- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Case Study on Adobe : Test of patience or inefficient use of capital

Adobe Inc., the powerhouse behind software like Photoshop and Adobe Reader, has captivated users for years. Its journey in the stock market reflects this dynamism, marked by significant highs and lows. Since 2001, the stock has experienced a rollercoaster ride, reaching . . . .

An amazing Mid Cap Large cap insight

In this insightful analysis, we delve into the comparative performance of CNX 200 and Nifty over the past two decades. Surprisingly, despite slight deviations in certain years, both indices have delivered nearly identical results. This raises an intriguing question: why do . . . .

Let’s dive into the fascinating journey of Nestle India as depicted in this 14-year chart analysis. From its humble beginnings around Rs200 in 2010 to its current impressive price of approximately Rs2500 in 2024, Nestle India has emerged as one of India’s biggest success stories. Despite encountering challenges like . . . .

As Tesla gears up to enter the Indian market, one might expect its stock to surge in anticipation of tapping into a vast automobile market. However, the reality is quite surprising. Despite the buzz surrounding its India expansion, Tesla’s stock has been on a downward trajectory, exhibiting significant volatility over the past year. This raises questions about . . . .

Recency Bias can be detrimental

The unpredictability of financial markets often catches investors off guard, challenging their assumptions and preconceptions. In this discussion, we shed light on the importance of . . . .

Today, we’re delving into an intriguing infographic from Samco focused on India’s market dynamics. One key metric highlighted is the VIX, which measures market volatility. Surprisingly, the VIX has taken a sharp 17% dive, catching many off guard, especially considering the . . . .

Where should one buy Gold now ?

In this insightful analysis, we’re diving into the gold price trends, specifically in INR. Over the past couple of months, there has been little change in the USD to INR exchange rate, making the gold price chart in both currencies practically identical. What’s fascinating to note is the . . . .

In this intriguing analysis, we’ll explore a fascinating phenomenon observed in the US and Indian markets over the past three years. We’ll delve into the performance of the S&P 500, representing large-cap stocks, and the Russell 2000, which tracks small-cap stocks. While the S&P 500 has surged by 28%, the Russell 2000 has experienced . . . .

You cannot guess what happens in few years

In this insightful analysis, we’ll examine the performance of four prominent banks over the past four years: ICICI Bank, Axis Bank, HDFC Bank, and Kotak Bank. Starting with ICICI Bank, we observe a remarkable gain of 110% since January 2020, showcasing its robust performance over this period. On the other hand, Axis Bank has registered a 50% gain, while HDFC Bank and Kotak Bank have . . . .

Intriguing insights emerge from a comprehensive analysis of gold seasonality, as depicted in the chart from seasonalcharts.com. This chart encapsulates the trends observed in gold prices over the past three decades, offering valuable insights into . . . .

Markets this week

The past week in the Nifty index showed positive signs, starting around 22,100 and closing at 22,450, marking a gain of approximately 350 points. There were no significant downward movements, although Friday saw some profit-taking activities. This week’s performance followed a period of volatility in the preceding weeks. The weekly chart displayed a slight upward trend, indicating some stability in the market for 2024. However, it remains uncertain if this marks the beginning of a sustained upward trend. The market may experience a significant move before the upcoming election results in the next five weeks.

For those new to the market, I advise not to be concerned about current market highs, even if there’s speculation about a potential peak post-election. I suggest that even in the scenario of a market downturn, such as a 20% decline over a year, it presents an opportunity to start investing gradually as the market establishes a base and eventually rebounds. I’d also like to stress on the importance of starting investing if you haven’t started yet. Even those who invested at market peaks during crises like the 2008 Global Financial Crisis or the COVID-19 pandemic in 2020 would have seen substantial gains over time. I’d recommend a runway of four to six years or more, as market returns are designed to occur over full cycles. Even entering at the end of one cycle presents an opportunity to build wealth over the next cycle.

