Introducing our brand new HNI strategy – HNI Capital Compounder

This is a meticulously crafted core strategy that can be your ideal companion for your long term – steady compounding journey. Designed exclusively for HNIs looking to invest between 25 lac and 1 cr, it aims to unlock the hidden alpha within the large and mid cap universe.

Check out the HNI Capital Compounder’s brochure

Check out the intro video to know more.

- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight - HNI Capital Compounder

- Rebalance Update

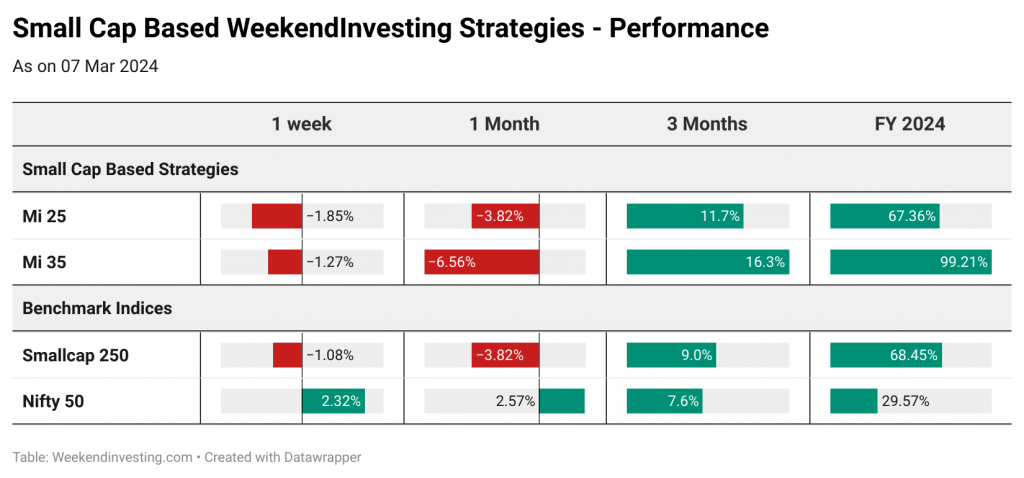

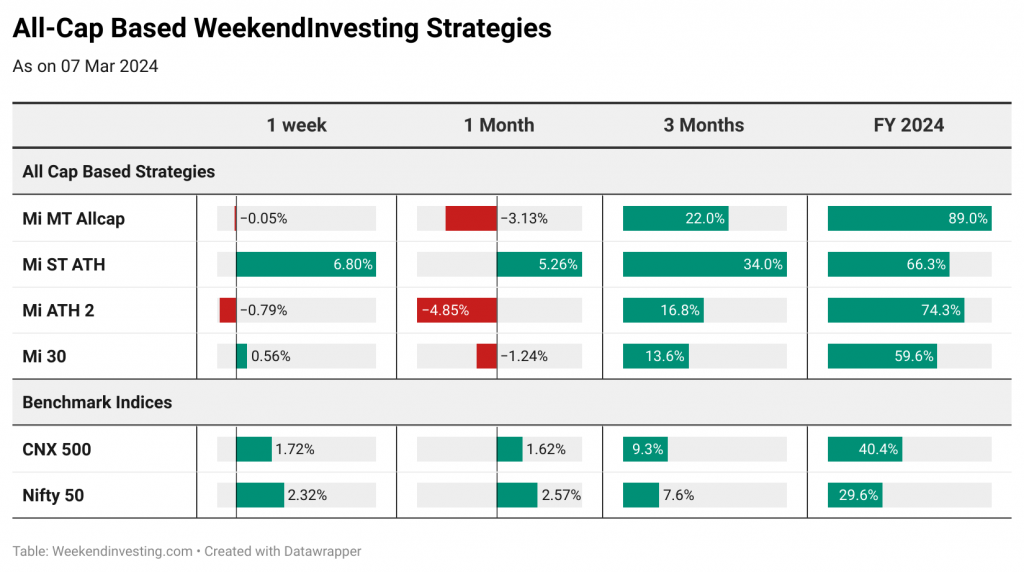

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Are you true to your EXIT decision?

In this blog, we analyze the recent predicament faced by investors in Max Healthcare, particularly in the wake of the Supreme Court’s suggestion regarding price capping for specific procedures in private hospitals.

