Unveiling our all new HNI strategy

Set Your Alarms!

🕚 On 02 Mar 2024 (Saturday) at 11 AM, we’re unveiling something BIG! 🎉

Introducing our exclusive HNI strategy: HNI Capital Compounder

Join us for a LIVE launch along with QnA. Click on the link below to set your reminders

- Introducing "The WeekendInvesting Newsletter"

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight - HNI Capital Compounder

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

You will be shocked to see this if you are an Apple fan!

Apple’s incredible 1000% gain in the past decade is a testament to its success. However, focusing solely on familiar favorites can blind you to even bigger opportunities. Many investors hold onto their favorite stocks, like Apple, Reliance, or HDFC Bank, due to past performance or personal preference. But this can lead to missing out on hidden gems like _____

The recent trend of underperforming mutual funds has sparked debate: can individual investors outperform the market themselves? This article explores this question, highlighting the challenges faced by fund managers and the potential advantages retail investors hold.

Can BBC detect a new player disrupting the industry ?

The recent entry of the Birla Group into the paints industry, dominated by established players like Asian Paints and Nerolac, sheds light on the ever-present threat of disruption and the challenges it poses for investors. While established brands often hold a significant market share, new entrants can significantly impact the landscape, forcing investors to adapt their strategies.

The recent surge of the Nikkei 225, reaching a new high after 35 years, offers valuable insights for investors. While it’s tempting to view passive index investing as a guaranteed path to growth, the Japanese market serves as a stark reminder of potential pitfalls.

Ever feel overwhelmed by the daily ups and downs of life, especially when it comes to your investments? Vishal Khandelwal, a popular figure in the investing community, offers a powerful message: zoom out.

The “Namaste Pattern” is a recurring phenomenon observed in the stock market, particularly after a bull run in a specific sector. This article explores this pattern using the example of Polyplex Corporation and highlights the importance of having an exit strategy.

5 ways to destroy family wealth

Building wealth and achieving financial security takes time, discipline, and informed decision-making. However, there are also certain strategies that can almost guarantee financial misery. In this article, we’ll explore five common pitfalls highlighted by Rahul Goel, CEO of Equitymaster, based on his interpretation of Warren Buffett’s 1986 speech at Harvard.

Imagine buying a stock that skyrockets tenfold over several years, only to see it plummet and erase most of those gains. This scenario, unfortunately, plays out for many investors who lack a clear exit strategy. This article explores the importance of having an exit plan in place, using the example of Bharat Heavy Electricals Limited (BHEL).

The opportunity cost of no Exits.

The stock market journey is rarely a smooth ride. Even fundamentally strong companies can experience significant price swings, leaving investors grappling with emotional turmoil and difficult decisions. This article explores the importance of exit strategies, using Sun Pharma as a case study, to navigate these market fluctuations and protect your capital.

Prospects for $Gold in 2024 are awesome!

Despite fluctuations in other markets, dollar gold has remained relatively stagnant, hovering between $1640 and $2000 for nearly four years. While Indian rupee gold has seen fluctuations due to currency depreciation, dollar gold has remained unchanged, teetering on the brink of a potential breakthrough. Read this article to dig into more insights.

Markets this week

A fantastic day on 01 Mar 2024 saw Nifty churn out an impressive 1.6% to make a new all time high daily & weekly close. This week started off on a cautious note with markets looking for cues. The news did come in the form of strong GDP numbers propelling the markets to resume the uptrend.

