A quick introduction to the Weekend Investing app, now available on Google Play and App Store. The app has been received with great enthusiasm, with over 5,000 users already joining. We encourage all weekend investors to download the app, as it provides numerous benefits and features that can enhance your investment experience.

By joining the app, you will receive immediate notifications for urgent messages from us. Additionally, all our content, including YouTube videos and Twitter posts, can be accessed in one place. This ensures that you stay up to date with relevant and valuable information. Moreover, the app allows you to interact with our team, ask questions, and provide feedback. It offers a seamless and convenient channel for communication between investors and our support team.

One of the key advantages of the app is access to exclusive educational content and strategies tailored specifically for weekend investors. We offer educational US strategies, trend analysis posts, market psychology insights, and much more. By leveraging these resources, you can enhance your investing knowledge and make informed decisions. Furthermore, the app provides opportunities for online and offline meetups exclusively for WeekendInvesting subscribers, allowing you to engage with fellow investors and expand your network.

A unique feature of the app is the ability to book a one-on-one call with the Weekend Investing team. This personalised support ensures that you receive prompt assistance and have your queries addressed directly. Additionally, a chat feature is available to provide immediate solutions to any questions or concerns you may have. The aim of the app is to facilitate seamless interaction and provide phenomenal support to all weekend investors and app users.

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our newsletters for this week.

From the Research Desk of WeekendInvesting

13%+ CAGR on SGBs ! ( GOLD Special )

One of the crucial advantages of Sovereign Gold Bonds is their attractive interest rate, which sets them apart from other gold investment options. These bonds offer a fixed interest rate of 2.5% per annum, payable semiannually. This additional interest, along with the potential appreciation of gold prices, makes Sovereign Gold Bonds a compelling investment opportunity.

Can India keep doing well without the USA ?

The performance of the US stock market has always been closely watched by investors worldwide. As the largest economy in the world, the United States plays a significant role in driving global economic growth. In this article, we will examine the relationship between the US market and the rest of the world, and why it is crucial for other economies to keep an eye on its performance.

Momentum Investing : Japan Case Study

In a recent interaction with one of our viewers, an intriguing question was posed to me: What would have happened if one had invested in the Japanese market and followed a momentum investing approach? Furthermore, the viewer wondered how Indian investors would fare if faced with a similar situation in the future. This query prompted me to delve into the historical performance of the Japanese market and draw lessons that can be applied to the Indian context.

India eating BIG into BRICS pie

In the world of finance and investment, it is crucial to identify emerging markets that show promising growth potential. Over the past 20 years, the allocation percentages of the BRIC countries – Brazil, Russia, India, and China – have undergone significant changes. A chart shared by an industry expert, Mr. Rajiv Mehta, highlights these shifts, shedding light on the evolving landscape of global investments.

Analysis : Has HDFC BANK bottomed ?

If you’ve been following HDFC Bank, you may have noticed its frustrating performance over the past few months. However, there seems to be a promising turnaround in sight. In this article, we will delve into the recent developments and discuss the potential for a positive trend in HDFC Bank.

Key Insight into how Momentum beats benchmark indices

When it comes to investing in the stock market, there is a common misconception that every stock in one’s portfolio needs to perform well in order to achieve significant returns. However, a closer look at market dynamics reveals that the performance of a select few stocks can have a disproportionate impact on overall market performance. This phenomenon is evident in the case of the S&P 500, where just seven stocks have driven the majority of the market’s gains.

Proof of the pudding : Value vs Momentum

Investing in the stock market is a complex task that involves various strategies and approaches. Among these, the debate between momentum and value investing has been a topic of interest and discussion for a long time. Both momentum and value investing have their own set of proponents who argue for the superiority of their chosen strategy. In this article, we will delve into the performance of momentum and value investing over a seven-year period and analyse the results.

Do not believe in projections !

In this blog, we discuss an interesting chart from BC Alpha Research that sheds light on the projections made by analysts and strategists for the market. This chart encompasses data from the past 23 to 24 years, ranging from 1999 to 2023. Although this data pertains to the US market, it still provides valuable insights that we can apply to other markets

Markets this week

Nifty had a remarkable week, climbing from 19,800 to 20,260 registering a gain of about 460 points and closing at an all-time high. The weekly candle that initially concerned bulls was quickly recovered in the following weeks, demonstrating the importance of following the price for market success.

