ALLL TIMEE HIGHHHH ! The long weekend has been greeted by the much awaited news of Nifty hitting a fresh all time high. There was a strong resistance around the previous peak at 18850 odd levels but markets broke out finally with a phenomenal 550 point rally in the last three trading sessions to end the week at 19189. We keep saying that all time high is a point where no resistance is applicable although there may be some profit booking at various stages. Let’s hope this uptrend goes far and beyond !

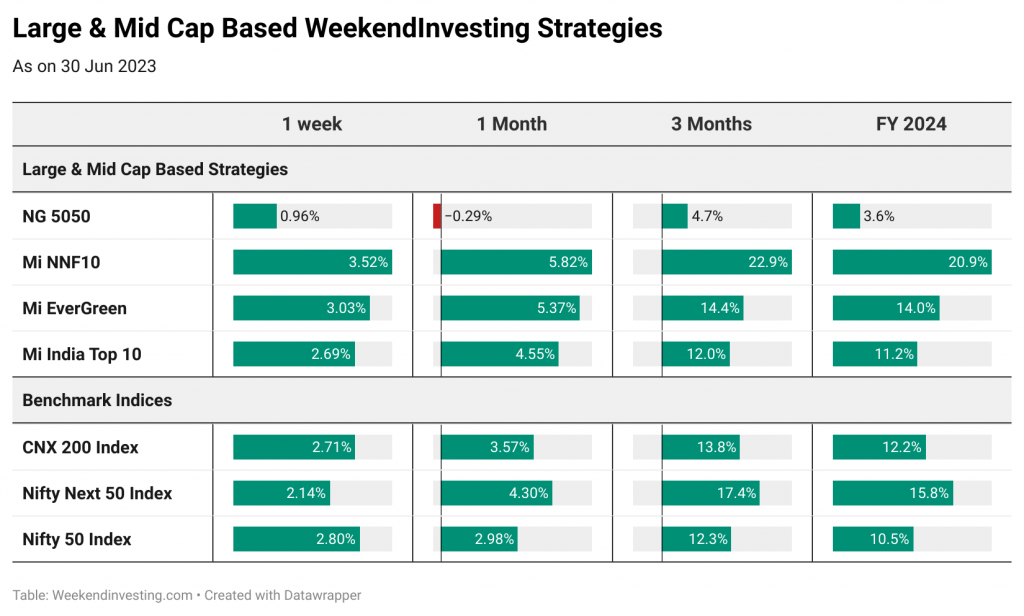

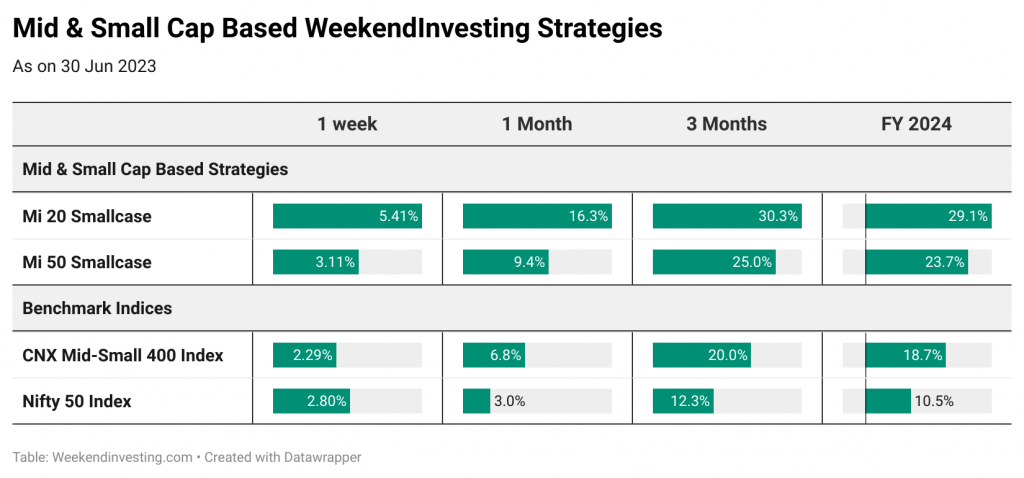

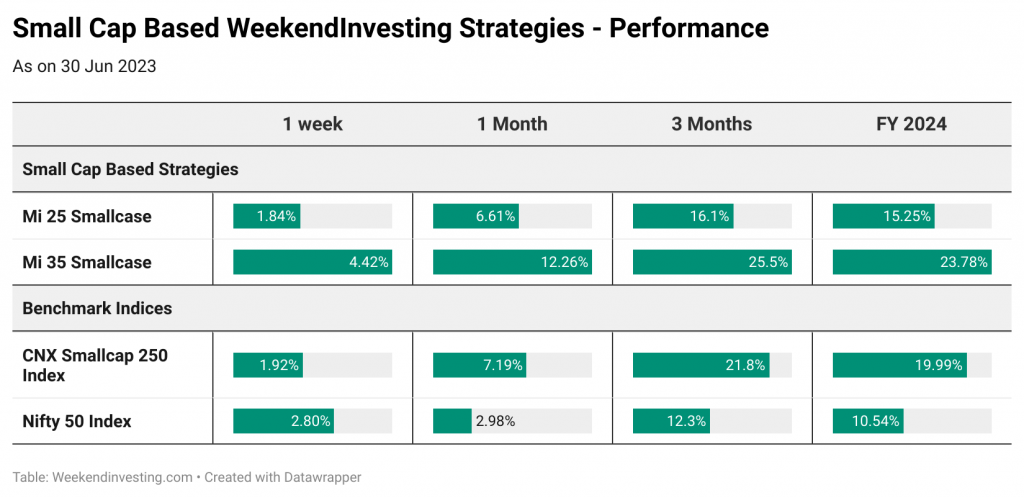

Nifty 50 was the best performer of the week clocking 2.8% followed by CNX 200 @ 2.7% and CNX 500 @ 2.6%. Smallcaps and midcaps still lead the FY 24 charts but the the important point to note is that all benchmarks are at fresh all time highs barring Nifty Next 50 which is a shade under 4% from a new peak.

PHARMA and AUTO were the leaders of the current week as money flow seems to have been distributed quite well across all sectors. REALTY has continued it’s good trend clocking 9.43% in the last month along with PHARMA returning 9.2%. REALTY has in fact been super solid returning 36% in Q1 FY 24. Overall, all sectors including IT are in green this FY & we hope this good run continues ahead.

Mi 20 and Mi 35 have been on an incredible run clocking 5.4% and 4.4% respectively this current week. Almost all strategies have done quite well with a few outperforming and rest staying in line with their respective benchmarks. A solid start to FY 24 & we have no complaints.

Mi 35 – Smallcap Rotational Momentum Strategy

Importance of having exposure to smallcaps is extremely underrated in our narrative. Smallcaps have always done incredibly well in all bull runs. Some exposure to this segment can add to the alpha quotient.

The objective of Mi 35 is to try and make the most out of bull run while keeping the downside minimal during weaker market regimes.

25% off on Mi 35 : code WI35

Offer only available till 02nd July 2023 (Sunday)

