A Special Video on Whether Nifty 50 will do well in FY 2025 ?

As we embark on a new FY journey, we try to throw some light on our perspective on whether Nifty 50 can do well in FY 2025 ?

- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

From the Research Desk of WeekendInvesting

Exploring the historical trends of various indices over the past 70 to 80 years reveals fascinating insights into market dynamics and the duration between all-time highs (ATH). While investors in India may be accustomed to frequent ATHs, this is not . . .

Can Energy Costs derail markets ?

The CNX Energy Energy index has been on a remarkable upward trajectory, especially in the aftermath of COVID-19. Over the past four to five years, it has soared, nearly quadrupling in value since its 2020 low. This surge is particularly noteworthy considering the increasing costs associated with . . . .

Why Gold is Important for all Investors!

Reflecting on the gold price trends over the past two decades reveals significant growth. From April 2004 to the present day, gold prices have surged from 675 to nearly 70,000 INR per 10 grams, marking an approximate tenfold increase. Despite a bear market . . . .

Why to not try to time the market.

Analyzing a Nifty chart spanning four and a half years reveals multiple instances where the market experienced both highs and lows. These fluctuations create windows for investors to strategically . . . .

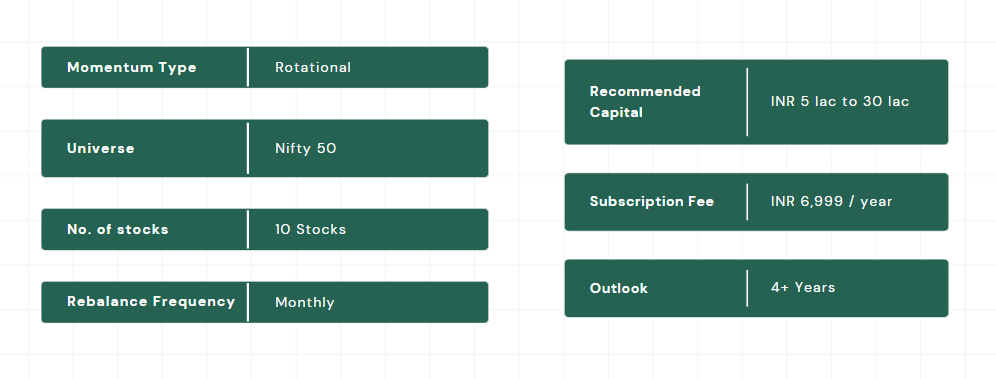

Mi India Top 10 stands out for its simplicity and effectiveness. This strategy, which selects stocks solely from Nifty 50 constituents, has showcased . . . .

In the world of stock investments, understanding when to buy and sell is crucial for maximizing returns and minimizing losses. In this blog, we delve into two case studies that shed light on the importance of . . . .

When it comes to investing, having a clear set of rules is paramount. The four cardinal rules I abide by are: what to buy, when to buy, how much to buy, and when to sell. These rules serve as the foundation for any investment strategy, whether it’s based on momentum or other factors.

In the world of investing, regret is a common emotion that many traders experience. Whether you sell a stock only to see it soar or buy one that plummets, these scenarios often lead to feelings of missed . . . .

There’s a common belief among many investors that small cap stocks are the holy grail of investing, the only way to achieve substantial returns and generate alpha. However, let’s take a step back and examine this assumption by comparing the performance of small cap stocks with that of another asset class—gold . . . .

Gold has experienced two major cycles in the past, characterized by significant price surges. The first cycle, from 1976 to 1980-81, saw the price of gold skyrocket from $100 to $800, marking an astounding seven to eightfold increase in just four years. Similarly . . . .

Markets this week

Nifty 50 was quite flat this week but this is coming in after a good trend we have been witnessing from 21750 levels (end of Mar 2024). So a pause after a decent trend is also a good sign because it forms a flag and pole pattern after which the uptrend usually resumes post some triggers if any. There was a slight panic on the 04th of March 2024 but it was well countered on the same day further leading to decent stabilization.

