- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

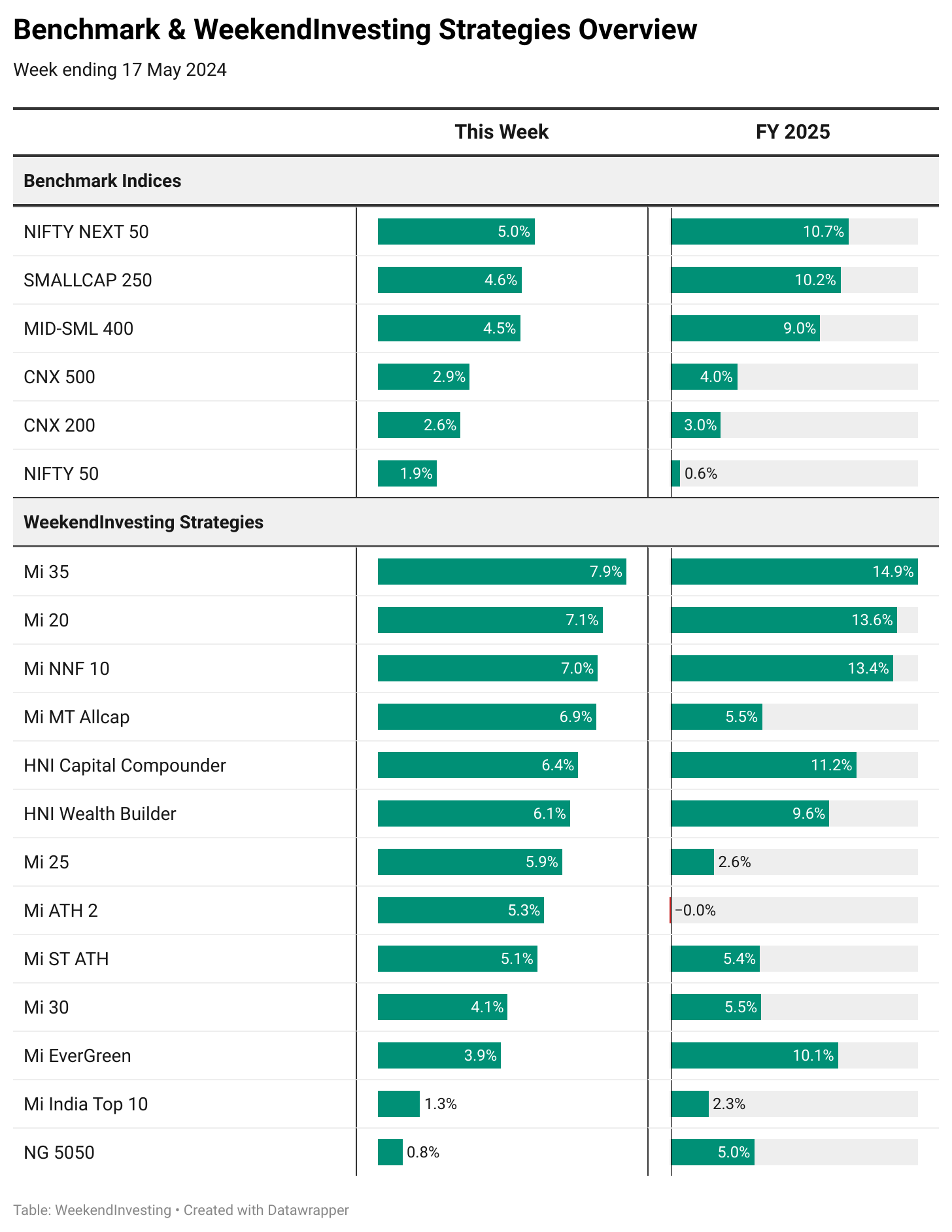

- Benchmark Indices & WeekendInvesting Overview

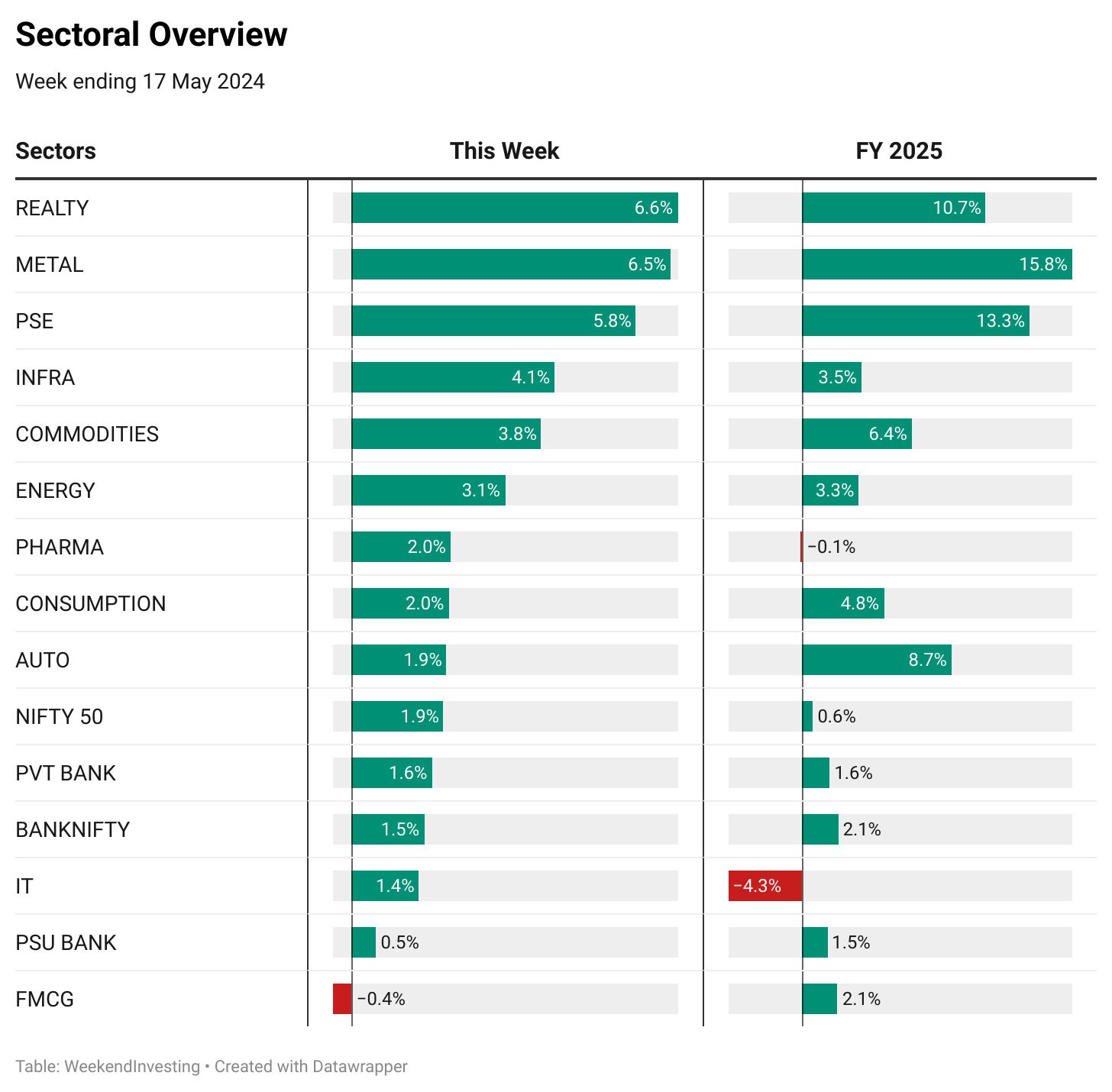

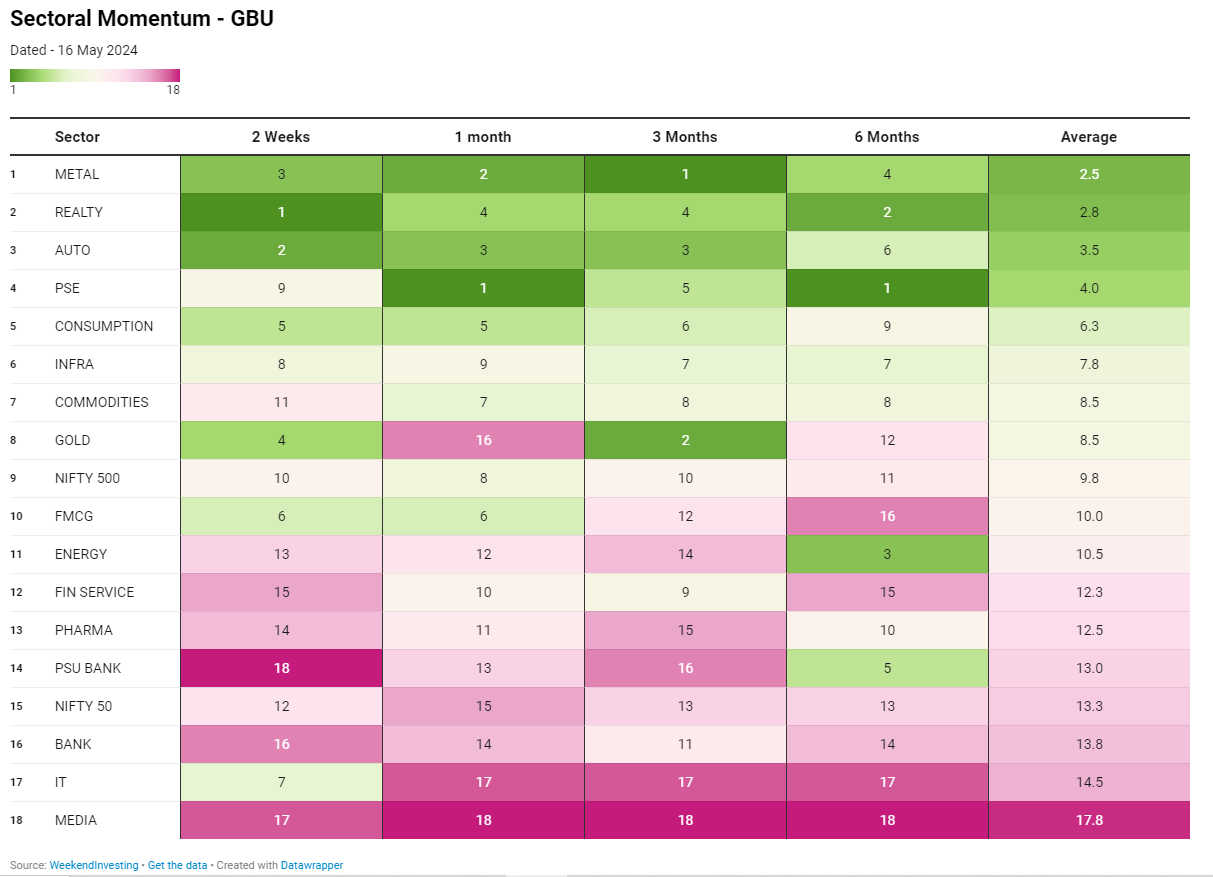

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Should you sell in May and go away ?

The adage “sell in May and go away” has been circulating for decades, suggesting that investors should exit the market in May and return later. However, recent data from Bloomberg challenges this notion. Over the past decade, the S&P 500 has been . . . .

Implications of a stable currency

One of the most intriguing developments in the current year, is the remarkable stability of the USD INR exchange rate. Unlike many other currencies that have experienced fluctuations, the USD INR remains . . . .

In recent times, there’s been a surge in equity options trading, as highlighted by data from FIA. The volume of options traded in India has seen a remarkable uptick, surpassing that of the . . . .

Visual Capitalist recently shared an intriguing chart projecting the global economy’s landscape by the year 2050. It’s a fascinating insight into what the world might look like in just 26 years. For those of us who are relatively young . . . .

FII don’t call the shots anymore

One fascinating trend observed in the financial markets, highlighted by amcharts and shared by Piyush Chaudhary, is the contrasting behaviors of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). Over the years, their trading activities have consistently been . . . .

The age-old debate of whether to rent or buy in real estate continues to baffle many. But recent statistics shed light on a compelling argument, especially for those hesitant to invest in property. Despite your stance on real estate as an investment, owning your . . . .

Stocks can keep you waiting for long !

