- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Have you ever found yourself stuck in a stock that just won’t budge? Perhaps you’re invested in a company with stellar prospects, yet the share price remains stagnant year after year. It’s a frustrating situation that many investors face, but it doesn’t have to be this way.

In the ever-evolving world of global markets, understanding the dynamics of market capitalization is crucial for investors seeking to make informed decisions. A recent report from Goldman Sachs offers valuable insights into the distribution of global market cap across different regions. The data reveals a striking dominance of . . . .

Here’s a captivating chart showcasing the illustrious journey of the Nifty 50 index over the past three decades. Spanning from 1990 to the present day, this logarithmic chart provides invaluable insights into the market trends that have shaped India’s financial landscape. Through minor fluctuations and . . . .

In a recent analysis by Tavi Costa from Crescat Capital, an intriguing observation sheds light on a significant shift in the global monetary system. The comparison between the gold price (depicted by the white line) and treasury prices (illustrated by the red line) unveils a . . . .

Don’t do rear view mirror driving

In an unexpected turn of events, Dell has outperformed Apple over the past five years in terms of stock performance. This scenario challenges the conventional belief that past success guarantees future performance, highlighting the importance of tracking momentum and being open to lesser-known stocks.

The Unitech chart spanning the last 25 years serves as a powerful reminder of the unpredictable nature of the stock market. It illustrates how stocks can experience . . . .

Has US done better than India?

The chart comparing Sensex to the S&P 500 over 45 years sheds light on a common misconception in the market. Many believe that the Indian market hasn’t performed as well as its US counterpart, leading to assumptions that investing in marquee US stocks like Google, Apple, or Amazon would have been more lucrative. However, a closer examination reveals . . . .

The rise and fall of Tesla stock serve as a prime example of market volatility and the risks associated with investment trends. In 2021, Tesla experienced a meteoric rise, soaring from around $20 to a staggering $421, representing a twenty-onefold increase. However, as the excitement waned, the stock began to normalize, leaving many investors in a loss.

Markets this week

Nifty 50 has been flat and also a bit volatile this week. As we can observe from the chart, the benchmark did make a couple of highs with the latest ATH at 22775, but there was a stiff test every time a new high high was established thus confirming the lack of continuity in the up trend. The low created on 09th of Apr was an important support zone which seems to have been comfortably broken by a sharp selling that occurred on the last session of the week. Going forward, we will monitor 22300 as the next support level while the latest ATH will serve as the immediate resistance.