Benchmark Indices & WeekendInvesting Overview

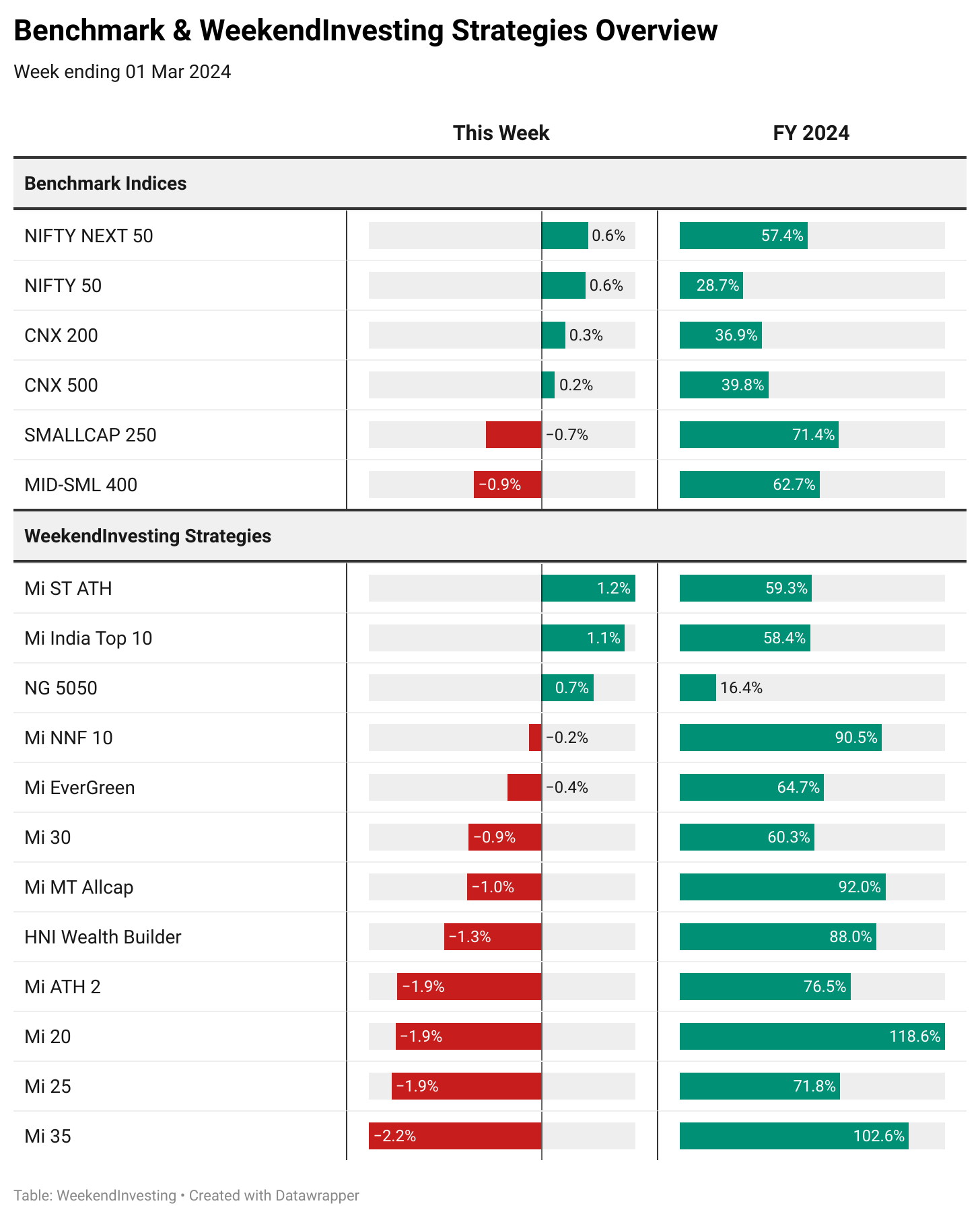

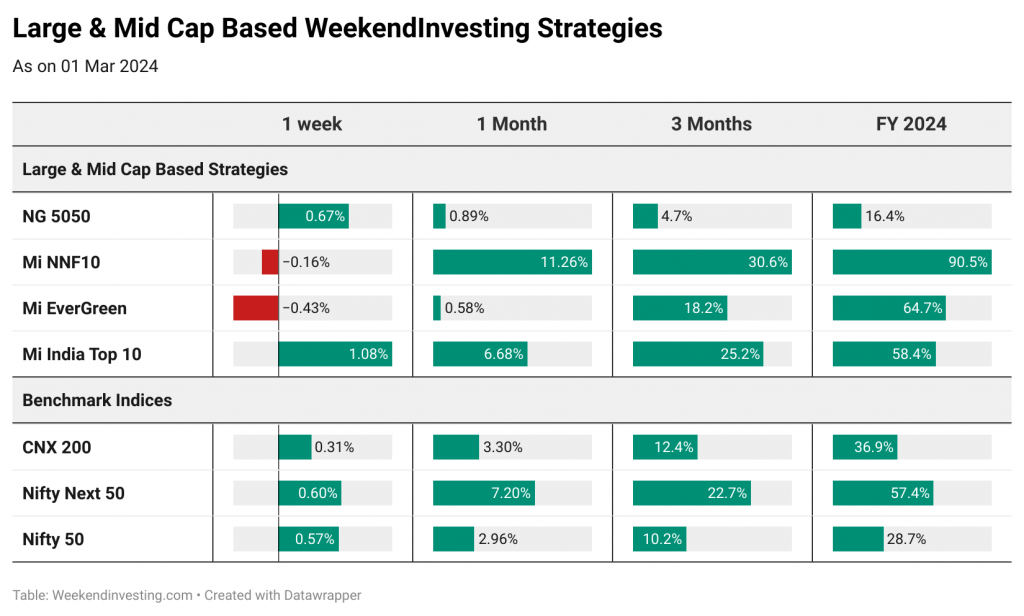

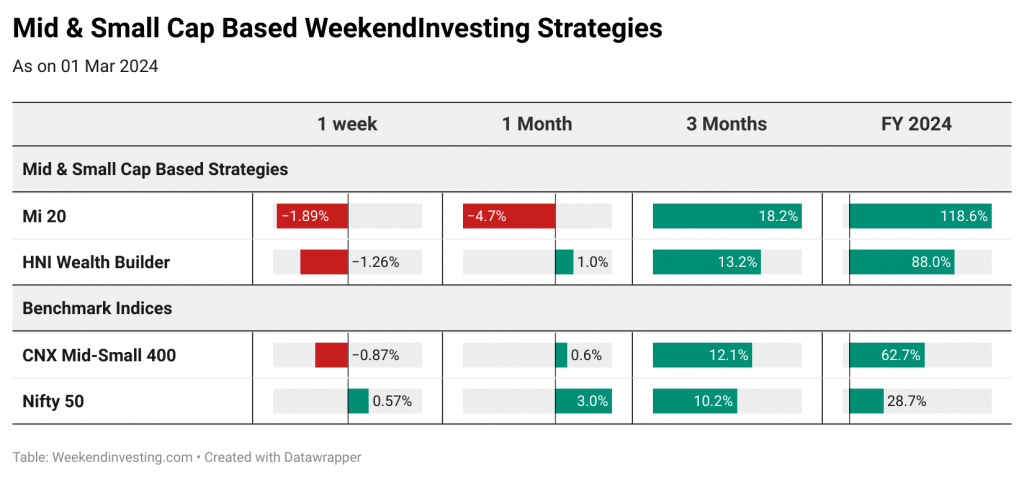

Thanks to the solid recovery on 01 Mar 2024, markets managed to pull up and post decent numbers for the week. Nifty 50 and Nifty Next 50 closed the week at 0.6% while CNX 200 and CNX 500 stayed flat at 0.2% and 0.3% respectively. Smallcaps and midcaps struggled with relative underperformance.

But on the contrary, it is Smallcap 250 index that leads the FY 24 chart with a solid 71.4% gain followed by midcaps at 62.7% gains. These two indices face a steeper correction compared to larger caps when markets enter weak territories. Nifty Next 50 has impressed everyone with a fantastic 57.4% return in FY 24.