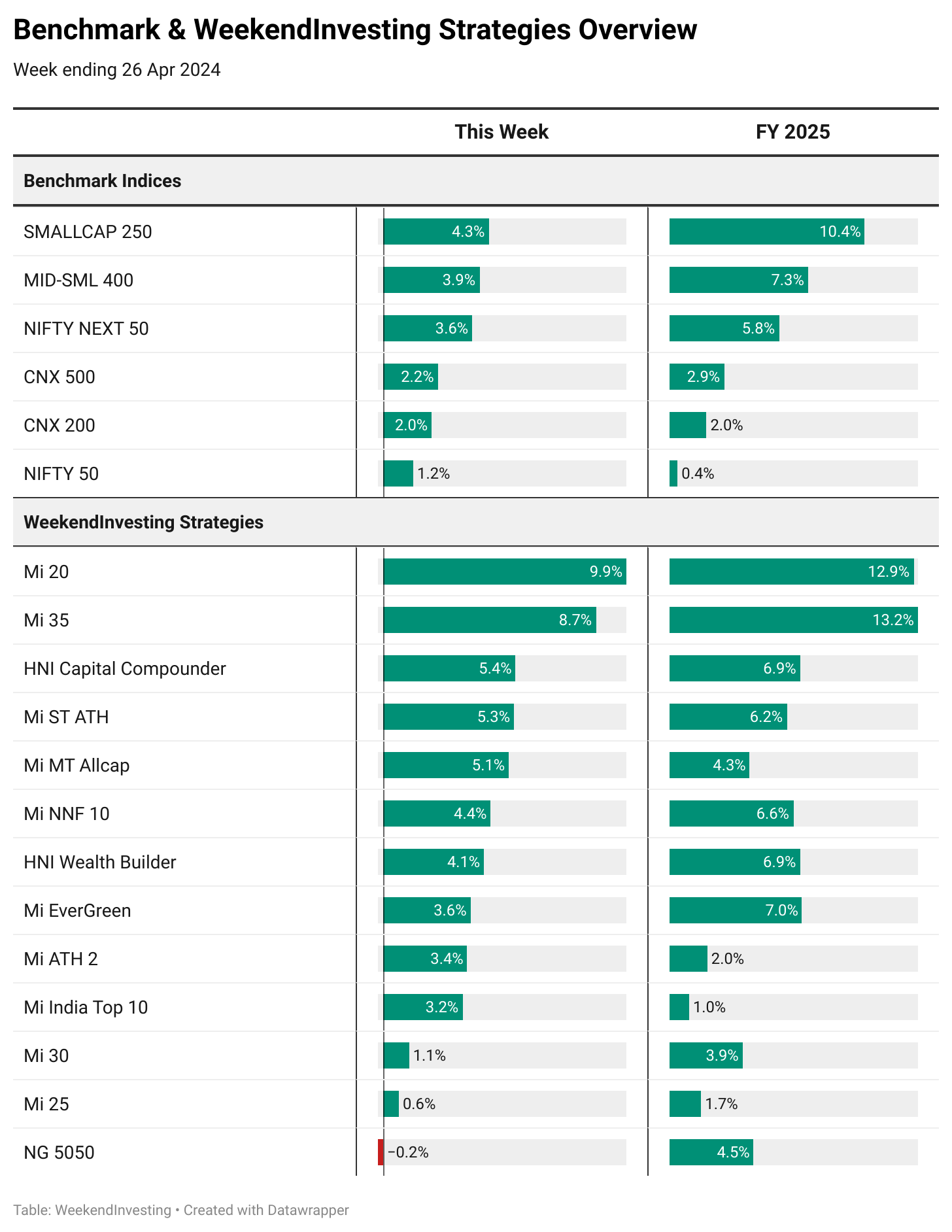

Benchmark Indices & WeekendInvesting Overview

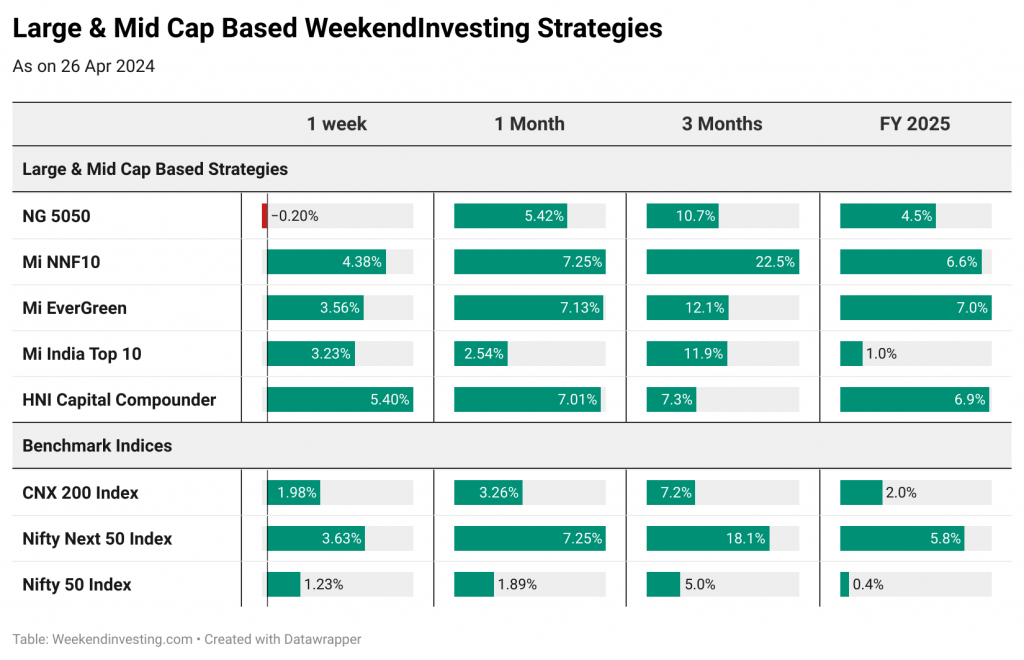

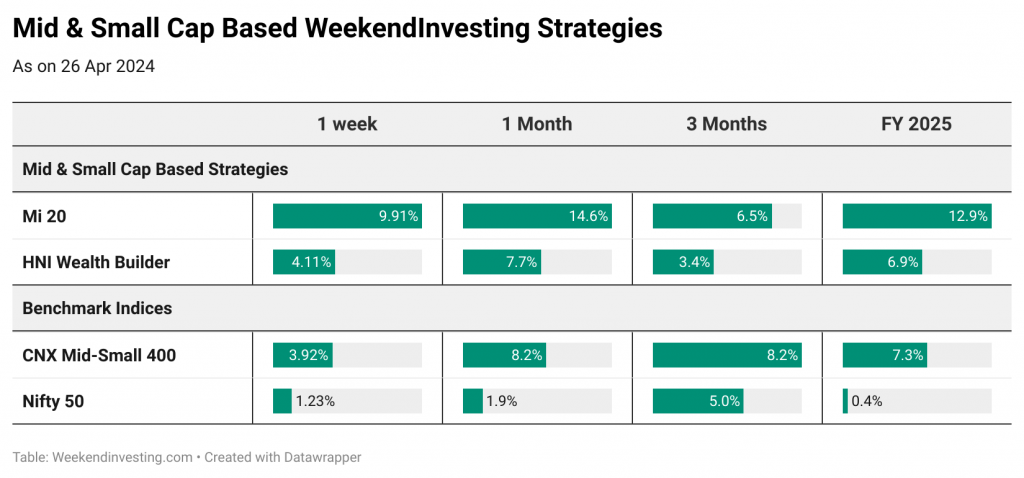

This week saw significant gains across various market segments. Smallcap 250 index led the pack with a robust 4.3% surge, followed closely by mid-small 400 index at 3.9%. The Nifty Next 50 index, regarded favorably by many investors, performed well with a 3.6% increase. Meanwhile, broader indices like the CNX 500 and CNX 200 posted gains of around 2%, while the Nifty itself gained 1.2%.

