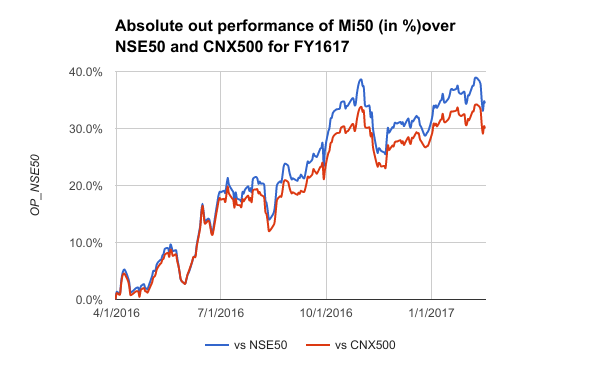

The strategy underperformed the market this week. Mi50 closed at 48.4% for the FY vs the highest achieved last week @52.46%. The benchamarks remain flattish meanwhile at +14% and +18.4% for NSE50 and CNX500 respectively. The main culprits this week were Arcotech and some RiceExporter stocks who tanked against the market. The 50% mark as somebody rightly pointed out is turning out to be a stiff resistance 🙂 Anyhow, this is not a cause of worry as we await the next move up.

The drawdown is now at a mild -2.6%.

This week there were 3 exits from the strategy and 3 new entrants. Exits were CamlinFin, BalmerLawrie and EsselPack. The new entrants are Mawana Sug, Motilal oswal and Vip Industries.

The out-performance of the strategy vs the benchmarks has been unremarkable since Oct 16 and that may be some indication that this current move may be stalling.

Starting the new FY1617, the newsletter format will change. I will continue to report the operating numbers on a weekly basis but will do a detailed stock analysis only in a month end report from April 1 2017 onwards.

Have a Happy Weekend.

Few months consolidation augurs well for you and all investors :-). We need just 2-3 months of slow decline to make new all time high in late 2017 or early 2018.

In fact, I read lot of reports worldwide which says all EMs are starting boom like 2003. Someone picking right sectors over next 5 years will hit goldmine.

Yes, i fully endorse your view. I too feel we are again set up for a long up trend soon.

This could be because large caps went up in the recent week while mid cap and small caps are consolidating