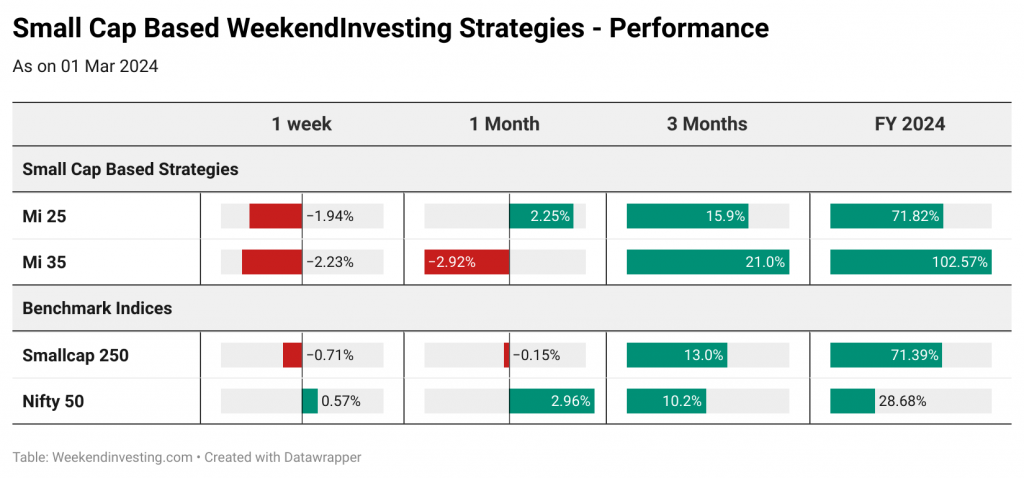

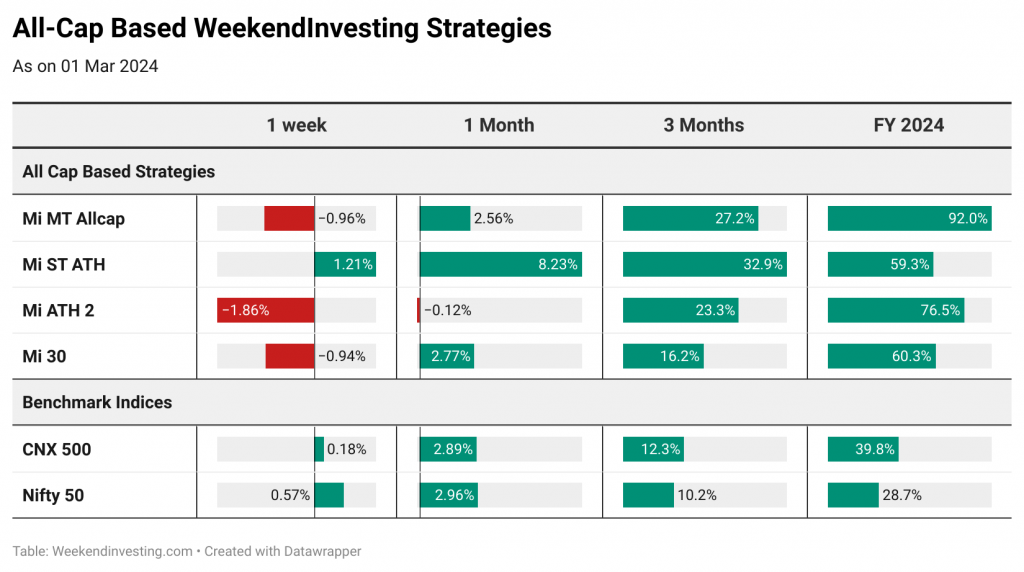

Almost all strategies ended up underperforming their respective benchmarks barring Mi ST ATH which posted gains of 1.2% along with Mi India Top 10 at 1.1%. There was some consolidation in Mi 20, Mi 35, Mi 25 and Mi ATH 2.