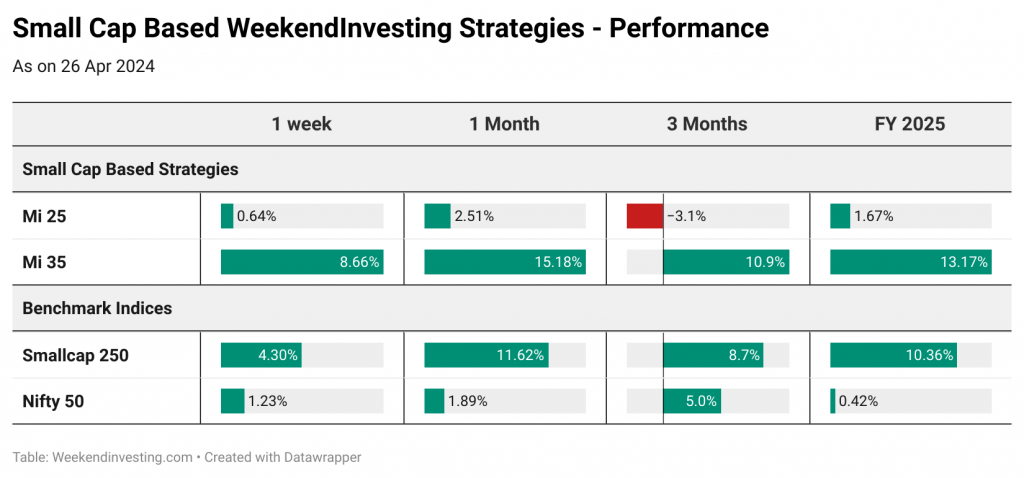

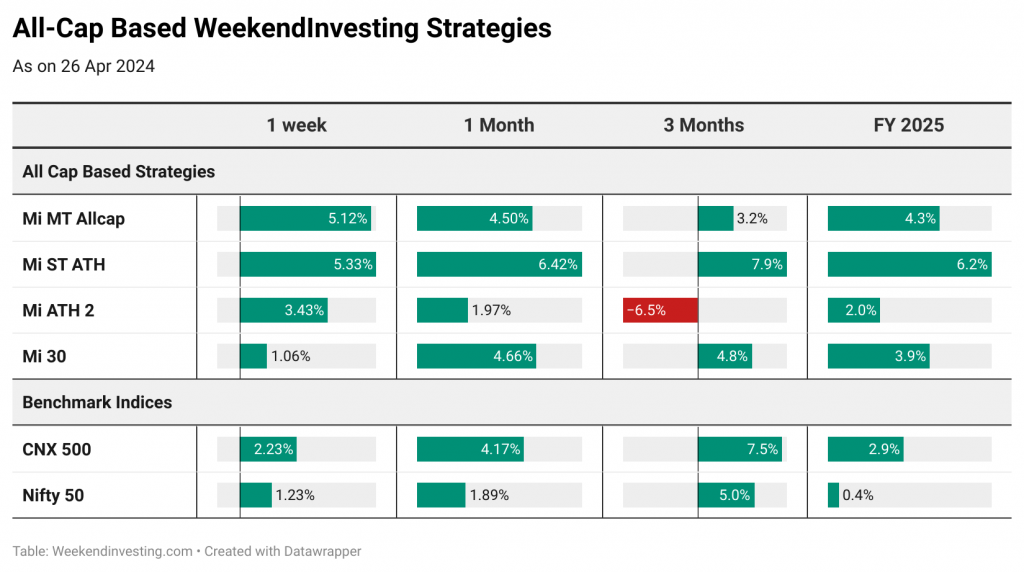

Notably, several WeekendInvesting strategies showed impressive performance this week. Mi 20 soared by 9.9%, marking a phenomenal start to the financial year 2025 after a remarkable FY 2024. Similarly, Mi 35 surged by 8.7% this week, outperforming benchmarks comfortably posting a remarkable 13.2% gain in FY 25. Other strategies like HNI Wealth Builder and Mi EverGreen also posted solid gains, adding to the list of top perming strategies. However, some strategies, such as Mi 25 and NG 5050, lagged behind this week, showcasing mixed performance. Despite minor setbacks, the overall market sentiment remained bullish, with the free NG 5050 portfolio too maintaining a decent 4.5% gain in FY 25 thus far.