Quality names often attract attention. However, recent data suggests that some of these esteemed stocks may not be delivering the expected returns. According to a list shared by Gurjot Ahluwalia on Twitter, several quality stocks have failed to outperform bank fixed deposits (FDs) . . . .

Gold is in a multi year Bull Run

In a recent article discussing the potential of gold on Gainesville Coins, compelling arguments have been presented for why gold may be poised for significant growth in the coming years. The article discusses historical data, particularly focusing on . . . .

Many people often hear that a stock is attractive because it’s cheap, or that it should not be bought because it is expensive. This is often about high-quality stocks. But there are other options. A stock might not be of the best quality but still have a good price. Similarly, a good stock might be overpriced, or a bad stock might be undervalued. It’s essential to remember that . . . .

Rising SIPs: Opportunity or Threat

As of April 2024, the contribution of Systematic Investment Plans (SIPs) in the market has seen significant growth. SIPs have increased from nearly 8,500 crores in April 2021 to about 20,000 crores per month in April 2024. This remarkable growth, almost tripling in three years, was not observed in the three or six years prior to April 2021. This surge indicates . . . .

Markets this week

This week, Nifty made a notable comeback from its previous fall. The low was hit on Monday the 13th, followed by a recovery throughout the week. On the 16th, there was a sharp decline followed by a significant upward move by the end of the day. Friday’s trading was more stable. Overall, the week ended on a positive note, with Nifty closing near all-time highs.

For the past two and a half months, Nifty has fluctuated within the 21,700 to 22,400 range. Despite concerns from the first four phases of polling suggesting that the combined entity might secure fewer than 400 seats, the market remains optimistic. Even if the BJP alone achieves a clear majority, the current market trajectory is expected to continue. The market seems to anticipate a favorable election outcome, reflecting this in the pricing and overall sentiment.