Mi 20 continues to lead the FY 24 chart with a staggering 118.6% gains followed by Mi 35 at 102.6%.Mi NNF 10 and Mi MT Allcap are in the nervous 90s with under 1 month to go for the close of FY 24. Overall, it has been an exceptional year for WeekendInvesting with all strategies outperforming their respective benchmarks by a handful margin.

Sectoral Overview

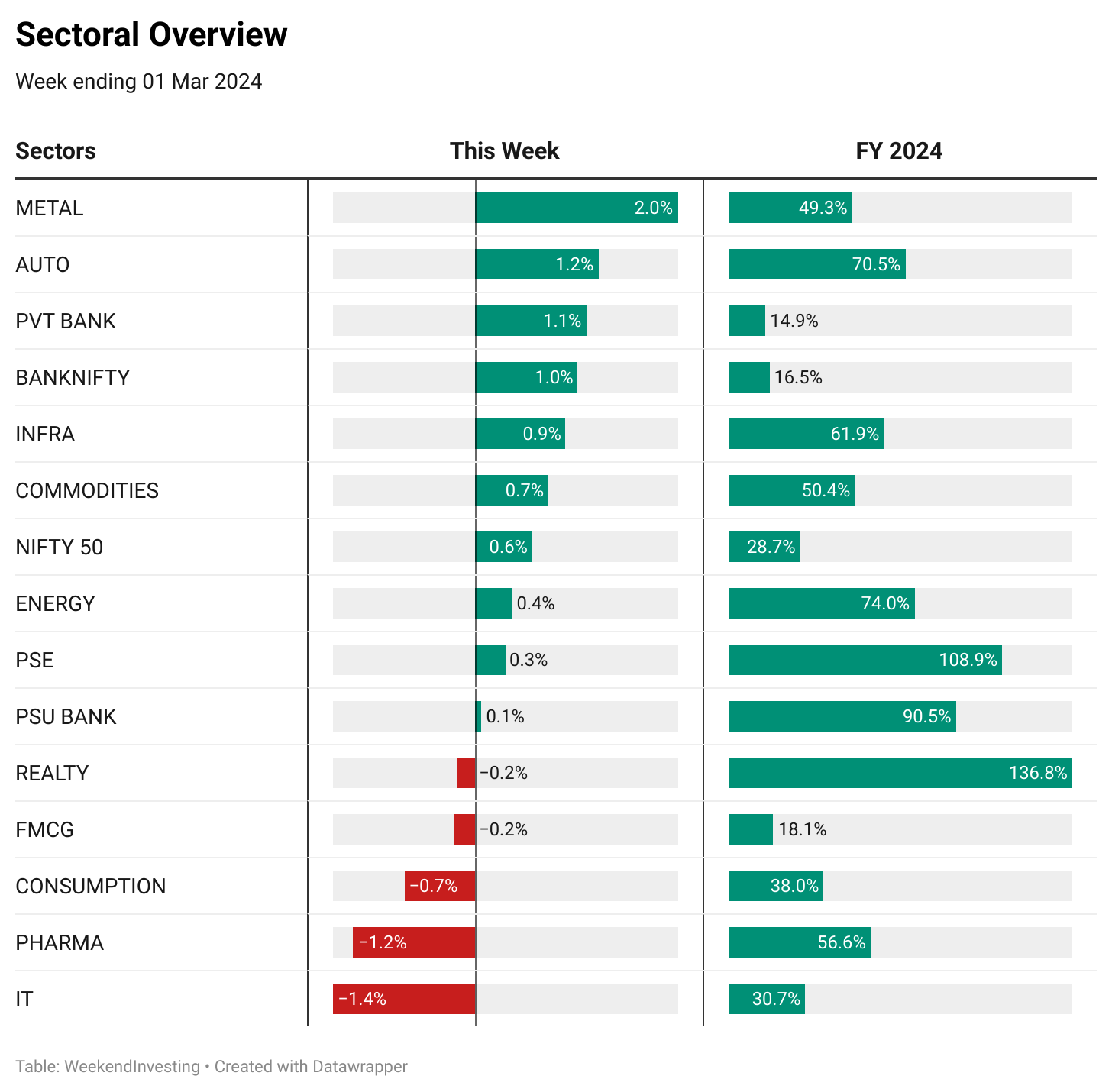

