- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

For many years, the 60/40 portfolio, which consists of 60% stocks (S&P 500) and 40% US Treasuries, has been a popular investment strategy. However, current trends suggest . . . .

Gold is moving out of weak hands

Recently, something unusual has been happening with Gold ETF holdings, and it’s worth exploring further. The chart of Gold ETF holdings shows an interesting trend. The orange line represents the price of gold in US dollars, currently around $2300. The other lines represent the total holdings of various Gold ETFs. Traditionally, these holdings have followed the price of gold. When gold prices went up . . . .

Another lesson in gold is here, and it’s crucial to understand its historical performance. Looking back at history can help us predict future trends. A strong correlation between gold prices and interest rates has been brought out by various studies. This relationship shows that . . . .

Emerging Markets relative bottom is near

A fascinating chart from Bank of America Global Research compares the performance of emerging markets equities against US equities. This chart shows the ratio of emerging markets to US equities, ranging from 0.3 on the low end to 2.1 on the high end. It provides a broad view of how these two markets have . . . .

No need to be too fearful here

In 2008, the Indian markets experienced one of the worst crashes during the Global Financial Crisis (GFC). The Nifty index plummeted from near 6400 to nearly 2200, a dramatic 70% drop. However, this decline came after a massive surge. From the third quarter of 2003 to January 2008, the Nifty had grown six and a half times. This context is crucial to understanding . . . .

A recent infographic from DSP highlights the impressive rise of India in terms of gross fixed capital formation. Using data from World Development Indicators and Bloomberg, this chart shows how India, China, and the US have progressed over the last three decades. The most striking detail is India’s remarkable growth rate of 8.1% CAGR. In recent years . . . .

Today, there is some great news that should bring joy to investors. Global funds have placed their highest ever net short bets on Indian stocks. This data spans the last twelve years, and the number of contracts is at its steepest point, indicating extreme short positions. Although . . . .

Chose the right benchmark and outperform it

Berkshire Hathaway has delivered returns almost identical to the S&P 500 over the past 20 years. Despite being an actively managed fund led by legendary investors Warren Buffet and Charlie Munger, Berkshire Hathaway has not outperformed the broader index.

Markets this week

This week was remarkably strong for Nifty, reaching an all-time high. The anticipated upward move happened earlier than expected, ahead of the election results. A significant move on Thursday caused many Foreign Institutional Investors (FIIs) to unwind their short positions. The presence of these short positions at all-time highs provides a cushion in case of a market fall. For the last ten weeks, Nifty had been stuck in an 1100 to 1200 point range, but this breakout suggests a potential significant upward move, similar to the July to November period when a similar range led to a substantial rise.