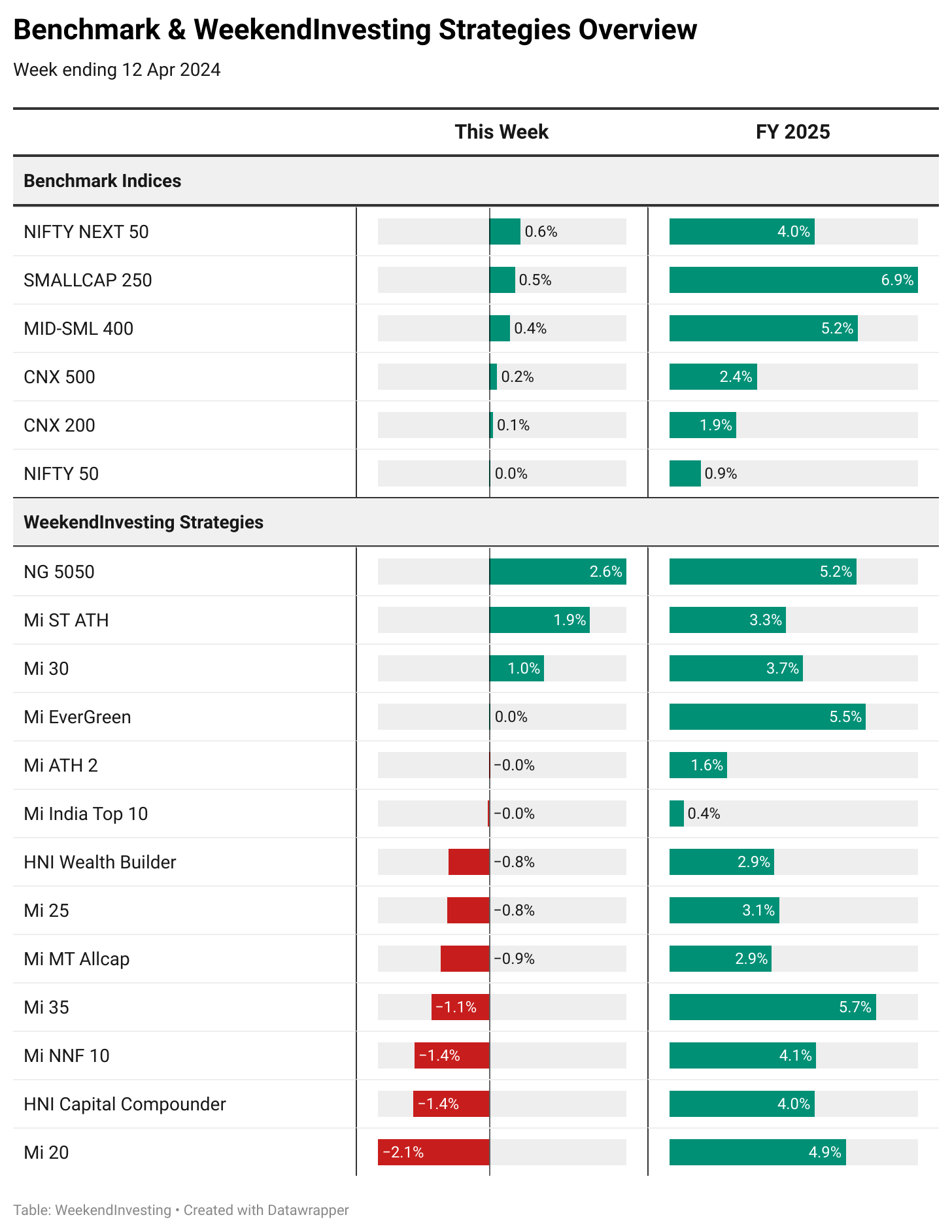

Benchmark Indices & WeekendInvesting Overview

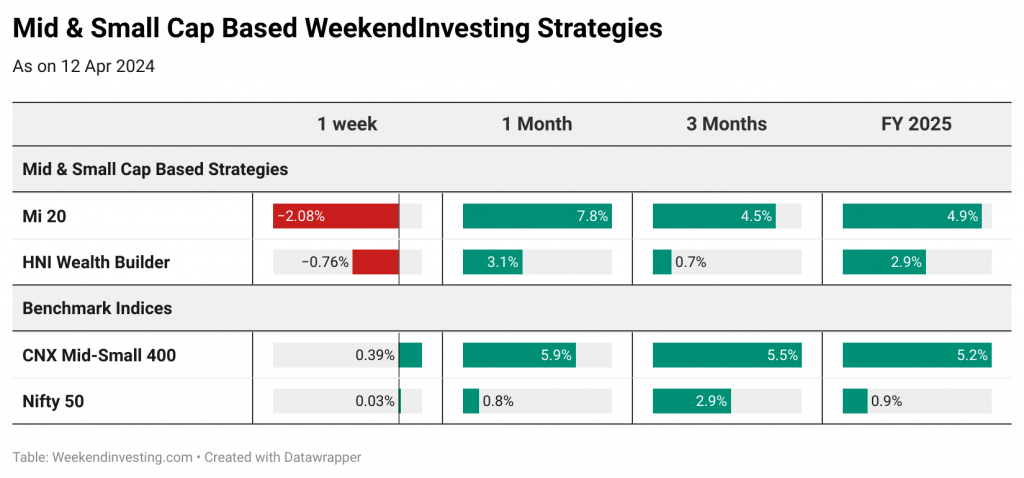

Markets were quite muted this week barring some of the lower cap segments which did well. Nifty Jnr, though, has been splendid with gains of 0.6% this week followed by Smallcap 250 and Mid-Small 400 at around 0.5% gains each. As far as FY 25 performance is concerned, Smallcap 250 index has taken a very strong lead at 6.9% but we will have to wait and watch how things go as we near elections, the global narrative on cut in interest rates and few more events that could play a crucial role in determining the course of action.