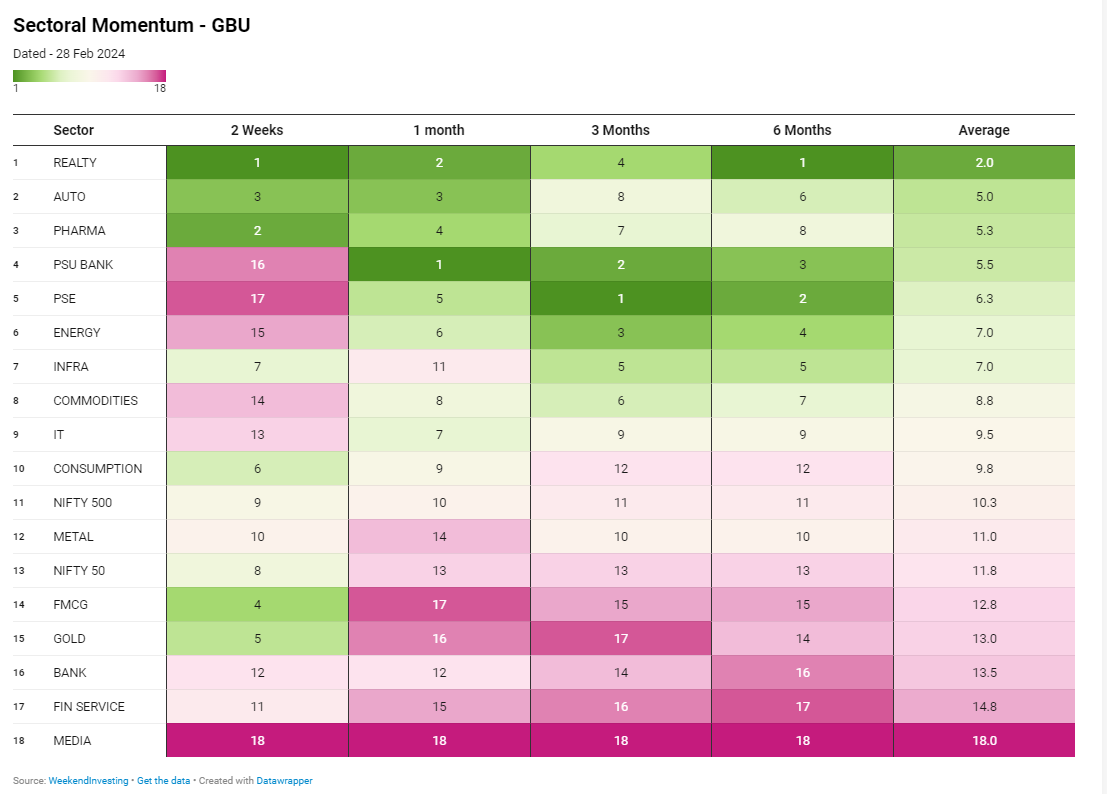

METALS had a ball this week clocking 2% gains while BANKS and AUTOs clocked 1.2% each. REAL ESTATE remained choppy for the week but hold fort for FY 24 with an astounding 136% gains. PSE’s and PSU BANKs have done extremely well to sit pretty at the top of the FY 24 table. PHARMA has been a silent performer with a more than decent 56% gain in FY 24.

