” As we grow older and our capital increases, it’s natural to become more risk-averse and seek ways to minimize volatility in our investment portfolios “

When deploying larger amounts of capital, investors often tend to think that large-cap stocks are the safest option for decent returns with lower volatility. It’s true that many investment funds and pools of capital concentrate on large-cap stocks. However, large caps don’t guarantee low volatility.

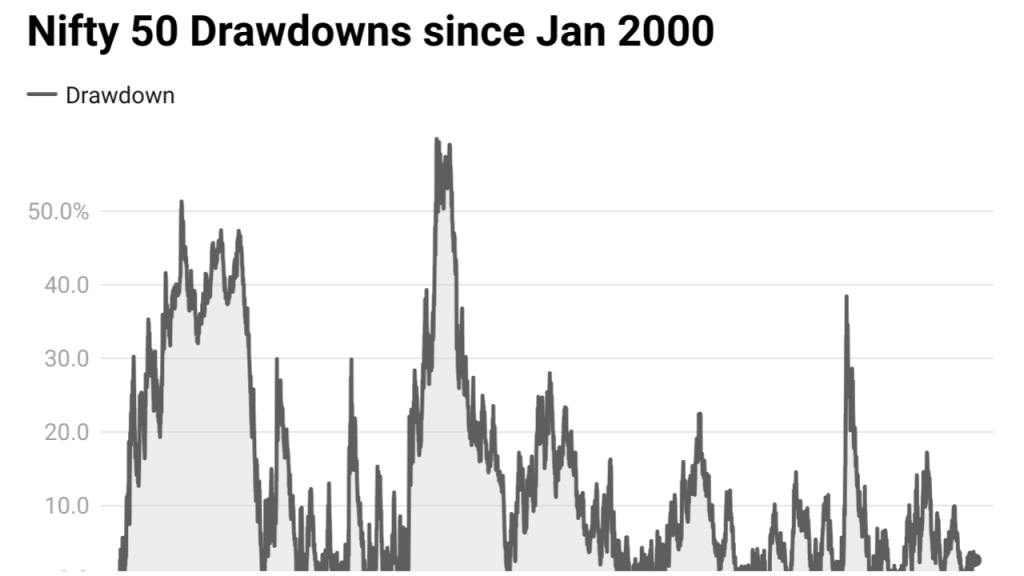

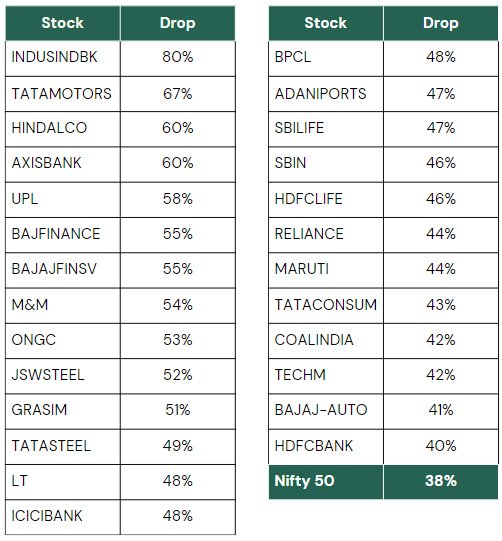

Historical market data shows that even large caps can experience significant drawdowns during market downturns.

Historical market data shows that even large caps can experience significant drawdowns during market downturns. For example, during the March 2020 covid crash, well-established large-cap stocks such as Indusind Bank, Tata Motors, Hindalco, Axis Bank, UPL, Bajaj Finance, Bajaj Finserv, M&M, ONGC, HDFC Bank, Coal India, and Reliance experienced a drop of more than 40% to 50%.

