Mi NNF 10 Prices are going to be increased from 01 Apr 2024

Effective 01 Apr 2024 , Mi NNF 10’s subscription fee will be increased for the first time since launch.

This adjustment is necessary to ensure that we can maintain the high-quality standards and provide you with the best possible investment experience.

Old Pricing : Rs 2,499 (Quarterly) | Rs 7,499 (Annual)

New Pricing : Rs 3,333 (Quarterly) | Rs 9,999 (Annual)

Watch this special video to know more

For Current Subscribers of Mi NNF 10

Nothing changes for current subscribers at all. You shall continue to enjoy access to the strategy at your current subscription fee as long as you do not break your subscription loop. Kindly ensure that you renew your subscription on time.

For those who haven’t subscribed yet

This is a great opportunity to subscribe to Mi NNF 10 at its current pricing. Use the link given below to subscribe.

- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight - Mi NNF 10

- Rebalance Update

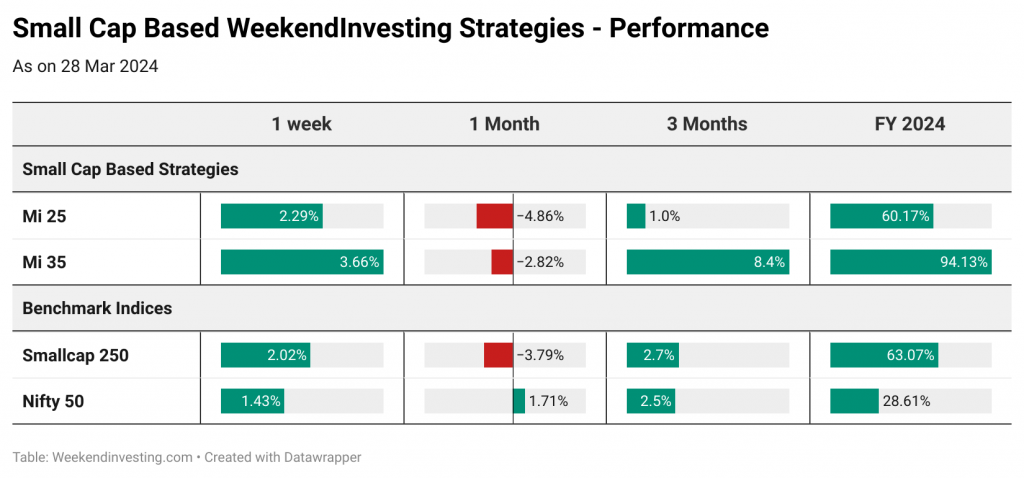

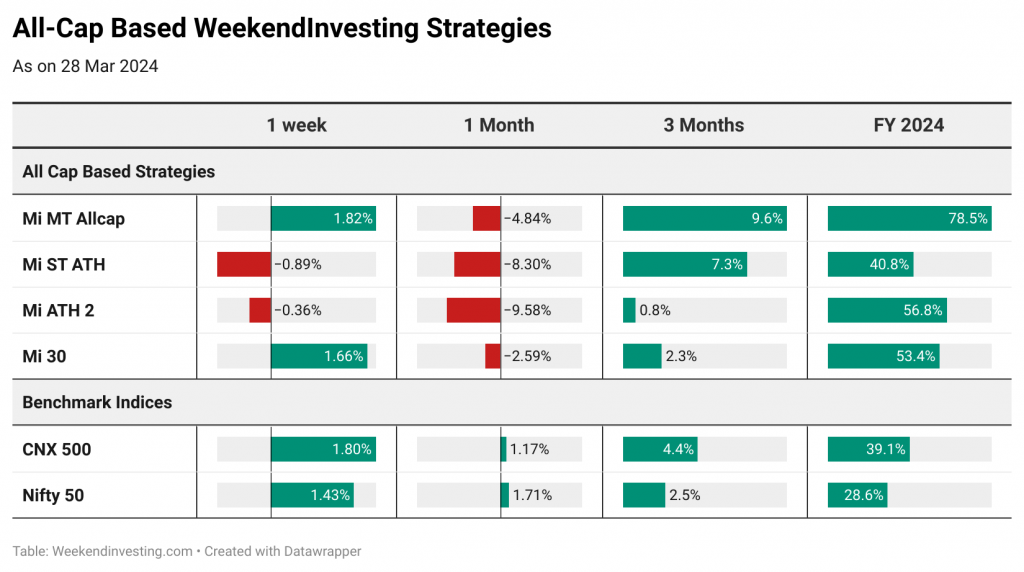

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

Hatsun Agro Products, a stock that lingered between 400 to 600 for years, saw a remarkable turnaround post-COVID. Despite a gradual decline, it surged beyond its previous highs in late 2020, reaching an all-time high by September-October. This caught the attention of one of our momentum strategies (HNI Wealth Builder), leading to a . . .

Should we follow the Central Bankers ?

In recent years, central banks around the world have been on a gold-buying spree, and the numbers are staggering. According to data from Bank of America global research, their net purchases have skyrocketed, particularly since the 2008 Global Financial Crisis. What was once a modest 400 tons per year has now surged to . . . .

Why all good stocks cannot be in all strategies!