The Buffett indicator, a popular metric named after legendary investor Warren Buffett, is under scrutiny in the face of a dramatically changed market landscape. This article delves into its historical significance, its current relevance, and alternative approaches for making informed investment decisions.

Why is JioFinancial running away ?

This blog delves into the recent inclusion of Jio Financial Services in the Nifty Next 50 index and analyzes the potential implications for investors. It also sheds light on the concept of “front running” and its prevalence in the Indian stock market.

What is your plan if Nifty goes to 100K ?

The Japanese market has always been a fascinating subject to dive into. Just take a look at its journey from 1984 to 1989. In a span of about five to six years, the Japanese market skyrocketed from nearly 10,000 to 40,000. That’s like hitting four times the initial mark in just over five years. Now, fast forward to today, where the Nifty sits at 22,000 in 2024. Could Nifty follow Japan’s lead and reach 100,000 or more by 2030?

Beat Index concentration by Strategy

In this blog, we take a look at a recent analysis that shed light on the concentration levels within various indices & also revealed interesting insights into market composition and potential investment strategies.

In this blog, we dived into some charts that might just flip your understanding of small cap versus large cap dynamics.

When it comes to investing, safety often takes precedence. Many retail investors gravitate towards well-known household brands, considering them safer bets in the market. This sentiment was recently echoed in a post by Nikhil Kamath, highlighting the top holdings of retail investors. The data suggested that retail investors tend to favor familiar household names over lesser-known brands.

Learnings from Buy and Hold on ABAN

ABAN Offshore, once a shining star in the stock market, experienced a dramatic rollercoaster ride in the late 2000s. During its heyday in 2006-2008, the company’s stock soared from Rs. 1000 to nearly Rs. 5000, establishing itself as a dominant player in offshore oil rig leasing. Investors were captivated by ABAN’s market leadership and anticipated continued growth.

Markets this week

Nifty was a bit volatile during the early part of the 4 session week but recovered very well especially on 06 Mar 2024 to close at a new all time high. On a weekly basis, this is the fourth consecutive week with a green candle for the markets & the overall trajectory seems to be very much on the upside.

