- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

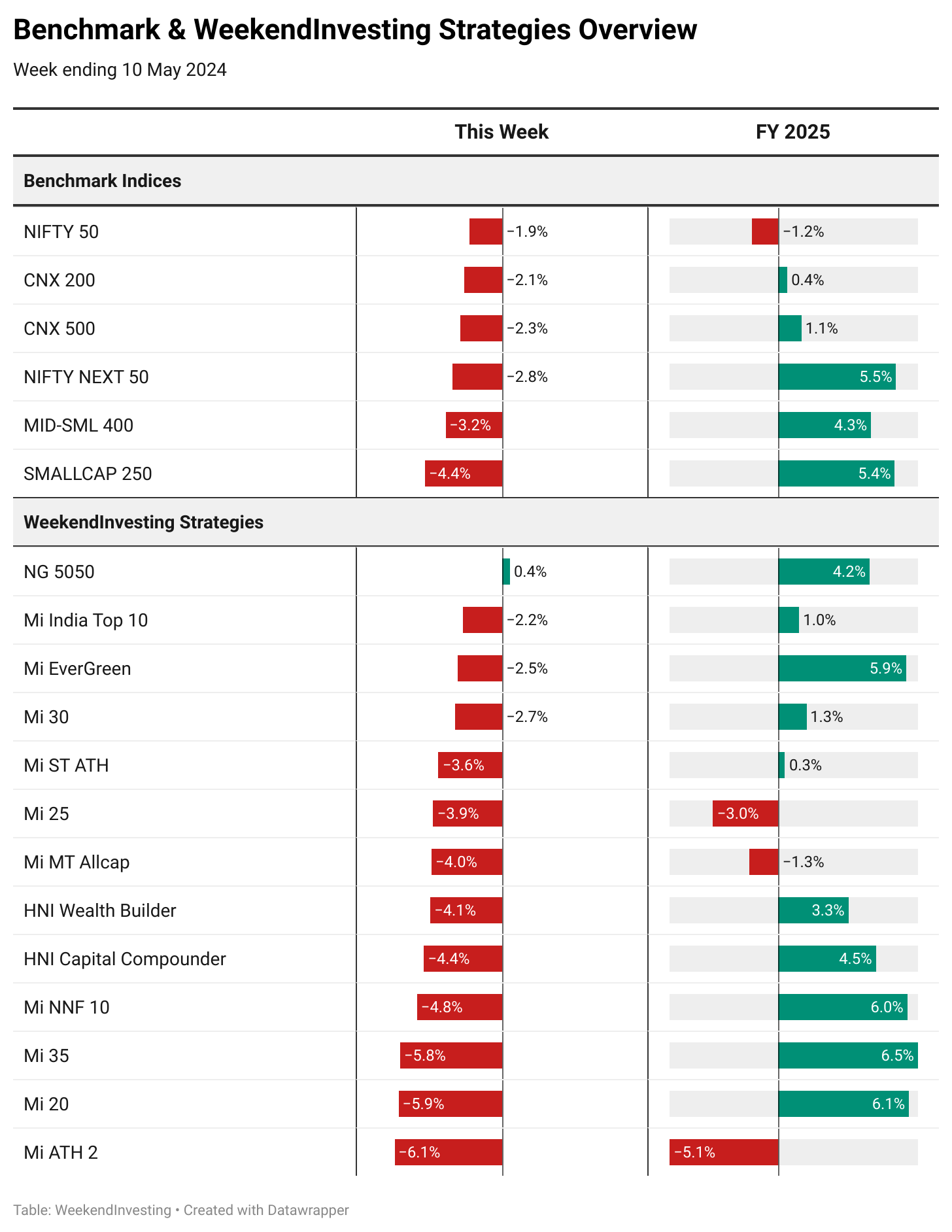

- Benchmark Indices & WeekendInvesting Overview

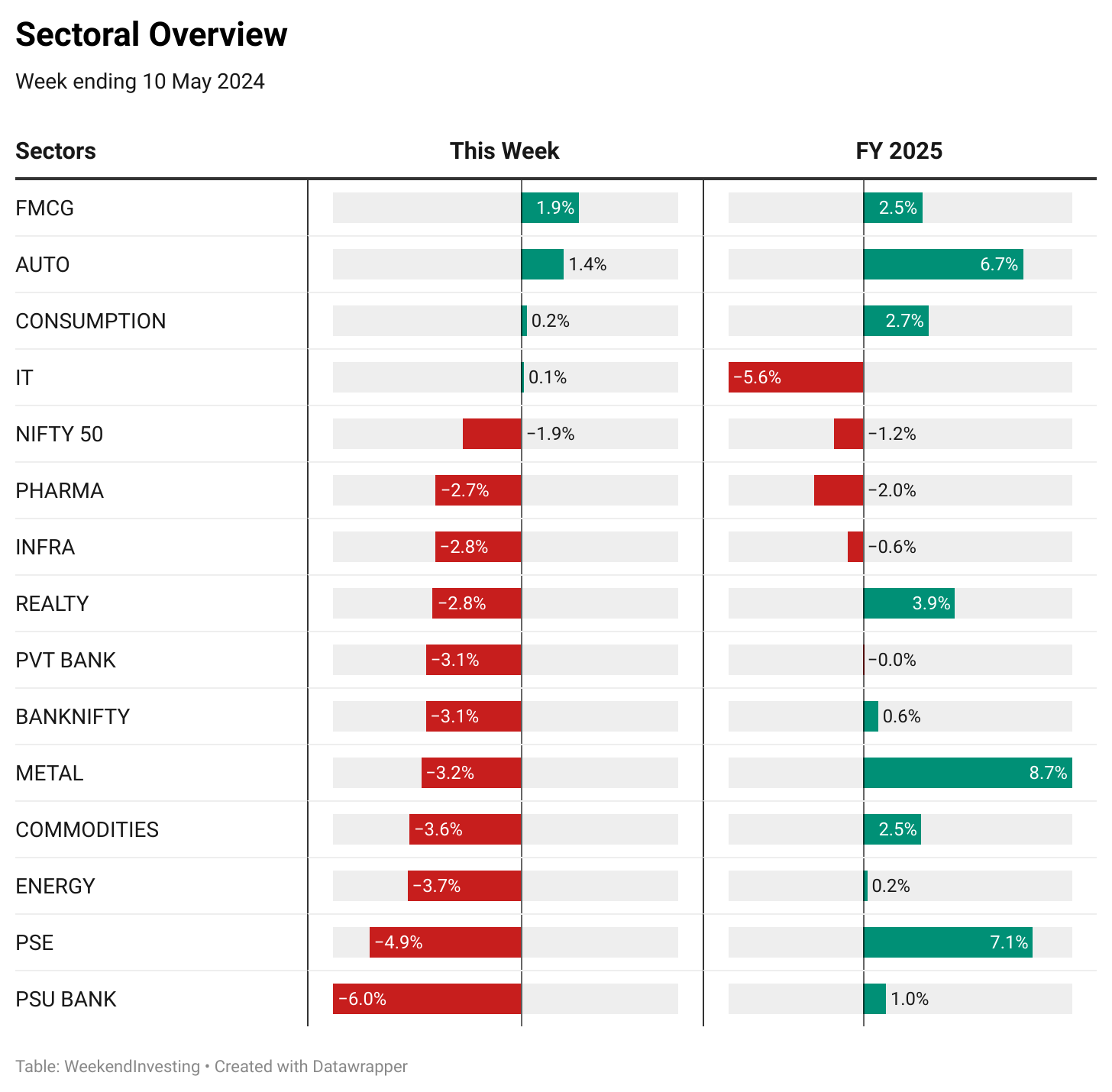

- Sectoral Overview

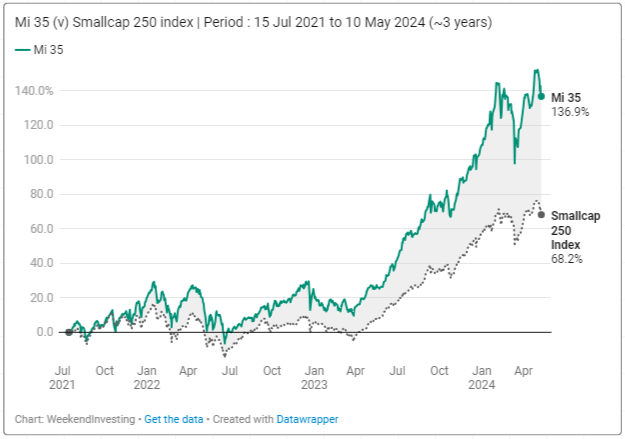

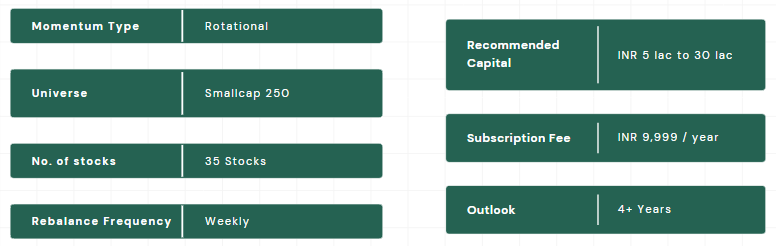

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

It is often not just about picking the right stocks; it’s about using your capital effectively. Take NBCC stock, for example. Over the past eleven years, there have been three major uptrends, each presenting an opportunity for significant gains. By employing a momentum-based strategy, investors could have . . . .