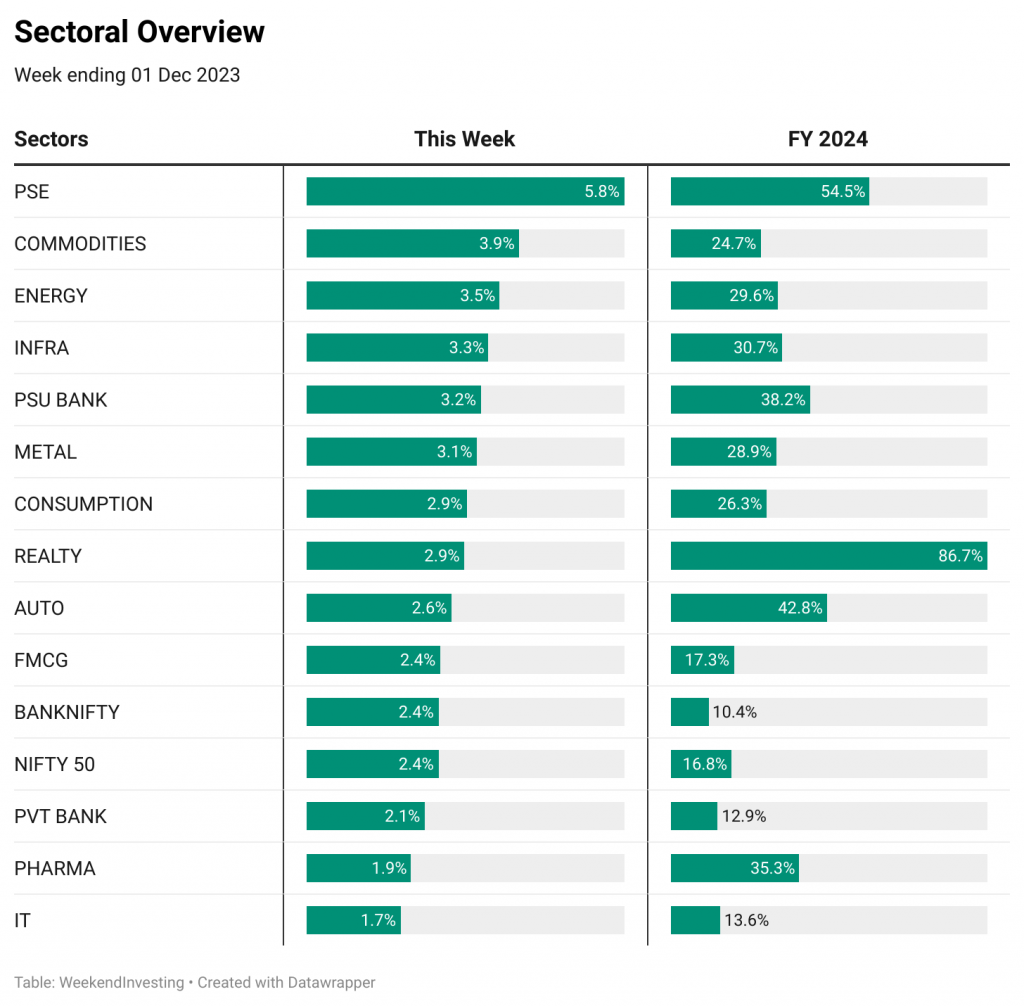

Sectoral Overview

Looking at sectoral performance, real estate stocks topped the charts with a phenomenal 86.7% gain in FY 24, followed by public sector enterprise stocks at 54%. These sectors, which may have been overlooked in the past, have shown exceptional returns during this period.

Autos, PSU banks, pharma, commodities, energy, and infrastructure stocks have also performed well, with gains ranging from 30% to over 40%.

In the weekly performance table, almost every sector experienced positive growth during the week, with the weakest performer still gaining 1.7%.