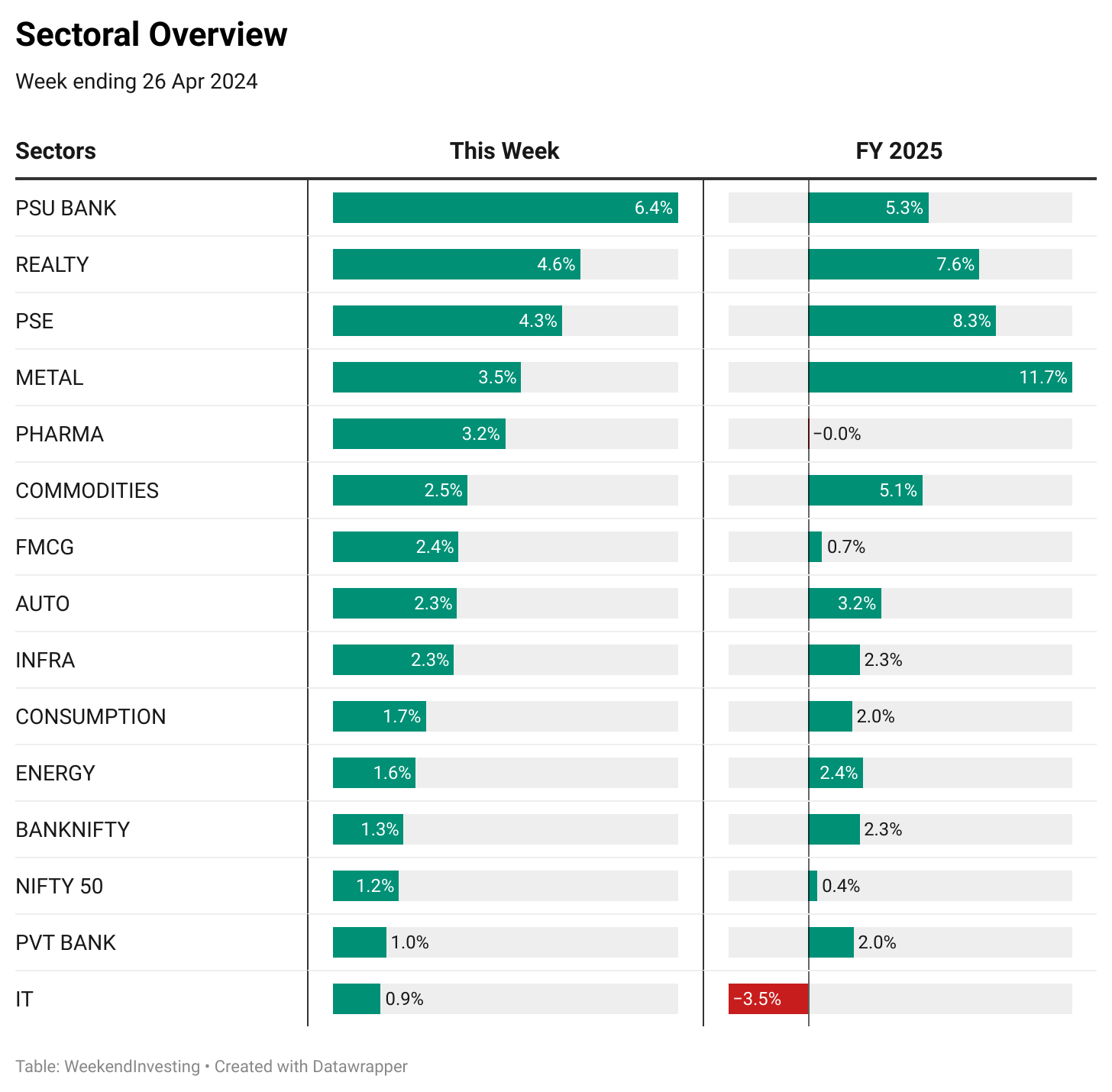

Sectoral Overview

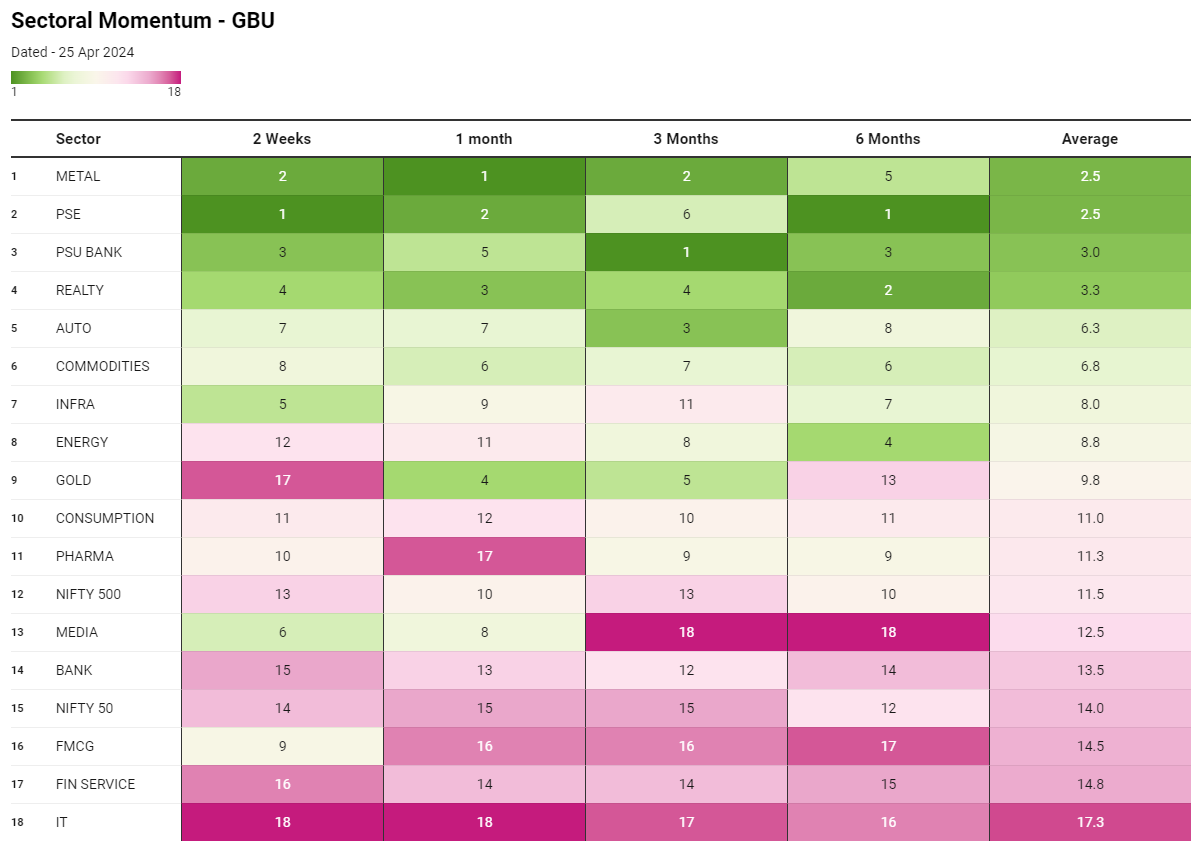

We witnessed significant gains in various sectors, with PSU banks leading the charge with a robust 6.4% surge. Real estate and public sector enterprise stocks followed closely behind, with gains of 4.6% and 4.3% in the current weel, respectively. However, the standout performer was the metals sector, which surged by 3.5% this week, marking an impressive 11.7% gain so far in the new financial year. The pharmaceutical sector also made a strong comeback, erasing all losses for the year with