A quick introduction to the Weekend Investing app, now available on Google Play and App Store. The app has been received with great enthusiasm, with over 5,000 users already joining. We encourage all weekend investors to download the app, as it provides numerous benefits and features that can enhance your investment experience.

By joining the app, you will receive immediate notifications for urgent messages from us. Additionally, all our content, including YouTube videos and Twitter posts, can be accessed in one place. This ensures that you stay up to date with relevant and valuable information. Moreover, the app allows you to interact with our team, ask questions, and provide feedback. It offers a seamless and convenient channel for communication between investors and our support team.

One of the key advantages of the app is access to exclusive educational content and strategies tailored specifically for weekend investors. We offer educational US strategies, trend analysis posts, market psychology insights, and much more. By leveraging these resources, you can enhance your investing knowledge and make informed decisions. Furthermore, the app provides opportunities for online and offline meetups exclusively for WeekendInvesting subscribers, allowing you to engage with fellow investors and expand your network.

A unique feature of the app is the ability to book a one-on-one call with the Weekend Investing team. This personalised support ensures that you receive prompt assistance and have your queries addressed directly. Additionally, a chat feature is available to provide immediate solutions to any questions or concerns you may have. The aim of the app is to facilitate seamless interaction and provide phenomenal support to all weekend investors and app users.

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our newsletters for this week.

From the Research Desk of WeekendInvesting

Support and resistance are key concepts in technical analysis that can provide valuable insights into market trends. In this article, we will explore a real-life example of support and resistance dynamics using the chart of Tata Investment.

As an investor, there are two crucial factors that greatly impact our success in the market – time horizon and drawdowns. These might seem like simple concepts, but it is important to truly understand and acknowledge their significance in order to achieve success in investing.

Building your own sectoral strategy

To begin, sectoral trends refer to the performance patterns of various industry sectors over a specific timeframe. By analysing these trends, you can gain insights into the sectors that are thriving and identify potential winners within them. This approach is based on the premise that the strongest sectors often produce the most successful stocks.

2024 can be a Challenging year

As investors, we often make assumptions about how the stock market may behave based on certain events or factors. One such factor is the Federal Reserve’s monetary policy and interest rate changes. It’s commonly believed that when the Fed cuts interest rates, the stock market will go up. However, a historical analysis conducted by 3Fourteen Research suggests thatthis may not always be the case.

Why Gold is breaking out in all currencies ?

The US dollar index is a significant indicator of the strength or weakness of the US dollar when compared to a basket of six other currencies. When the US dollar index moves up, it suggests that the dollar is gaining strength against other currencies. On the other hand, when the index moves down, it means that the dollar is weakening in comparison to other currencies.

Can you do what Mr Jhunjhunwala did ?

Titan, a renowned Indian consumer goods company, has witnessed an exceptional journey of success and wealth creation. Investing in Titan has been regarded as one of the biggest missed opportunities of a lifetime. However, this success story is not without its challenges and risks. In this article, I will delve into the remarkable trajectory of Titan Company’s stock and the lessons it offers to investors.

As an investor, the concept of a market crash can be terrifying. The thought of your carefully curated portfolio plummeting in value can be overwhelming. We’ve all witnessed the COVID crash, where the Nifty went from 12,400 to 7,500 within a short span of time. However, it’s important to understand that market crashes are not uncommon and have occurred throughout history.

In this article, we will delve into the fascinating interplay between market probabilities and financial forecasts and explore the concept of the tail wagging the dog.

Can this be the decade of commodities ?

The commodities-to-equity ratio measures the relative valuation between commodity prices and equity market performance. By studying the historical trends and potential future implications of this ratio, investors can gain valuable insights into market dynamics.

7 Lessons for a Wealthy future

Many people dream of achieving financial independence and living a life of abundance. However, not everyone realises that the path to wealth is not as elusive as it seems. In fact, there are seven critical lessons that can help anyone create wealth over time. These lessons are derived from the popular book “The Millionaire Next Door” and have been compiled into an informative infographic by Compounding Quality

Markets this week

Nifty remained relatively flat throughout the week, with no significant movement observed over the past four sessions. However, it is worth noting that the index has not experienced any major declines either. Despite a few days of FII selling, the index is holding strong and is approaching its all-time high close. This indicates a positive and strong chart, suggesting that we may challenge the previous all-time high in the coming weeks.