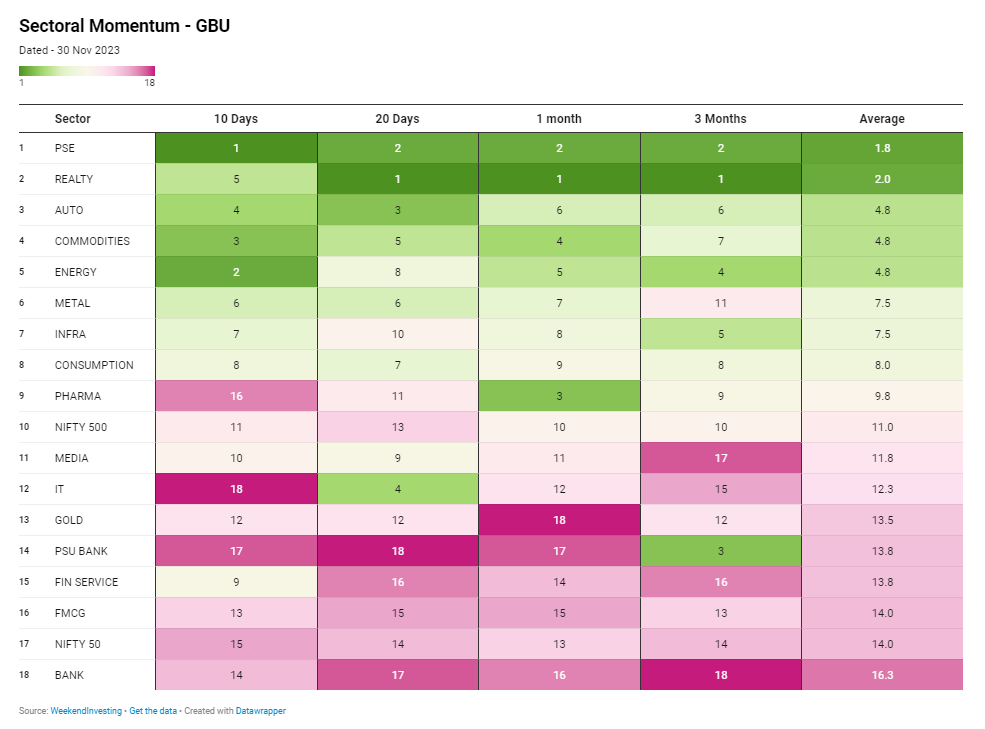

The short-term momentum is particularly strong for public sector enterprise stocks with real estate slipping to second rank behind the former.

