- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

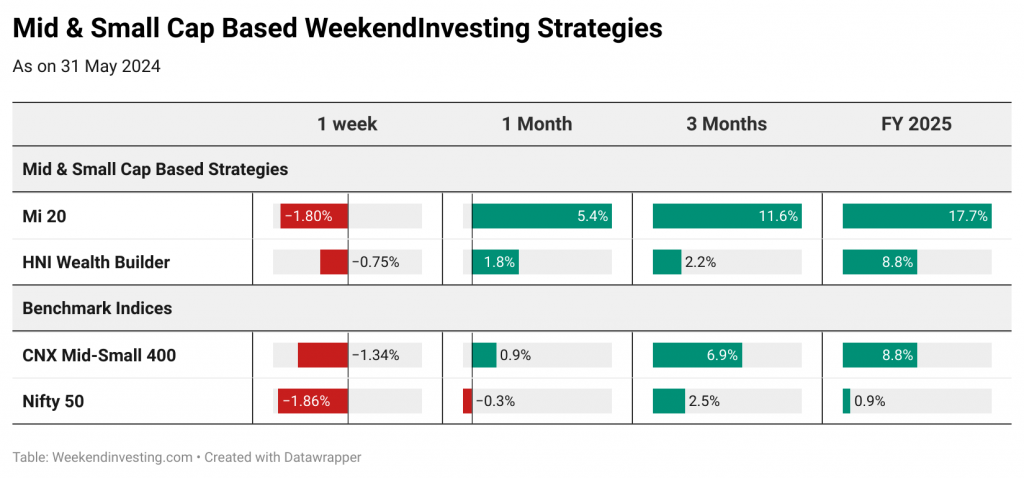

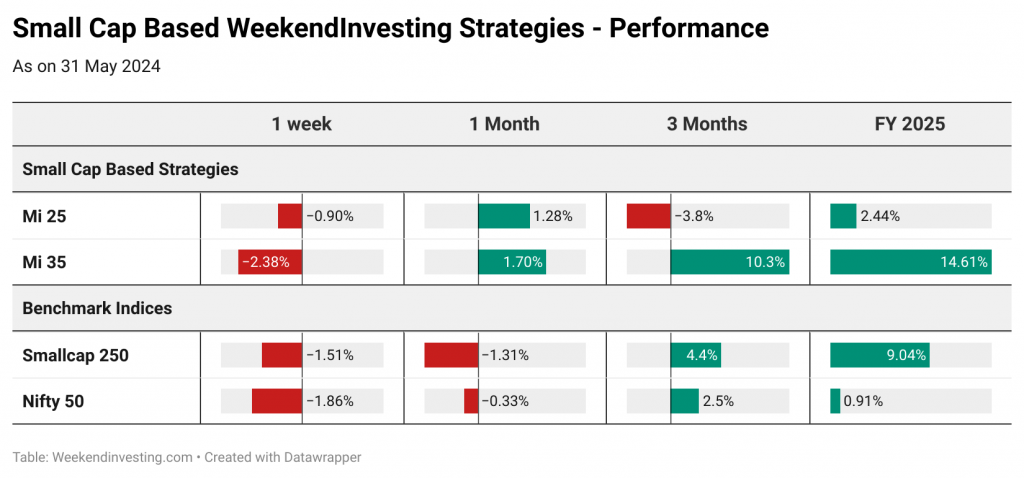

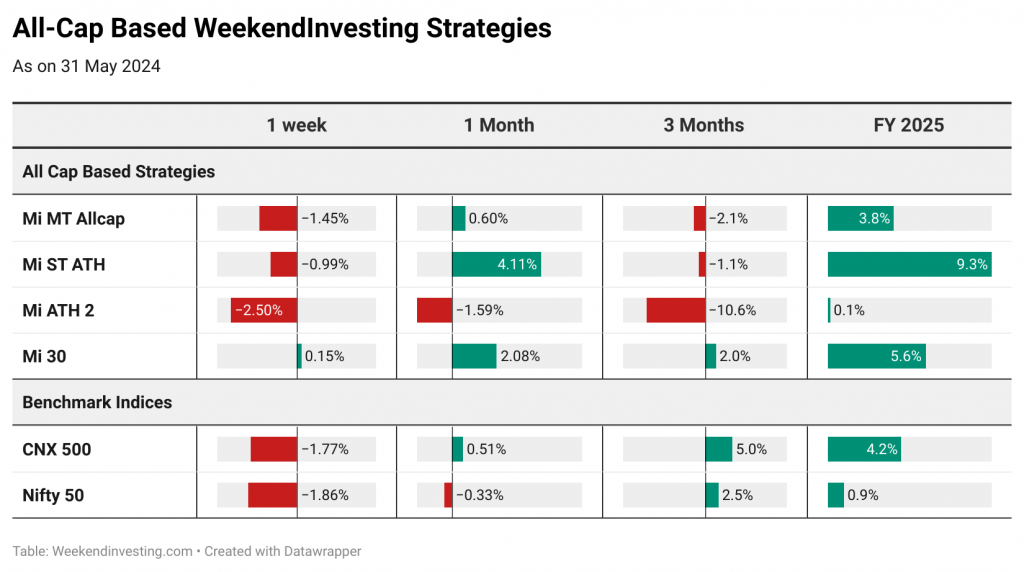

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

A recent study by Bank of America Global Research, using data from Bloomberg, reveals interesting insights about the S&P 500’s performance during U.S. presidential election years. With the current year, 2024, being a U.S. presidential election year . . . .

Rise of India in the current century!

A fascinating graphic from Ray Dalio’s book shows the relative standing of great empires over the last 600 years. This chart spans from 1500 to the present, tracking the rise and fall of . . . .

If you are reading in the papers it may be late!

In September 2022, the Wall Street Journal had a headline that caught many by surprise. It stated that gold had lost its status as a safe haven, with the metal trading at $1,678 and down 8.2% for the year. Fast forward to May 2024, and gold had surged by almost 50% from that point. This dramatic rise . . . .

Do you always regret in markets?

When you buy stocks, they often go down. When you hold them, they go sideways. When you sell them, they go up. This is something many investors experience. Most of the time, these decisions are . . . .

Over the past decade, central banks have purchased an average of 400 to 570 tons of gold per year. Yet, in the last two years, these purchases have nearly . . . .

Is brokerage eating into your trading?

There’s an amusing graphic floating around online that humorously depicts the impact of brokerage fees on different types of market participants. The graphic categorizes market players as investors, swing traders, intraday traders, and options traders, highlighting how . . . .

