A recent analysis of US companies over the past 90 years provides valuable insights into wealth creation in the stock market. The data shows that a small percentage of companies generate most of the wealth. This trend, observed in the US market, can apply to other markets, including India. Understanding these trends can help investors make better decisions and avoid potential pitfalls.

Concentration of Wealth in Few Companies

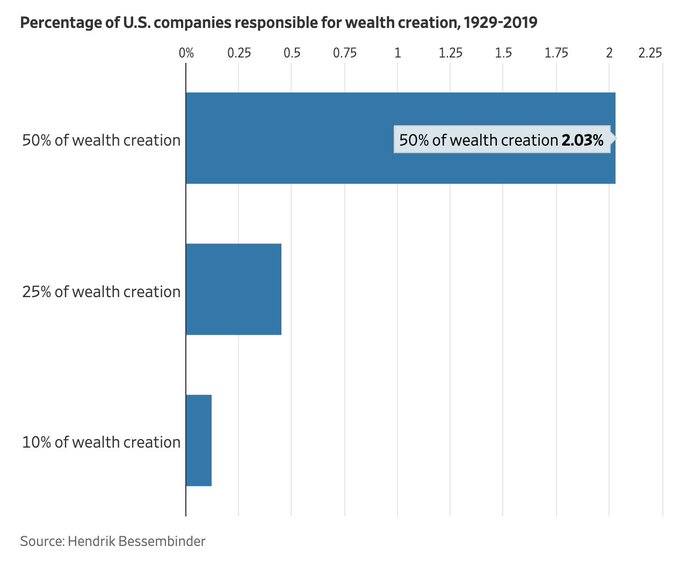

The analysis categorizes companies into three groups based on their wealth creation. Astonishingly, 50% of the wealth was created by just 2% of the companies. In a hypothetical pool of 10,000 companies, this means only 200 companies were responsible for half of the wealth generated. Furthermore, less than 0.5% of companies created 25% of the wealth, and less than 0.25% of companies created 10% of the wealth. In total, less than 3% of companies were responsible for almost all the wealth creation in the market.

The Majority of Companies Underperform

While a small fraction of companies create significant wealth, the remaining 97% either do not contribute much or result in negative returns. This means that most companies are not good long-term investments. This stark reality highlights the importance of identifying strong companies that have the potential to create wealth.

Importance of Stock Selection

Given that only a few companies are responsible for most of the wealth creation, it is crucial to have a strategy to identify these companies. Blindly investing in any equity and hoping for positive returns will not work in the long term. During bull markets, it might seem that all stocks are rising, but over time, only a small percentage will continue to generate wealth.

Developing a Winning Strategy

To be successful in the stock market, investors need a strategy that focuses on identifying and investing in the strongest companies. This involves regularly reviewing and updating the portfolio to ensure it includes potential winners and excludes underperformers. Staying disciplined and sticking to a well-thought-out plan can help investors achieve long-term success.

Long-Term Investment Perspective

Investing in the stock market requires a long-term perspective. The data clearly shows that over an extended period, only a few companies will generate significant wealth. Therefore, it is essential to focus on long-term growth rather than short-term gains. By understanding the market trends and making informed decisions, investors can maximize their chances of being in the top-performing stocks.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com