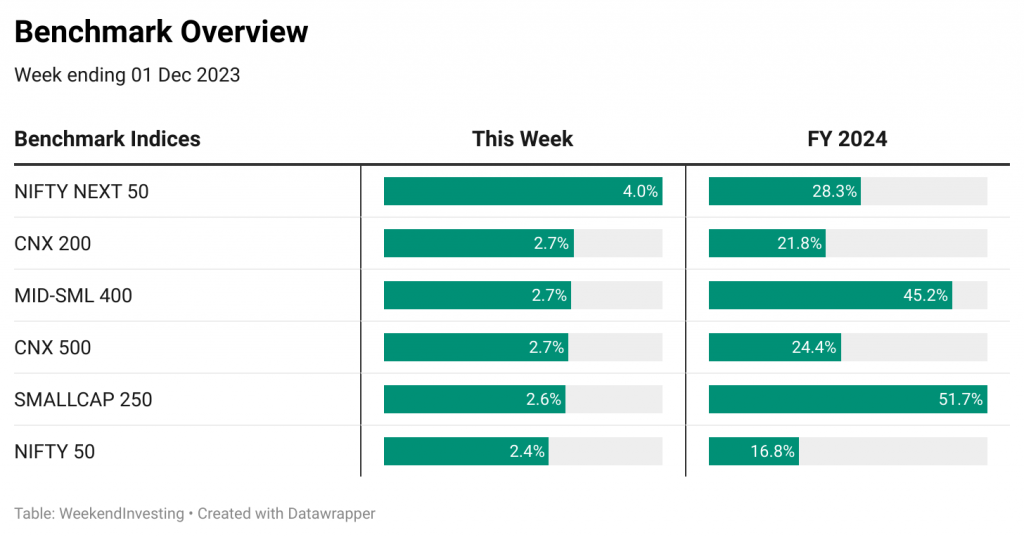

Benchmark Indices Overview

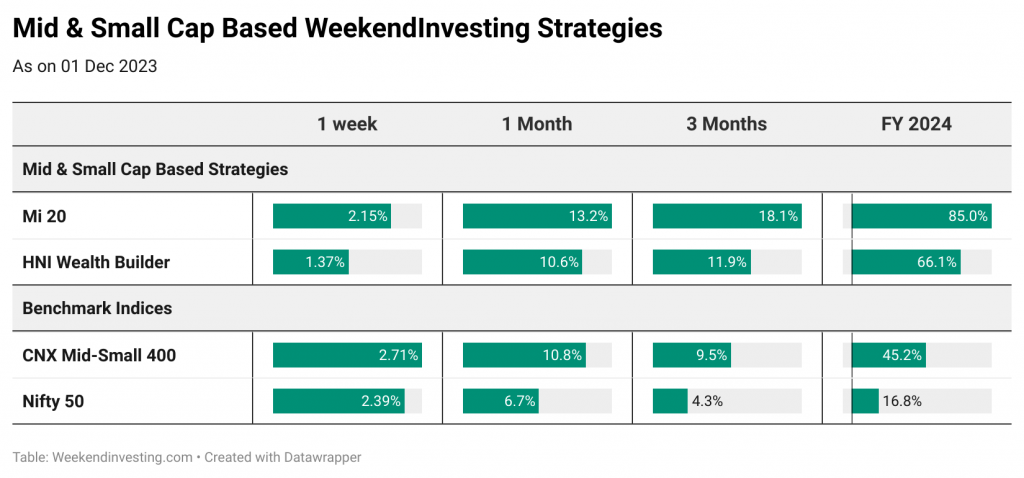

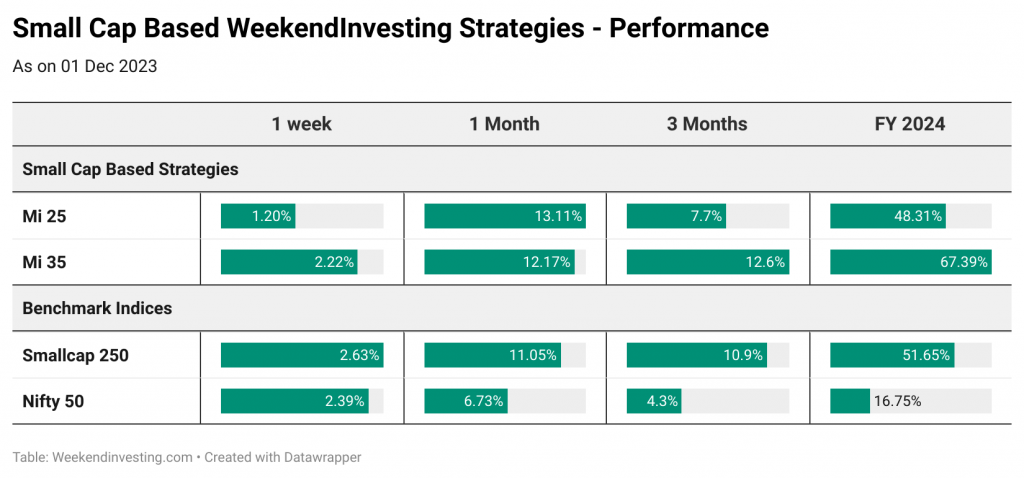

Nifty Next 50 index outperformed other indices, gaining 4% for the week while Nifty 50 recorded a 2.4% gain. Small-cap 250 and Mid-small 400 registered impressive FY 24 gains of 52% and 45%, respectively while The CNX 500, CNX 200, and Nifty Next 50 indices all rose by around 25%.