Avoid weak stocks in the markets

A recent survey in the US revealed that half of the Americans surveyed believe they are losing money this year, even though the stock market is up by 12% as of May 22. This surprising result shows a clear disconnect between market performance and . . . .

Hindustan Aeronautics Limited (HAL) has been a remarkable performer in the stock market, truly living up to its name by soaring high. The stock has seen an incredible rise from around Rs 400 to an impressive Rs 4800 in just a few years. At every stage, skeptics have doubted . . . .

Largecaps poised to trump Smallcaps

This chart is a real eye-opener for many investors. It shows the ratio of the Nifty 50 index divided by the small cap index over the last 20 years. This ratio, on a weekly timeframe, ranges between 0.5 and 1. When Nifty performs better than small caps, the ratio goes up. When small caps outperform, the ratio comes down. Over the last two decades . . .

Is it time to say goodbye to Bonds ?

A fascinating chart from Bank of America Global Research shows the total returns of US 30-year treasury bonds over the last 40 years. Since the 1980s, there have been phenomenal returns as interest rates continually dropped. When interest rates go down, bond prices go up, leading to higher returns. However, something significant happened . . . .

Markets this week

Nifty saw cautious trading this week following a strong two-week rally from 21,800 to around 23,000. On Monday, a new high of 23,100 was reached, but profit-taking ensued, leading to a pullback in the subsequent sessions. This cautious behavior is primarily due to the anticipation of important exit polls on Saturday and the resulting market reactions on Monday and Tuesday, with actual election results expected by Tuesday.