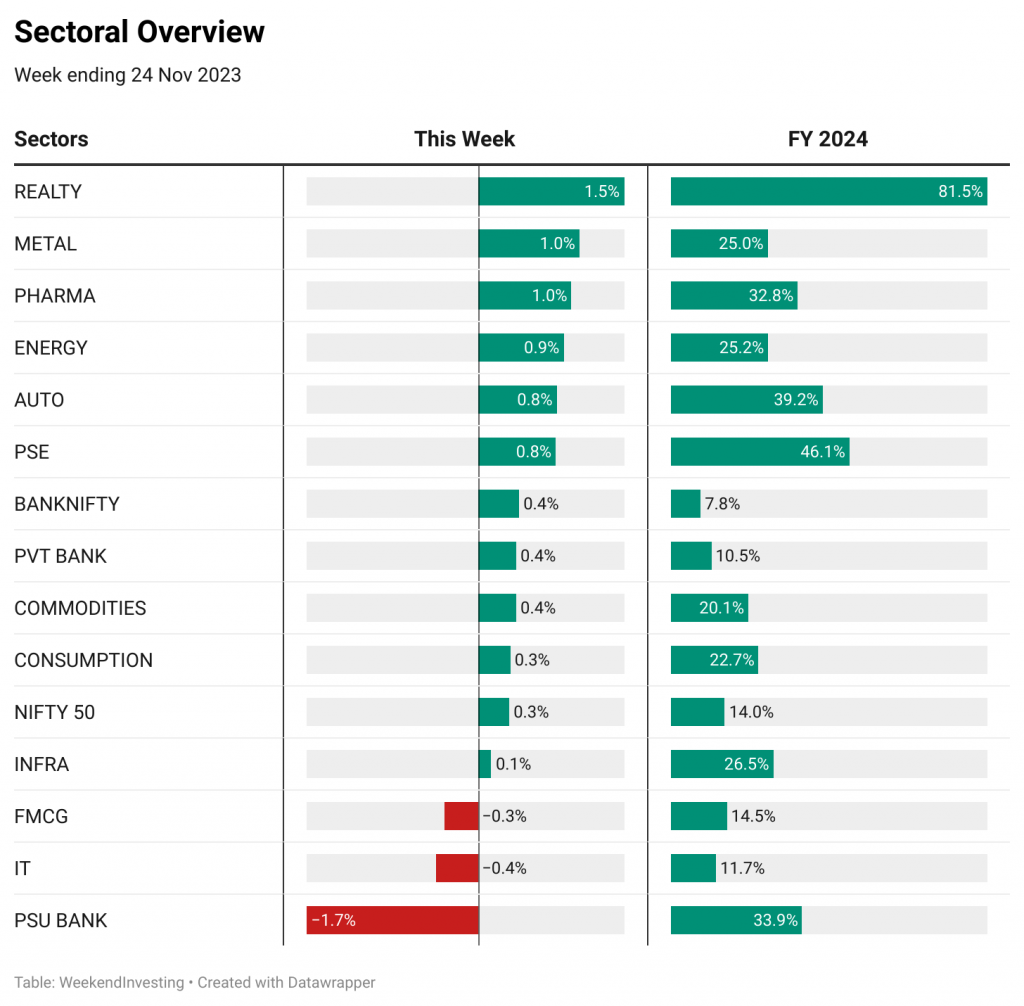

Sectoral Overview

Real estate continues to perform exceptionally well. As we know, real estate cycles run for a long time and with great intensity. In the current financial year, the Real Estate index has surged by a staggering 81.5% in just eight months. Additionally, metals and pharma sectors have also shown positive performance, with gains of 1% and 1.5% in the current week respectively. Energy, autos, and public sector enterprises have experienced marginal increases as well. On the other hand, FMCG and PSU banks have seen a decline of 0.3% and 1.7%, respectively on a previous week basis.

Looking at the sectoral momentum table, we can observe that certain sectors are gaining traction while others are losing favor. Autos and consumption stocks have seen a sudden rise in momentum. Simultaneously, public sector enterprise stocks have started to lose popularity. Gold is making a comeback, while pharma remains in the top five or six sectors in terms of momentum. However, real estate continues to dominate as the top-performing sector.