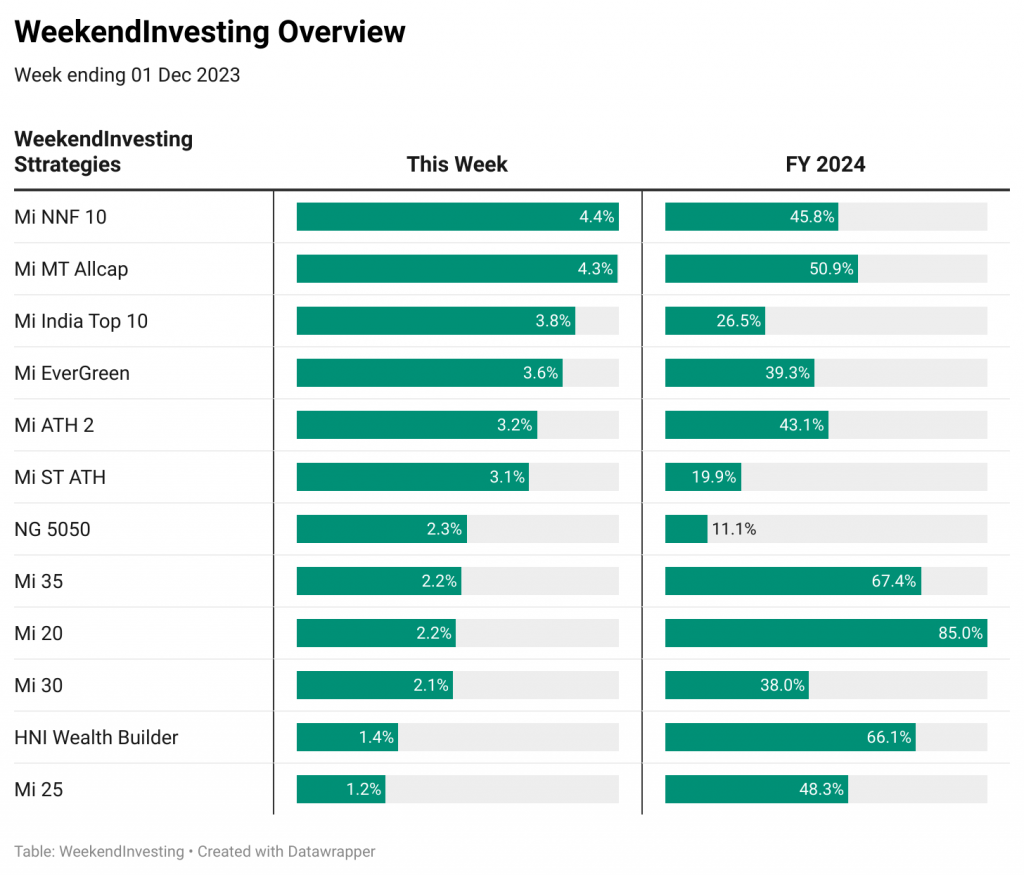

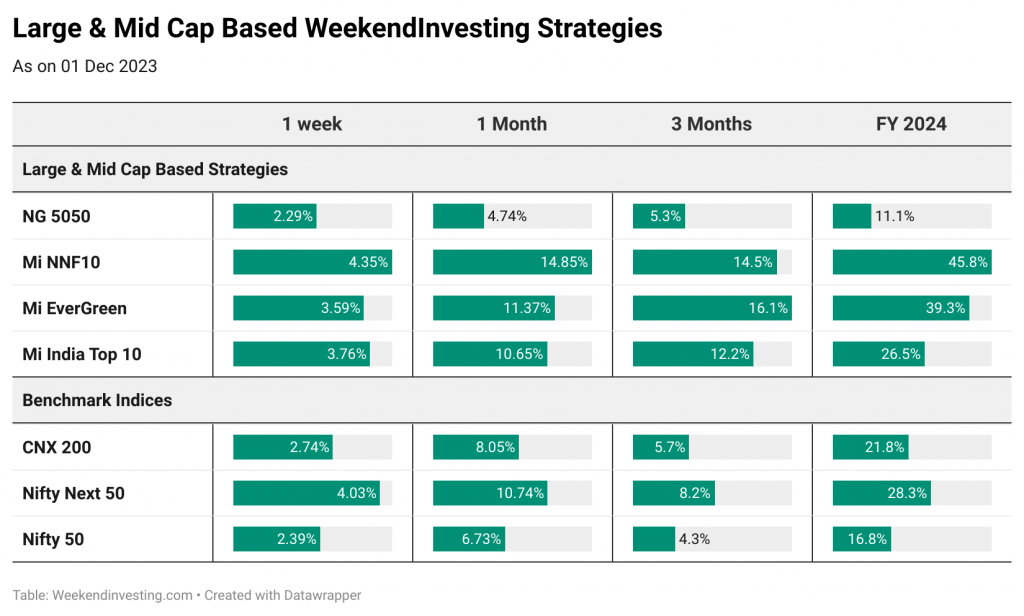

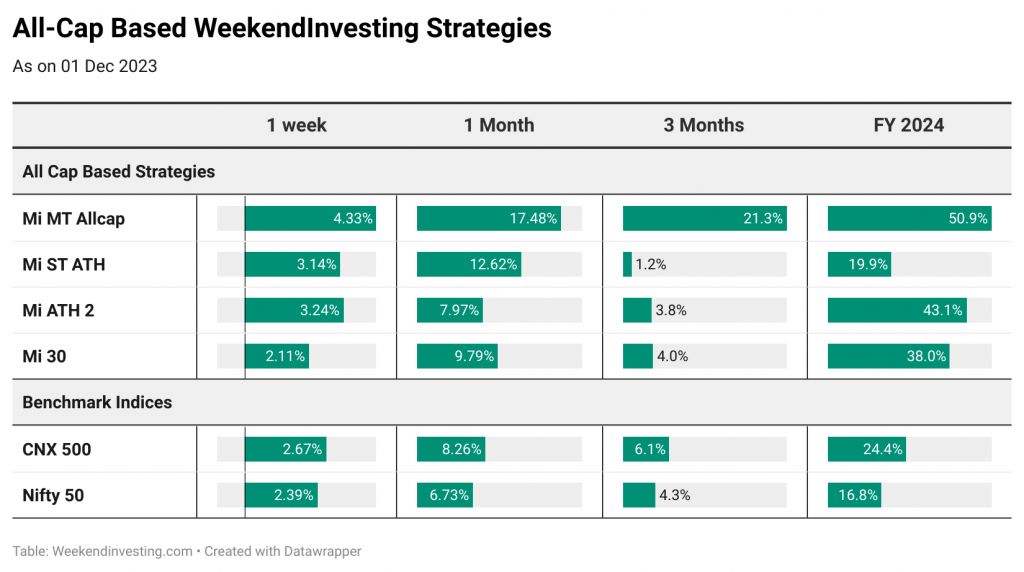

WeekendInvesting Overview

Mi NNF 10, which focuses on the top trending stocks in the Nifty Next 50 universe, recorded a massive gain of 4.4%. Similarly, the Mi India Top 10 strategy gained 3.8% this week. These strategies have exhibited exceptional performance during the financial year, with NNF Ten delivering a 51% return and Mi India Top Ten recording a 26.5% gain.

Other strategies such as Mi Evergreen, Mi ATH, Mi35, Mi20, and HNI Wealth Builder have also shown positive returns ranging from 3.2% to 3.8% this week. These strategies exhibit the power of momentum investing and debunk the myth that diversification leads to loss of returns.