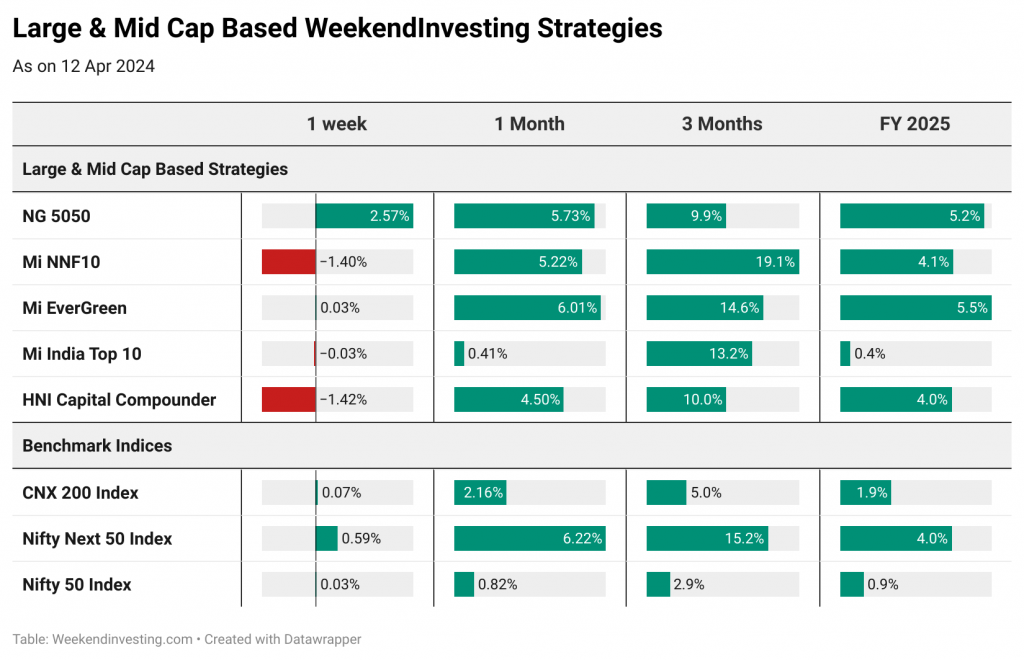

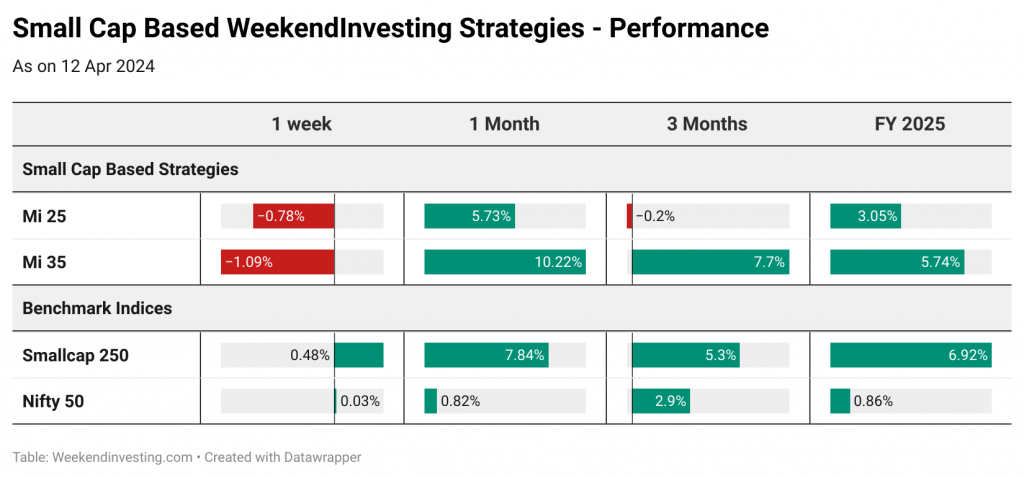

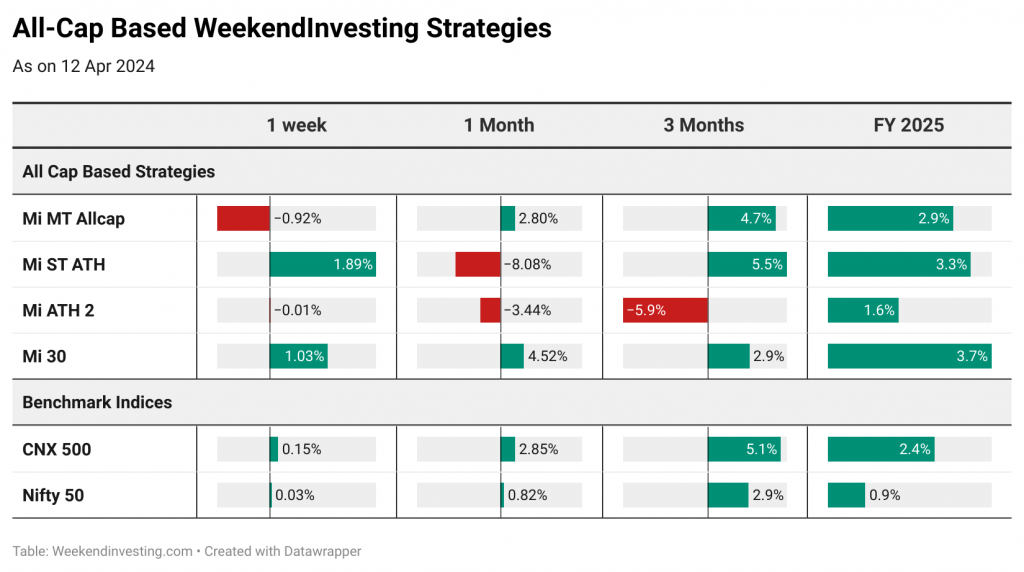

NG 5050 topped this week’s chart clocking 2.6% riding on Gold’s solid performance followed by Mi ST ATH at 1.9%. Mi 30 also did well to return about 1% but a few strategies returned flattish results and some other had a difficult turnaround in this difficult and volatile week. In the first two weeks of this FY, Mi 35, Mi EverGreen and NG 5050 have taken a strong lead clocking in excess of 5%.

