HNI Capital Compounder is launching on 17 Mar 2024 (Sunday) @ 11 am

HNI Capital Compounder is a meticulously crafted core strategy that can be your ideal companion for your long term – steady compounding journey. Designed exclusively for HNIs looking to invest between 25 lac and 1 cr, it aims to unlock the hidden alpha within the large and mid cap universe.

The subscription links have been shared on our social media platforms.

Check out the HNI Capital Compounder’s brochure

Check out the intro video to know more.

- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight - HNI Capital Compounder

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Can you predict which segment will do better Next?

In this blog we analyze the performance of various market cap segments like Nifty 50, Nifty Jnr and Smallcaps to try and decipher some interest data points that can add value to us.

Gold has been buzzing with excitement lately, and for good reason. A recent breakout in the dollar gold chart has caught the attention of this commodity’s enthusiasts worldwide. After a period of consolidation following its significant surge in 2019-2020, gold seems poised for another impressive rally.

Large cap can be mutlibaggers too !

In this blog, we discuss the Mi NNF 10 strategy where we’ve witnessed remarkable success stories. Currently, stocks like DLF, Trent, Varun Beverages, and Hindustan Aeronautics Limited have delivered impressive gains ranging from . . .

Who will protect your Smallcaps ?

In the world of investing, small cap stocks offer the allure of high returns but often come with elevated risks. In this blog, we explore a simple yet effective strategy to hedge against this risk using the timeless asset

Why you need to Pivot sometimes !

In the world of investing, success isn’t merely about picking the right stocks; it’s about embracing a dynamic process. Think of it like running a business. Entrepreneurs constantly refine their strategies, pivoting when necessary to ensure profitability. Similarly, as investors, we must focus on the process rather than fixating on past successes or individual stocks.

In this blog post, we delve into the superiority of momentum investing, exploring its undeniable potential as a key factor in driving market success. Backed by extensive research and empirical evidence, momentum investing has emerged as a reliable strategy for achieving superior returns in the ever-evolving landscape of global equities.

The real reason for Nifty Jr performance!

In this blog, we explore a compelling story shared on Twitter that sheds light on the performance of stocks before and after they enter the Nifty 50 index.

Momentum as Capital protector !

In this blog, we delve into the fascinating phenomenon of momentum investing, using real-life examples to illustrate its effectiveness in navigating the unpredictable terrain of the stock market.

Is the Indian market really Expensive ?

In this blog, we examine key indicators to gain insights into various countries’ financial landscapes. While we won’t delve into the nitty-gritty of PE ratios and such, we’ll explore a broader perspective on how different nations stack up against each other in terms of growth potential and valuation.

The most important thing you will see this year

In this blog, we delve into a crucial aspect of market dynamics: the relationship between interest rates and gold. By closely examining historical data over the past 25 years, we uncover patterns that shed light on potential market movements and investment strategies.

Markets this week

Nifty 50 was extremely volatile this week starting around 22500 levels and closing around a shade below 21900 levels losing almost about 600 points in the process. Overall, Nifty is exactly back to where it was around the end of February 2024 which means that we have just about given up the gains of the last couple of weeks. We are seeing a red candle on the weekly timeframe after four consecutive strong green candles and one can certainly argue that a profit booking phase may a bad thing after all in the middle of a bull run. But during such up trends, you never know how quickly things can turn around.