Every investment strategy operates differently, tailored to specific risk-reward profiles and objectives. Just like how different models of cars have varying engine tunings for performance or fuel efficiency, investment strategies are tuned for specific purposes. For instance, momentum-based strategies share the same core principles of buying winners and selling losers but . . . .

Can you really go wrong in India ?

Over the past few decades, Japanese investors have witnessed remarkable growth in their equity and gold portfolios. For those who entered the workforce around 2000, their journey has been marked by . . . .

When it comes to investing in the stock market, many investors worry about timing their entry, fearing that starting during a downturn may lead to losses. However, data from Funds India Research reveals an interesting trend: regardless of when you start investing . . . .

Which markets are the best in the world to invest in ?

In a recent tweet by Zafar Sheikh of Investors Capital, a fascinating comparison of index returns from various global markets over the past five, ten, and 15 years was shared. These insights provide valuable perspective on . . . .

Markets this week

As we bid farewell to March, we also mark the close of a significant chapter – the end of the quarter, the fiscal year, and what has been a remarkable year overall. Reflecting on March 2023, it’s fascinating to note how perceptions have shifted over the past year. Few could have predicted the market’s current trajectory, yet here we are, witnessing exceptional performance across both large and small caps. This unexpected surge coincides with the approaching elections, stirring unique dynamics within the market.

Nifty was remarkable the entire last week which was largely a 3 session week due to the Holi and Good Friday festivities. There was some profit booking towards the fag end of the FY 24 (last 30 minutes to be precise) but still the overall outcome was positive when compared to the previous week.