Benchmark Indices & WeekendInvesting Overview

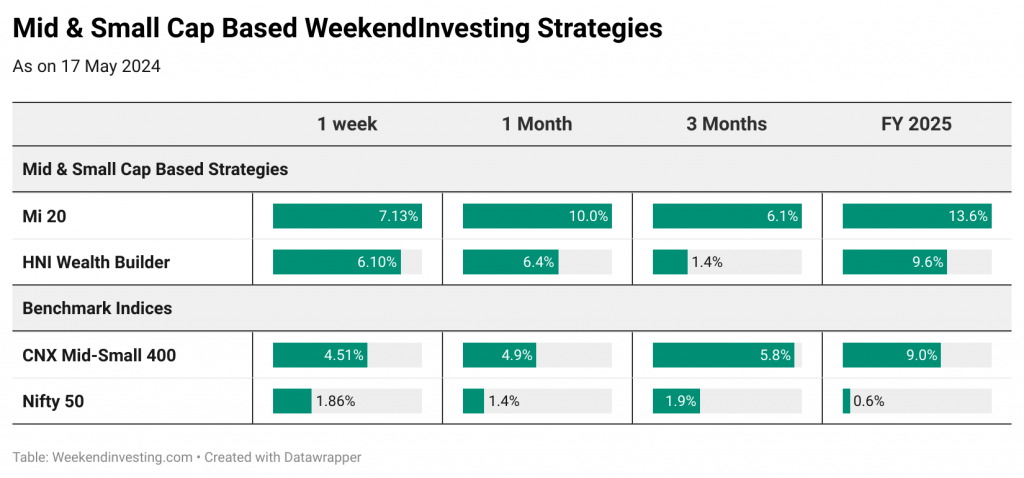

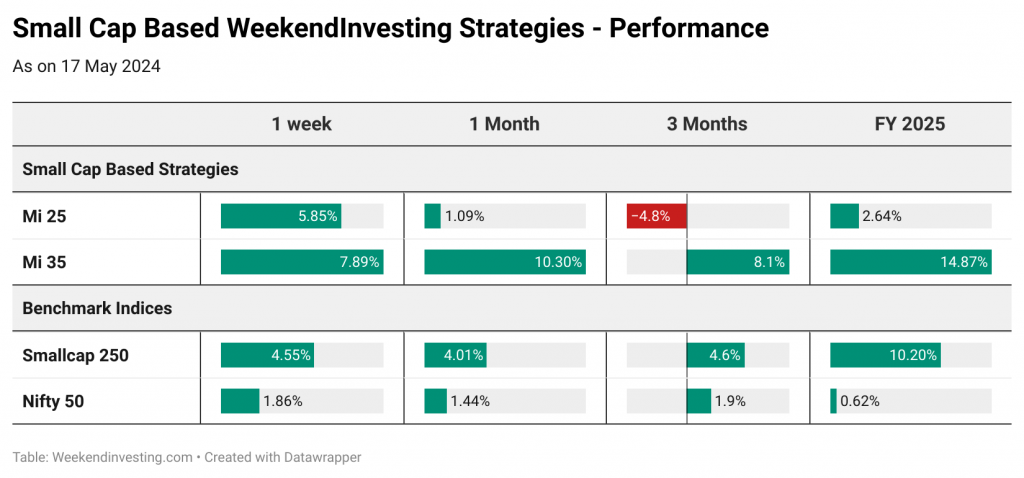

This week saw strong performance across various market indices. Nifty Next 50 gained 5%, small caps were up 4.6%, and the Mid-Small 400 rose by 4.5%. Both CNX 500 and CNX 200 increased by 2.5% to 3%, while Nifty itself gained 2%. Overall, it was a very positive week for all indices. For the financial year, Nifty is now back in the green with a 0.6% increase, and the Nifty Next 50 is up nearly 11%, which is particularly impressive.

This week, WeekendInvesting strategies performed exceptionally well. Mi 35 saw a remarkable 7.9% gain, making it an underrated gem with a 14.9% increase in FY 25. Mi 20, popular among small and mid-cap investors, gained 7.1%, totaling a 13.6% increase for the financial year. Mi NNF 10 also had a strong week with a 7% gain, up 13.4% for FY 25. Mi MT Allcap recovered from a slow start, gaining 6.9% this week and 5.5% for the year. HNI Capital Compounder and HNI Wealth Builder were up 6.4% and 6.1%, respectively. Mi India Top 10 gained 1.3% this week and is beating Nifty by a couple of percentage points for the financial year, with a total increase of 1.9%. Mi Evergreen rose by 3.9% this week, reaching a 10% gain for the year.

Sectoral Overview

This week, real estate led the market with a 6.6% gain, followed closely by metals at 6.5%, which is already up 15% in FY 25. Public sector enterprise stocks also performed well, rising 5.8% this week and 13% for the financial year. These three sectors are currently at the top of the charts, making them prime targets for opportunistic swing trading or buying. Autos gained 1.9% this week, with an impressive 8.7% rise in FY 25, highlighted by strong moves in stocks like Mahindra and Mahindra.

The IT sector, despite being sluggish overall, showed some recovery this week but remains down 4.3% for the financial year. FMCG and PSU banks were flat both this week and for the financial year. Pharma is also flat for the year with a slight -0.1% change. Meanwhile, Nifty is up by 0.6% for the financial year.

Over the past six months, three months, one month, and two weeks, the sectors with the best momentum scores have been metals, real estate, autos, and public sector enterprises. These four sectors consistently rank the highest across different measurement periods, indicating strong performance. In contrast, banking and PSU banks have ranked much lower compared to these leading sectors while IT and Media continue to languish at the bottom.

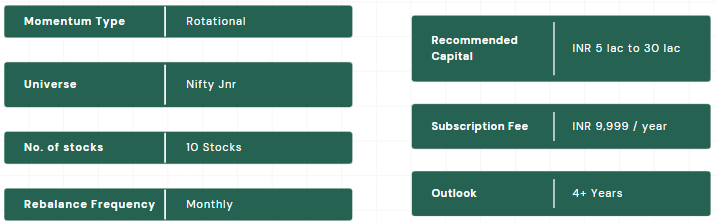

WeekendInvesting Strategy Spotlight

How late is too late ?

Today’s spotlight focuses on the idea of timing in stock investment, specifically examining the example of Hindustan Aeronautics Limited (HAL).

HAL’s stock price was stagnant around Rs 300-400 for a long time. After the COVID-19 crash, the stock surged from Rs 245 to nearly Rs 700, then dropped back to Rs 350. This 50% decline could have discouraged many investors. However, from Rs 340, HAL never looked back, reaching Rs 453, marking a 12x gain from this low point by 17 May 2024.