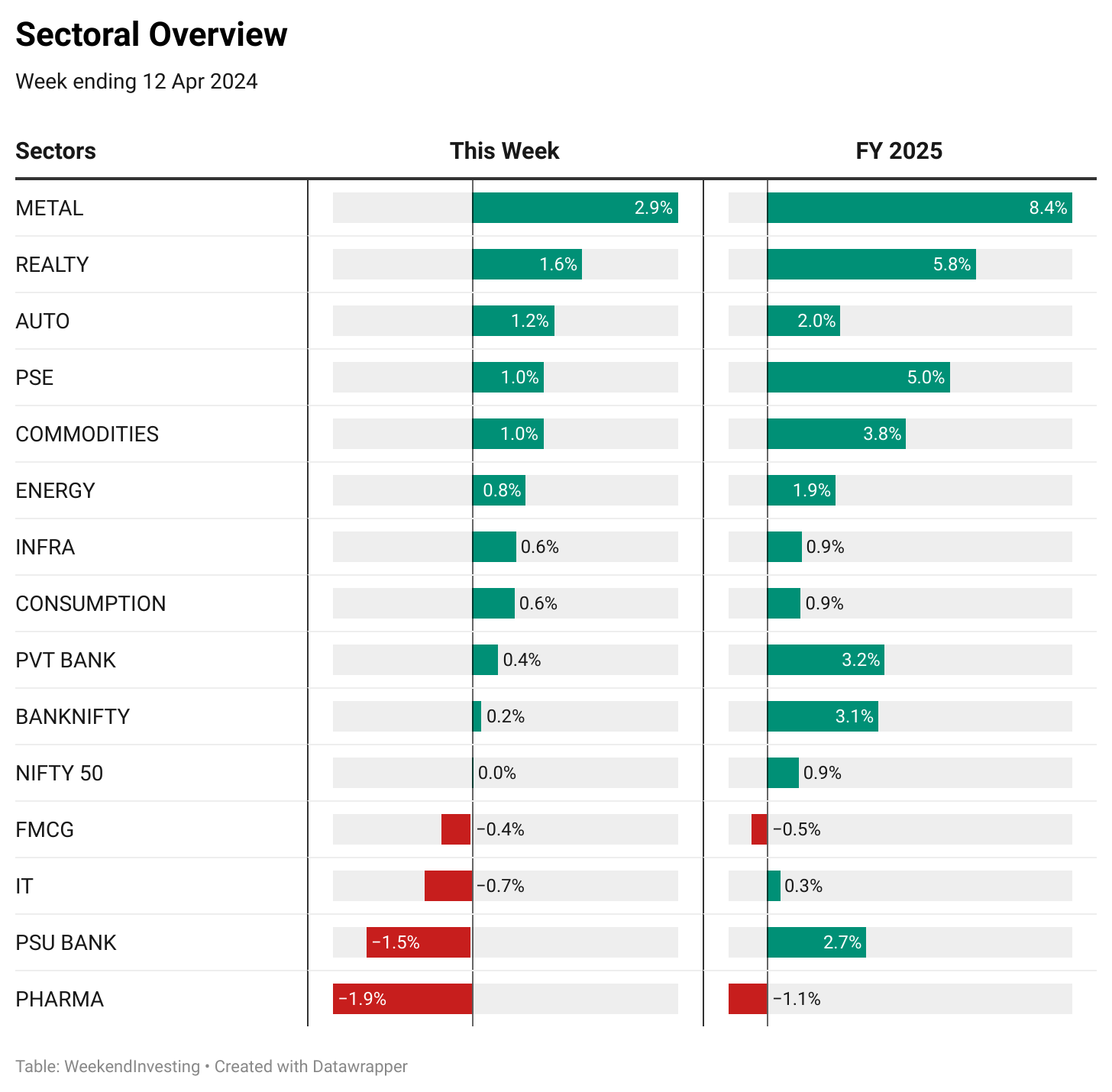

Sectoral Overview

METALS have continued to perform really well returning a superb 2.9% this week followed by REALTY and AUTO at 1.6% and 1.2% respectively. PSE, COMMODITIES and ENERGY stocks did well to return about a percent each while the others remained muted or in the mildly negative territory.

METALS have been in a very strong momentum clocking a superb 8.4% in the first two weeks of FY 25 while REALTY which has done a very good recovery job to come back strong at 5.8% this FY 25. PSE’s have done well too to return about 5% in FY 25.

METALS continue to do well to secure the top position in the sectoral momentum ranking chart. Despite not being the best performers in the 