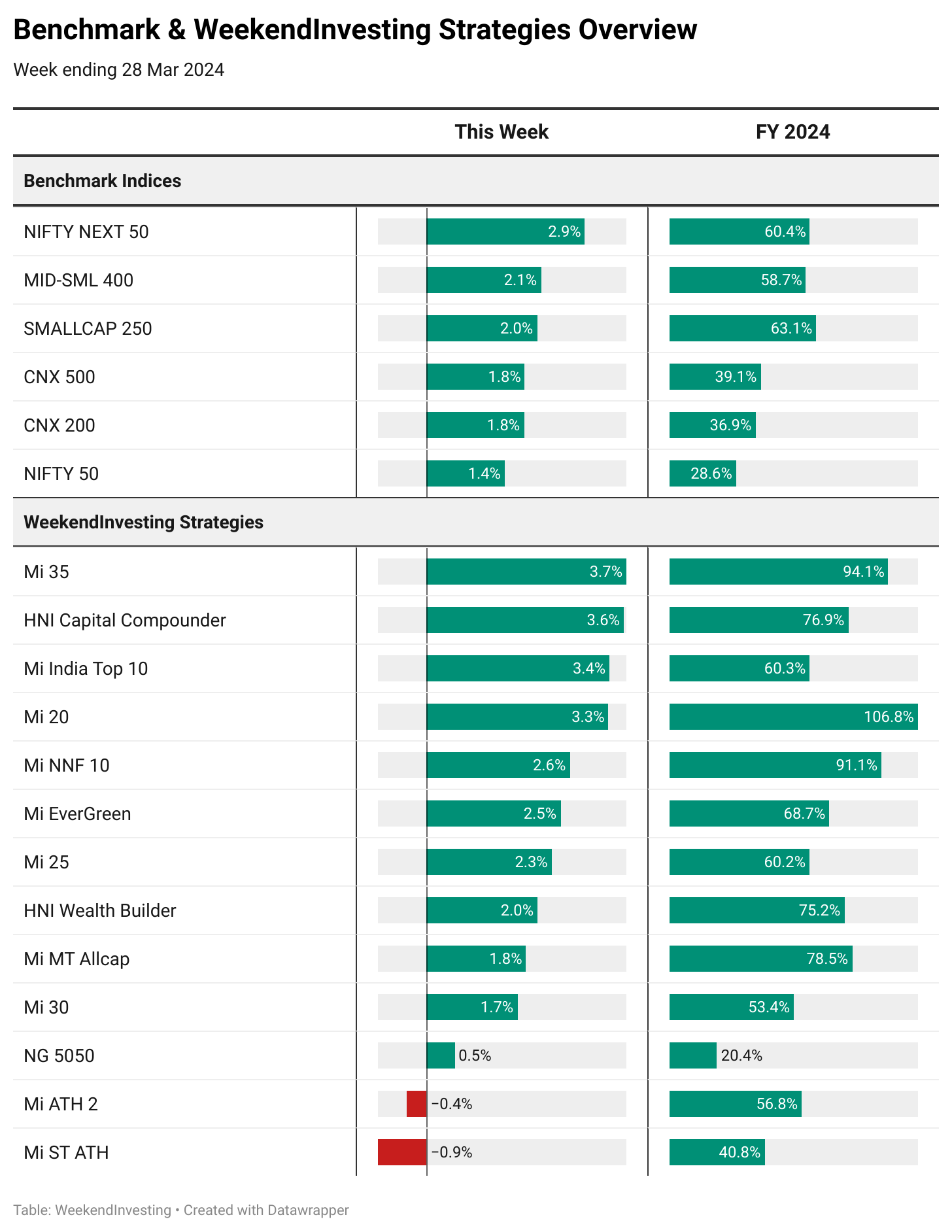

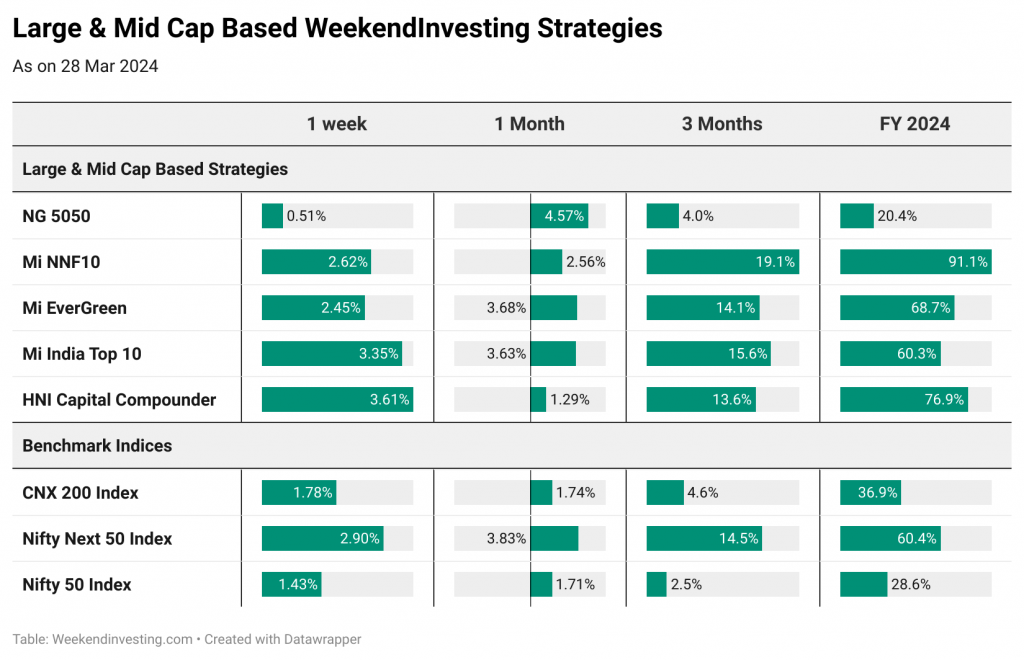

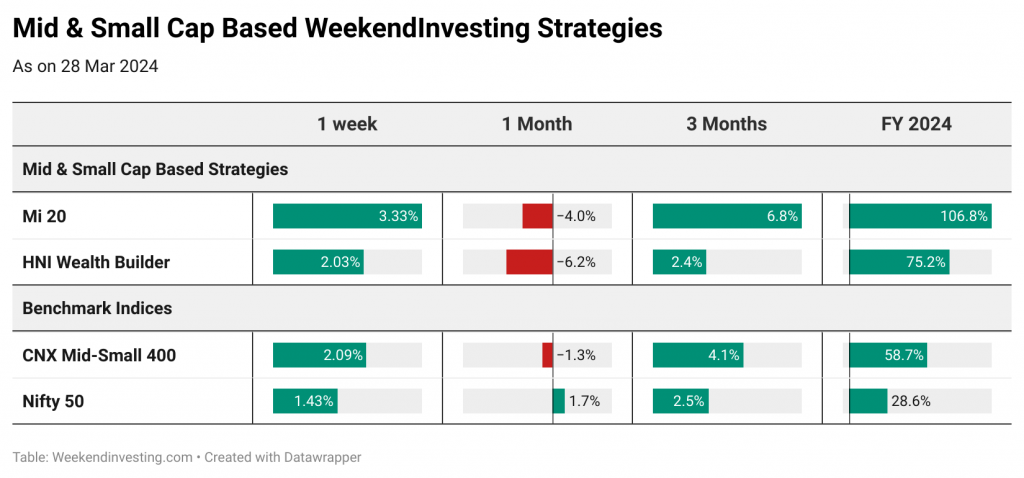

Benchmark Indices & WeekendInvesting Overview

Most folks would be quite satisfied with the way markets have turned up particularly in the last couple of weeks with superb recovery after a rocky start back in March 2024. This week, Smallcap 250 and Mid-small 400 were back in business with gains of 2% each which was much needed considering the downward slide these lower cap benchmarks had witnessed in early March 2024. Nifty Jnr was in its elements though recording superb gains of 2.9% thus topping the weekly chart as well while rest of the benchmarks witnessed gains between 1.4% and 1.8%. FY 24 has been a phenomenal year for Midcaps and Smallcaps with Mid-Small 400 recording a superb 58% gains followed by Smallcap 250 at 63% gains. But the real show stealer has to be Nifty Next 50 which has recorded a massive 60% gains, on par with midcaps and smallcaps. Nifty 50 put on a decent show clocking 28%.