Mid & Small caps have had high alpha compared to large caps

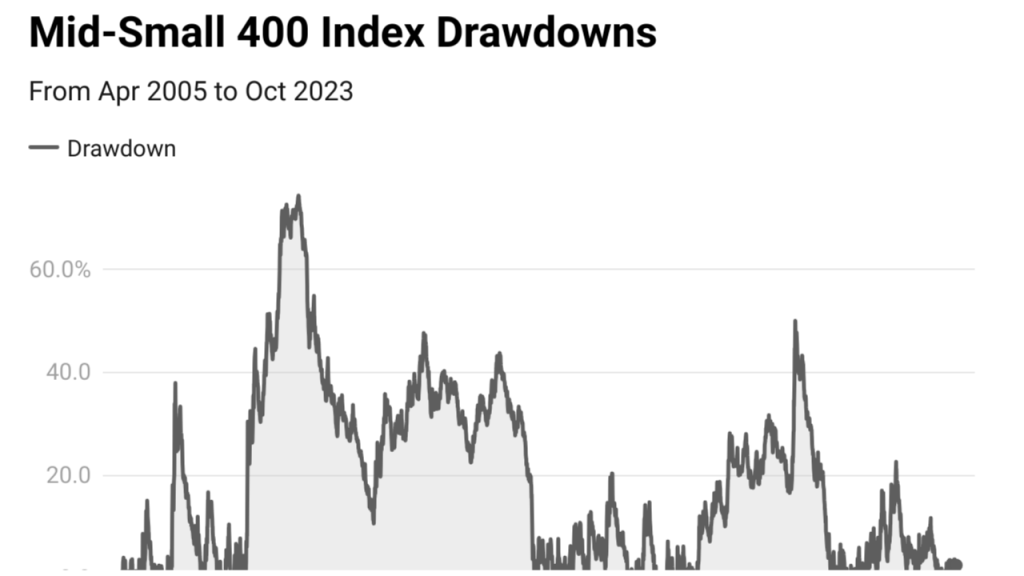

On the other hand, mid and small caps have shown high alpha (excess returns above the benchmark) compared to large caps.