Are markets ready for a correction?

Taking a step back to look at the bigger picture of the market can offer valuable insights. Over a five-year period, we can observe the market’s overall trajectory, unaffected by short-term fluctuations. Before the onset of COVID-19, the market was relatively stable, showing signs of equilibrium. However, the pandemic brought about significant . . . .

Buy what goes up, Sell what goes down!

Over the past two and a half years, Paytm’s chart reflects a consistent downward trend, with occasional minor fluctuations. Despite this clear pattern, many investors remain bullish on the stock, raising the question . . . .

Consider a simple scenario: a stadium with a single drop of leakage from a tap every minute. Now, imagine that the number of drops doubles every subsequent minute. Initially, progress seems slow, but astonishingly . . . .

Starbucks, Inc. has long been a staple in the market, but recent trends beg the question: is the narrative driving its stock price sustainable? Despite only a modest 4% decline in same-store sales post the earnings release, the stock has plummeted from . . . .

Don’t believe everything you see or hear

The world map, a familiar sight, yet often misunderstood in its true dimensions. Just as Asia spans 6400 kilometers and Africa stretches 7200 kilometers, reality can differ greatly from what’s portrayed on the surface. Similarly, corporate results often present an idealized version of reality, designed to showcase . . . .

See what they Do – Not what they Say

A recent tweet by Sameer Arora shed light on Warren Buffett’s investment approach, challenging the conventional wisdom of buy-and-hold strategies. While many investors advocate holding onto stocks for the long term, Buffett’s actions reveal . . . .

Discovering an eye-opening statistic from the World Federation of Exchanges sheds light on the precarious nature of stock survival. Over the past 28 years, a staggering 43% of stocks in US markets have . . . .

In recent years, Apple Inc. seems to have hit a plateau in terms of stock performance. Despite releasing new products, the tech giant has failed to make significant strides, leaving investors . . . .

Just takes one man to change history

One topic that’s been garnering attention is the debate surrounding Federal Reserve rate cuts. Initially, there were talks of multiple cuts in the calendar year, but now the forecast has dwindled to only about two cuts. Some speculate that . .

Markets this week

This week, Nifty witnessed a significant downward trend, marking a clear directional movement. Starting from a new high of 22,800 last Friday, it closed this week at 22,000, indicating a loss of around 500 points from the previous week’s close and 800 points from the peak. This decline represents a notable correction in the market, which is often considered healthy for its overall stability.

The weekly candles of the last two weeks have failed to show upward movement, suggesting a continued congestion zone that has persisted since the end of February. This range is characterized by 22,500-22,600 at the top and 21,700-21,800 at the bottom. However, there is anticipation for potential support around the 21,200 level or even a slight dip to 20,000, although a significant fall seems unlikely without a substantial market event.