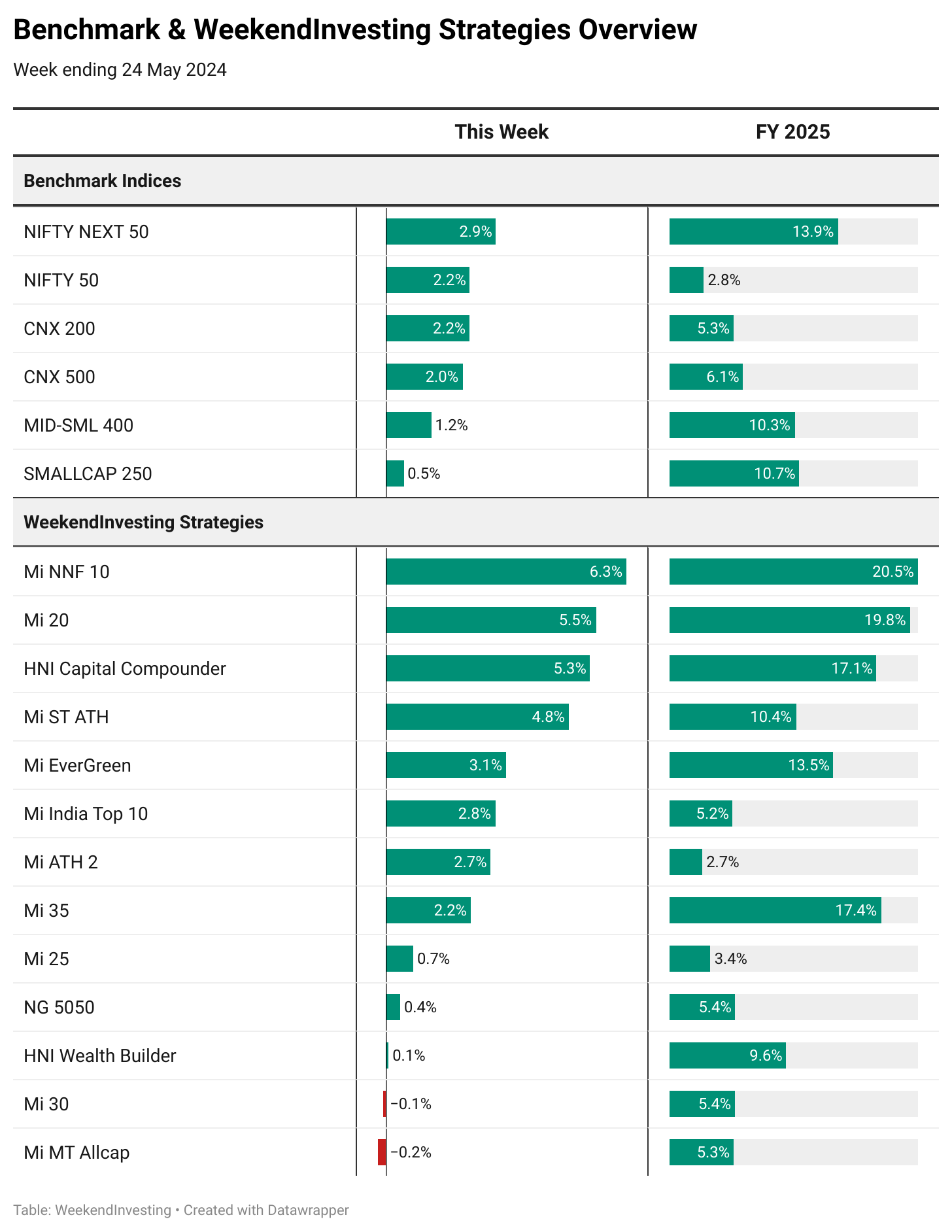

Benchmark Indices & WeekendInvesting Overview

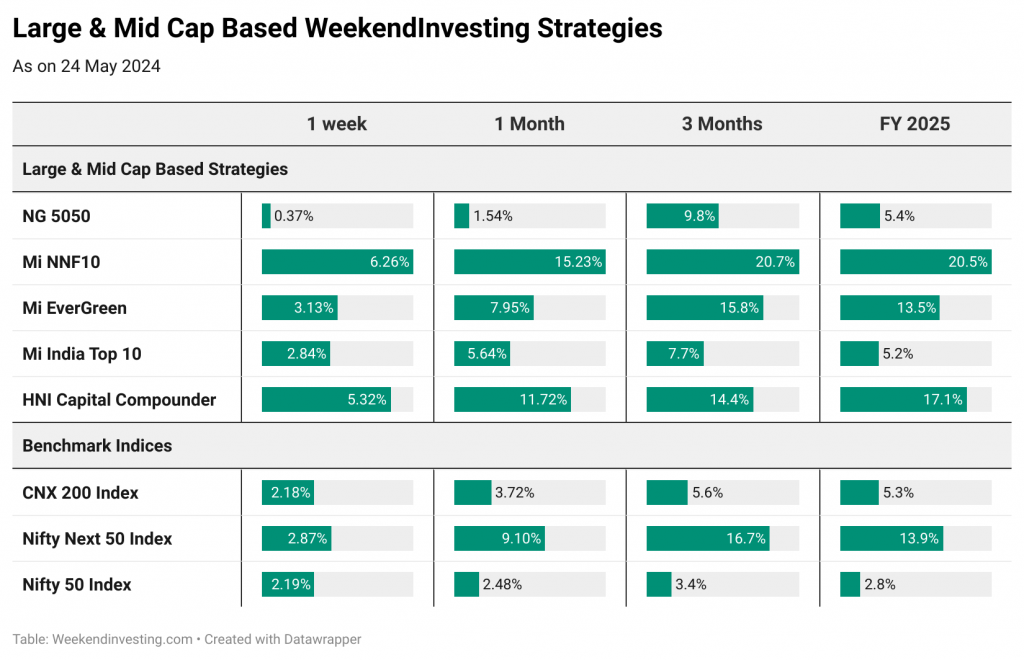

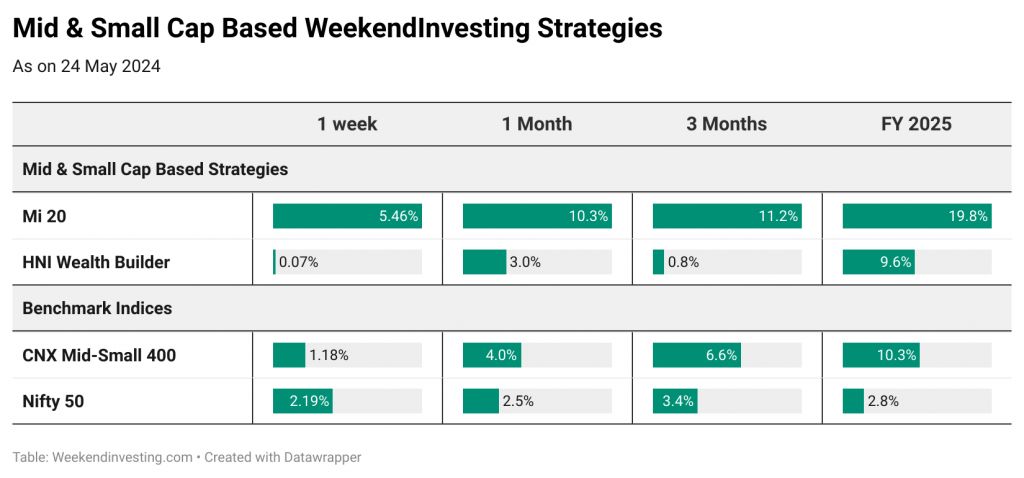

This week, Nifty moved up by 2.2%, along with gains in the CNX 200 and CNX 500. Mid caps increased by 1.2% and small caps by 0.5%, showing less participation. The standout performer was the Nifty Next 50.