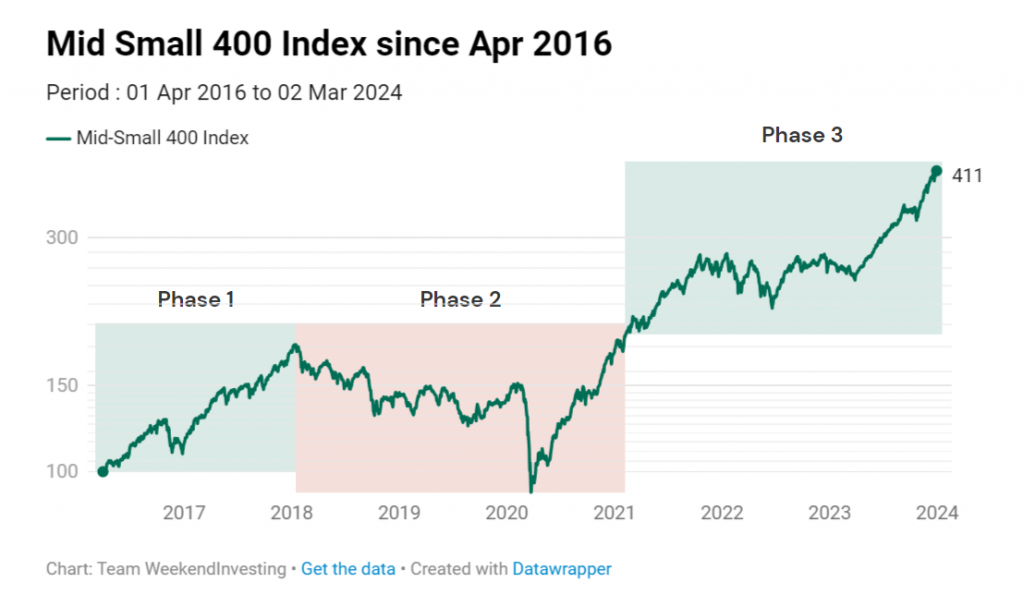

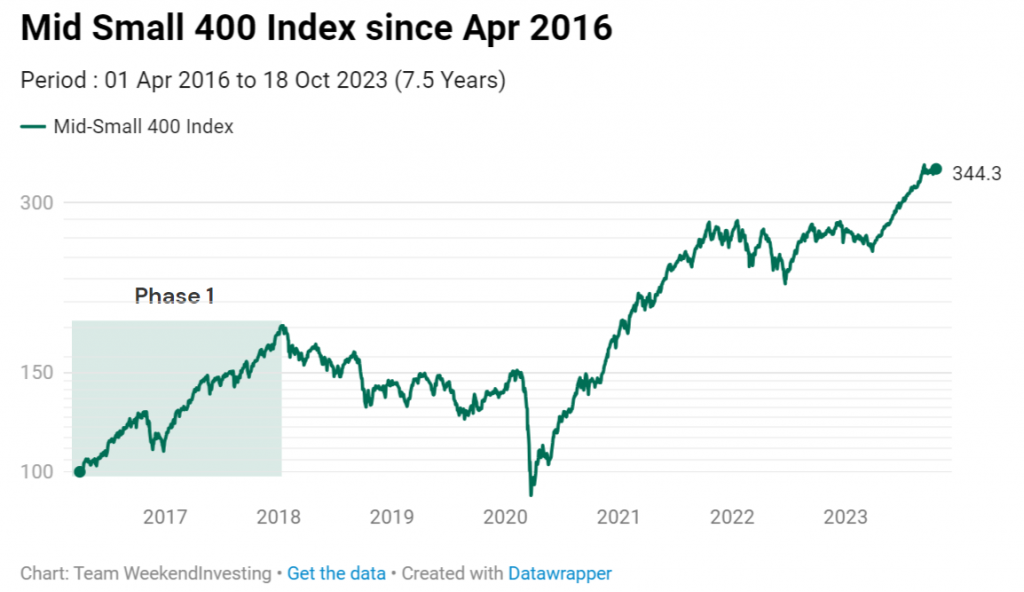

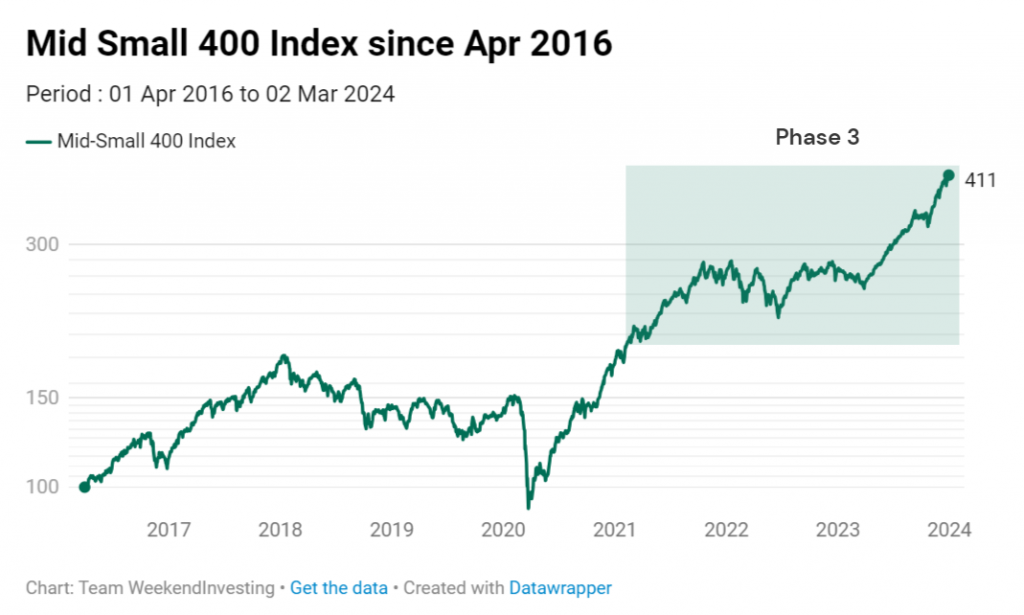

However, their drawdowns (peak-to-trough declines) tend to be higher. For example, take a look at the historical drawdowns in the Mid-Small 400 index which comprises of 101st to 500th stock in the Nifty universe.

Deeper drawdowns can be problematic because the larger the decline, the more difficult it becomes to recover and continue your investment journey. A shallower fall increases the chances of recovery. Therefore, a balanced strategy that offers the potential for capital growth while minimizing drawdowns is ideal for investors with larger amounts of capital.