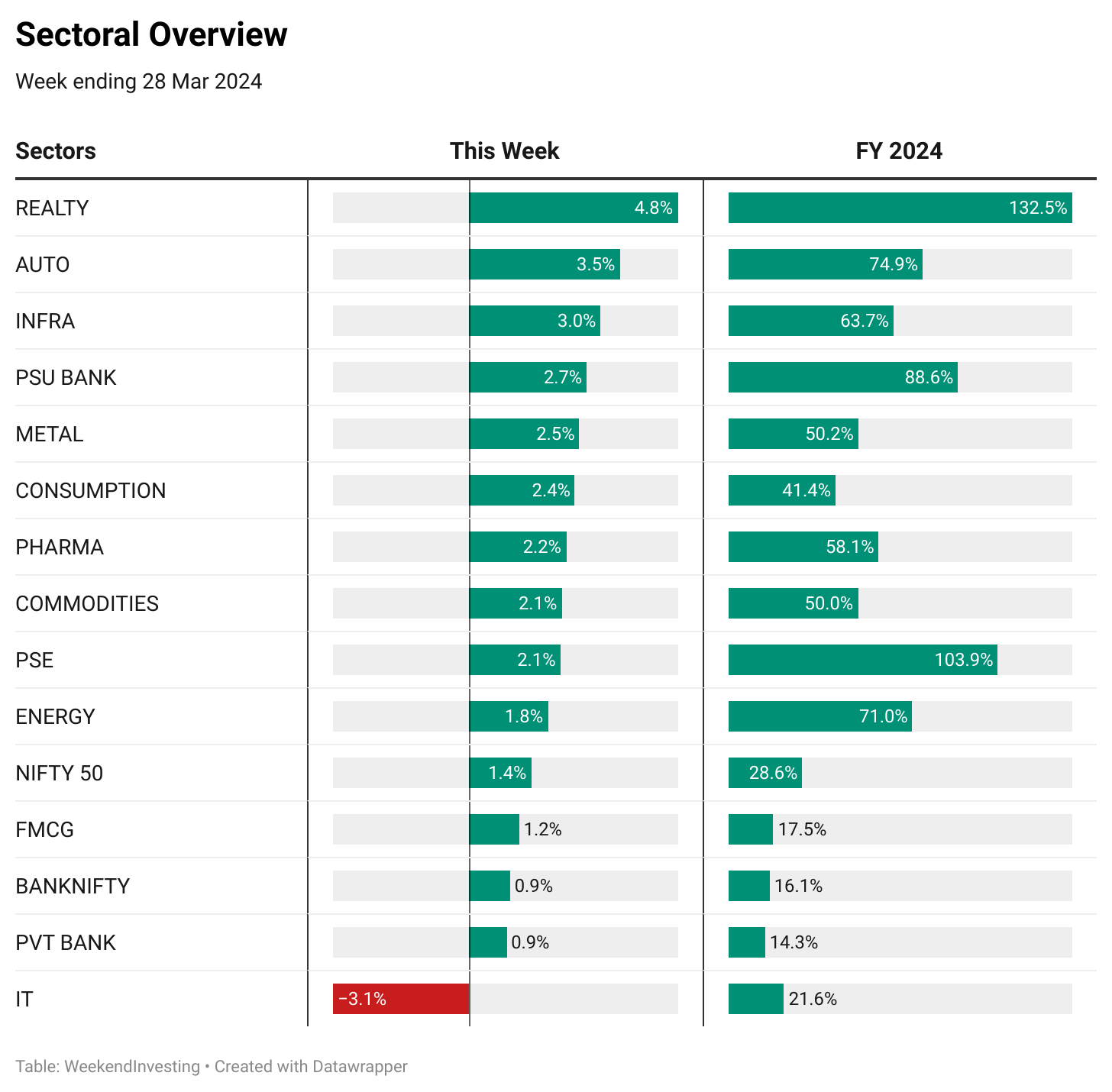

Sectoral Overview

REALTY ended its chart topping FY24 run with a splendid 4.8% gains (weekly) and 132% (FY24). All sectors barring IT (-3%) had a good week. AUTO, INFRA, METALS & PSU BANKS performed quite week to recover from the earlier slumps. PSE came in a end position in FY 24 chart with gains of 103% followed by PSU BANKS at 88%. FY 24 proved to be very comforting especially after a difficult volatile phase in the markets prior to that. Most sectors managed to outperform the Indian benchmark, Nifty 50 with FMCG, BANKS and IT being the only ones to record underperformance.