Benchmark Indices & WeekendInvesting Overview

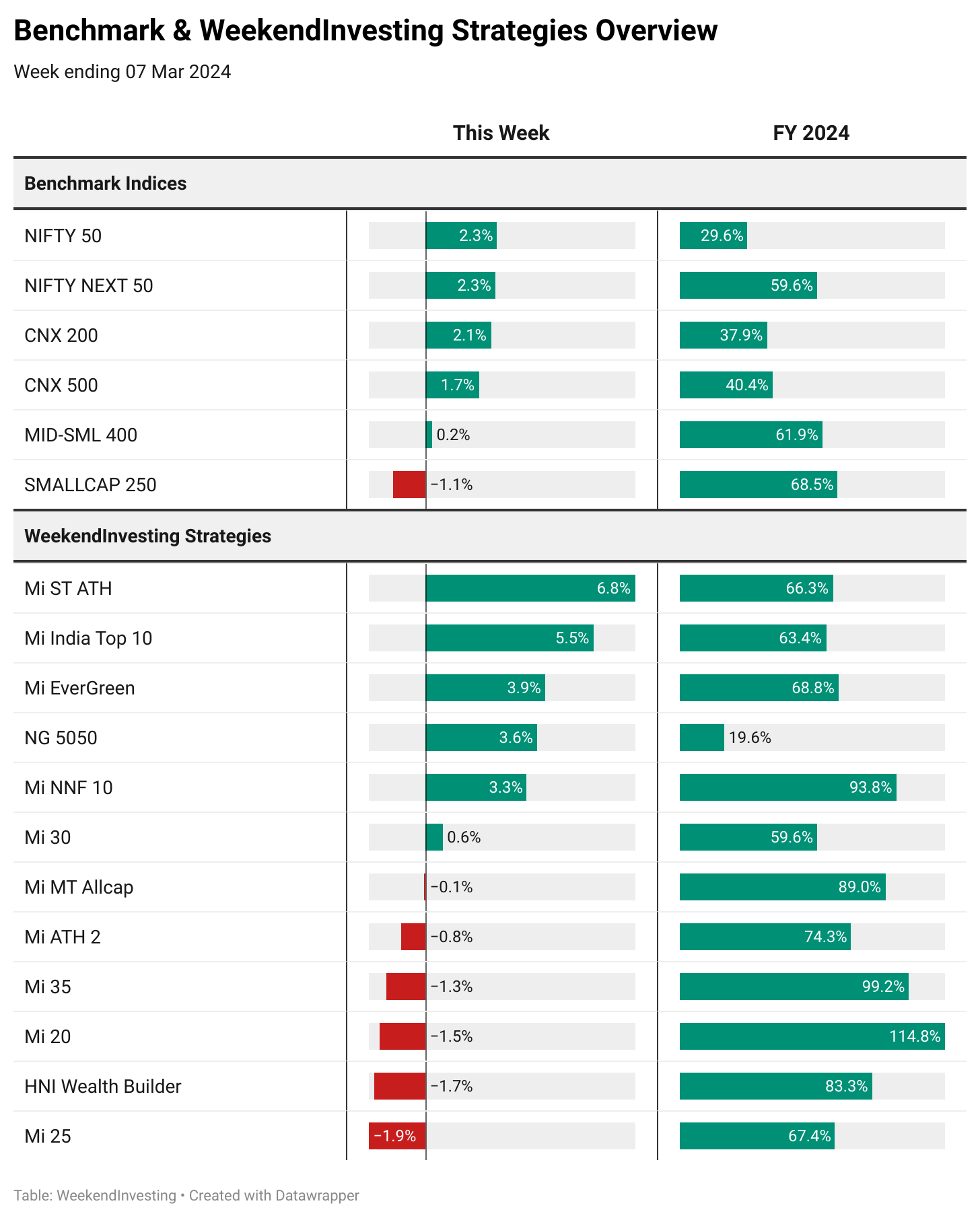

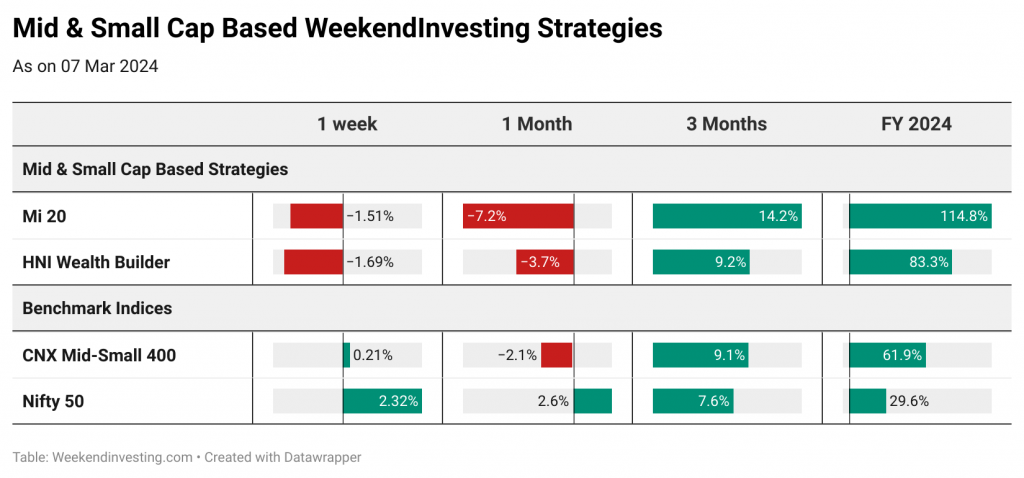

All benchmark indices had a good week barring midcaps and smallcaps with gains ranging between 1.7% and 2.3% across Nifty 50, CNX 200, Nifty Jnr and CNX 500. On the FY 24 front, Larger cap indices have witnessed a decent jump with Nifty Jnr now nearing the 60% mark and Nifty 50 closing in on 30% gains. Despite the correction, Smallcaps and midcaps still top the charts with 60% plus gains in FY 24.