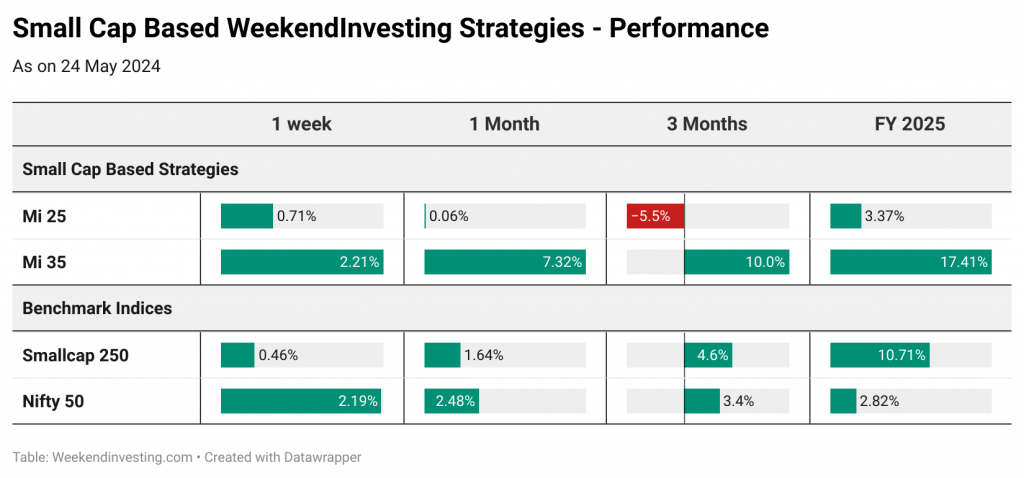

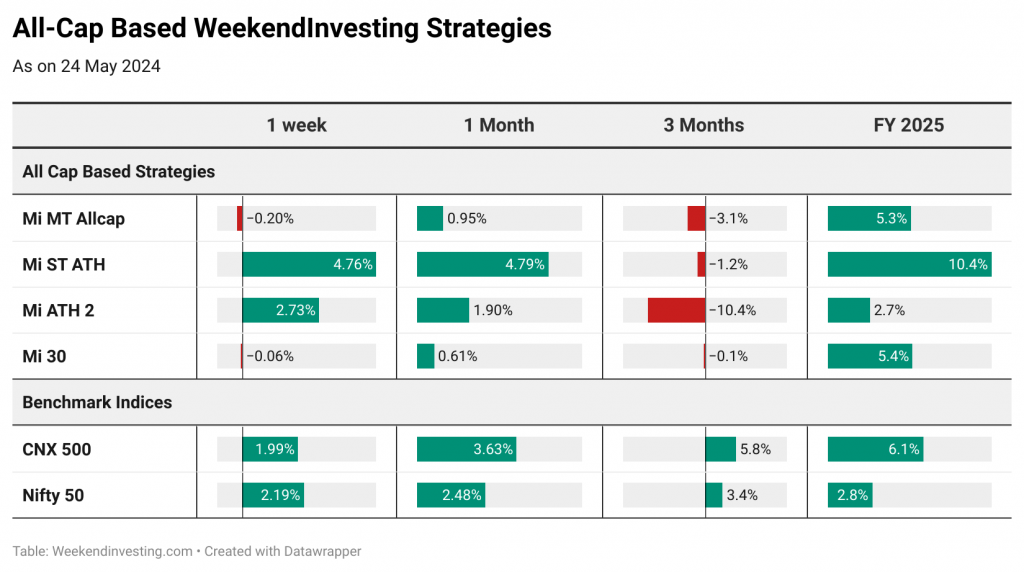

The Nifty Next 50 index performed exceptionally well, with the Mi NNF 10 strategy tracking it and achieving a 6.3% gain this week compared to the formers 2.9%. Mi NNF 10 is up 20% for FY 25. Mi 20 and Mi 35 also showed strong performance with gains of 19.8% and 17.4% respectively for FY 25. HNI Capital Compounder and Mi ST ATH gained nearly 5% this week, while Mi EverGreen and Mi India Top 10 saw around 3% gains. Although Mi 35 was relatively weaker with a 2.2% gain, it still outperformed the small caps’ 0.5%. HNI Wealth Builder, Mi 30, and Mi MT Allcap did not perform as well this week.