The market sentiment suggests confidence in the continuation of the current government. However, a surprise outcome could lead to significant market volatility. Despite the pullback, the market remains fundamentally strong, as it hasn’t broken recent support levels of 21,600 or 21,000. A breach of these levels might indicate weakness, potentially leading to further declines towards 18,800 or 17,600 if political uncertainty prevails.

Overall, the market appears overcautious, and while media and social media amplify this nervousness, the underlying market strength suggests there is no immediate reason for alarm.

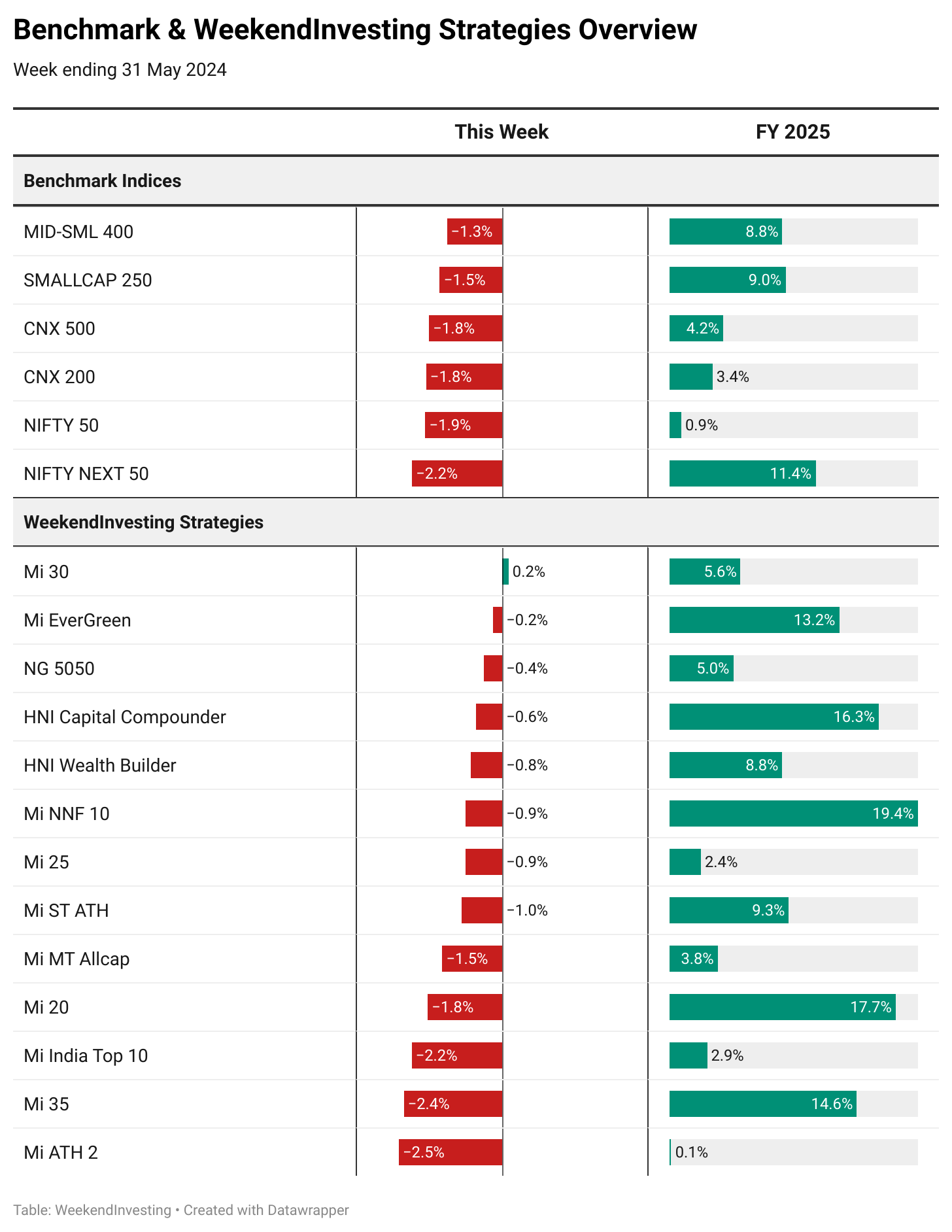

Benchmark Indices & WeekendInvesting Overview

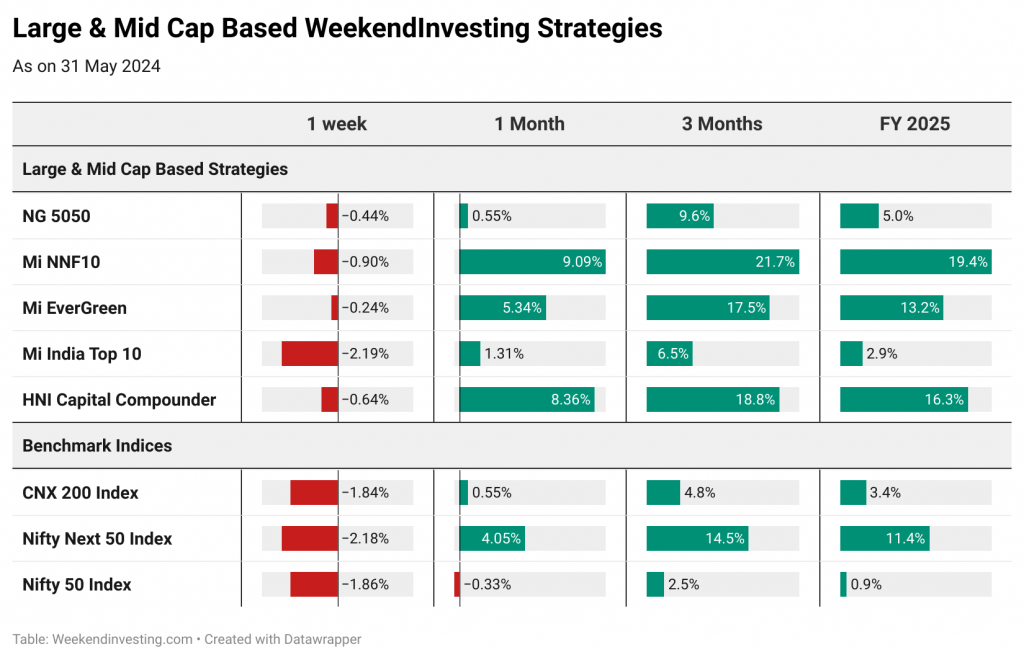

This week, benchmark indices saw a decline, with the Nifty 50 dropping 1.9% and the Nifty Next 50 falling 2.2%. Other indices also decreased by 1.5% to 2%. Weekend investing strategies followed suit, with losses up to 2.5%. However, Mi Evergreen experienced the smallest loss at 0.2%, and Mi 30 actually ended in the green. HNI Capital Compounder and HNI Wealth Builder also outperformed the indices, losing less than the broader market. Mi 35 and Mi ATH 2 faced slightly higher losses compared to the market.