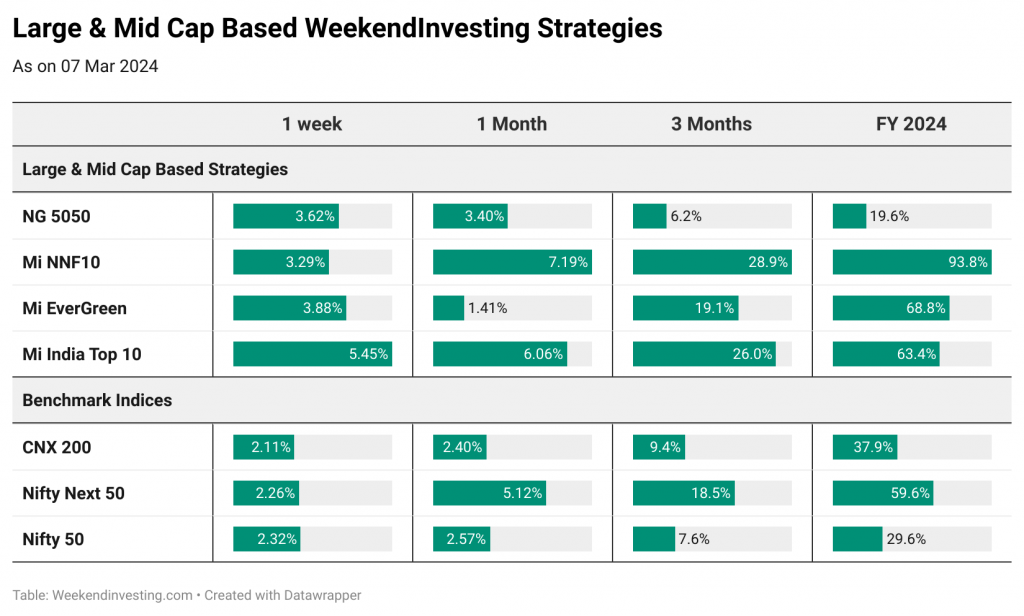

Mi ST ATH has performed exceptionally well this week clocking 6.8% compared to 1.7% on the CNX 500 index. This strategy has also recovered really well to post a solid 66% gains compared to 40% on its benchmark. Mi India Top 10 continues to have an outstanding time clocking a massive 5.5% this week compared to Nifty 50 which gained only 2.3%. The biggest surprise is on the FY 24 front where Mi India Top 10 has cruised to a whopping 63% gains compared to 29% on Nifty 50 – a 2x beat on benchmark speaks volumes on the capability of the strategy. Mi EverGreen continues to do well with a robust 3.9% gains this week and a solid 68% in FY24 comfortably beating its benchmark, the CNX 200. A few other strategies also performed better than their respective benchmarks but some faced a bit of correction.

