Understanding Bear Market Lows

Bear markets can be distressing for investors. When the market falls, many people panic and sell their stocks. But why does the market fall? It happens because liquidity is going out of the market. When many investors believe that the market cannot rise in the short to medium term, they pull out their money and move it to other assets. This reduces the buying pressure, and the market declines. Once prices drop to a certain level, new buyers enter the market, bringing fresh funds. This buying pressure pushes prices up again, starting a new cycle.

The Cycle of Boom and Bust

The market moves in cycles of booms and busts. When stocks are overbought and over-owned, a correction happens. Eventually, the market reaches an underbought and under-owned position, forming a bottom. At this point, few people own stocks, and buying starts again. These cycles have been occurring for many years. In the last two decades, we have seen several such cycles. Currently, we are in a cycle that began with the 2020 bottom. Eventually, there will be another fall, creating a new bottom, which will lead to the next upward cycle.

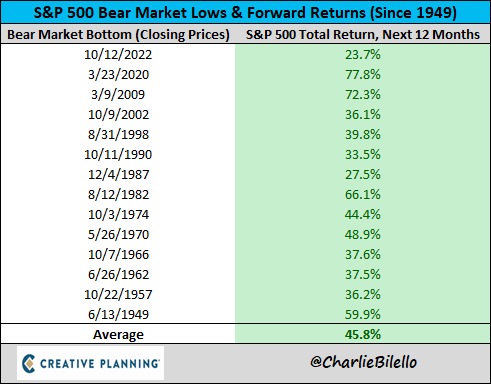

Major Market Bottoms

Historically, major market bottoms occur roughly every six to eight years. After a bottom, the market often sees significant returns in the following twelve months. It’s important to remember that no one can predict the exact bottom. However, the period following a market bottom is usually very profitable. If you sell your stocks at the bottom, you miss out on these gains. This pattern happens every time: most people sell near the bottom and buy near the top. Understanding this can help you avoid making the same mistakes.

Learning from History

History teaches us valuable lessons about market cycles. One famous example is the Peter Lynch Magellan Fund. The fund achieved an impressive 28% annual return over 13 years. However, investors in the fund often bought high and sold low, trying to time the market. As a result, they did not benefit from the fund’s overall success. This shows the importance of staying invested through market cycles. By doing so, you can benefit from long-term gains instead of getting caught in short-term volatility.

Staying Invested in the Market

To succeed in the stock market, it’s crucial to stay invested. If you need to take some money out, consider a partial exit instead of selling all your stocks. This way, you remain in the market and can benefit from future gains. It’s also important to have a structured plan for entering and exiting the market. A disciplined approach helps you avoid panic selling during market declines and missing out on subsequent recoveries.

Disclaimers and disclosures : https://tinyurl.com/2763eyaz

If you have any questions, please write to support@weekendinvesting.com