It’s essential to understand the circuit limits set by the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). These limits are in place to manage volatility and ensure orderly trading. While there’s no current indication that these limits will be tested soon, knowing the rules can help investors navigate unexpected market movements.

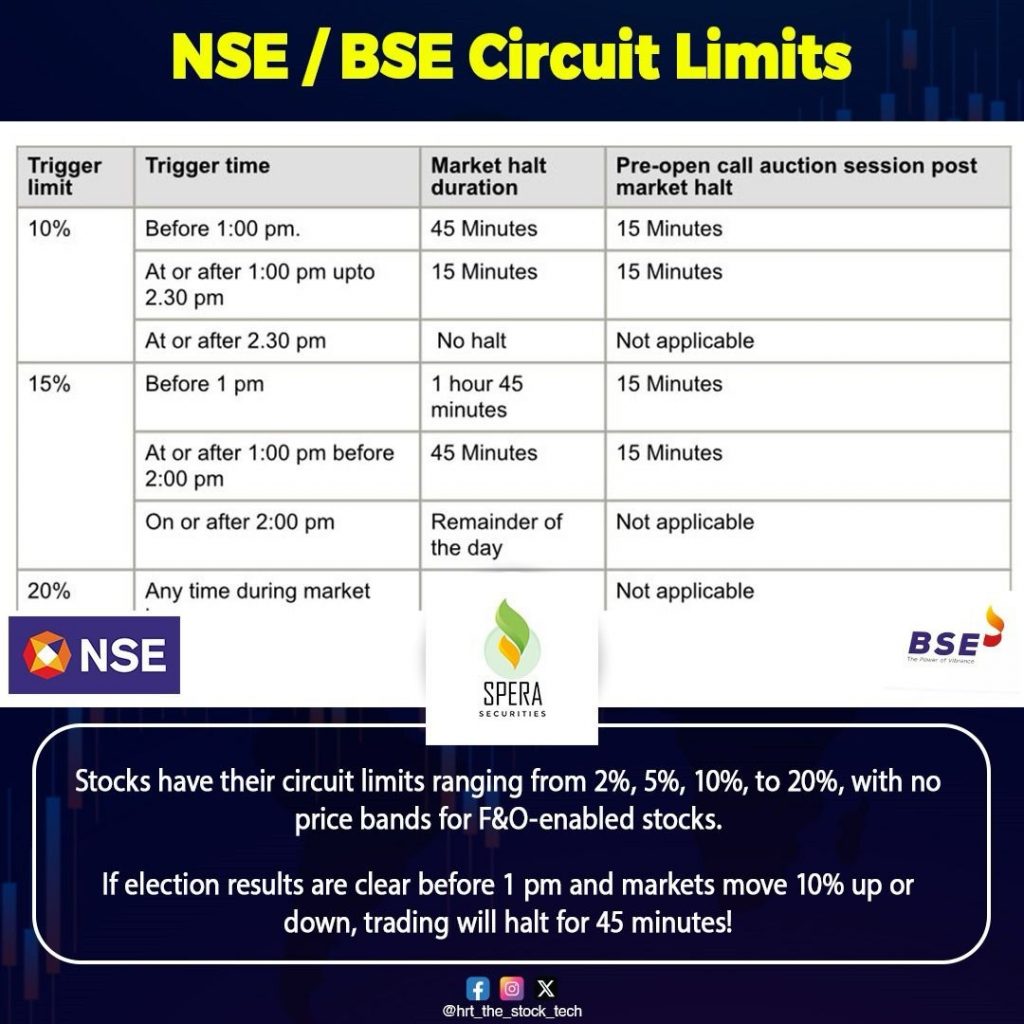

10% Circuit Limit Rules

If the market index moves 10% up or down before 1:00 p.m., trading is halted for 45 minutes. After this pause, there is a pre-open call auction session to restart the market. This rule gives investors a chance to cool off and rethink their positions. If the 10% move happens between 1:00 p.m. and 2:30 p.m., the market halt is shorter, lasting only 15 minutes. If it occurs after 2:30 p.m., the market does not reopen for the day.

15% Circuit Limit Rules

For a 15% move, if it happens before 1:00 p.m., trading is halted for 1 hour and 45 minutes. This extended pause allows for more time to reassess market conditions. If the 15% move occurs between 1:00 p.m. and 2:00 p.m., the halt lasts 45 minutes. After 2:00 p.m., if the market hits a 15% move, trading is halted for the rest of the day. These measures help manage extreme volatility by giving investors time to make informed decisions.

20% Circuit Limit Rules

The 20% circuit limit is the final threshold. If the market hits this limit at any point during the trading day, trading is halted immediately for the rest of the day. There are no cool-off periods or pre-open sessions after this point. This rule ensures that in cases of extreme market movements, there is a complete stop to allow for comprehensive evaluation of the situation.

Individual Stock Limits

For individual stocks not in the Futures and Options (F&O) segment, circuit limits are set at 2%, 5%, 10%, and 20%. These predefined limits help manage volatility in specific stocks. Stocks in the F&O segment do not have fixed circuit limits. However, if extreme movements occur, trading is paused and then reopened to allow further movement. This helps in managing both overall market and individual stock volatility effectively.

Importance of Circuit Limits

Circuit limits play a crucial role in maintaining market stability. They provide time for investors to cool off and reconsider their positions during volatile market movements. Rapid market changes can be challenging, as they make it difficult for investors to make informed decisions quickly. By understanding and respecting these limits, investors can better navigate periods of high volatility and protect their investments.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com