Even if you missed the initial rise from Rs 245 to Rs 680, momentum investing could have helped you catch significant gains. For example, entering HAL at Rs 1151, after it had already surged, still resulted in a 4x gain. This demonstrates that buying high isn’t necessarily bad if the stock continues to perform.

A structured approach is crucial. Whether you’re buying 20 or 50 stocks, knowing some will outperform significantly can offset minor losses. The BBC principle—Bhav Bhagvan Che (price is God)—emphasizes trusting the price movement as an indicator of future performance.

In essence, it’s never too late to enter a stock if you have a solid plan and strategy for managing your investments. The focus should be on what you do after entering the stock, not on the initial timing.

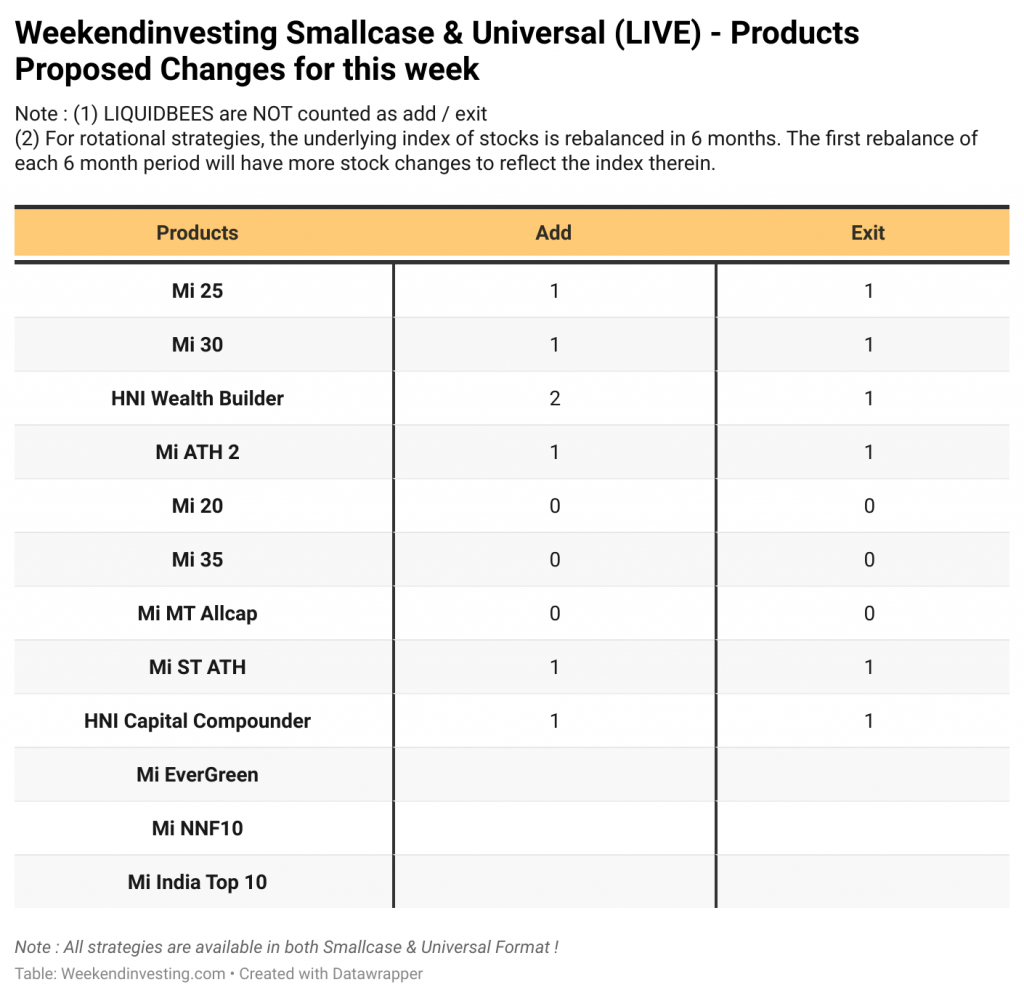

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.