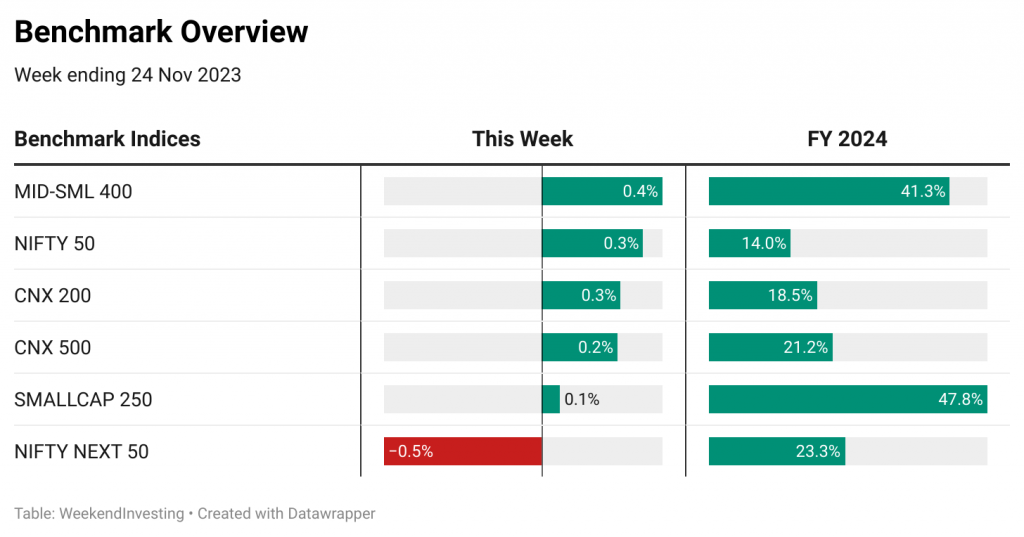

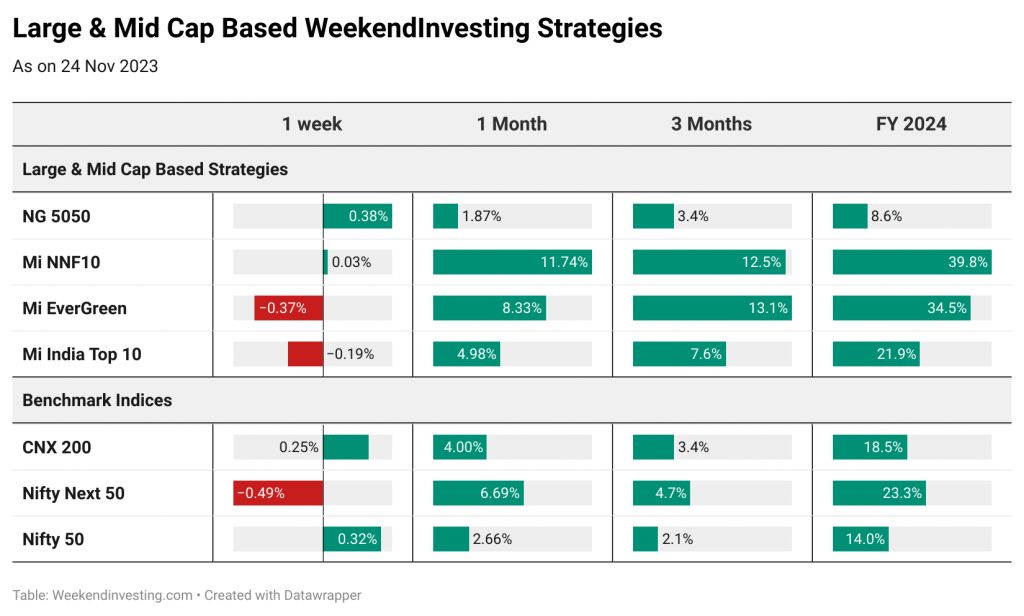

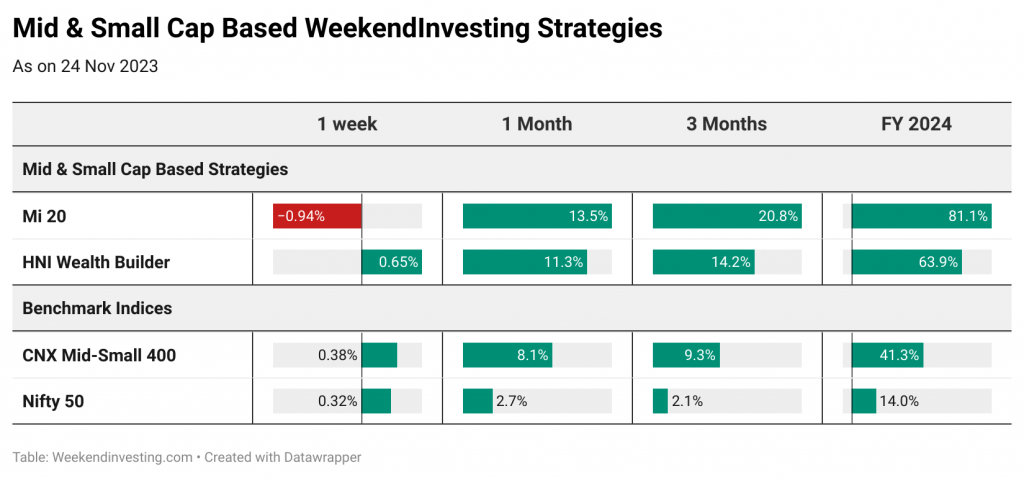

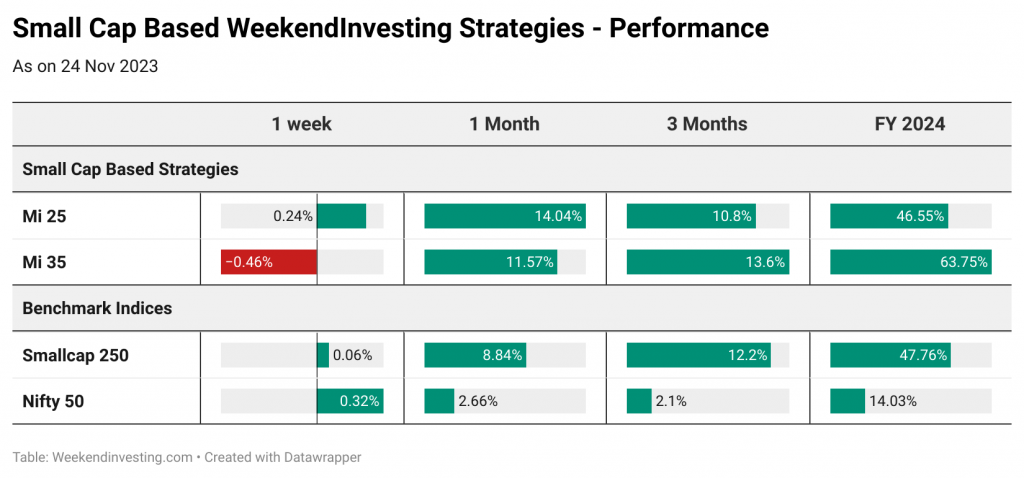

Benchmark Indices Overview

In terms of benchmark indices, the mid and small-cap 400 index saw a marginal gain of 0.4% this week. Nifty 50, CNX 200 and CNX 500 indices all witnessed a 0.3% and 0.2% increase, respectively. Meanwhile, the Nifty Next 50 index experienced the biggest loss of -0.5%. Among these indices, the small-cap 250 index performed the best, showing a significant gain of 47.8% in the financial year. Mid and small-cap indices demonstrated robust performances, with gains of 41.3% and 47.8%, respectively, for the financial year.