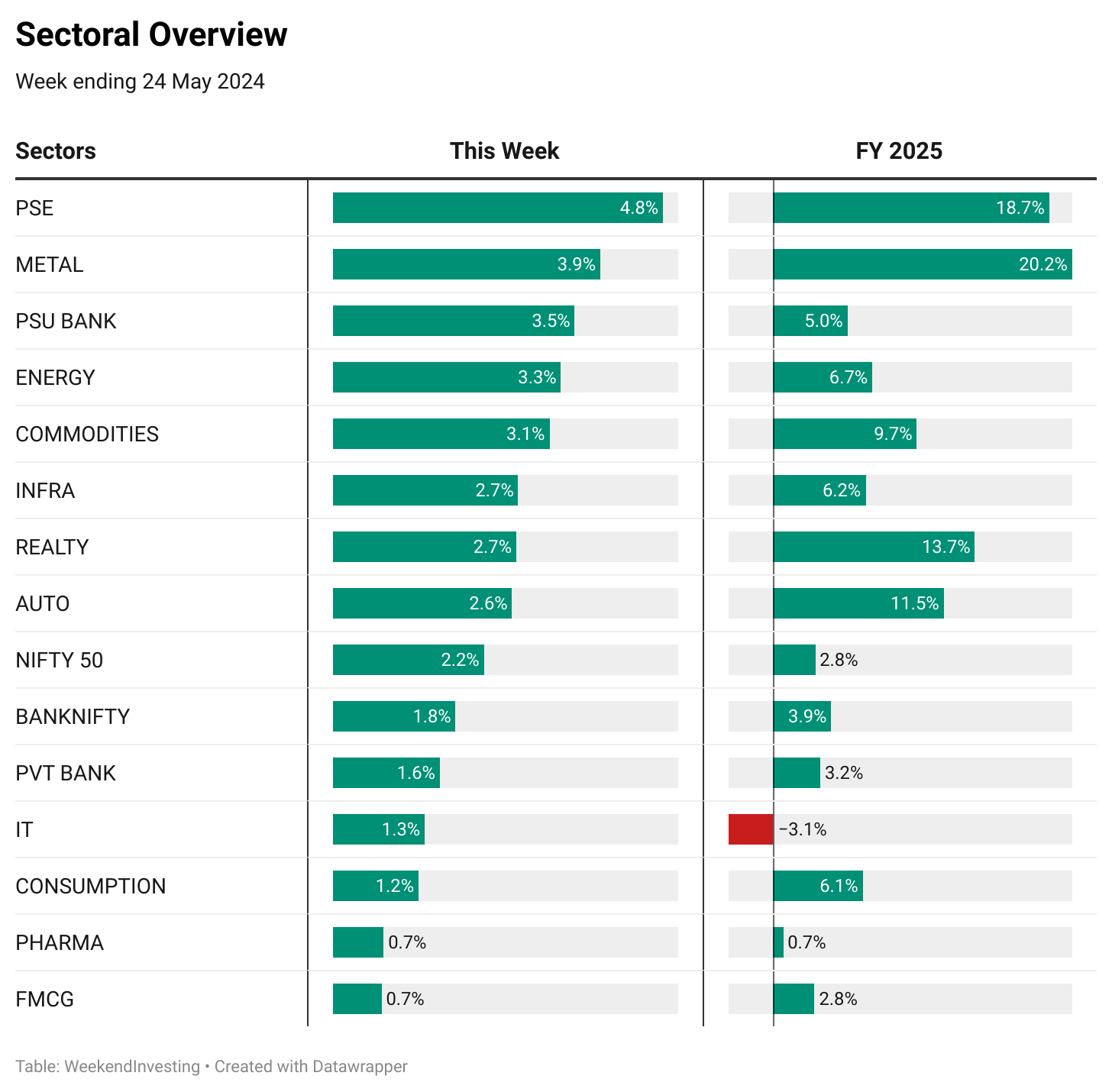

Sectoral Overview

Public sector enterprise (PSE) stocks continued their strong performance, up 18% for FY 25. Metals gained 3.9% this week, reaching a 20% gain for the financial year, making them the best performers over the last few months. PSU banks, energy stocks, and commodities also rallied significantly. The overall market saw upward movement, although FMCG and Pharma did not participate in the rally. Private banks performed well with a 1.6% gain while IT is recovering quickly and is now down only 3.1% for FY 25.