Since June 2022, we have seen a fantastic rally where Nifty 50 went from 15200 to almost 22500, a 7000 point rise. Expecting this kind of a trend linearly each year would be irrational. But continuing to invest without expectations, simply taking what we get can be a much better way to approach the markets for better outcomes.

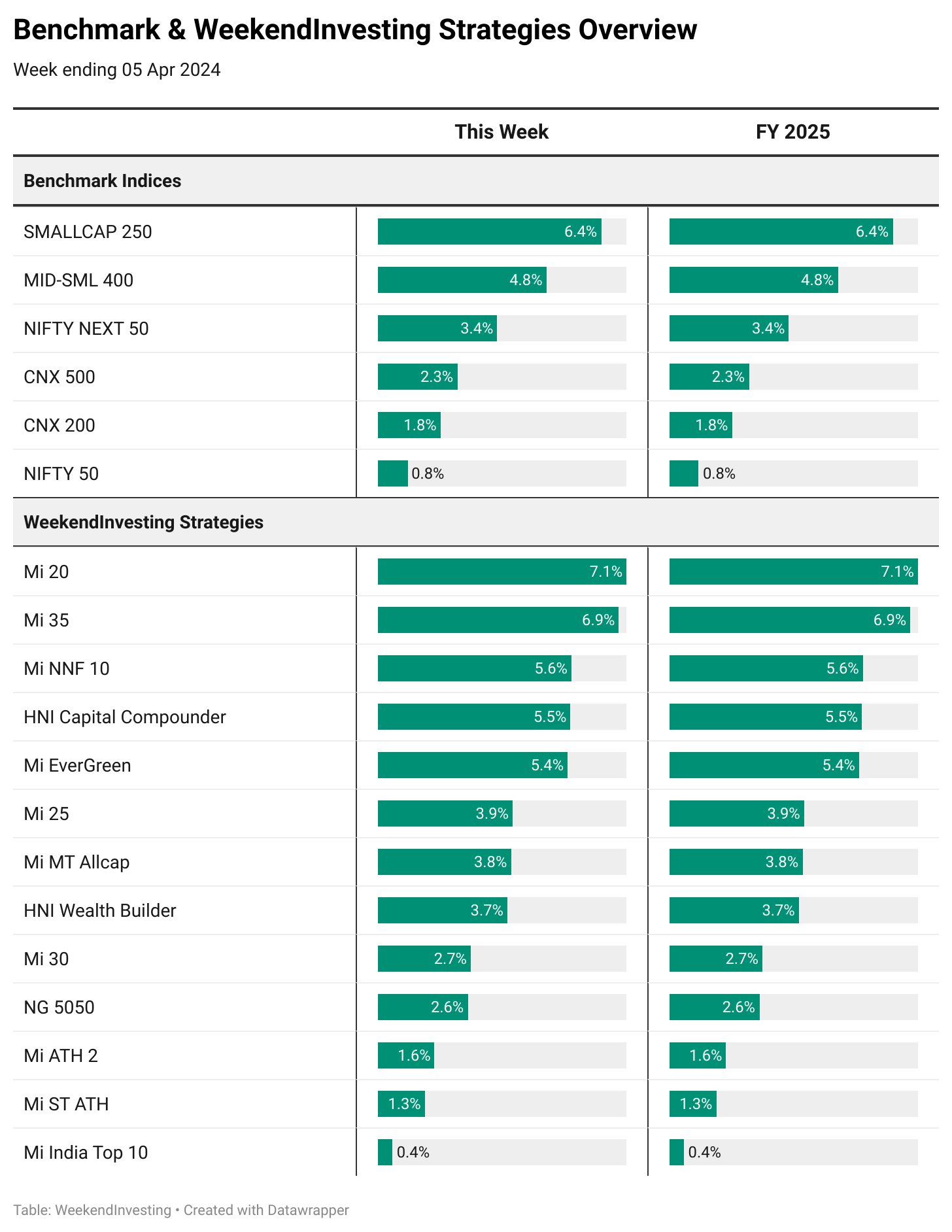