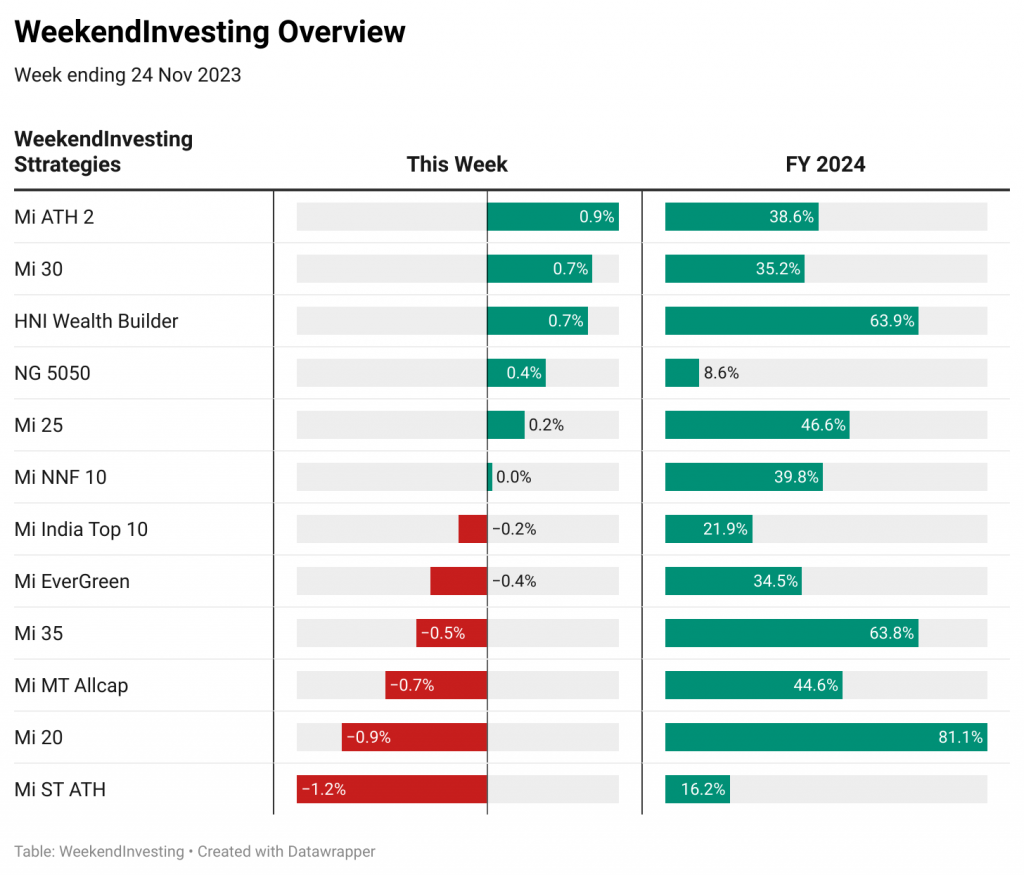

WeekendInvesting Overview

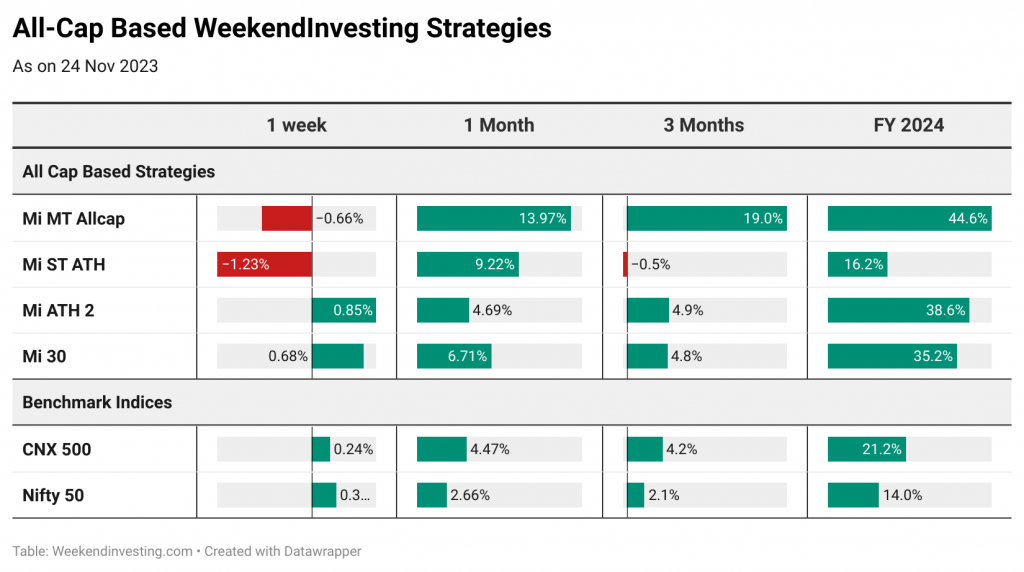

Some of the WeekendInvesting strategies did decently to stay in line with their respective benchmarks while the rest marginally underperformed. Mi 20 continues to remain robust with an exceptional 81% gains in the current FY 2024 followed by HNI Wealth Builder & Mi 35 at 63% gains each. It has been a remarkable year so far for almost all strategies barring Mi ST ATH which has lagged a bit.