Benchmark Indices & WeekendInvesting Overview

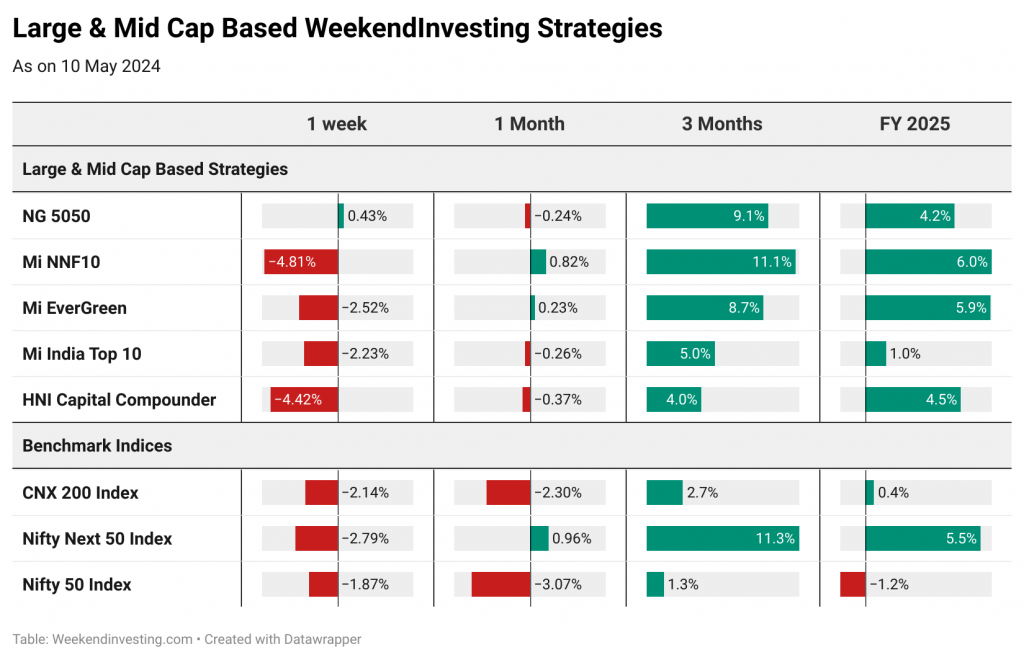

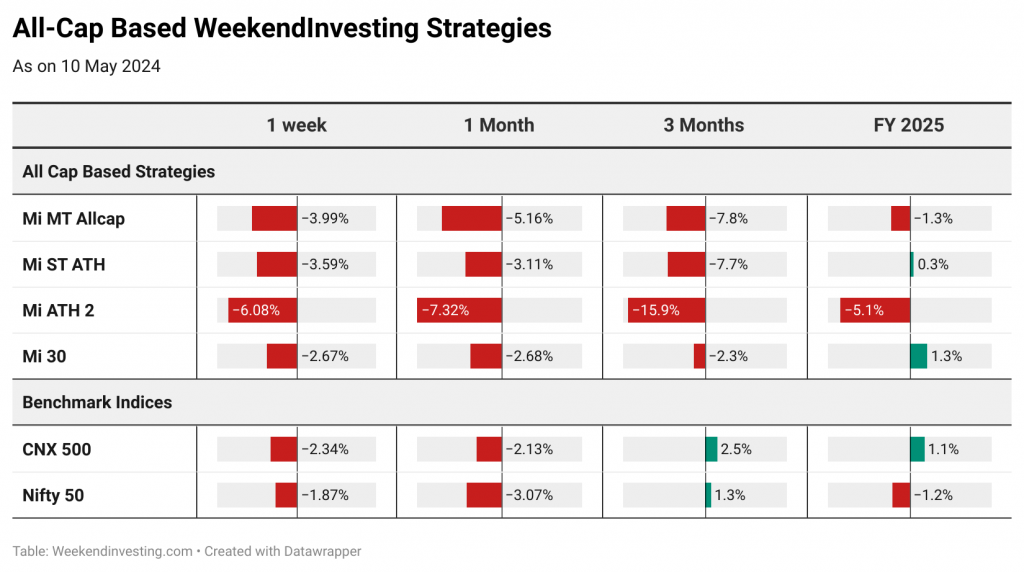

This week, the benchmarks experienced a notable downturn, with Nifty down by 2%, CNX 200 down by 2.1%, and Nifty Next 50 down by 2.3%. Mid and small caps faced even steeper declines, with drops of 3.2% and 4.24% respectively. This indicates a significant cut in the lower segment of the market, reflecting considerable bearish sentiment and selling pressure at least in the shorter timeframe.

In terms of weekend investing strategies, there were cuts ranging from 2% to 6% across various portfolios. Some strategies experienced particularly deep cuts, notably in Mi ATH 2, Mi 20, Mi 35, and Mi NNF 10. Despite this, most of the strategies still managed to retain some gains for FY 25. However, Mi ATH 2, Mi 25 & Mi MT Allcap are currently in the red for FY 25.

Sectoral Overview

Most sectors experienced losses except for FMCG, which saw a 2% increase, and Auto’s, which rose by 1.4%. Auto’s performed well, with positive numbers reported and stable consumption contributing to the sector’s resilience. Rural consumption is reportedly growing faster than urban consumption, which is positive news for India’s economy. Despite overall stability this week, the financial year has been challenging for many sectors, with losses ranging from 2% to 6%. PSU banks faced significant losses, eroding most of their gains for the current financial year. However, the metal sector remained strong, topping the sectoral list with an impressive 8.7% increase.

In various timeframes, Auto’s stands out prominently, followed closely by public sector enterprises. Gold has shown an upward trend in recent months, indicating its strength. Consumption stocks are maintaining stability, suggesting potential opportunities in consumption-related stories. Although FMCG and metals experienced a decline in the short term, they remain among the top five sectors overall.