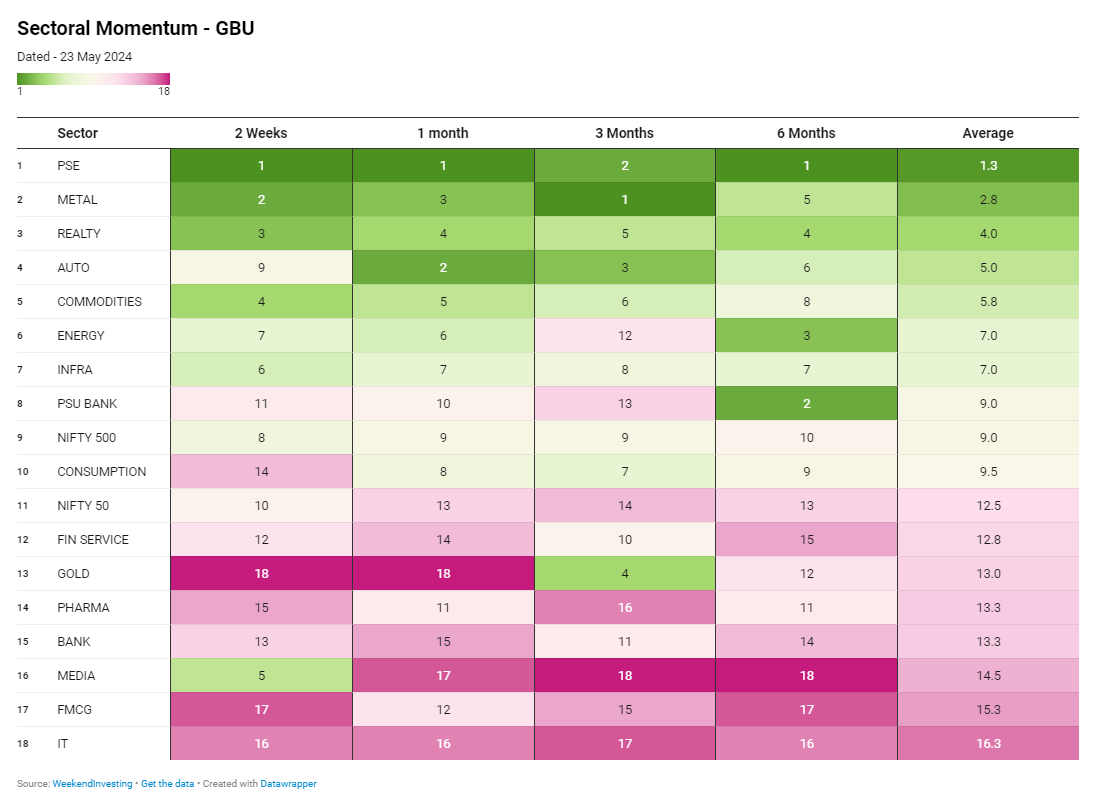

Sectoral momentum shows that public sector enterprises, metals, real estate, and autos are top performers across various time frames. GOLD has lost some steam in the recent few weeks after a strong run. MEDIA has also done quite well to recover from the recent weakness to occupy the 5th spot in the fortnightly ranking.

Discretionary investors can focus on opportunities within these strong sectors.