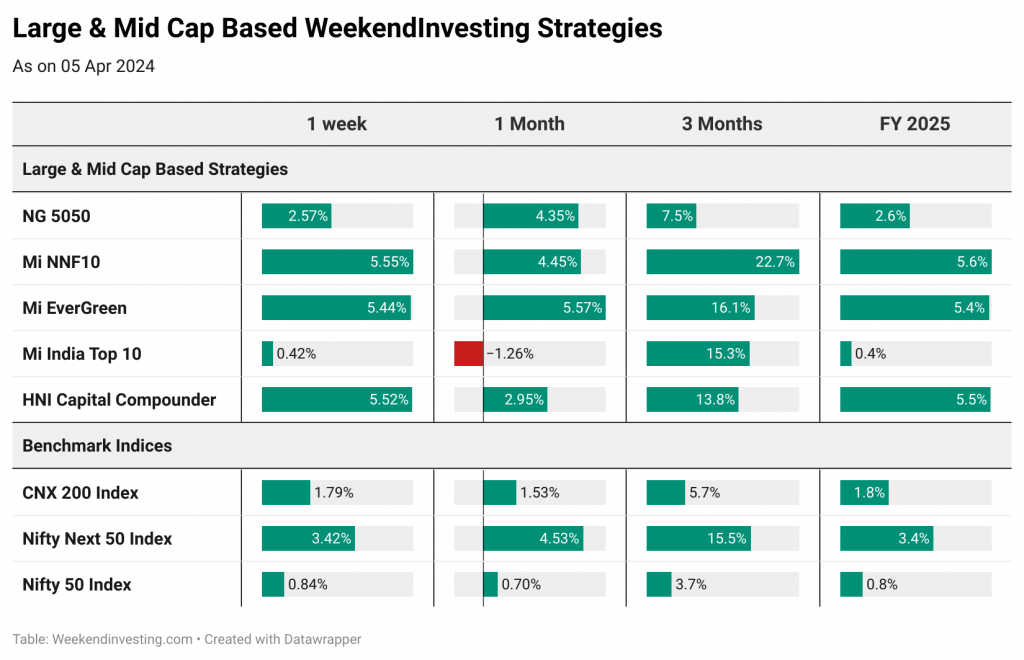

Benchmark Indices & WeekendInvesting Overview

This week, there was a great recovery in Smallcaps, with the Smallcap 250 index clocking a massive 6.4% followed by Mid-Small 400 index at 4.8%. Nifty Next 50 continues to dominate with a 3.4% gain this week followed by rest of the benchmark indices hovering around 0.8% to 2.3% returns.