Sectoral Overview

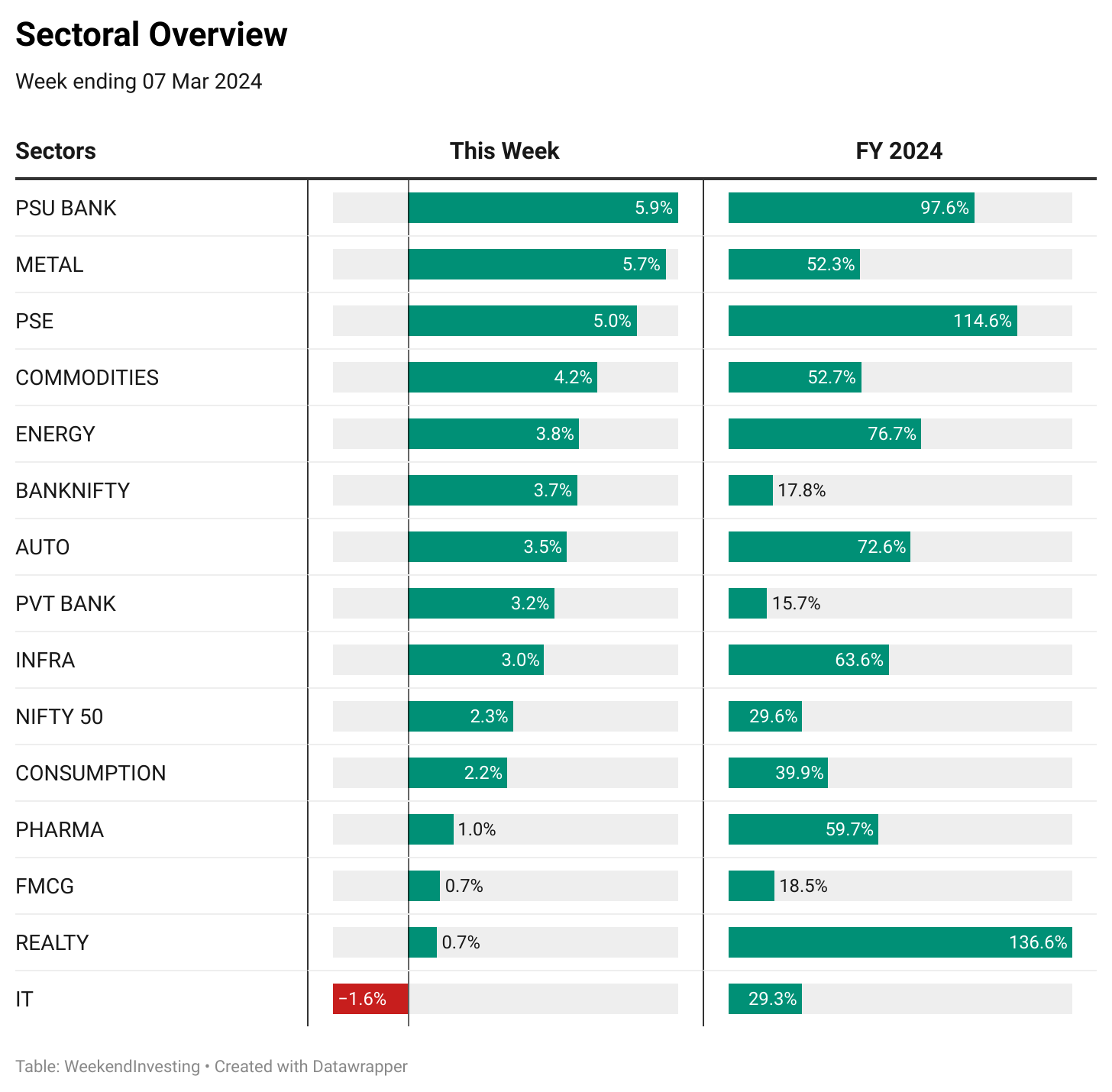

PSU BANKS did well to gain almost 6% this week with METALS taking in the second spot at 5.7%. Majority of the sectors did well outperforming Nifty 50 while IT was the only sector in red. On the FY 24 front, PSU BANKS are closing in on the coveted 100% mark with REALTY and PSE already having conquered that milestone sometime ago.

Owing to some profit booking, PSU BANKS have slipped to #7 on the fortnightly chart while AUTOs put on a fabulous show to top the table. PHARMA has slipped to #11 while the highlight has to be GOLD which has taken #3 position. METALS have done well to take up #4 in last two weeks. PSE has done very well to recover and occupy the 2nd spot (fortnightly) despite the earlier correction. Overall, GOLD and BANKS are also recovery quite well to slowly climb up on the table.