a 3.2% gain (current week). Additionally, commodities performed well, posting a 2.5% gain this week and reaching a 5% increase for the financial year. Conversely, IT stocks, while showing some improvement with a 0.9% gain, remain 3.5% down for the current financial year.

Gold prices have experienced a recent decline, while public sector enterprise stocks, metals, and PSU banks have shown notable movement in the last couple of weeks. Among these sectors, metals have demonstrated the strongest performance consistently across various periods, indicating their significant influence in driving market momentum. Therefore, for discretionary investors seeking trading opportunities, focusing on these sectors—metals, public sector enterprises (PSEs), PSU banks, and real estate—could be particularly beneficial.

WeekendInvesting Strategy Spotlight

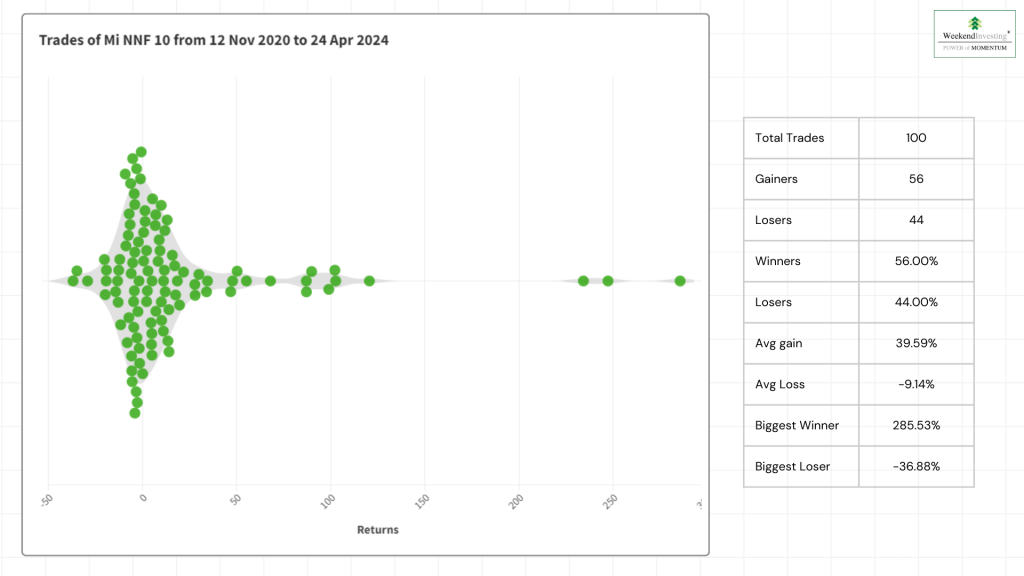

The casino math behind Mi NNF 10

The “casino math” concept in Mi NNF 10 is intriguing. Since its launch in November 2020, the strategy has executed approximately 100 transactions. Out of these, 56 resulted in gains, while 44 ended in losses, indicating a win rate of 56% and a loss rate of 44%.