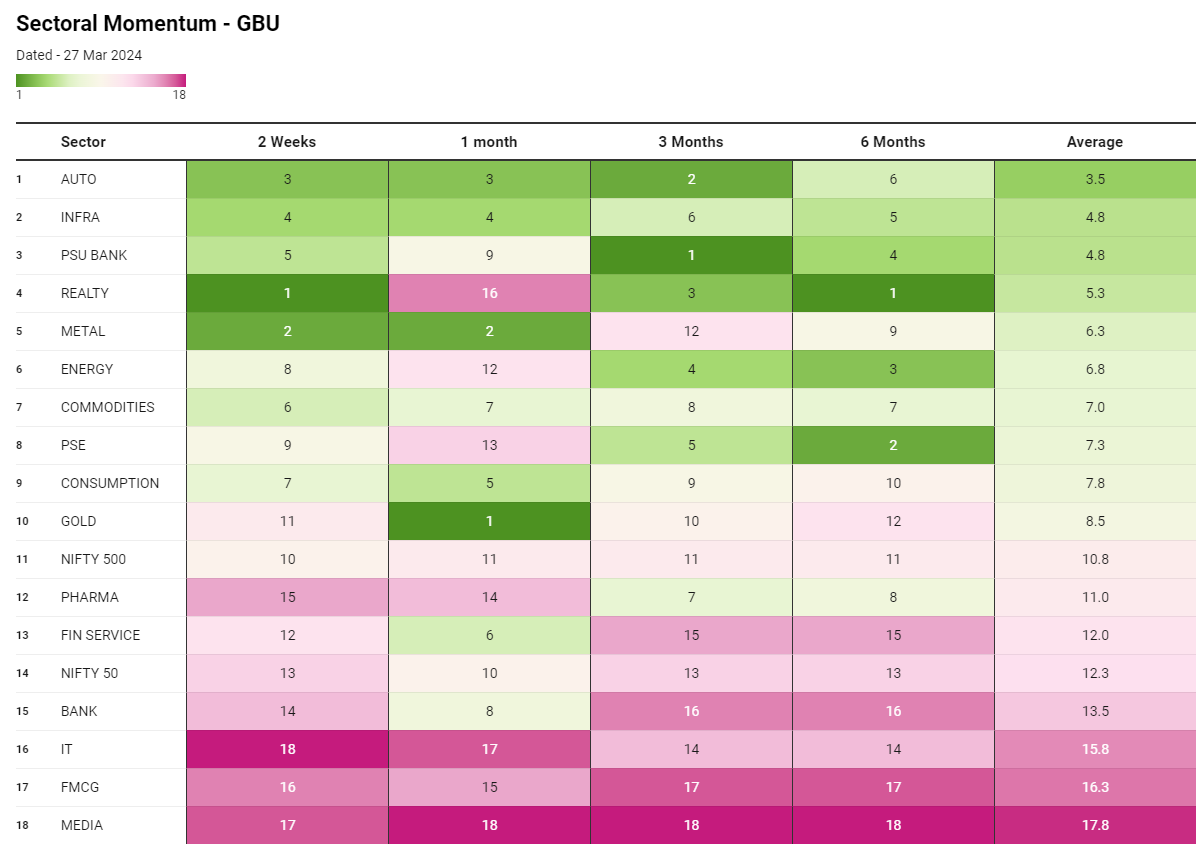

AUTO sector has done well to get back right on top with a consistent run in the recent 6 months with INFRA taking the second spot. What is interesting to note is that neither AUTO nor INFRA have taken the top positions in any of the timeframes mentioned below but their consistent run has ensured that they occupied the top two spots as far as the overall average performance is concerned. REALTY has come back quite strong to top the weekly chart after a bit of a slump in the last month. This sector has also done consistently well across FY 24 barring the short profit booking period in Mar 2024. GOLD has slipped from #1 in monthly chart to #11 on the fortnightly while IT continues to languish at the bottom along with FMCG and MEDIA.

WeekendInvesting Strategy Spotlight – Mi NNF 10

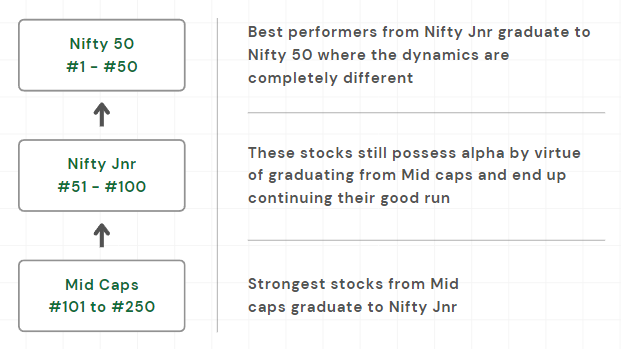

Why should you have exposure to the Nifty Next 50 Index (Nifty Jnr) ?