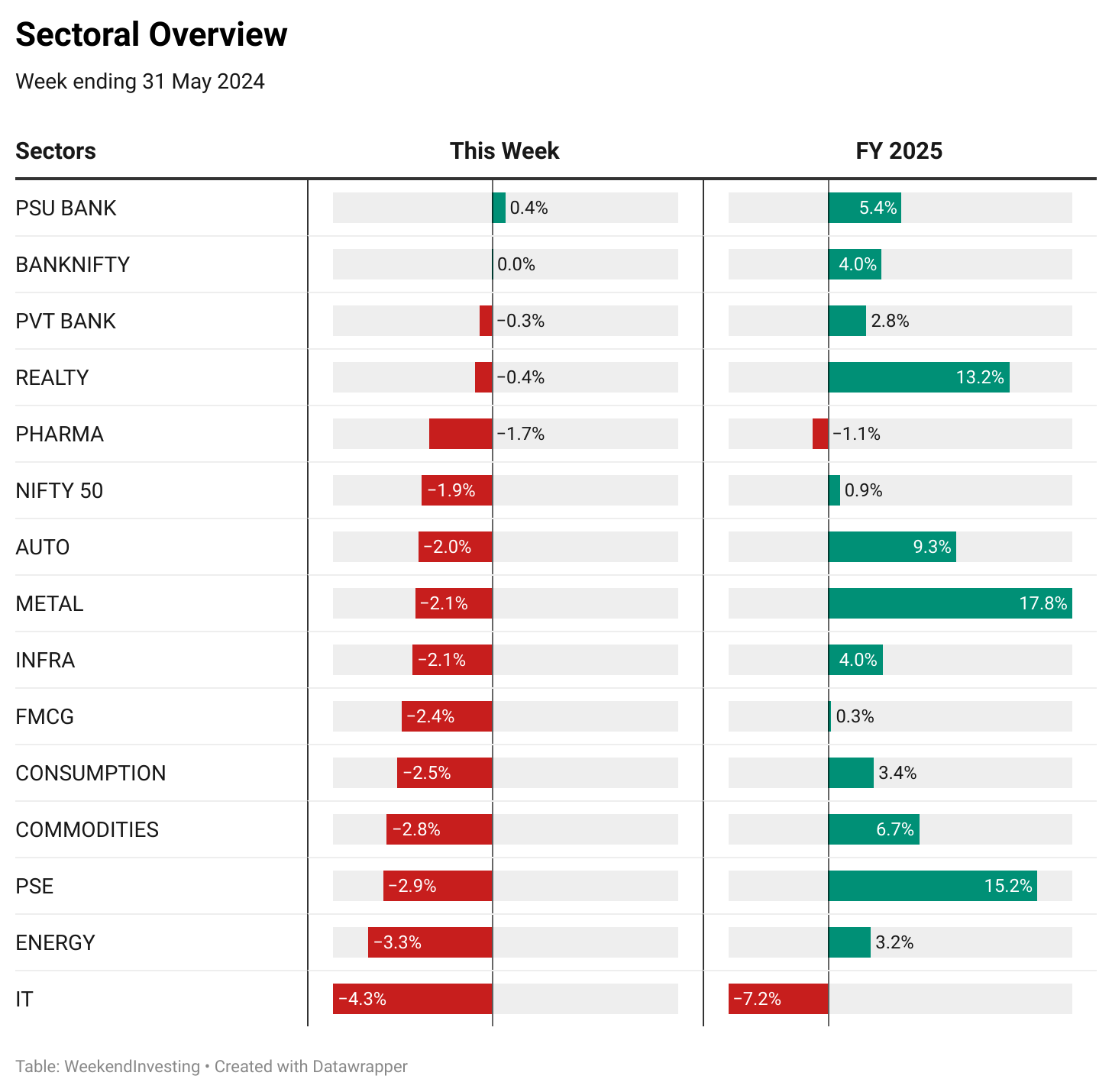

Sectoral Overview

This week saw minimal gains for PSU banks and small losses for private banks, keeping the banking sector stable. This stability in banking is a positive sign for the market, as it often follows the banking sector’s lead. Real estate remained flat, maintaining its 13% gain for FY 25. Other sectors experienced losses between 2% and 4%, with the IT sector being the hardest hit, down 7.2% for FY 25. Energy and public sector enterprises lost 3.3% and 2.9%, respectively. Despite these losses, public sector enterprises and metals have shown significant gains of 17.8% for FY 25, making the recent 2% loss for metals relatively insignificant. Overall, the market is experiencing mixed performance across different sectors.