PSE, PSE BANKS and ENERGY have dropped dramatically to occupy the last few positions in the last two week momentum ranking owing to some poor performance off late. But, these three sectors still occupy rank 2, 3 & 4 on the 6 month chart respectively. This may have been a small profit booking considering how these sectors bounced on 01 Mar 2024. COMMODITIES and IT has slipped down the rankings a bit on the shorter term. CONSUMPTIONS stocks are also coming up quite well in the shorter term while REAL ESTATE took the throne after being under the pump for a bit.

WeekendInvesting Strategy Spotlight – HNI Capital Compounder

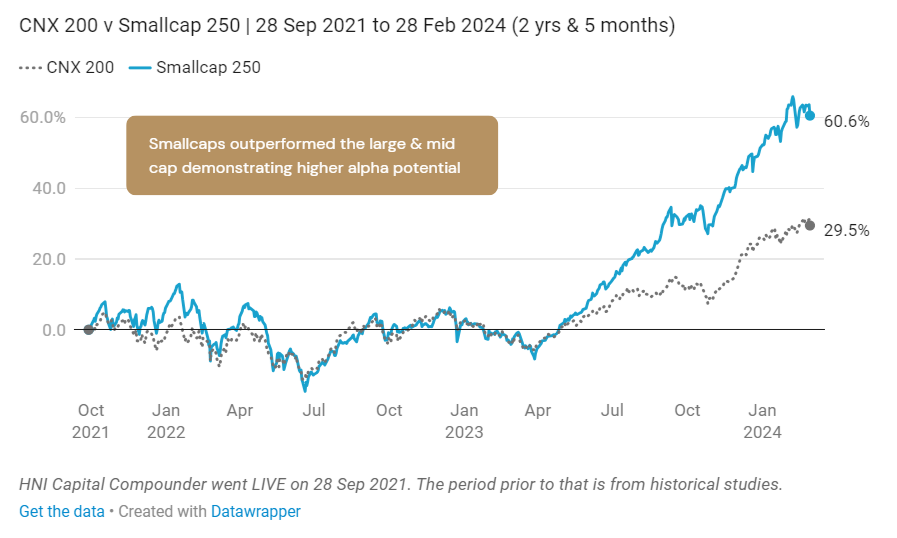

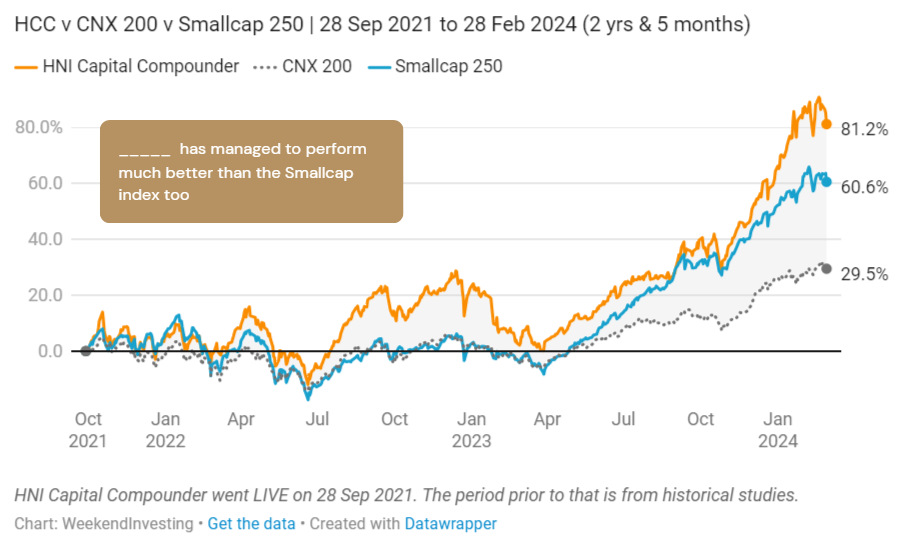

Can a strategy based on a large & mid cap index put up a performance similar to or better than a Smallcap index ?