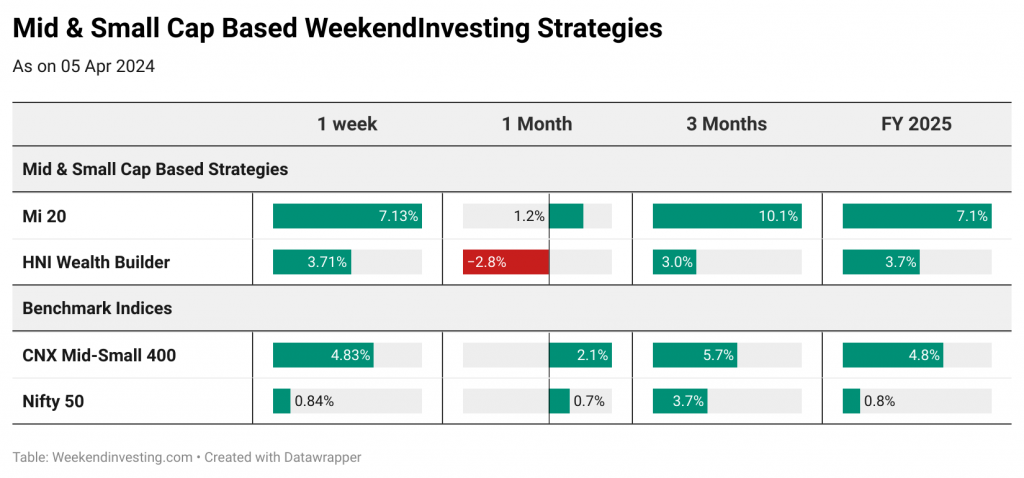

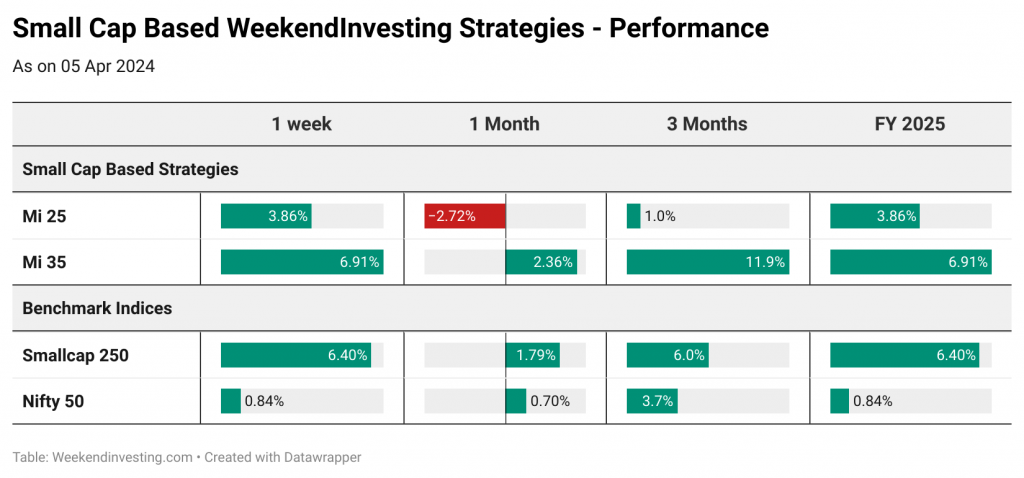

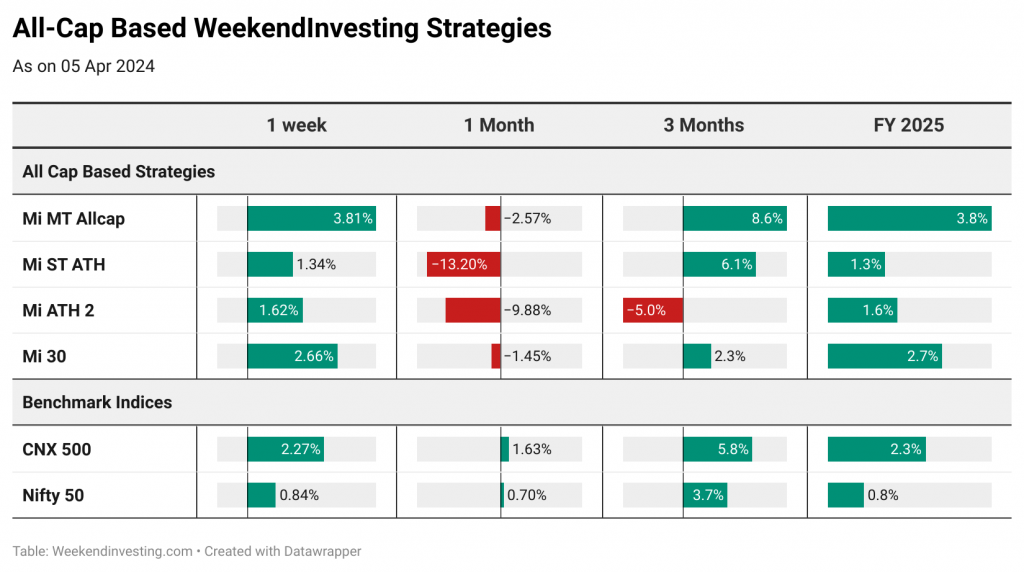

WeekendInvesting strategies also had a good start to FY 25 with Mi 20 clocking 7.1%, Mi 35 returning 6.9% while Mi NNF 10, HNI Capital Compounder & Mi EverGreen returning between 5.4% and 5.6%. Rest of the strategies also took a decent start clocking between 0.4% to 4%. Mi ST ATH & Mi ATH 2 had some cash exposure and thus could not make the most of this recovery in markets while Mi India Top was also slightly lagging its benchmark, the Nifty 50.