Introducing HNI Wealth Builder

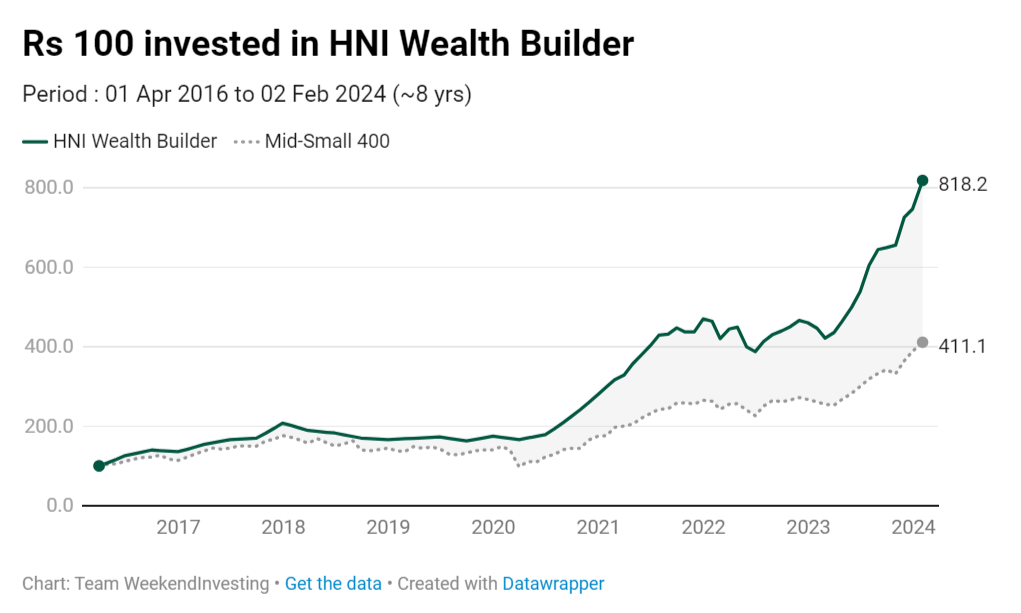

HNI Wealth Builder is a strategy designed to meet the needs of investors with larger amounts of capital (typically greater than 25 lakhs) primarily keeping the focus on prioritizing capital preservation.

Key features of HNI Wealth Builder

HNI Wealth Builder is a weekly Rebalanced, absolute momentum Strategy.

The portfolio includes up to 50 trending mid and small-cap stocks with a market capitalization above 1000 crores. This diversification ensures that the strategy is not overly concentrated in a few stocks.

Dynamic Cash Allocation: The strategy dynamically moves to cash when the market is overly weak, aiming to preserve and maintain capital during market downturns.

Let us take 3 phases of the mid-small 400 index between 2016and see how HNI Wealth Builder managed to extract outperformance from its benchmark in each of these phases

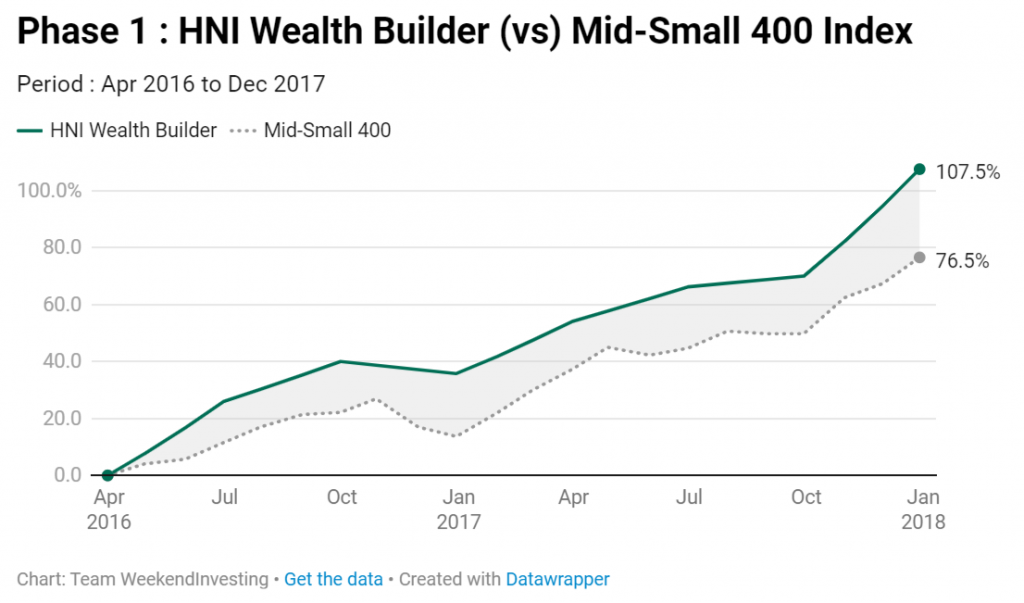

Phase 1 : Apr 2016 to Dec 2017

In this period of 1 year and 8 months, the mid-small 400 index was on an uptrend clocking a solid 76.5%.