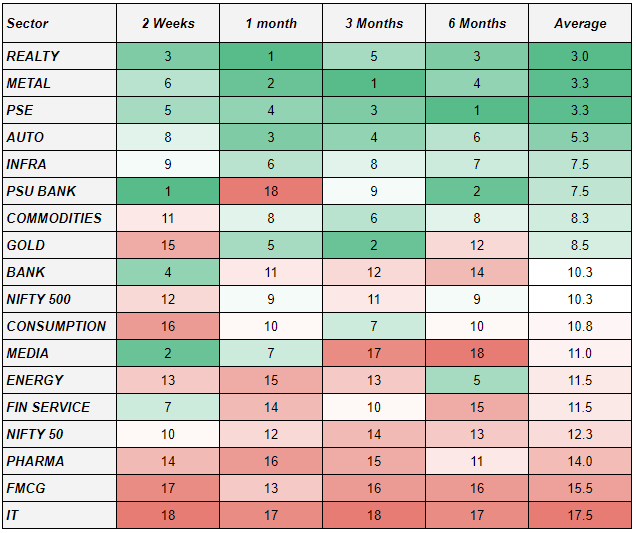

Sectoral momentum shows that public sector enterprises, metals, real estate, and autos are top performers across various time frames. GOLD has lost some steam in the recent few weeks after a strong run. MEDIA has also done quite well to recover from the recent weakness to occupy the 5th spot in the fortnightly ranking.

Discretionary investors can focus on opportunities within these strong sectors. Real estate, metals, public sector enterprises, and autos have consistently held top positions in sectoral momentum over various time frames (two weeks, one month, three months, and six months). If you are a discretionary trader, these sectors are likely to lead the market, so it would be interesting to look for stocks within these sectors for potential leadership and investment opportunities.

WeekendInvesting Strategy Spotlight

The art of Extracting Alpha from a Rangebound Stock – Bank of Baroda case study

today let us see how to momentum investing extracts alpha from range-bound stocks, using Bank of Baroda as an example. Over ten years, the stock fell from ₹200 to ₹35, a drop of more than 80%.

This significant decline illustrates the emotional challenges investors face when holding a stock over a long period with no system in place. Investors might prematurely exit positions due to loss of confidence, even when the stock starts to recover.

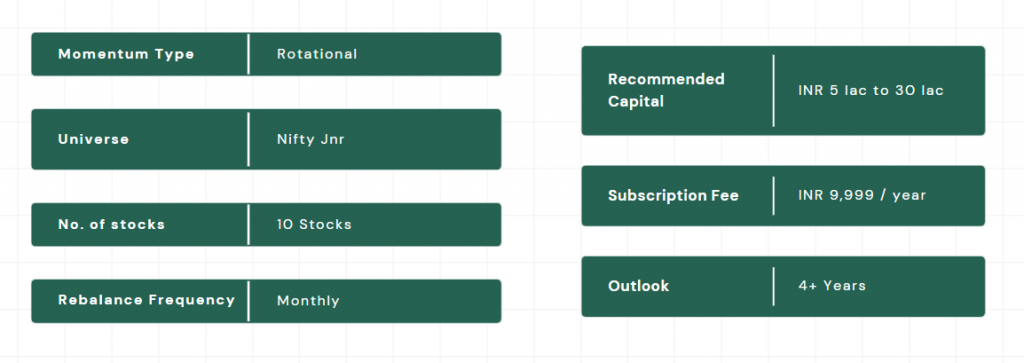

By employing a system-based approach like Mi NNF 10, investors can avoid going through emotional roller coaster & ambiguous situations. For instance, Mi NNF 10 bought Bank of Baroda at ₹107 and exited at ₹214, achieving a 98% gain without having to ponder over the decade-long drawdown on the stock.

This systematic strategy helps manage risks and capitalize on market opportunities without getting emotionally entangled.