SPOTLIGHT – Mi MT Allcap completes 5 glorious years of great performance

Mi MT Allcap has successfully completed 5 glorious years of exceptional performance in the markets !

Let’s take a journey through the last five years and see how the strategy has performed in different phases.

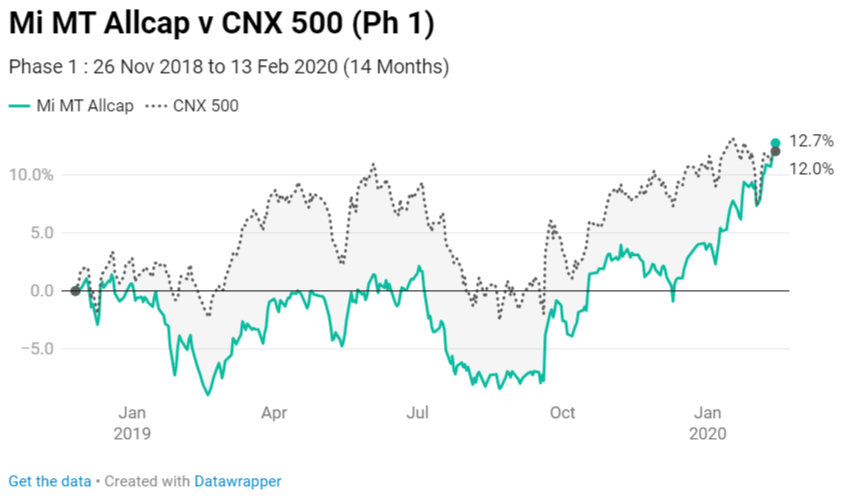

Phase 1: November 2018 – February 2020

In the initial phase, Mi MT Allcap underperformed for a brief period but made a strong comeback towards the end. Overall, it managed to largely meet the benchmark, achieving a return of 12% in this 14-month period.

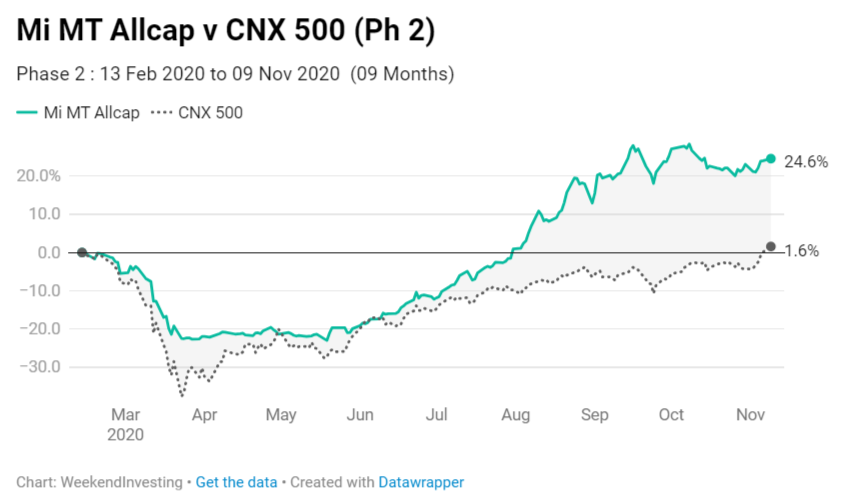

Phase 2: February 2020 – November 2020

This phase was marked by the COVID-19 pandemic, which caused a significant market correction. Mi MT Allcap, however, corrected much less than the underlying benchmark due to its dynamic cash allocation strategy. As the market recovered post-May 2020, the strategy outperformed the benchmark with an impressive return of 24.6% compared to just 1% by the benchmark.