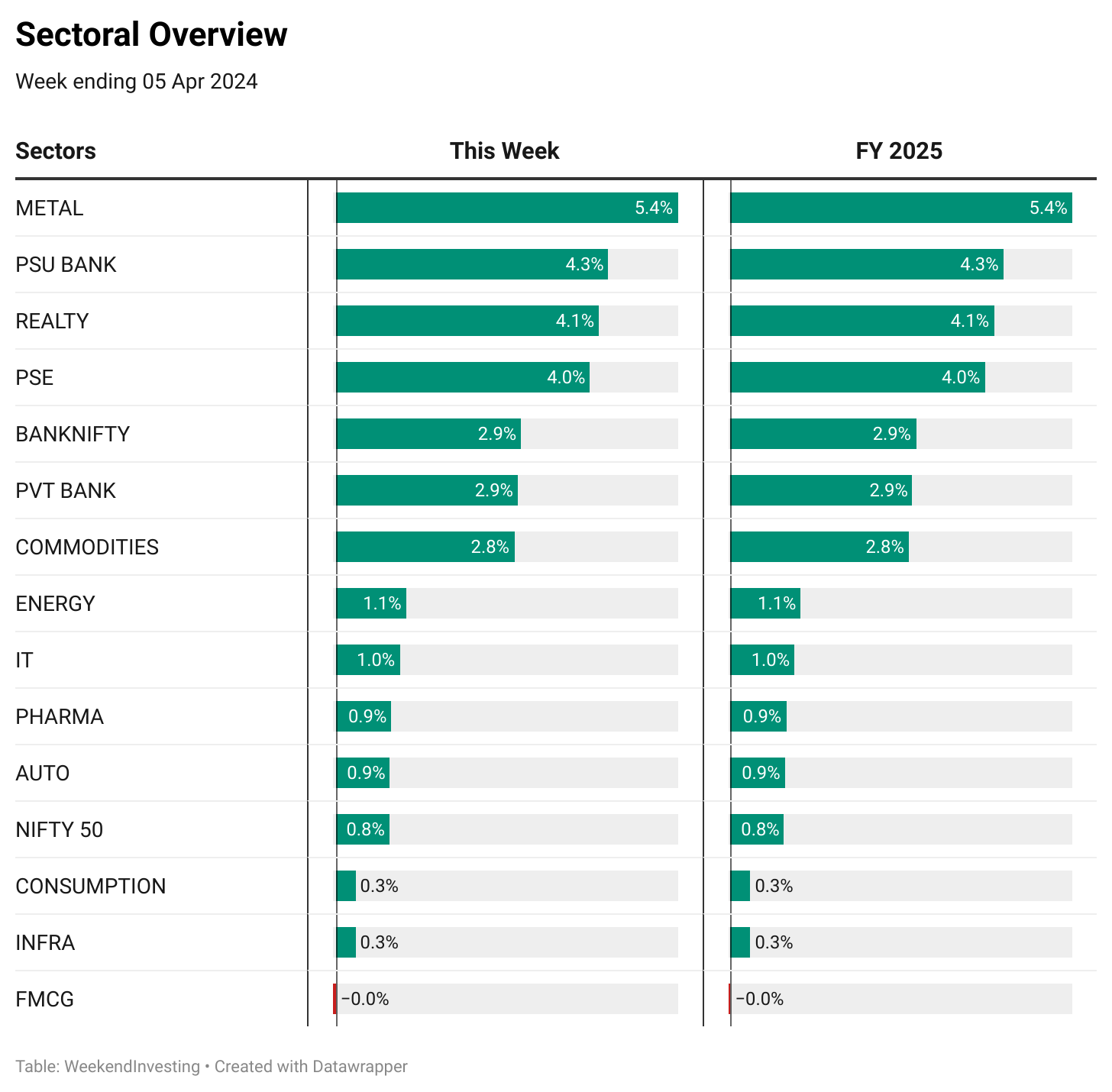

Sectoral Overview

METALS, PSU BANKS, REALTY and PSE are the top four sectors for the week. These are the same sectors which have been doing consistently well in the recent past and have also taken lead in this new FY. PVT BANKS are looking more rejuvenated with HDFC BANK leading the charge while ENERGY, IT & PHARMA were all muted. Markets might be looking forward to the election results but the outcome may probably already be baked in. FED’s narrative of 2-3 interest rate cuts in 2024, earnings growth, India being the fastest growing economy and many other factors may have already been baked in. So there may be new triggers required to continue to the upward trajectory.

