oversold and exhausted. The market has rebounded strongly in the last few sessions, which suggests that we may be finding some stability.

In terms of sector performance, PSU banks stood out this week with a 1% gain. This can be attributed to decent results and an improving relative performance compared to private banks. Private banks, on the other hand, lost about 1% for the week and have only gained 10% for the financial year, while PSU banks have gained nearly 14%. This highlights a good divergence between the two groups.

Commodities and metals, however, did not fare as well this week. Commodities were down 1.7%, and metals were down nearly 3%. This decline is largely driven by weakness in the Chinese market. Overall, though, it hasn’t been such a bad week for the Nifty, with only a 0.6% decrease for the financial year. All sectors are still in the green, and there are no alarming situations developing at the moment.

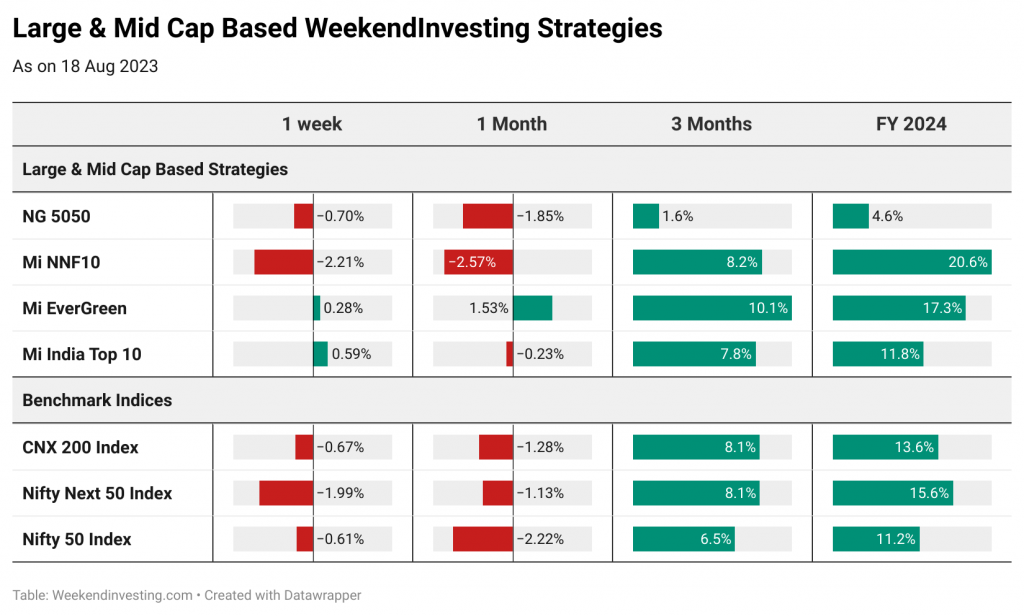

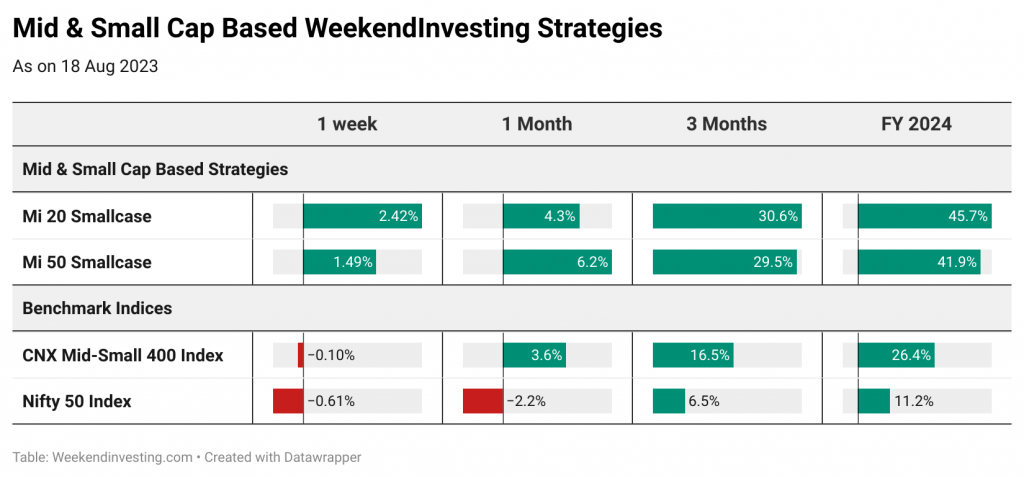

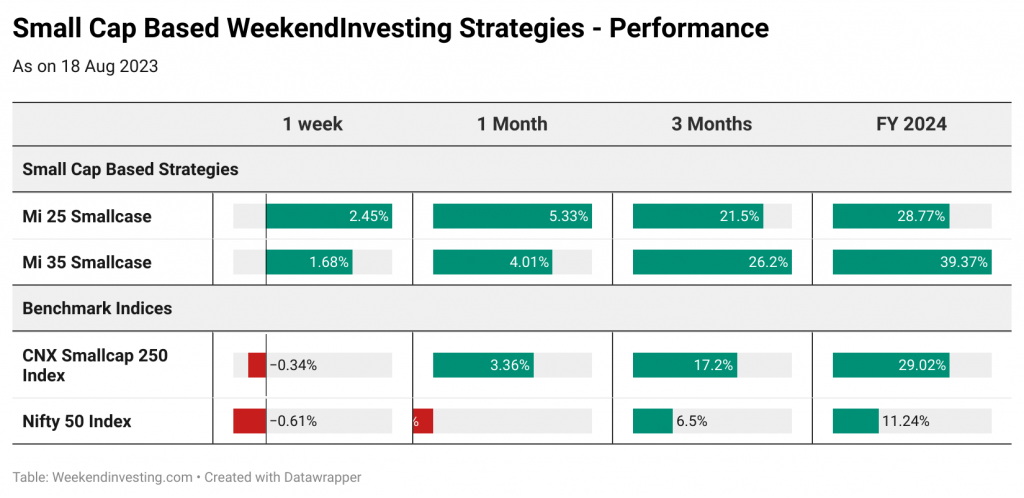

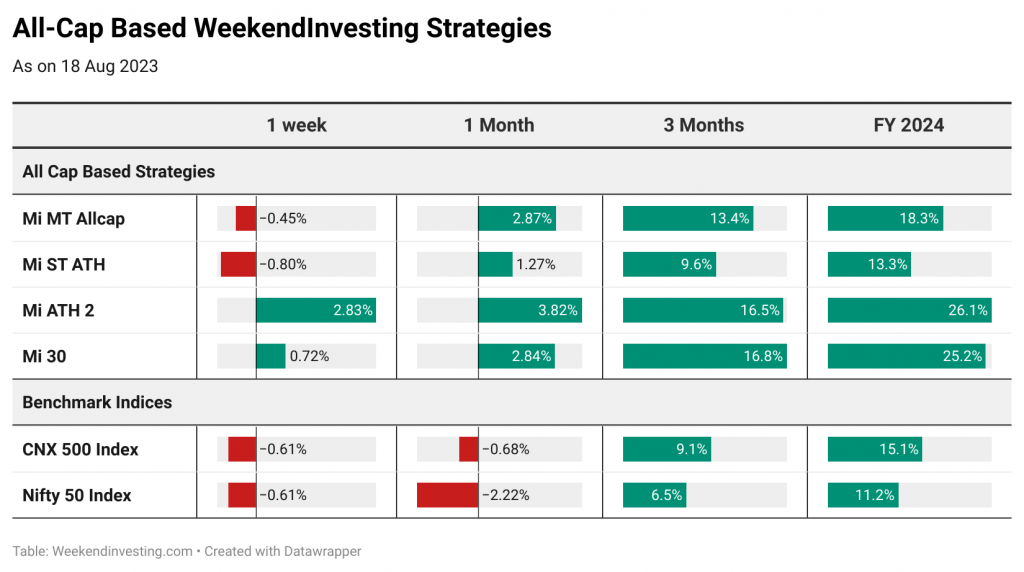

Looking at the broader market, the mid and small cap 400 index and the small cap 250 index have maintained their buoyancy and are up 26% and 29% respectively for the financial year. The CNX 500, Nifty 50, and CNX 200 all fell within the same range of 0.6% to 0.7%. However, the Nifty Next 50 saw a larger fall of -2%, while the weaker investing strategies Mi ATH 2 and Mi NNF 10 gained 2.8% and 2.5% respectively. The Mi 20, Mi 35, and Mi 50 strategies also gained between 1.5% and 2.4%. Most strategies have performed relatively well, with the top ten gaining 0.6% for the week compared to Nifty’s loss of -0.6% for the financial year. Momentum stock picks continue to provide alpha in most strategies.