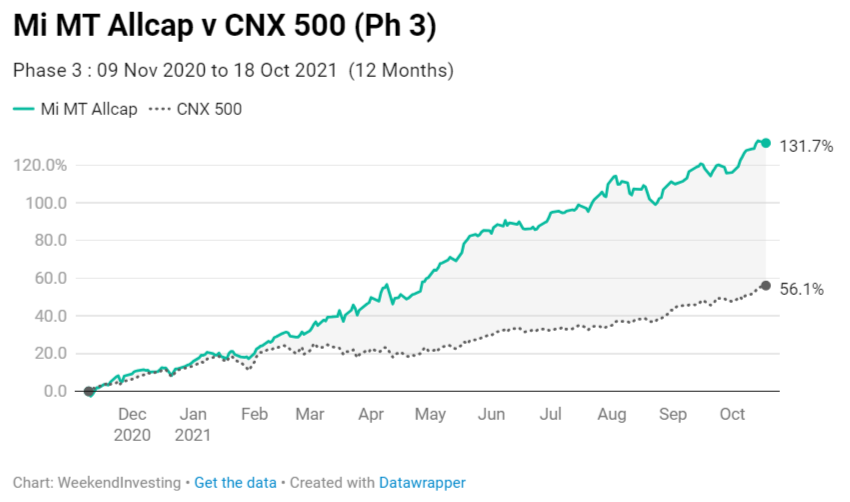

Phase 3: November 2020 – October 2021

This phase witnessed rapid market growth, and the strategy truly shined. The strategy achieved a remarkable return of 131% compared to the benchmark’s 56%. The pace at which it performed during this period was exceptional.

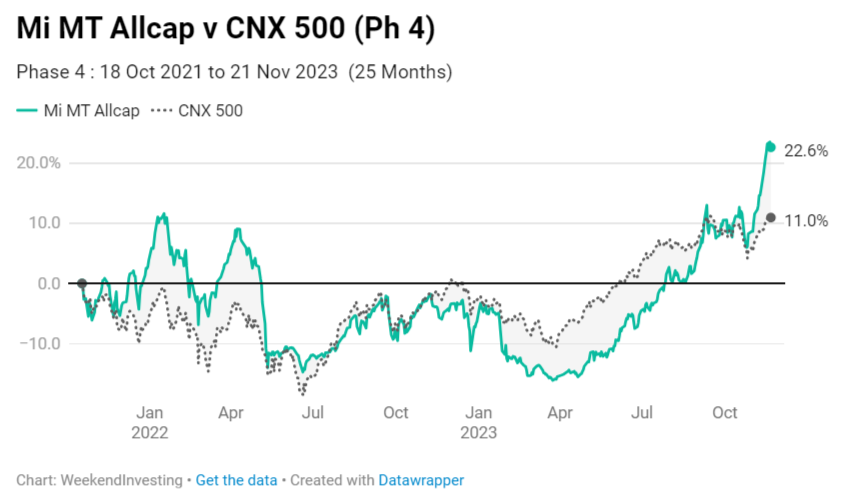

Phase 4: October 2021 – Nov 2023

Currently, we are in a consolidation phase, and while the strategy has performed well, it has not done exceptionally well so far primarily due to the lack of sustained uptrends. The phase is closing at a return of 22% compared to the benchmark’s 11%.

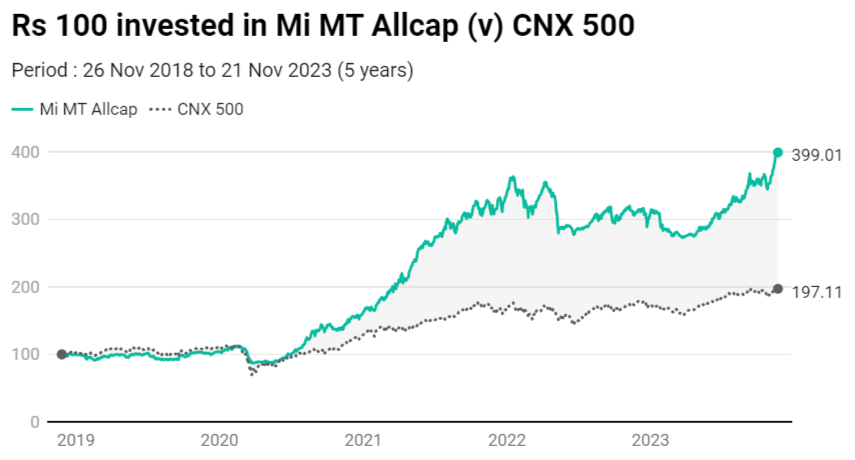

Looking at the overall five-year performance, it is evident that there were phases where Mi MT Allcap performed in line with the market, phases where it outperformed even during market downturns, phases of rapid outperformance, and phases of market-matching returns.