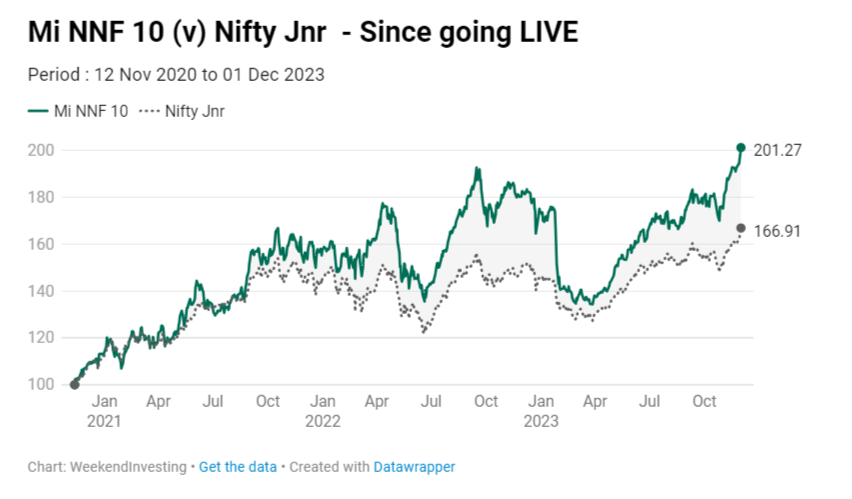

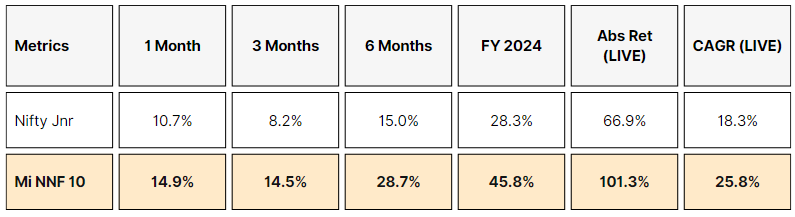

SPOTLIGHT – Mi NNF 10 scores a splendid 2x !

The spotlight of the week is on Mi NNF 10, which has doubled its performance since its launch in November 2020.

Despite two drawdowns and market volatility, the strategy has consistently bounced back and outperformed expectations. This highlights the importance of staying invested for the long term and having faith in the momentum approach.

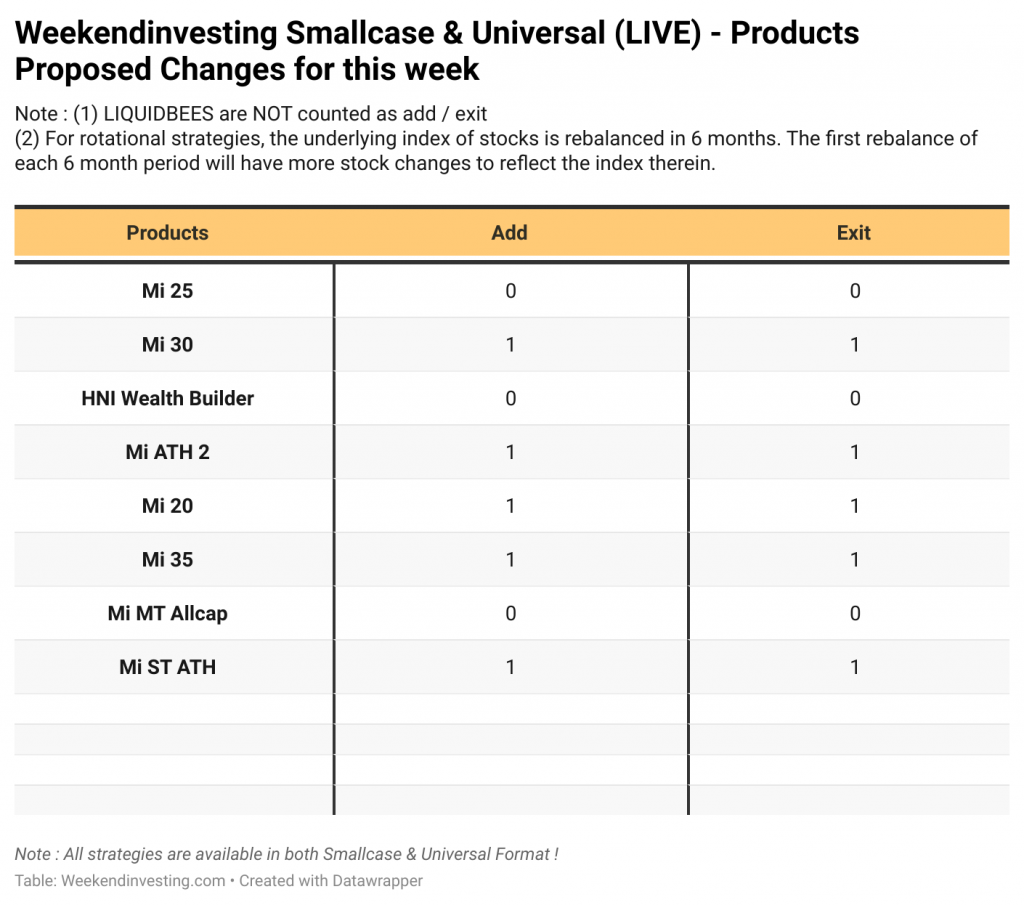

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s edition !