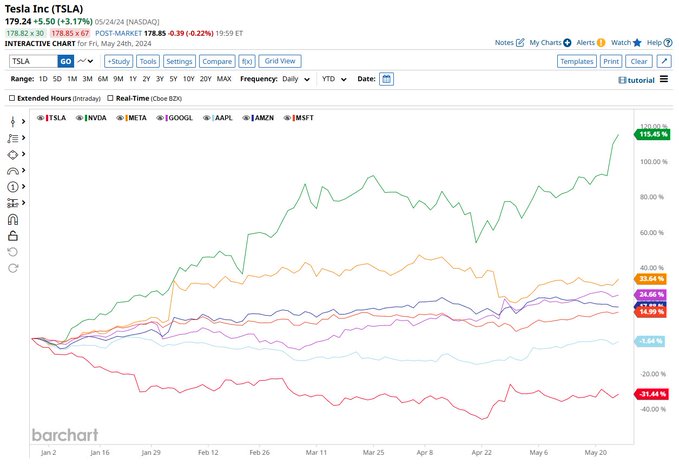

The Magnificent Seven Stocks in the US Market

In the world of stock market investments, the “Magnificent Seven” stocks are highly talked about. These stocks include Tesla, Apple, Microsoft, Amazon, Google, Meta, and Nvidia. Since the start of the year, their performance has varied greatly. Let’s take a closer look at how these stocks have performed over the last five months.

Performance of the Magnificent Seven

Tesla has seen a significant drop, down 31%. Apple has been relatively stable, down only 1%. On the other hand, Microsoft has increased by 14%, Amazon by 17%, Google by 24%, Meta by 33.6%, and Nvidia has skyrocketed by 115%. If you had invested in all these stocks, Nvidia would be pulling your portfolio up, while Tesla would be dragging it down, with the others in the middle.

Betting on the Right Stocks

This scenario is similar to a horse race. Imagine you have a race with seven horses. After a few rounds, one horse is leading, five are in the middle, and one is trailing behind. You are more likely to bet on the horse in the front and maybe some on the ones in the middle. The same strategy applies to stock investments. You need to focus on the stocks that are performing well and avoid those that are lagging.

Importance of Choosing Strong Stocks

To build a successful portfolio, it is crucial to choose strong stocks and let go of weak ones. The experimental US portfolio, which has been running for eight or nine months, is a perfect example. This portfolio has seen a 365% gain on Nvidia because it was identified as a strong stock early on. By sticking with the winners and not selling them prematurely, you can ride the entire wave of growth.

Momentum Investing

Momentum investing is about staying with the winners and exiting the losers. Even among the hyped “Magnificent Seven,” not all stocks perform equally. Some may be flat or underperform. The key is to have a strategy that allows you to buy into stocks when they gain momentum and sell them when they start to lose it. This self-rotation into stronger stocks and out of weaker ones is essential.

Building a Winning Portfolio

The beauty of momentum investing lies in its automatic mechanism. By consistently choosing strong stocks and rejecting weak ones, you can significantly enhance your portfolio’s performance. Over time, this approach creates a magical effect on your investments, leading to substantial gains. Always remember to focus on strength and have a clear strategy for your investments.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com