WeekendInvesting Strategy Spotlight

How Momentum Investing is hell bent on making best use of your capital ?

Mazdock experienced a choppy phase between July 2021 and August 2022 before breaking out in August 2022. Mi 35, a rotational strategy focusing on small caps, identified this stock during its breakout phase. While one might expect a modest increase, Mazdock saw a remarkable rerating, soaring from 350 to 2193, marking a staggering 520% gain. Exiting in September 2023 allowed investors to avoid the subsequent consolidation phase.

This strategy relies on algorithms to identify the strongest stocks in the small cap basket, adapting based on momentum scores across different time frames. It moves into stronger stocks if available, ensuring capital is utilized optimally.

Mi 35, since its inception, has shown significant growth, up by 136%, outperforming the base index, which rose by 68.2%. The strategy focuses on the small cap 250 universe, consisting of 35 stocks initially held in equal proportion. Every six months, as the underlying index rotates, the weights are reset to equal weight. Weekly reviews ensure timely adjustments, with a recommended investment outlook of four to five years for best results.

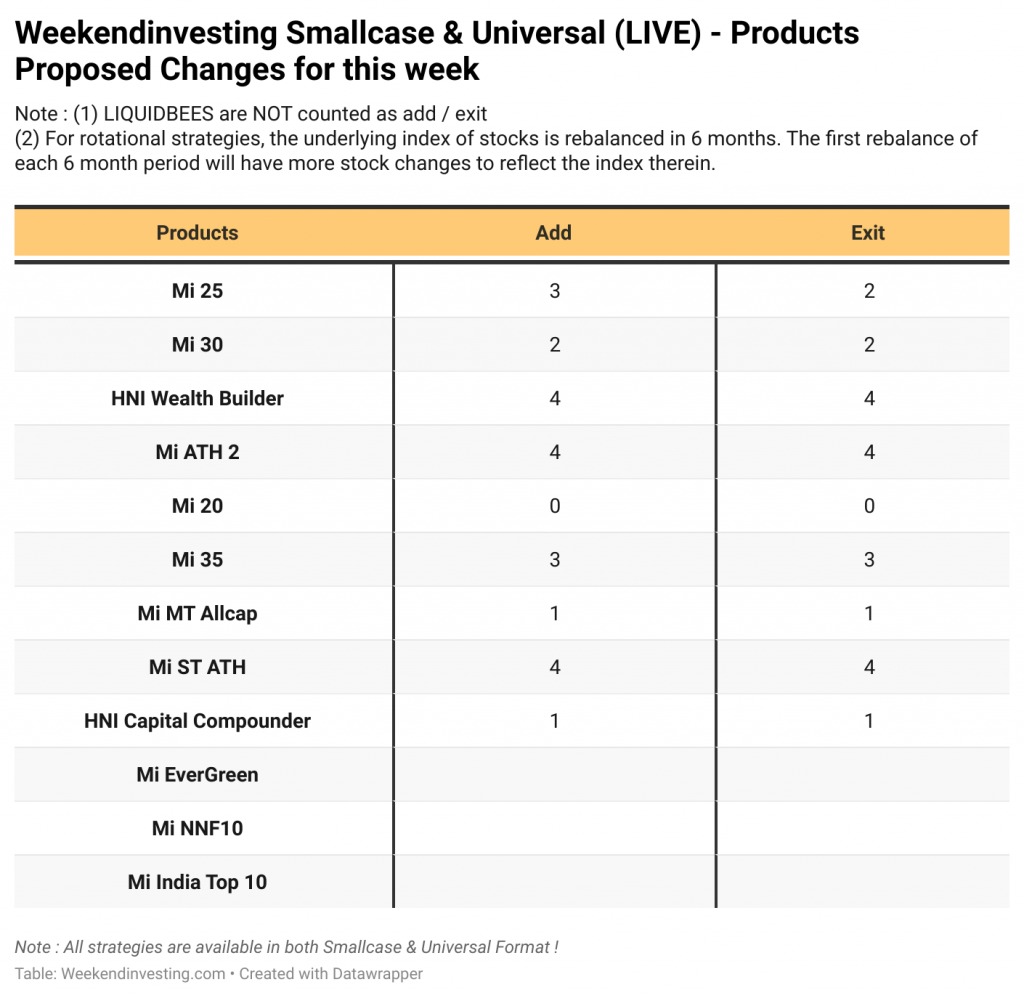

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.