3 & 6 month charts, METALS have occupied the top position due to their splendid performance in the past couple of weeks and the past month. REALTY have come back strong after a minor profit booking round to occupy the second spot as PSE’s take in the 3rd position after s string of consistent performances. The spotlight is on GOLD though which has performed extremely well in the last month as markets navigated through a little bit of volatility. PSU BANKS seem to have slipped down a little bit relatively while there seems to be no change of fortune for IT, FMCG and MEDIA which continue to languish at the bottom.

WeekendInvesting Strategy Spotlight

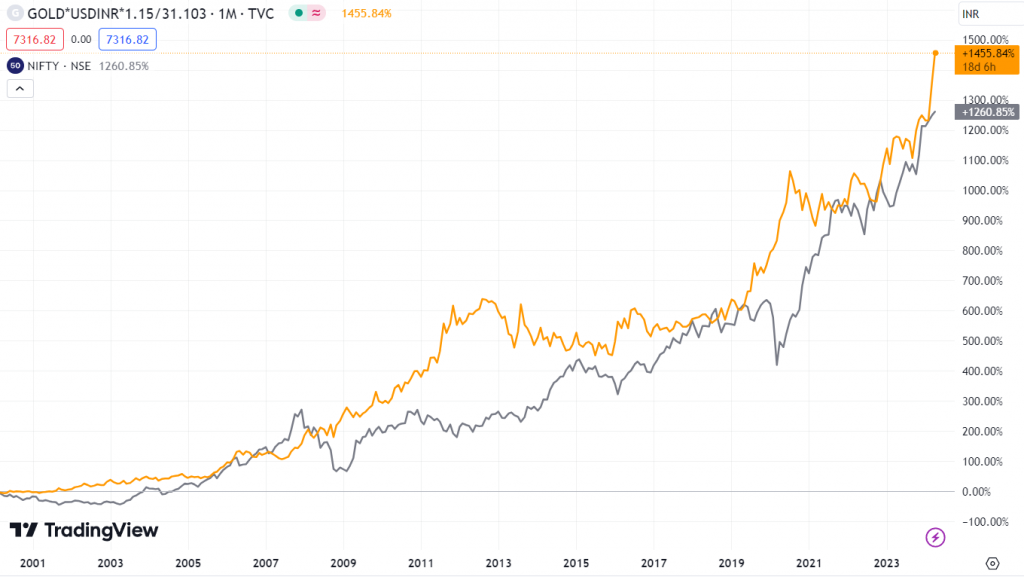

Time for GOLD to take off ?