During this period, the mid and small-cap index gained approximately 76.5%. HNI Wealth Builder, which commenced in April 2016, achieved a return of 107%, thus outperforming the index by a decent margin.

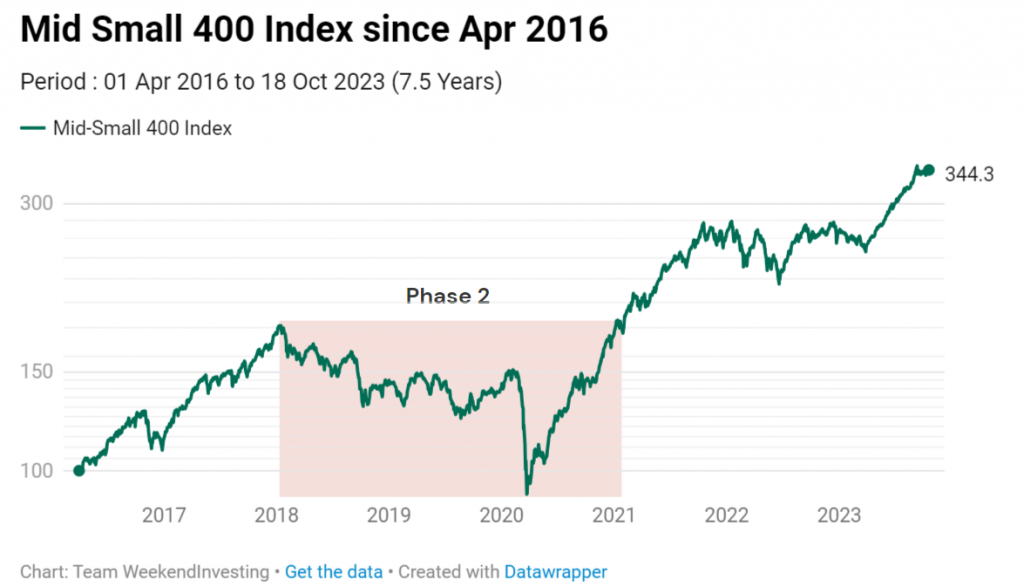

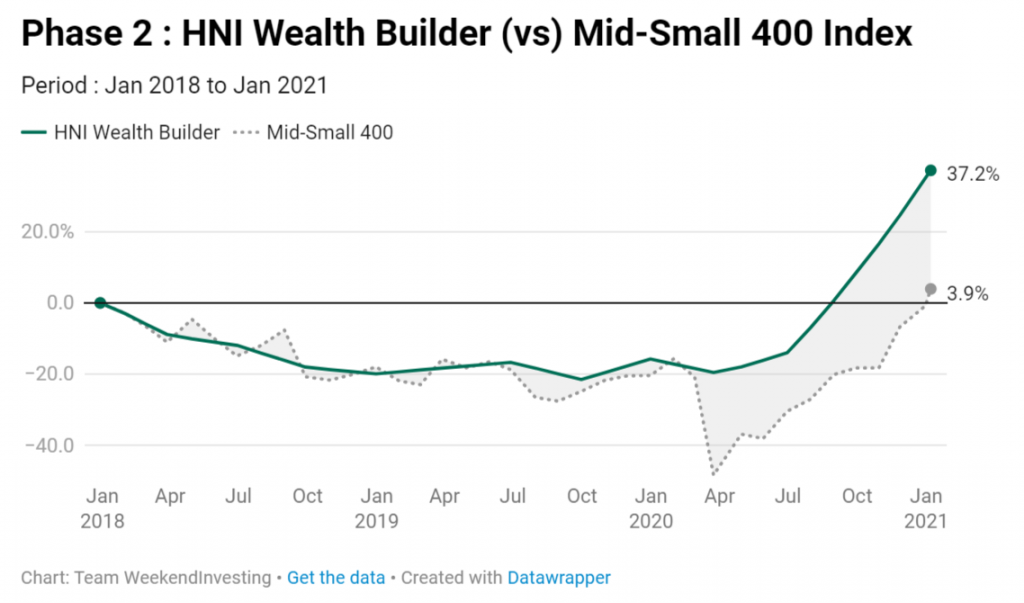

Phase 2: Jan 2018 to Jan 2021

This phase compartmentalized into two parts. In the first part, the benchmark started on a downtrend back in Jan 2018 all the way till Mar 2020 (period of 2 years and 3 months) which saw the benchmark record a mammoth drawdown of 50%.