A large cap index performing in line with a smallcap index is something that can throw a lot of people by surprise but that is exactly was Nifty Next 50 has done. Popularly called as the Nifty Jnr, this index comprises of stocks between #51 and #100 in the Nifty Universe. When you compare the performance of this index against the Smallcap 100 index and the Nifty 50 index over the last 20 years, you will notice that the Nifty Jnr’s performance has been nothing but outstanding and has caught a lot of attention for its Smallcap-like performance despite holding top quality large cap stocks.

What is happening is the fact that the best performing stocks from the mid caps graduate to enter the Nifty Jnr and continue their good performance thus aiding the index in putting up a solid performance.

Mi NNF 10 is a 10 stock – rotational momentum strategy that aims to extract alpha from this high performance Nifty Jnr Index.

The subscription fee for Mi NNF 10 increases to Rs 9,999 from Rs 7,499 effective 01 Apr 2024. So please do make use of this opportunity if you are still not subscribed.

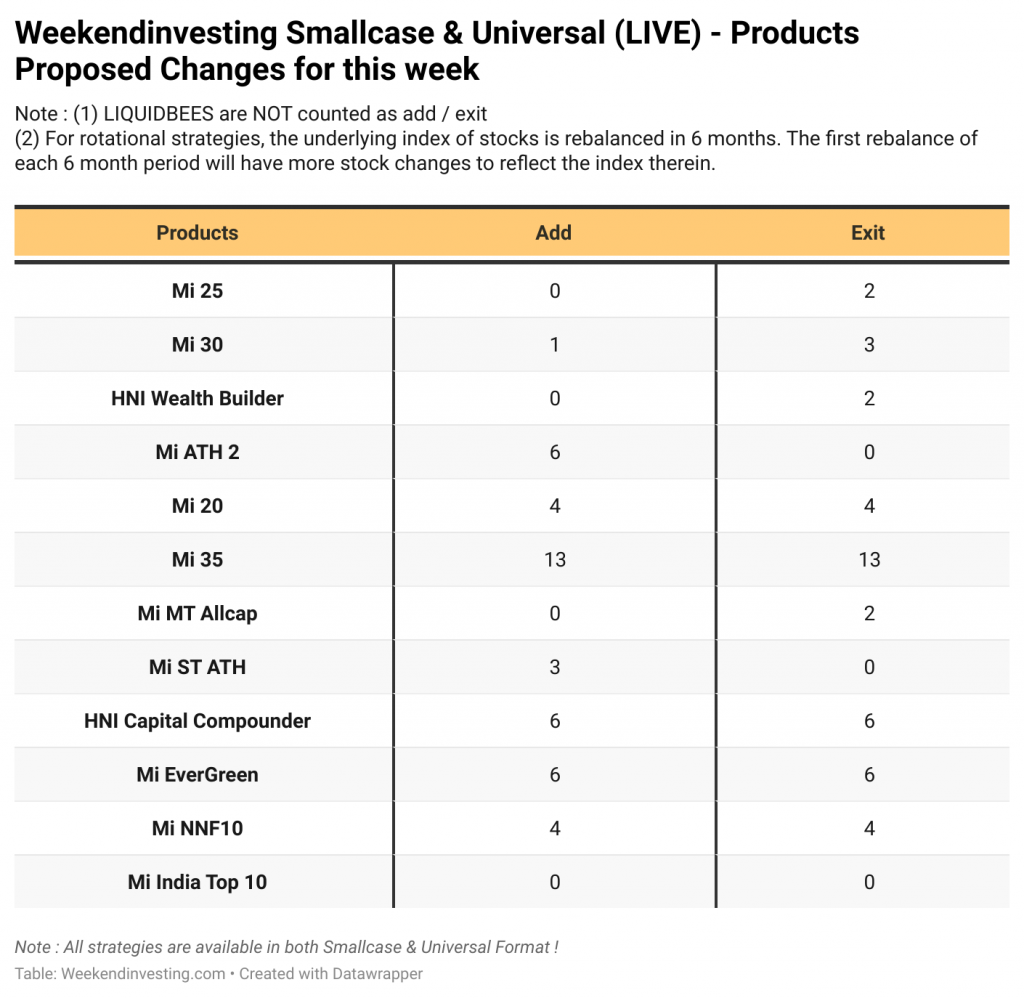

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s report.