Gold has been playing a very critical role in offering remarkable stability every time there has been a scare in the economy or the markets. In the recent times, GOLD has outperformed the Nifty 50 by a significant margin as we navigate through a volatile phase. Since late Jan 2024, GOLD has clocked a superb 16% while Nifty 50 has remained flat at under 2% gains.

We have compiled three important charts showcasing how GOLD would’ve offered stability had you held this precious metal (in any format) right before a major crash.

Chart 1 – Pre COVID Top

It may be surprising to note that both equities and GOLD may have the same performance if you measured right before the COVID crash. Allocation to GOLD would have ensured that your portfolio remains a bit more stable during this tough phase.

Chart 2 – Pre GFC Crisis Top

Pre GFC crash, GOLD has a strong lead against Nifty 50 with a resounding 503% gains compared to only 266% on Nifty 50

Chart 3 – Pre Dotcom crash Top

GOLD has yet again outperformed Nifty clocking 1455% compared to 1260% since pre dotcom crash top.

Check out Mi EverGreen

Mi EverGreen is a remarkable combination of top 200 stocks (75% allocation) and the goodness of GOLD (25% allocation).

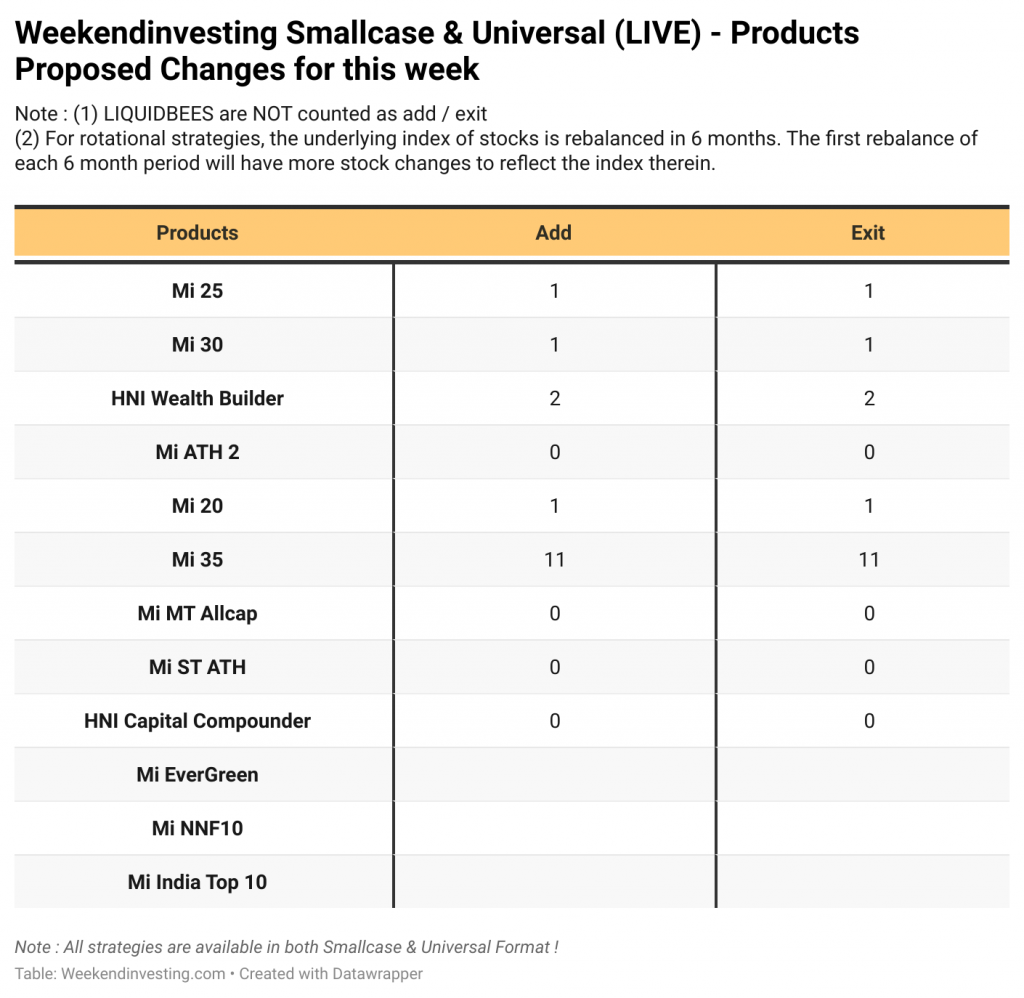

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.