WeekendInvesting Strategy Spotlight

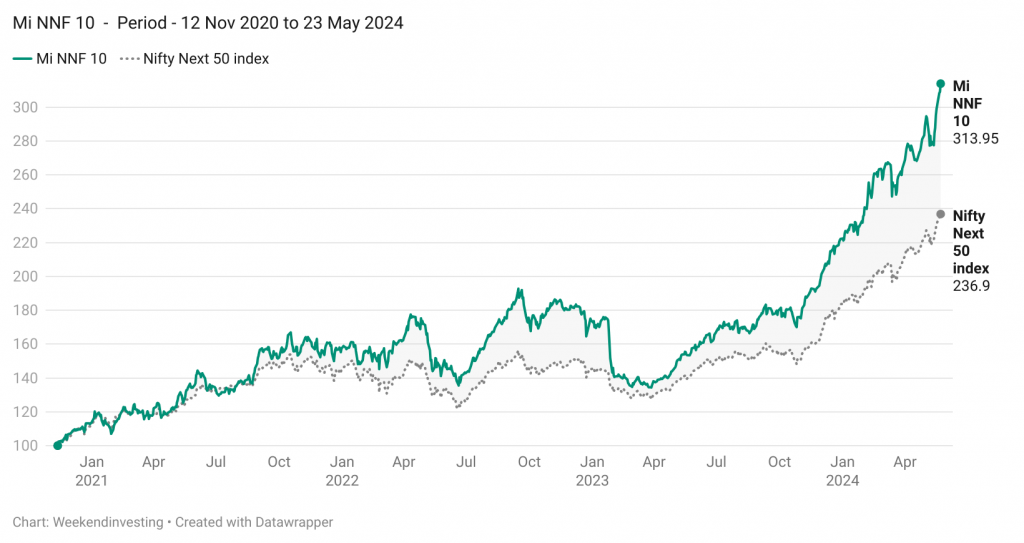

Mi NNF 10 hits 3x since launch !

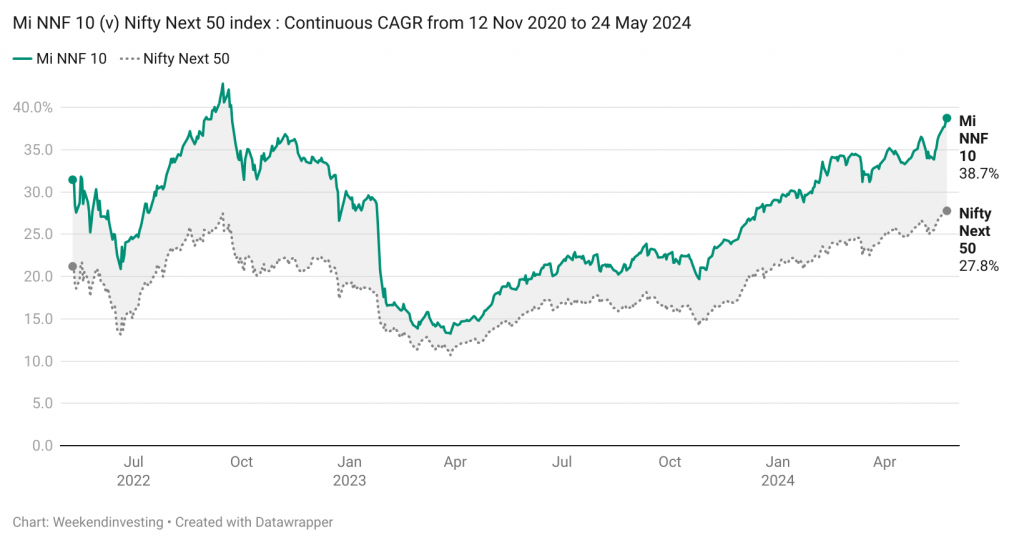

Mi NNF 10 has been one of our most popular strategies right since we launched it back in Nov 2020. The strategy has clocked an impressive 3x (200% gains) since going live on 12 Nov 2020 (3.5 years) at an exceptional CAGR of 38% (till 23 May 2024).

In the same period, Mi NNF 10’s benchmark index, the Nifty Next 50 (also called Nifty Jnr) has clocked 136% (vs 213% on Mi NNF 10) at a CAGR of 27% (vs 38% on Mi NNF 10)