METALS, PSU BANKS and REALTY occupy the top spots in the fortnightly chart. REALTY in particular has done very well to recover from a slump from being at #15 in 1 month chart to coming in at #2 in the fortnightly chart. This sector aso happens to have occupied the top spot in the 6 month analysis. The same story carries on with PSE which has recovered very well after a bit of dullness in the fag end of Mar 2024. CONSUMPTION has lost some steam in the recent timeframe while GOLD continues its impressive run.

WeekendInvesting Strategy Spotlight

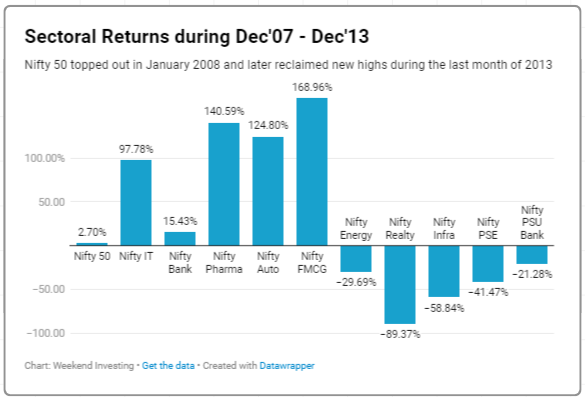

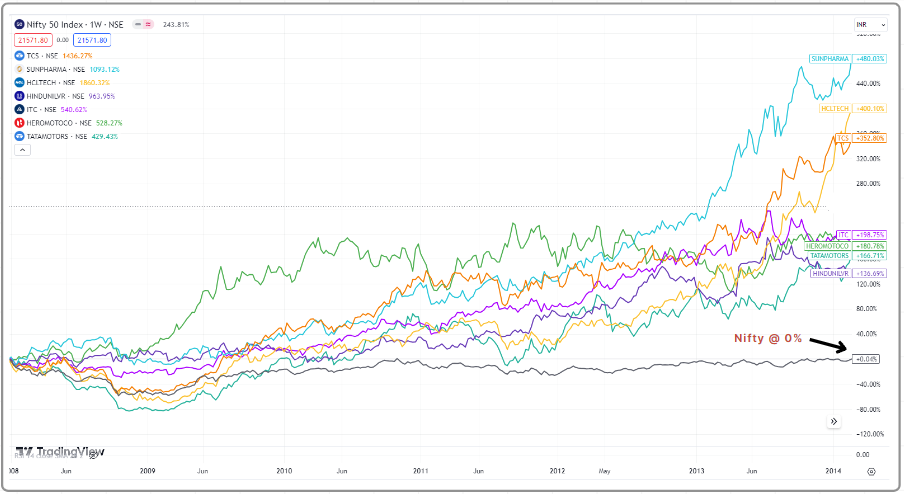

The Problem with Nifty 50 & Index Investing

Index investing, particularly in the Nifty 50, has long been hailed as a safe and straightforward approach to the stock market. However, a closer look reveals some inherent limitations in this strategy. Between January 2008 and March 2014, the Nifty index delivered a disheartening 0% return. This prolonged period of stagnation, known as the Global Financial Crisis (GFC), highlights a critical flaw in relying solely on index investing.

During the tumultuous 2007 to 2013 period, while the Nifty remained flat, certain sectors and individual stocks thrived. Pharmaceuticals surged by 140%, Auto by 124%, and FMCG by 168%. Meanwhile, real estate, energy, infra, PSU banks, and other sectors floundered. This disparity underscores the importance of strategic stock selection, even within stagnant market conditions.