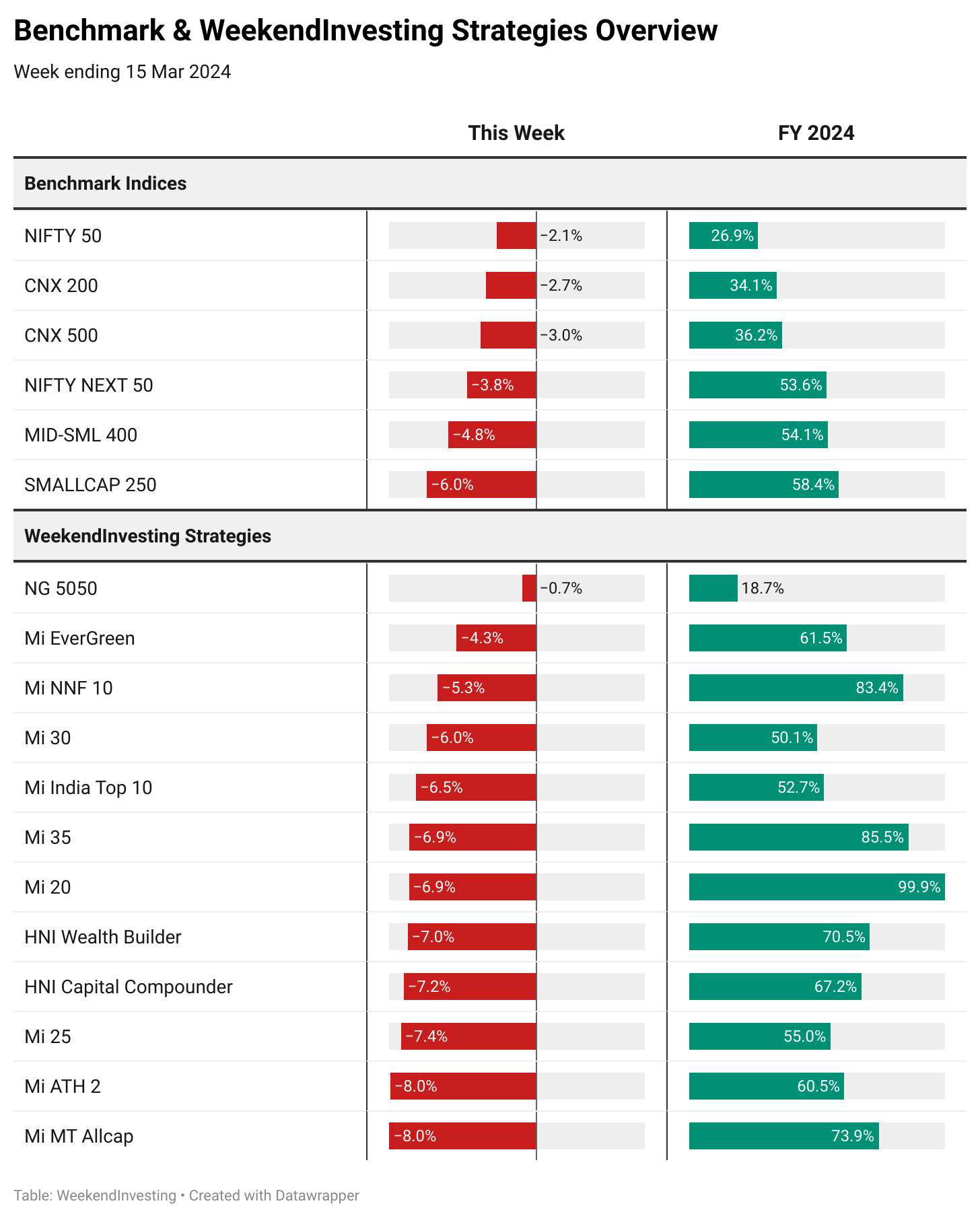

Benchmark Indices & WeekendInvesting Overview

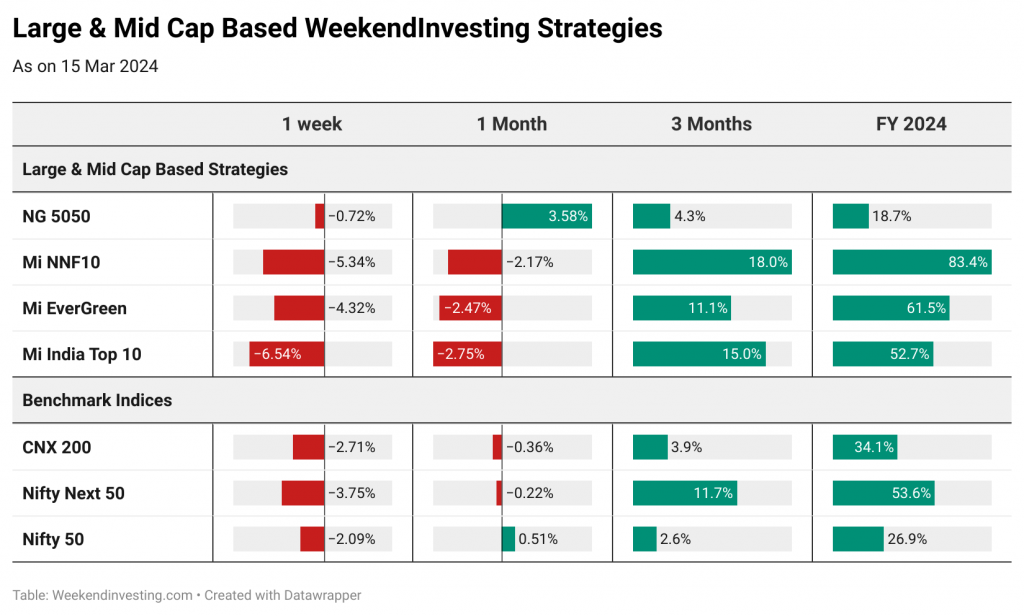

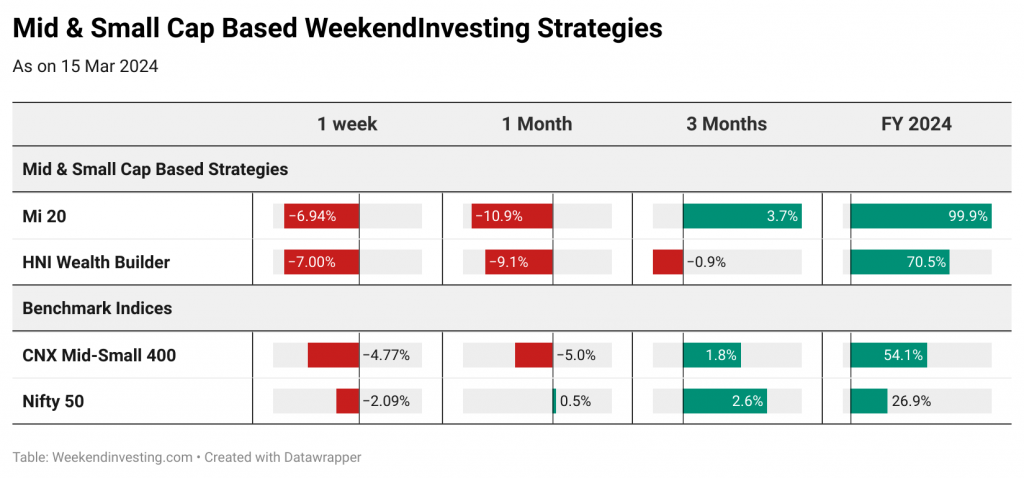

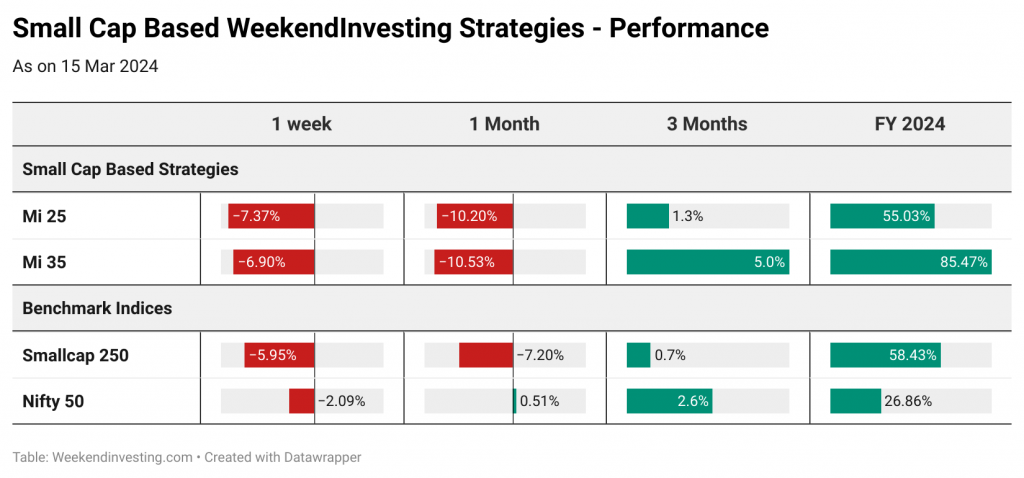

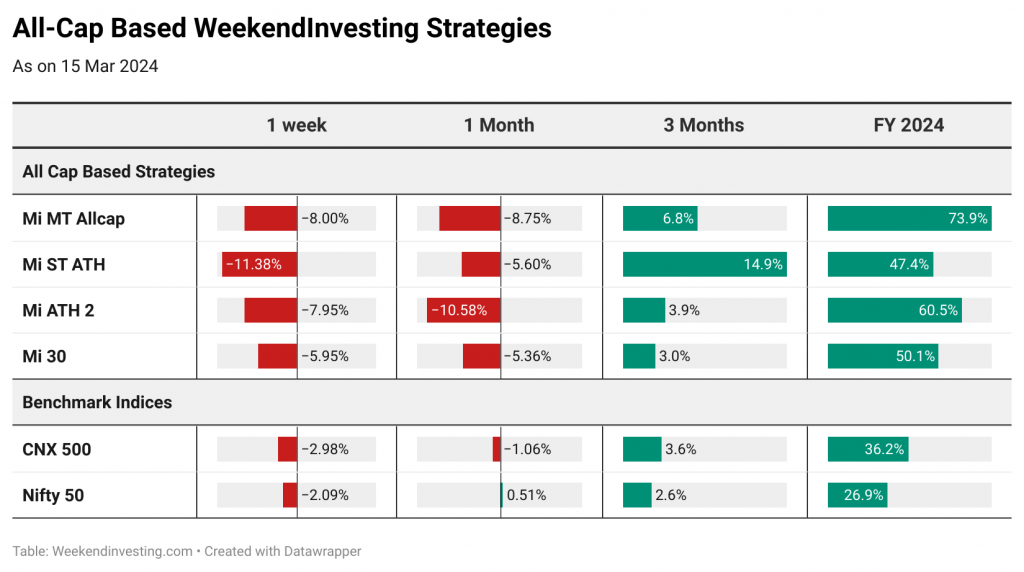

Nifty 50 lost 2% along with CNX 200 and CNX 500 losing in the range of 2.7% to 3% but there was a sharper fall occurring in mid caps and small caps with Mid-Small 400 index losing about 4.8% and Smallcap 250 index dropping about 6%. Despite this correction. FY 24 numbers look still in tact with a couple of weeks to go for the end of FY.

WeekendInvesting strategies had a dull outing this week with majority of the strategies losing between 6% and 7%. Despite this correction, the strategies still have great numbers to show as far as the FY 24 performance is concerned with Mi 20 a touch below 100%, Mi NNF 10 and Mi 35 around the mid 80s. The main point to note is the outperformance of all strategies compared to their respective benchmarks over the longer time frame that WeekendInvestors have been able to appreciate since the beginning. Having continuous – linear performance may not be the best outcome as far as the markets are concerned. So, some corrections / consolidations to remove weak hands is always par for the course.