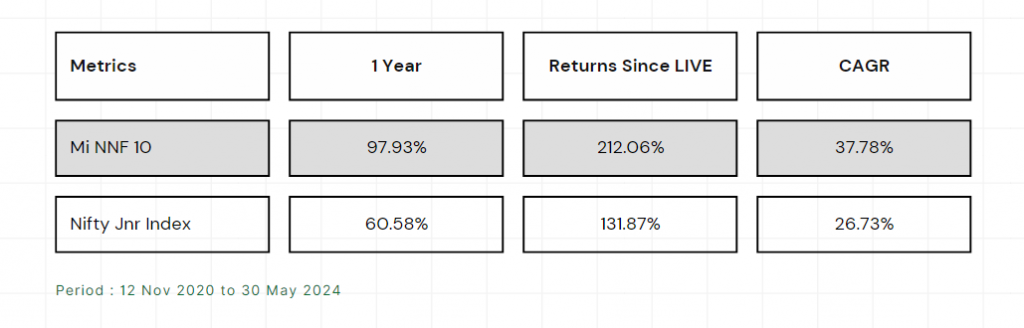

The Mi NNF 10 strategy has demonstrated impressive performance, achieving 98% returns in one year and 212% since its inception in 2020, showcasing the benefits of structured investing and risk management over long-term, emotional decision-making.

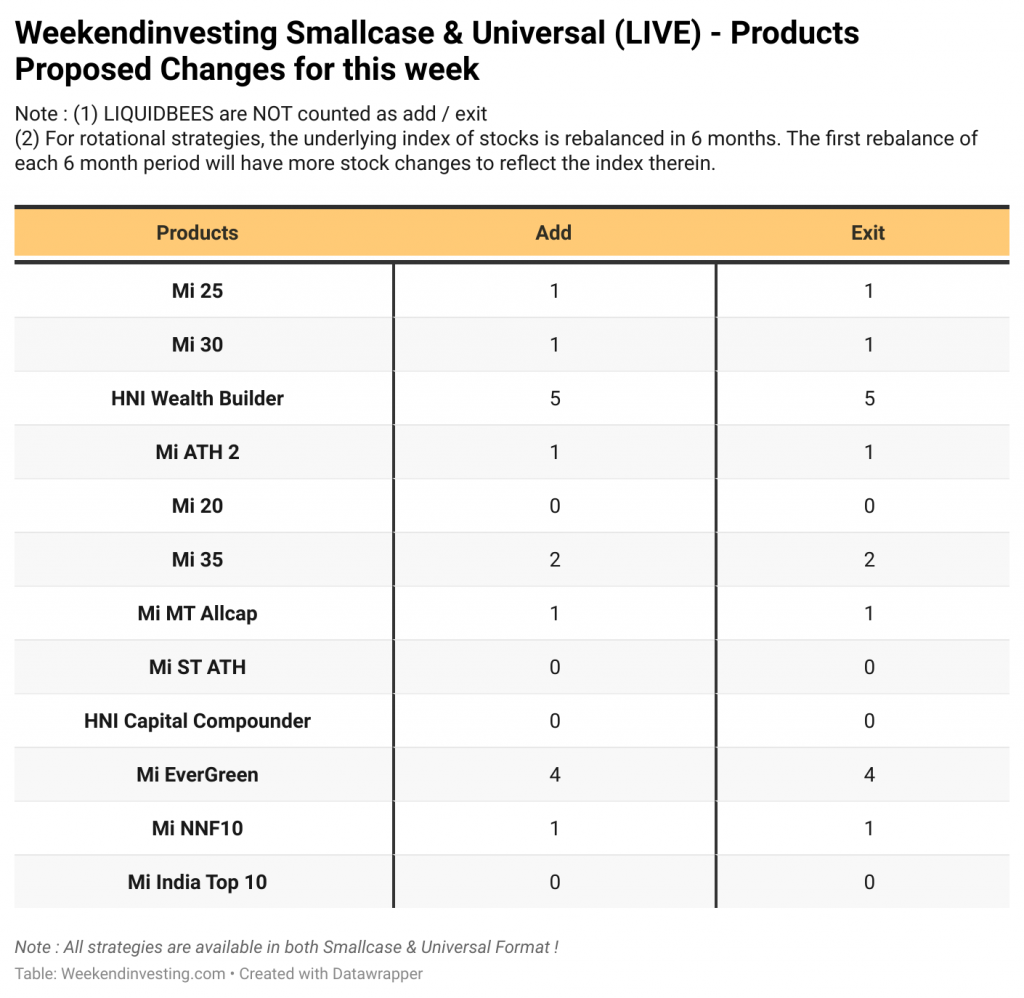

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s review.