Identifying Winning Pockets

Despite the Nifty’s lackluster performance, select stocks within the index exhibited remarkable strength. Companies like Hindustan Unilever, Tata Motors, Hero MotoCorp, and others saw significant growth during this challenging period.

If you held onto Nifty, you would probably have not made much but if you could have a structured approach to identifying momentum pockets within the universe, you can probably create a better opportunity in outperforming the benchmark and this is exactly what Mi India Top 10 aims to do.

Also, we have a special offer of 25% discount on Mi India Top 10 (use code FY2025) to mark the beginning of a new financial year.

Note : Code will be valid till 10th of Apr 2024.

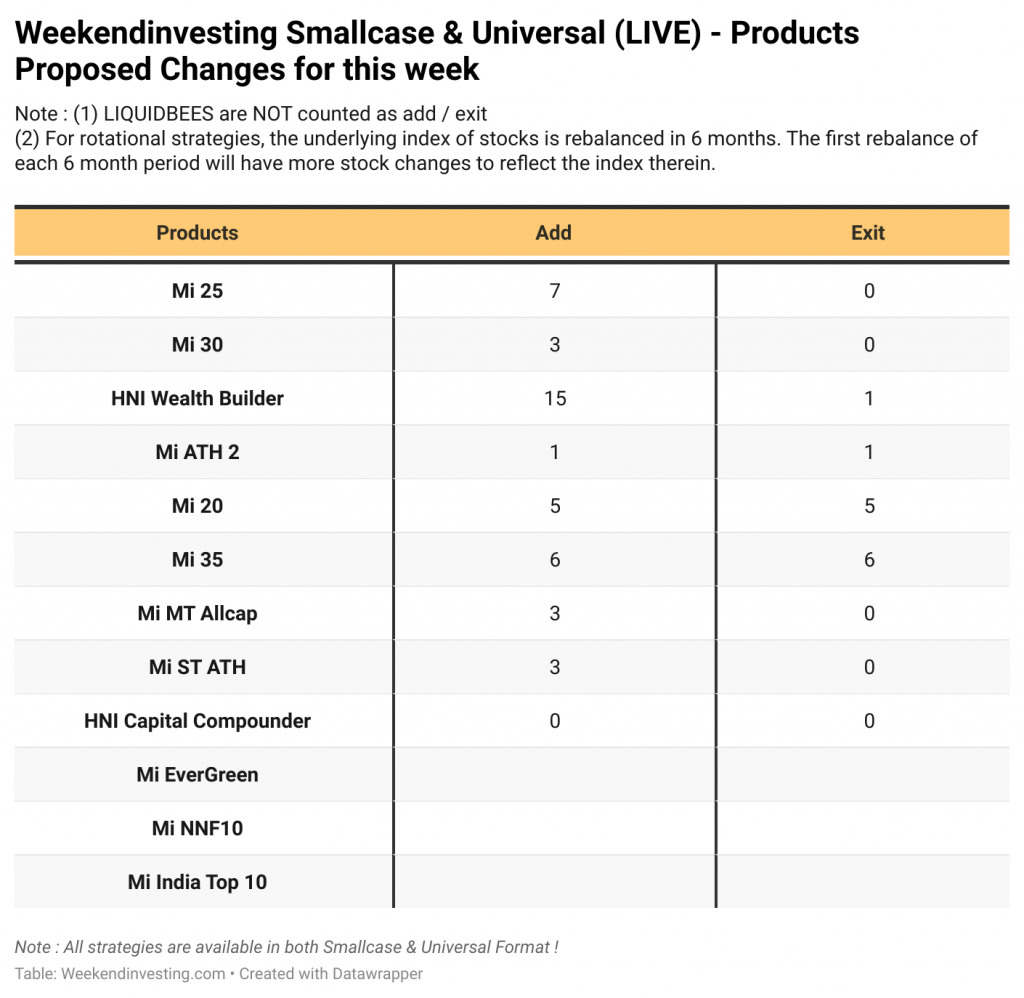

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.