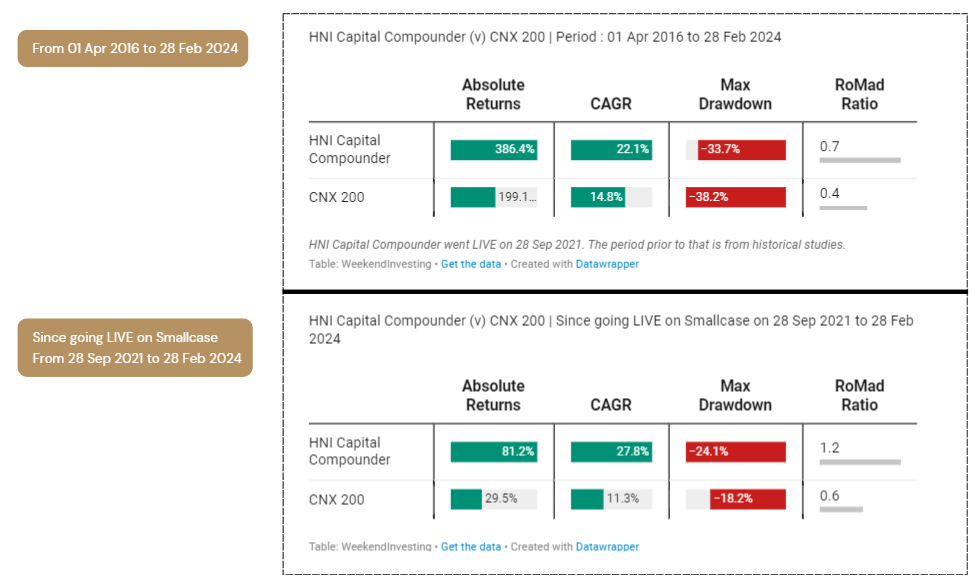

WeekendInvesting Strategy Spotlight – HNI Capital Compounder

The spotlight will continue on our brand new launch – HNI Capital Compounder. Below is a table that showcases the performance of the the strategy in comparison to the CNX 200 index.

Since going LIVE on Smallcase on 28 Sep 2021, the strategy has amassed a superb absolute gain 81% at a CAGR of 27% compared to CNX 200 which clocked only 29% absolute gains at 11% CAGR.

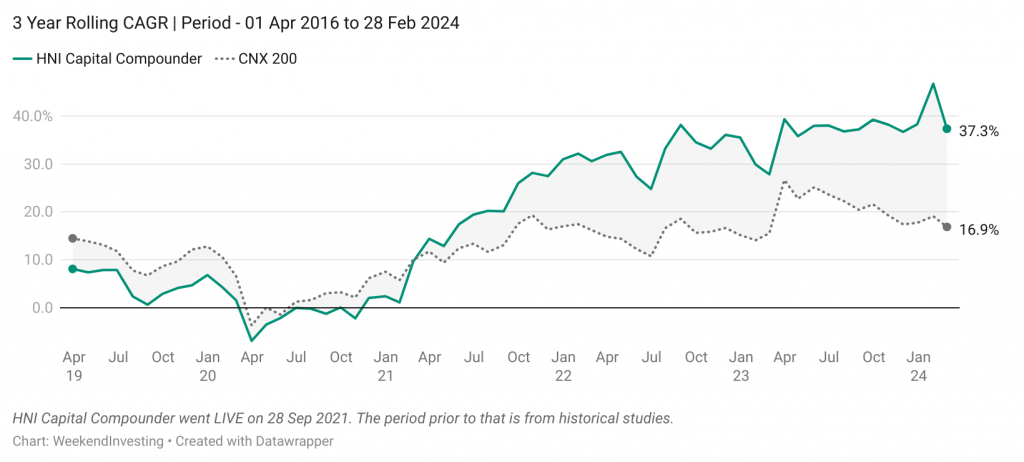

3 Year Rolling CAGR

3 year rolling CAGR indicates the latest CAGR at any given point in the timeframe provided in the chart. So, in Apr 2023, if the 3 year rolling CAGR is 40%, it means that the one would have experienced a CAGR of 40% if you stayed invested in the 3 year period culminating in Apr 2023 (Apr 2020 to Apr 2023).

The strategy trailed its benchmark till about Apr 2021 post which there was no looking back. The gap has widened considerably and the current 3 year CAGR stands at a superb 37% compared to only 17% on CNX 200.

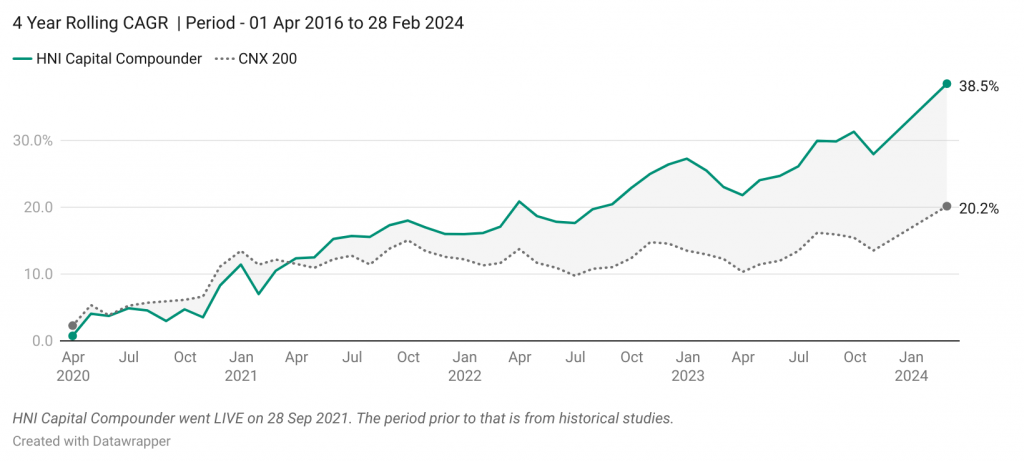

4 Year Rolling CAGR

The 4 year rolling CAGR paints a much better picture to also illustrate the importance of taking a long term view along with the strategy’s superior outperformance.