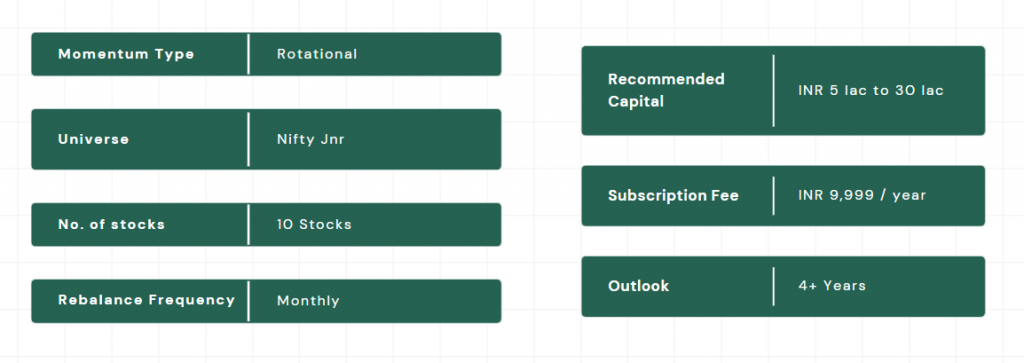

The highlight of the strategy is its ability to rotate into the top performing stocks within the Nifty Jnr index (Nifty universe #51 to #100 stocks) aiming to extract further alpha from this special universe which is already the best performer compared to some of the other popular benchmark indices across several timeframes.

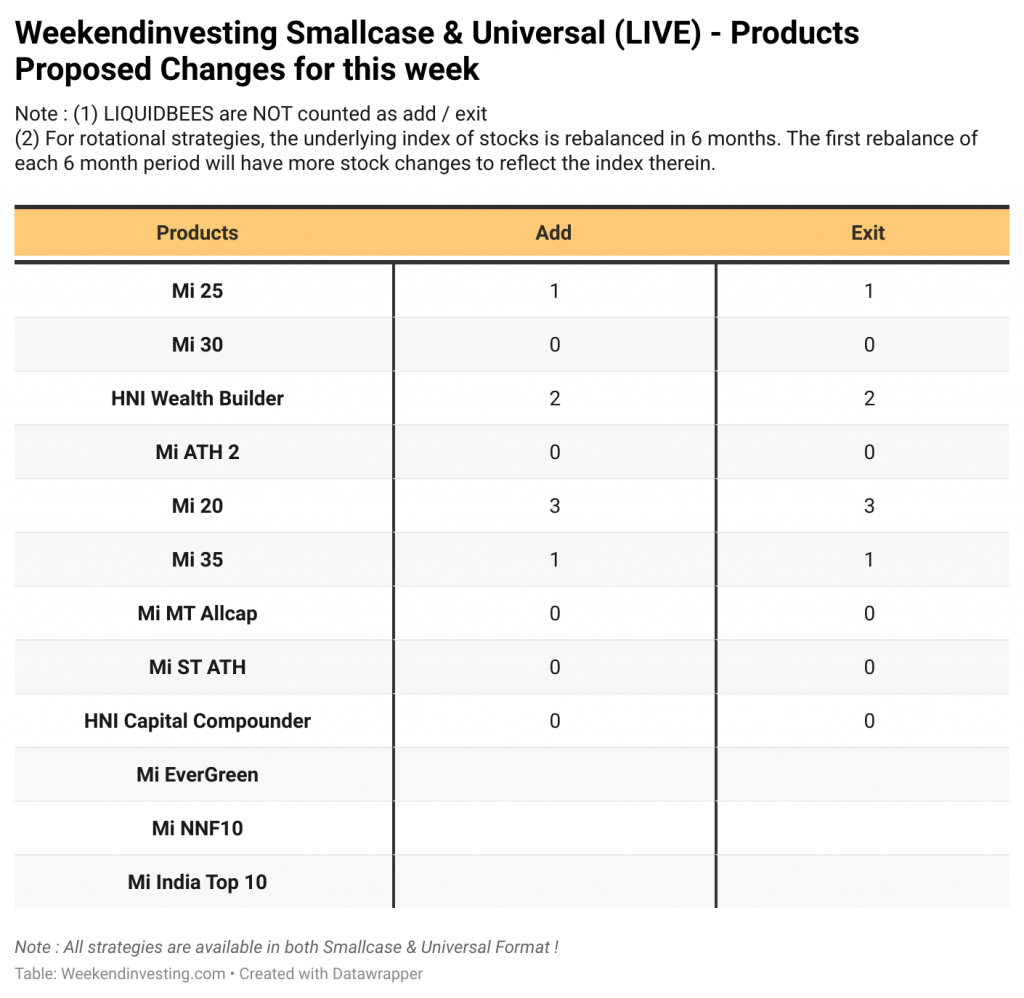

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.