Interestingly, the average gain per winning transaction stands at 39.5%, whereas the average loss per losing transaction is 9%. This dynamic mirrors the workings of a slot machine in a casino, where the wins are more substantial than the losses. By allowing winning positions to run while cutting short losing ones, the strategy emulates the strategy of maximizing gains and minimizing losses.

This approach resembles the dynamics of a horse race, where underperforming horses are replaced with new contenders, and the leading ones are allowed to maintain their momentum. Overall, this strategy aims to capitalize on outliers that significantly impact its performance, highlighting the essence of momentum investing.

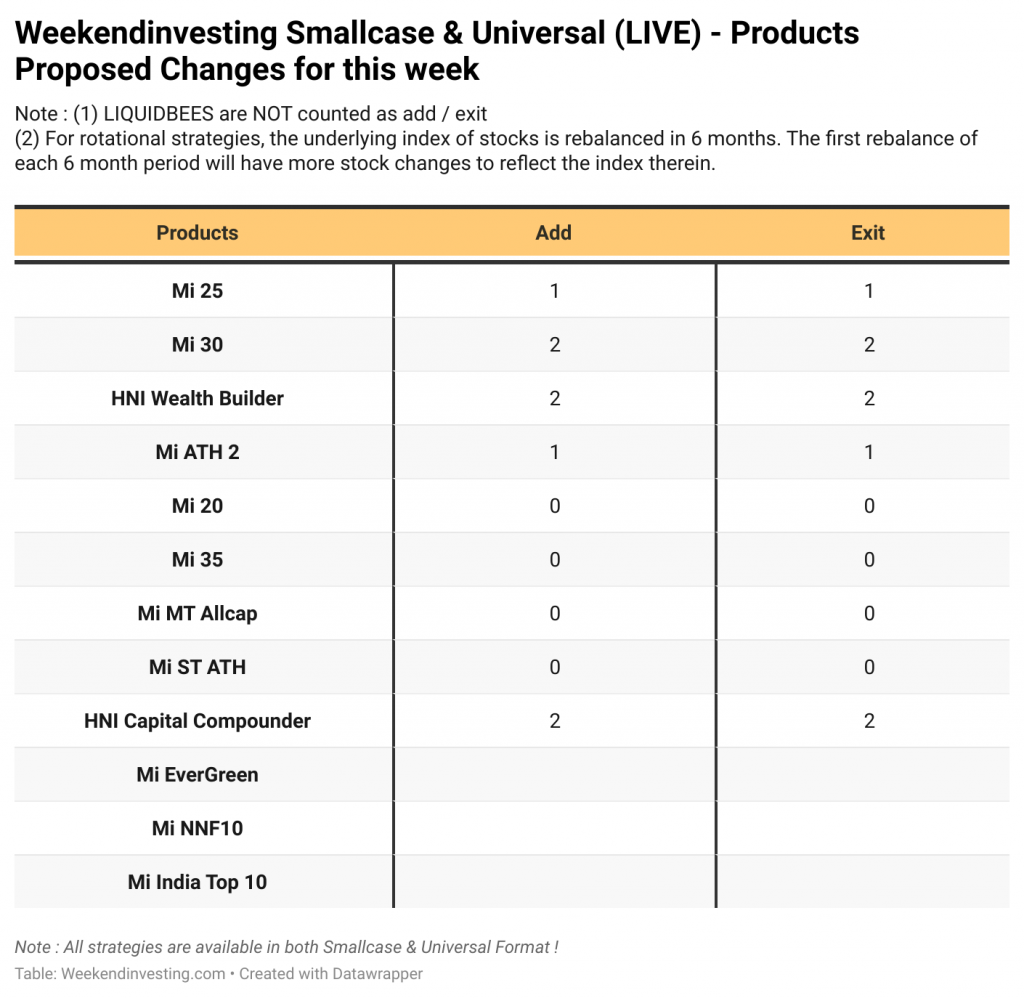

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.