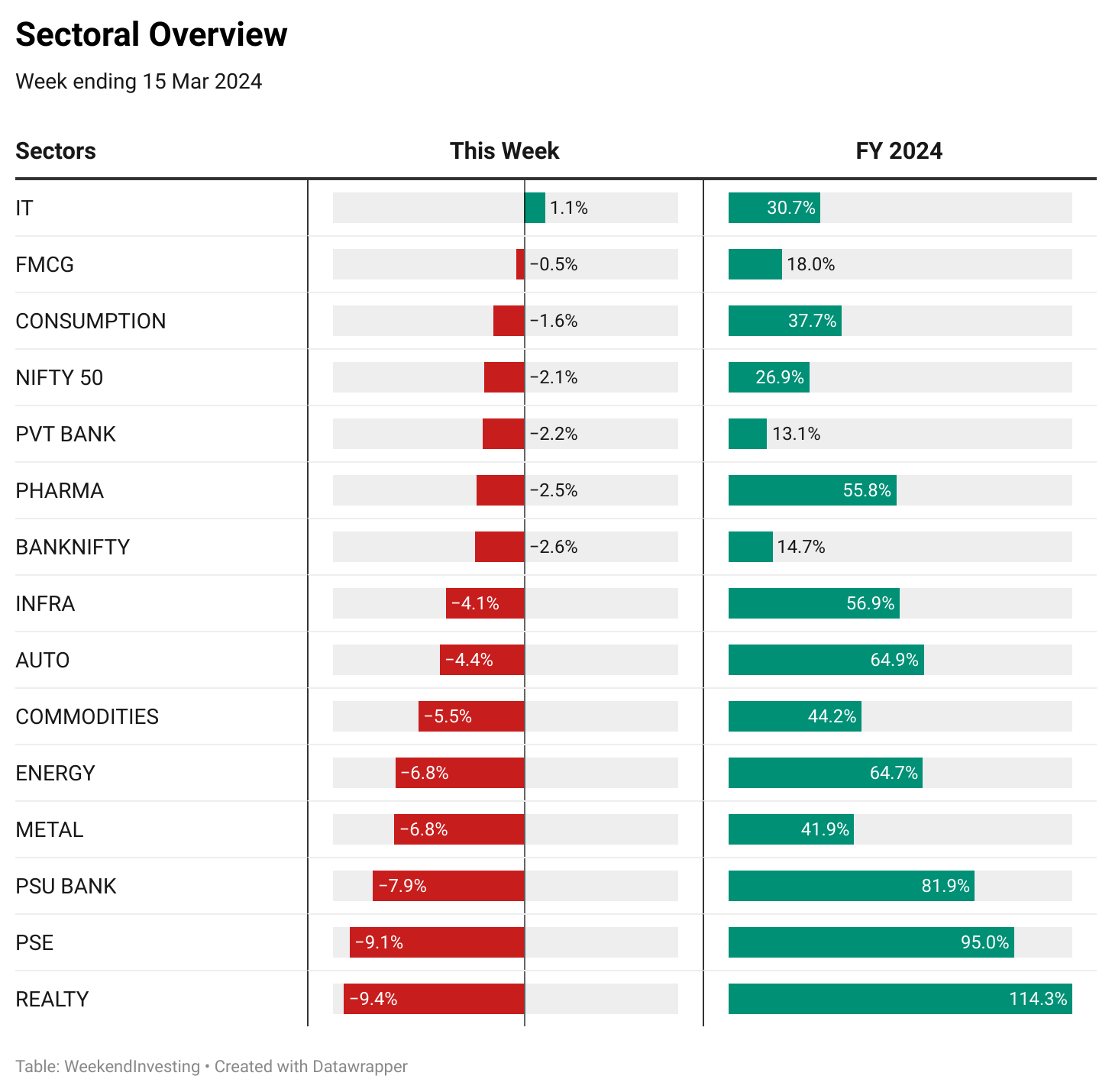

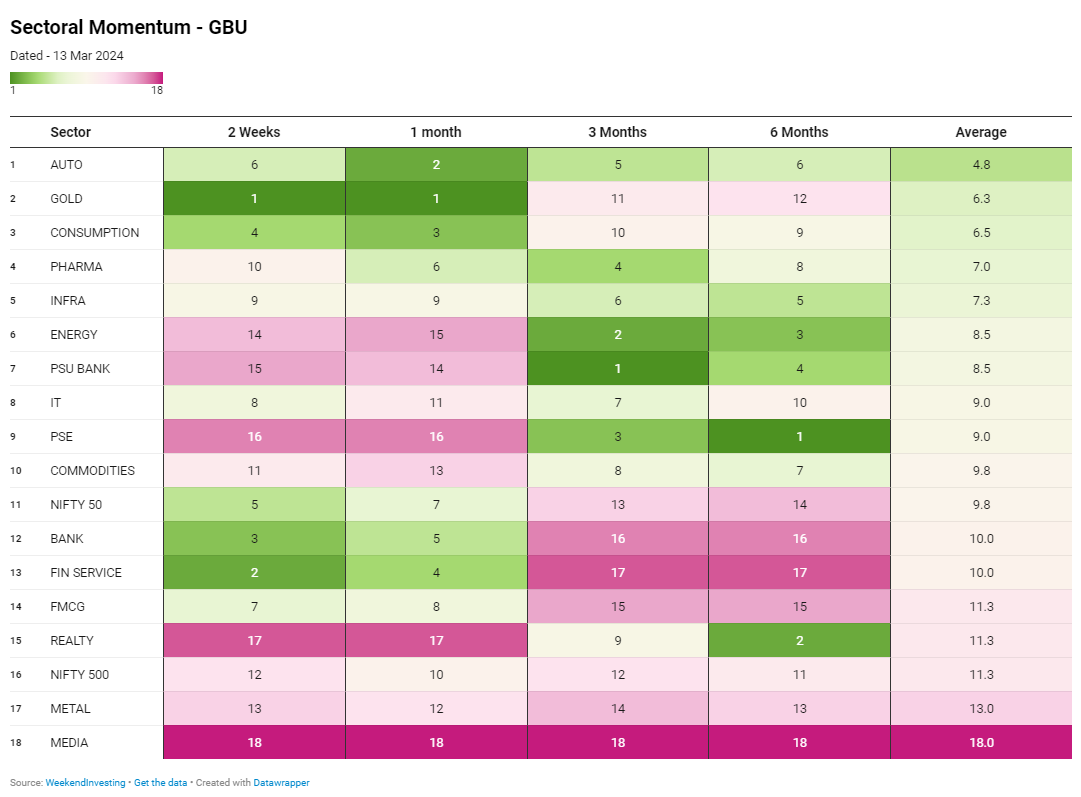

Sectoral Overview

BANKS, FMCG, PHARMA and IT did decent on a relative basis while sectors like REALTY, PSE, PSU BANKS, METALS, ENERGY, etc. took a beating or rather witnessed a bout of profit booking after their splendid performance in the recent times. IT has done quite well to recover and come back around its previous highs as GOLD seems to be making some noise too.

Complete change around of fortunes as AUTOs occupy the top spot on the momentum chart this week despite not being the best performer across any timeframe. The regular toppers of the recent past – REALTY, ENERGY, PSU BANKS & PSE have slipped to the absolute bottom owing to some fierce correction in the last couple of weeks. In the last 2 weeks, GOLD has come back roaring at #1 while BANKS are also quietly making a come back