Apr 2020 to Jan 2021 (period of 9 months) saw a ferocious bull rally across all segments of the markets with mid-small 400 recovering from its drawdowns thus establishing a new peak since Jan 2018.

HNI Wealth Builder was on par with its benchmark all the way till Feb 2020 but Mar 2020 was a different story. The strategy, by virtue of its dynamic allocation to CASH during weaker market regimes escaped the majority of the COVID crash thus staging a fantastic outperformance on the downside too. HNI Wealth Builder’s max drawdown was at 22% compared to 50% on the mid-small 400 index.

This helped the strategy gain a head start when the markets commenced their uptrend. At the end of this period in Jan 2021, HNI Wealth Builder had clocked 37% outperforming its benchmark which recorded ~4% gains only.

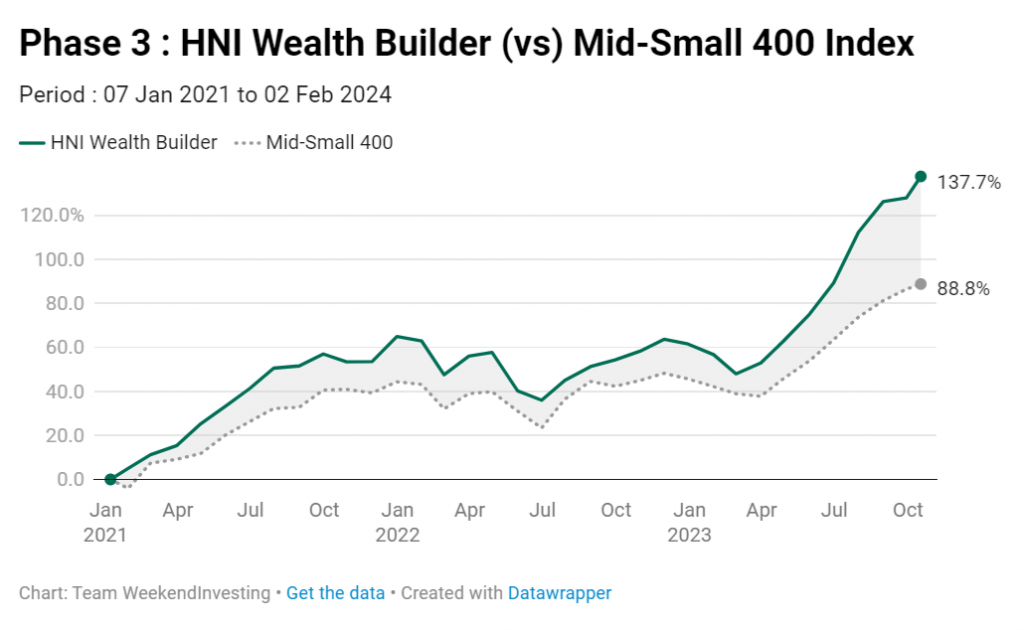

Phase 3 : Jan 2021 to Oct 2023

The final phase in this study is between Jan 2021 and Oct 2023. The first 12 months of this phase (between Jan 2021 and Dec 2021) saw the mid-small 400 index clock about 44% whereas the HNI Wealth Builder amassed a healthy 65%.

This was followed by a period of consolidation between Jan 2022 to May 2023 post which we have witnessed a break out.

In the entire period (Jan 2021 to Oct 2023), HNI Wealth Builder Clocked a superb 137% compared to 89% on the mid-small 400 index.

The objective of the strategy has been to achieve outperformance on both upside and downside while keeping focus on capital protection via dynamic cash allocation and a widely diversified portfolio.

Busting a popular myth !

One common misconception among investors is that diversification beyond a certain number of stocks is unnecessary or detrimental to performance. However, HNI Wealth Builder’s track record disproves this notion.

The strategy holds between 40 to 50 stocks, ensuring a high level of diversification. At any given time, only 2% of the portfolio is allocated to a single stock. Over the last 7.5 years, this approach has proven extremely effective, delivering impressive returns for investors.

Other details

Recommended Capital : INR 25 lac to 100 Lac (minimum investment amount : INR 10 Lac)

Subscription Fee : INR 44,999 per annum.

HNI Wealth Builder’s Key USP’s

HNI Wealth Builder – Performance since inception

Check out this blog for detailed metrics of the strategy

Book a discovery call with Team WeekendInvesting to know more about HNI Wealth Builder