When we compare the CNX 200 index & Smallcap 250 index between 28 Sep 2021 and 28 Feb 2024, the latter has taken an obvious lead especially post Apr 2023 owing to the extra alpha that the lower cap segments possess during uptrends.

Now, take a look at the same when we add our latest / brand new HNI strategy – HNI Capital Compounder

To know more, watch the below video

Check out the HNI Capital Compounder’s brochure

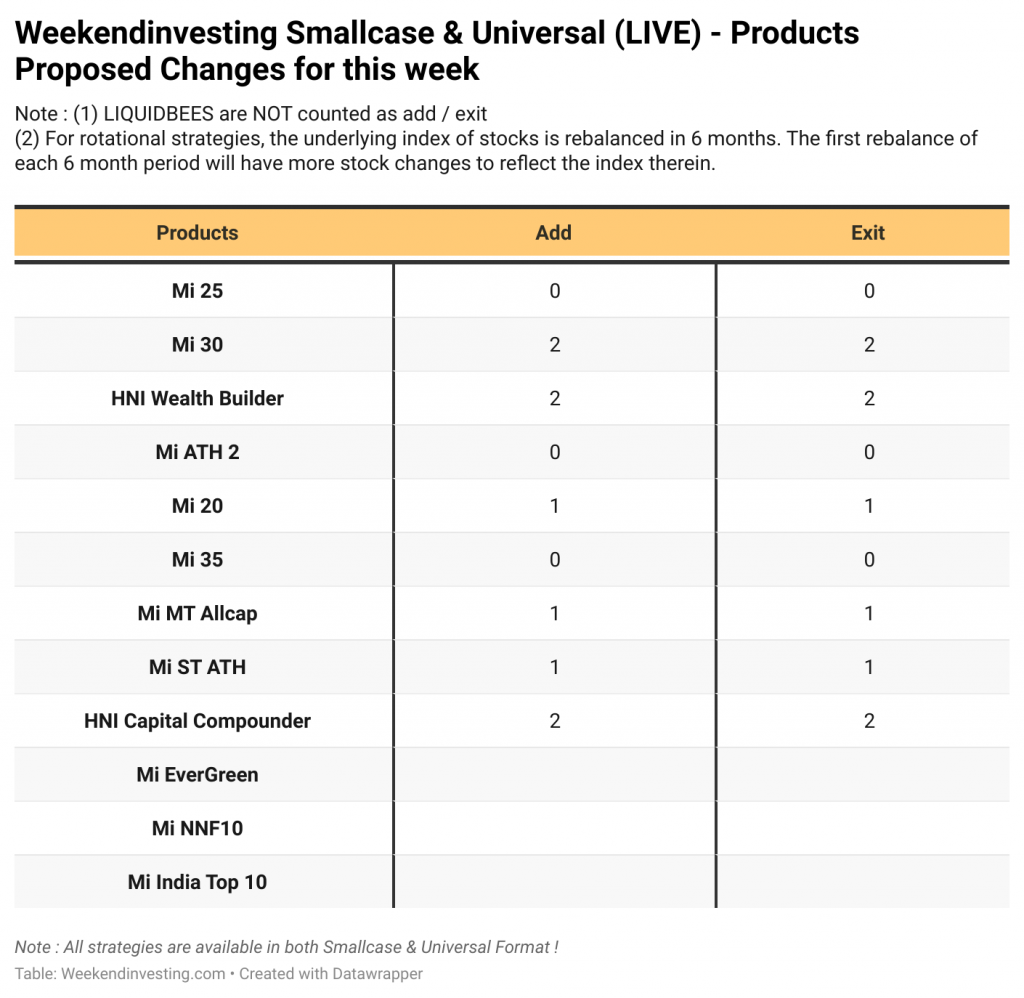

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report