A SHORT COURSE to Help you Stay Calm in All Market Conditions

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

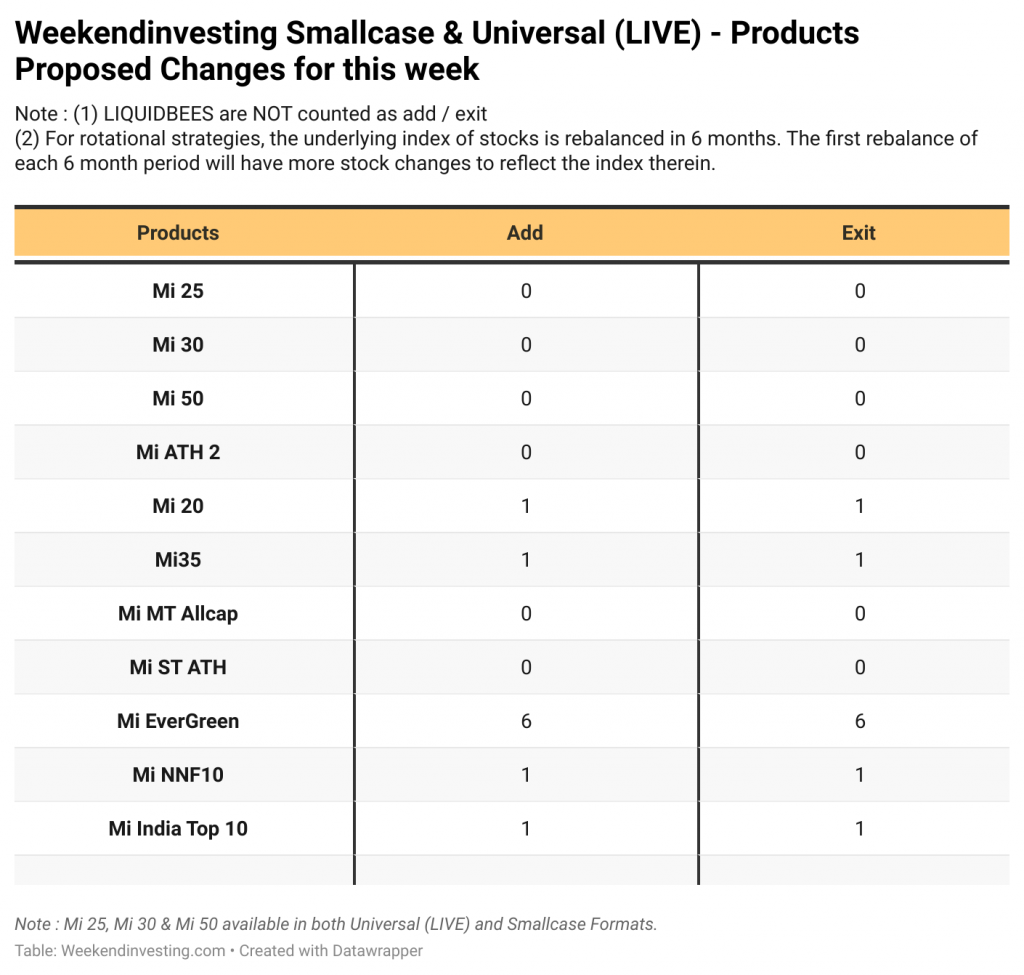

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

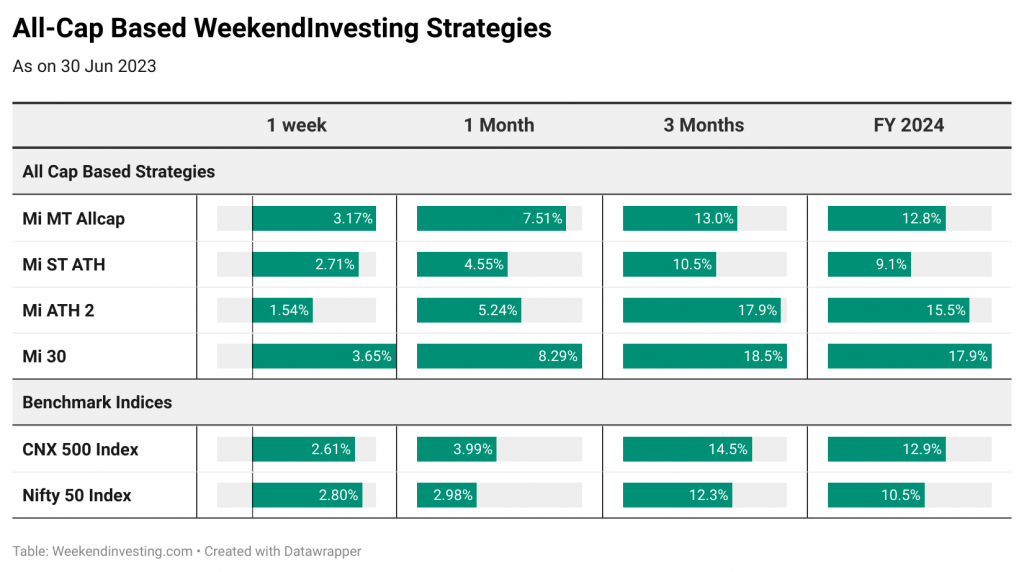

The performance of all strategies across various timeframes are listed below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.