Spotlight – Mi 50

Now let’s shift our focus to Mi 50, a mid and small cap strategy that has been performing exceptionally well. Contrary to the belief that diversified strategies don’t do well, Mi 50 has proven this narrative wrong. Since its inception in 2016, it has consistently outperformed the index. It has achieved a 28% CAGR compared to the index’s 17%, a 41% return in the current financial year compared to the index’s 26%, and returns of 29% and 6% in three months and one month respectively.

Mi 50 follows a weekly balance strategy where it goes to cash if there is trouble. It tracks the top 50 trending stocks in the universe of 1,000 crores and above. Since its launch on smallcase in the beginning of 2021, it has gained 98% compared to the mid and small cap index’s 65.9%. Overall, it has delivered outstanding performance, breaking the myth that diversified strategies don’t do well. In our view, if you are allocating larger amounts of money towards mid and small cap stocks, a diversified strategy like Mi 50 is the ideal approach.

In conclusion, despite the current dilemma in the Nifty market, we are still performing well compared to other major markets. We may see further corrections in the coming weeks, but stocks seem to be reaching a point of stability. PSU banks have stood out as top performers, while commodities and metals have experienced some declines. The broader mid and small cap market has maintained its buoyancy, and investing strategies continue to show positive results, particularly Mi 50, which has consistently outperformed the index with its diversified approach.

Things that led to the SUCCESS of my BUSINESS !

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

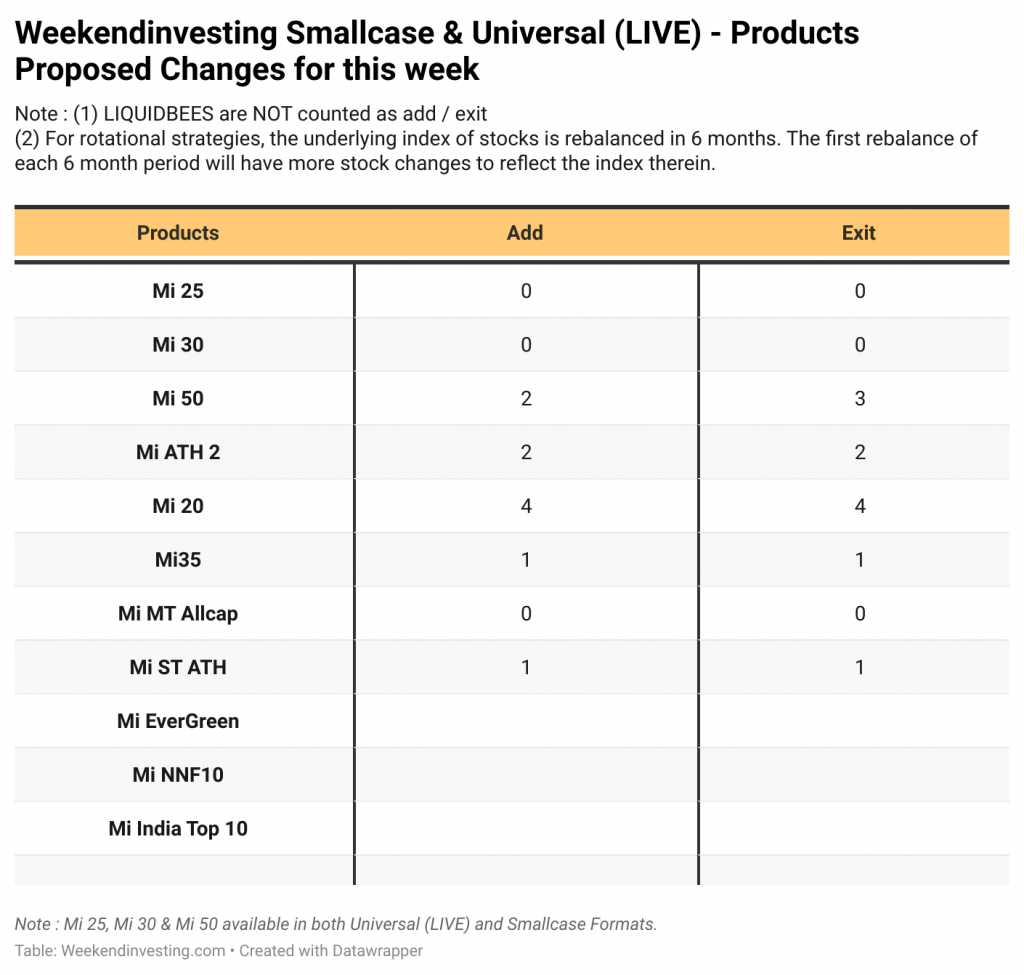

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

MEDIA !