WeekendInvesting Strategy Spotlight – HNI Capital Compounder

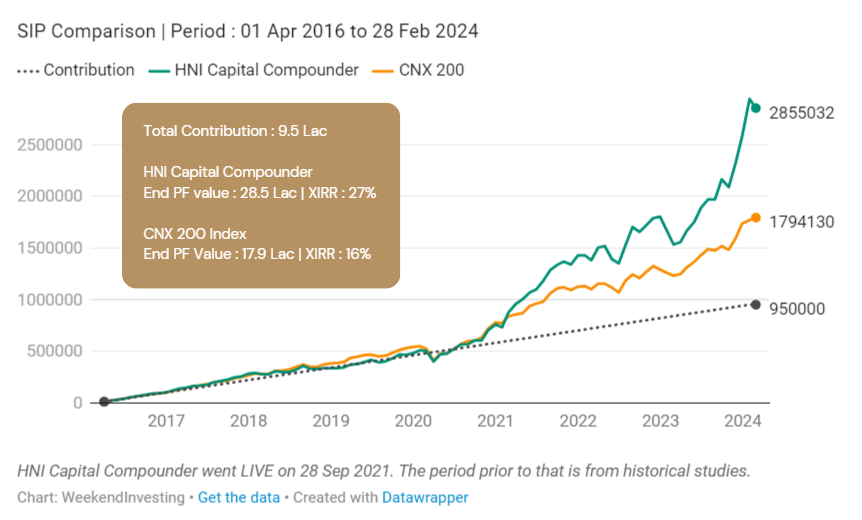

If you would have done a monthly SIP starting from Apr 2016 to Feb 2024, your total current portfolio value on the HNI Capital Compounder will be 28.5 lac (XIRR of 27%) compared to 17.9 lac on the CNX 200 index (XIRR of 16%).

SIP Returns Comparison

If you would have done a monthly SIP starting from Apr 2016 to Feb 2024, your total current portfolio value on the HNI Capital Compounder will be 28.5 lac (XIRR of 27%) compared to 17.9 lac on the CNX 200 index (XIRR of 16%).

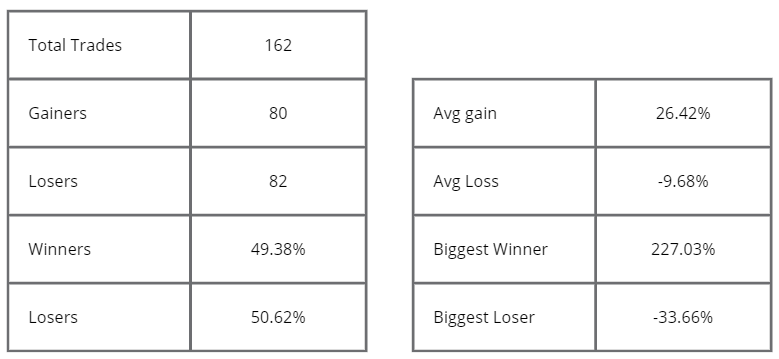

Win – Loss Metrics

Despite having equal number of winners and losers, HNI Capital Compounder’s ability to ride winners for long and dump losers early provides a solid edge against the benchmark. This is visible in the average gain / loss metric. Every winning stock gets you 26% on an average basis compared every losing stock that takes 9.6% away on average.

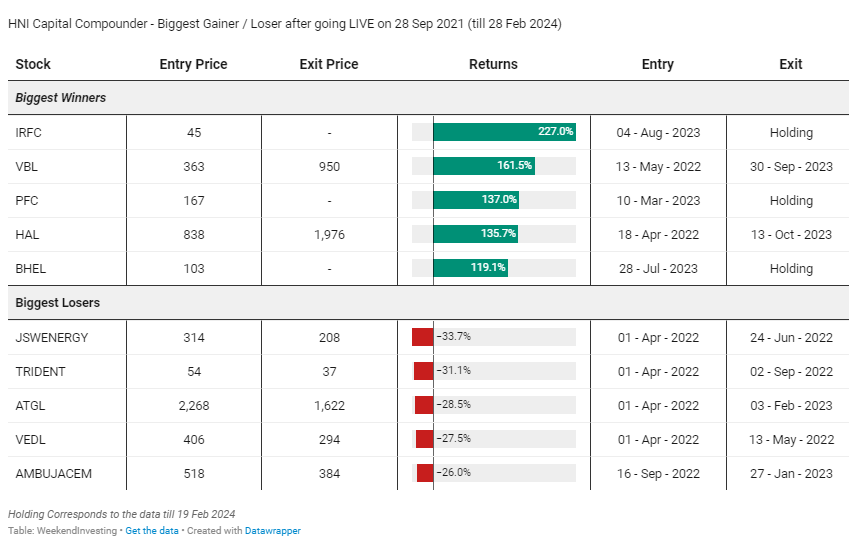

Top Gainers / Losers of HNI Capital Compounder

Check out the HNI Capital Compounder’s brochure

HNI Capital Compounder is launching on 17 March 2024 at 11 am. Please use the subscription link given below.