The 4 year CAGR by end of Mar 2020 is at the lowest point owing to the COVID crash that coincided around that time but the performance started to improve dramatically post COVID and the gap has continuously widened.

The current 4 year CAGR is 38.5% on the HNI Capital Compounder compared to only 20% on the benchmark, the CNX 200 index.

Check out the HNI Capital Compounder’s brochure

HNI Capital Compounder is launching on 17 March 2024 at 11 am.

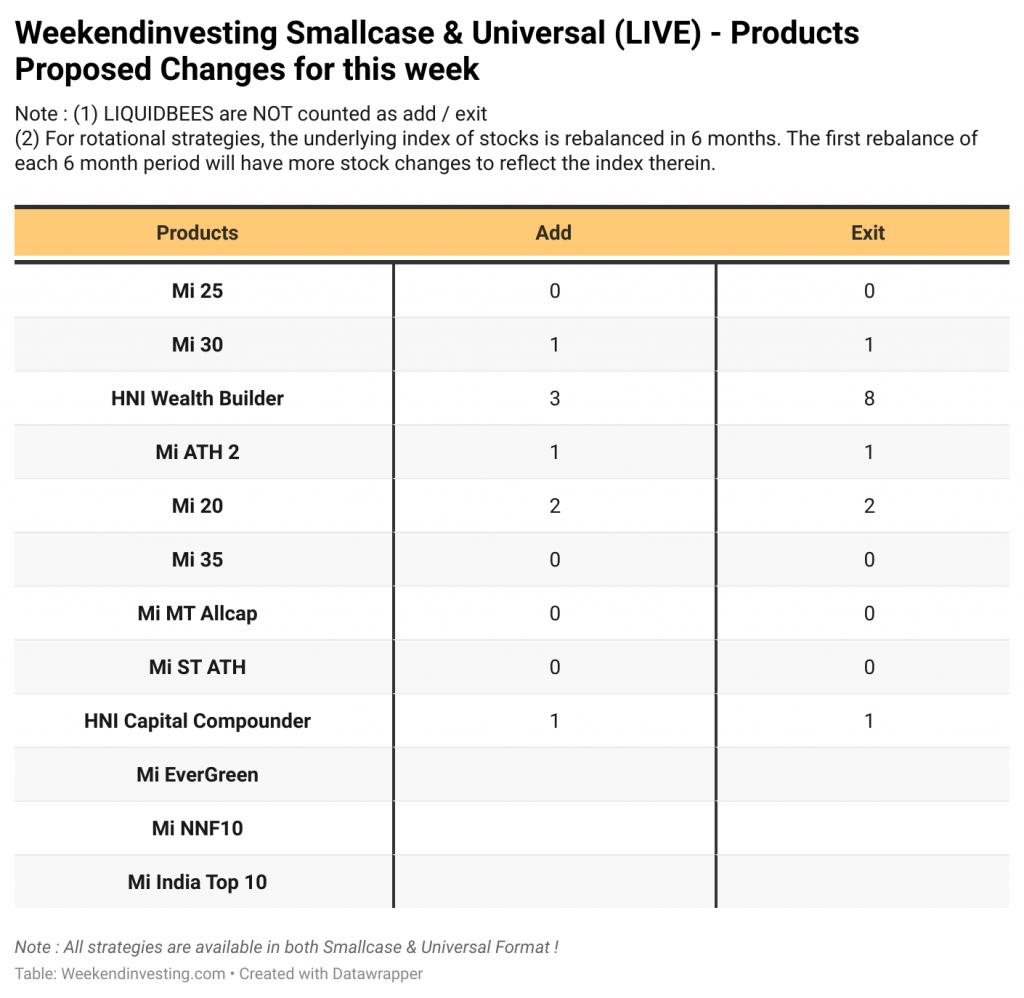

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report