However, the power of compounding over time has resulted in impressive overall returns. If someone had invested ₹100, their investment would now be almost at ₹400 (4x gains), compared to the benchmark’s ₹197 (2x gains). This is a substantial beat over a five-year period.

Special Anniversary Offer

Use code ALLCAP25 to avail a flat 25% discount on your annual subscription of the Mi MT Allcap

Note : Valid only till end of 26th Nov 2023 (Sunday)

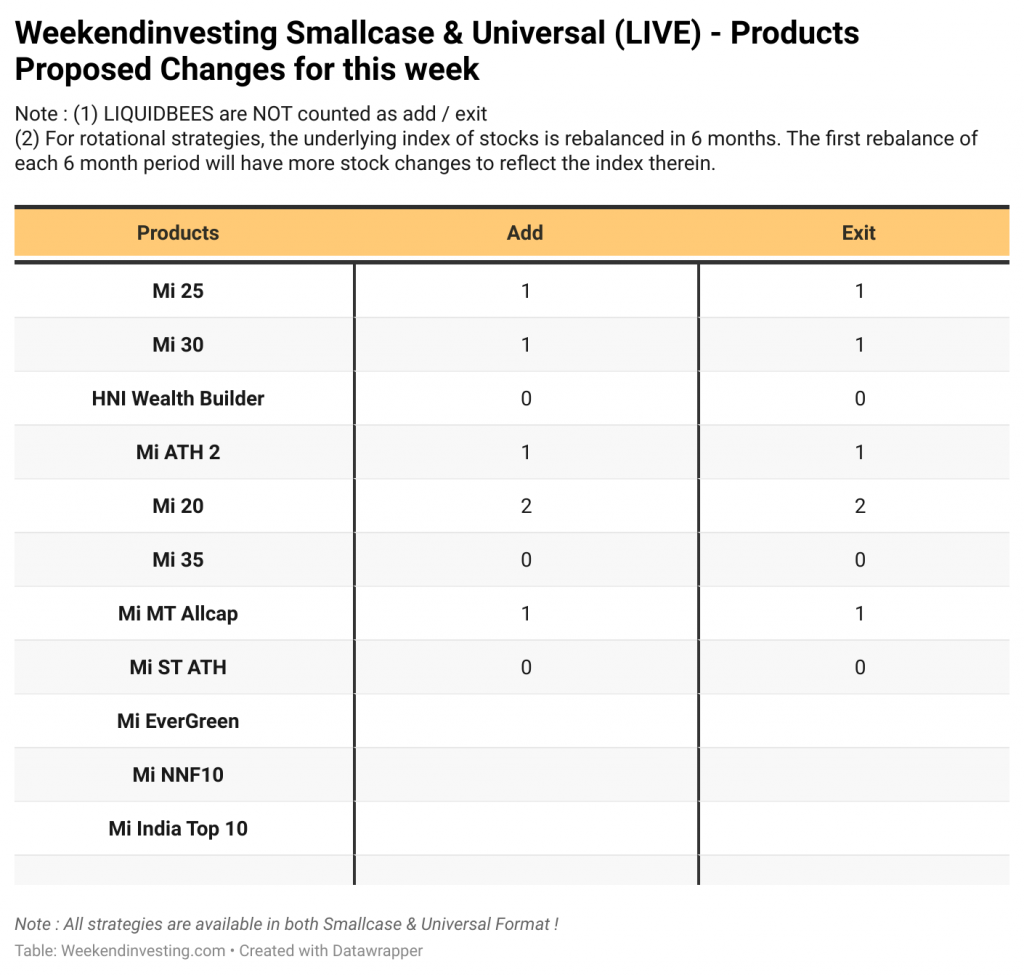

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s edition !