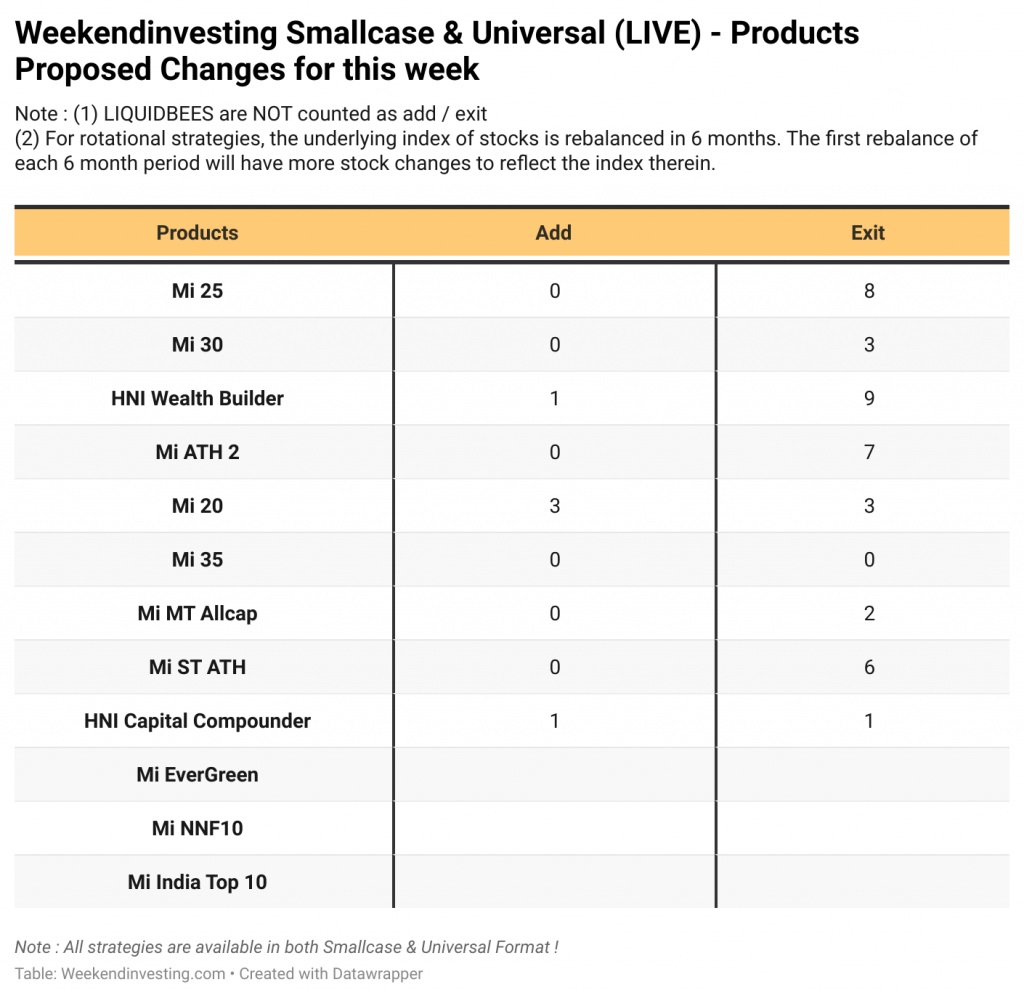

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report