- The WeekendInvesting Newsletter

- From the Research Desk of WeekendInvesting

- Creating Awareness

- Markets this week

- Benchmark Indices & WeekendInvesting Overview

- Sectoral Overview

- WeekendInvesting Strategy Spotlight

- Rebalance Update

- WeekendInvesting Strategies Performance

- WeekendInvesting Products – LIVE Index Data

- WeekendInvesting Telegram and YouTube Channel

- Introducing M Profit

The WeekendInvesting Newsletter

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Check out our past newsletters.

From the Research Desk of WeekendInvesting

It’s essential to understand the circuit limits set by the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). These limits are in place to manage volatility and ensure orderly trading. While there’s no current indication that . . . .

Bear markets can be distressing for investors. When the market falls, many people panic and sell their stocks. But why does the market fall? It happens because . . . .

The chart of Foreign Institutional Investor (FII) ownership as a percentage of total market capitalization reveals interesting trends. About a decade ago, FII ownership in the BSE 200 and overall Indian equity market showed . . . .

When will you buy your House ?

When considering whether to buy a house, there are many factors to think about, such as location, responsibilities, and family needs. However, one key aspect often discussed is the financial perspective. This discussion is based on trends observed in . . . .In the world of stock market investments, the “Magnificent Seven” stocks are highly talked about. These stocks include Tesla, Apple, Microsoft, Amazon, Google, Meta, and Nvidia. Since the start of the year, their performance has

In the world of stock market investments, the “Magnificent Seven” stocks are highly talked about. These stocks include Tesla, Apple, Microsoft, Amazon, Google, Meta, and Nvidia. Since the start of the year, their performance has . . . .

Less than 3% stocks will make most of your wealth

A recent analysis of US companies over the past 90 years provides valuable insights into wealth creation in the stock market. The data shows that a small percentage of companies generate . . . .

An infographic from ICICI Direct highlights the debt to GDP ratios of various countries. This ratio measures a country’s debt compared to its economic output or GDP. A high debt to GDP ratio indicates that . . . .

Your investing is dependent on your psychology

When thinking about investing, your goals significantly influence your strategy. If your goal is to buy a house in the future, your approach to investing will be different compared to someone who already owns a home. This difference is rooted in psychology and behavior. For instance, if you . . . .

Stocks are losing premium over Bonds

This interesting chart highlights the S&P 500 earnings yield compared to the ten-year Treasury yield. Recently, as Treasury yields have gone up, the gap between what you . . . .

Markets will move ahead despite roadblocks

Markets are running fast and at an elevated point. Many people feel nervous about the markets, especially with constant talks about potential events that might disrupt them significantly. Over the past eight years . . . .

Creating Awareness

Markets this week

It was an unforgettable week in the markets, marked by dramatic moves and broken expectations, yet culminating in a new all-time high close. Despite anticipating a stronger government outcome, which did not materialize, and the opposition narrowly missing governance, the market displayed resilience. The market’s performance, reaching an all-time high, serves as the ultimate indicator of current sentiment and confidence, underscoring that the market’s perception is undeniably positive.

Nifty experienced significant volatility earlier this week. Initially, there was a rally driven by positive exit poll predictions, suggesting a comfortable victory. However, when actual election results indicated a closer outcome, nearing a hung parliament, the market faced a sharp decline. Despite the initial negative reaction and media narrative emphasizing the unexpected results, the market rebounded once it assessed the actual numbers, realizing they weren’t as bad as perceived.

The market closed at a new all-time high of around 23,270, marking a remarkable recovery. This week saw an unprecedented market candle where Nifty started at a new high, plunged to lows not seen in three to four months, and then recovered to close at a new high. This historical movement established the 21,200 mark as a crucial support level. Moving forward, as long as this level holds, the market is expected to remain stable, possibly entering a consolidation phase.

Benchmark Indices & WeekendInvesting Overview

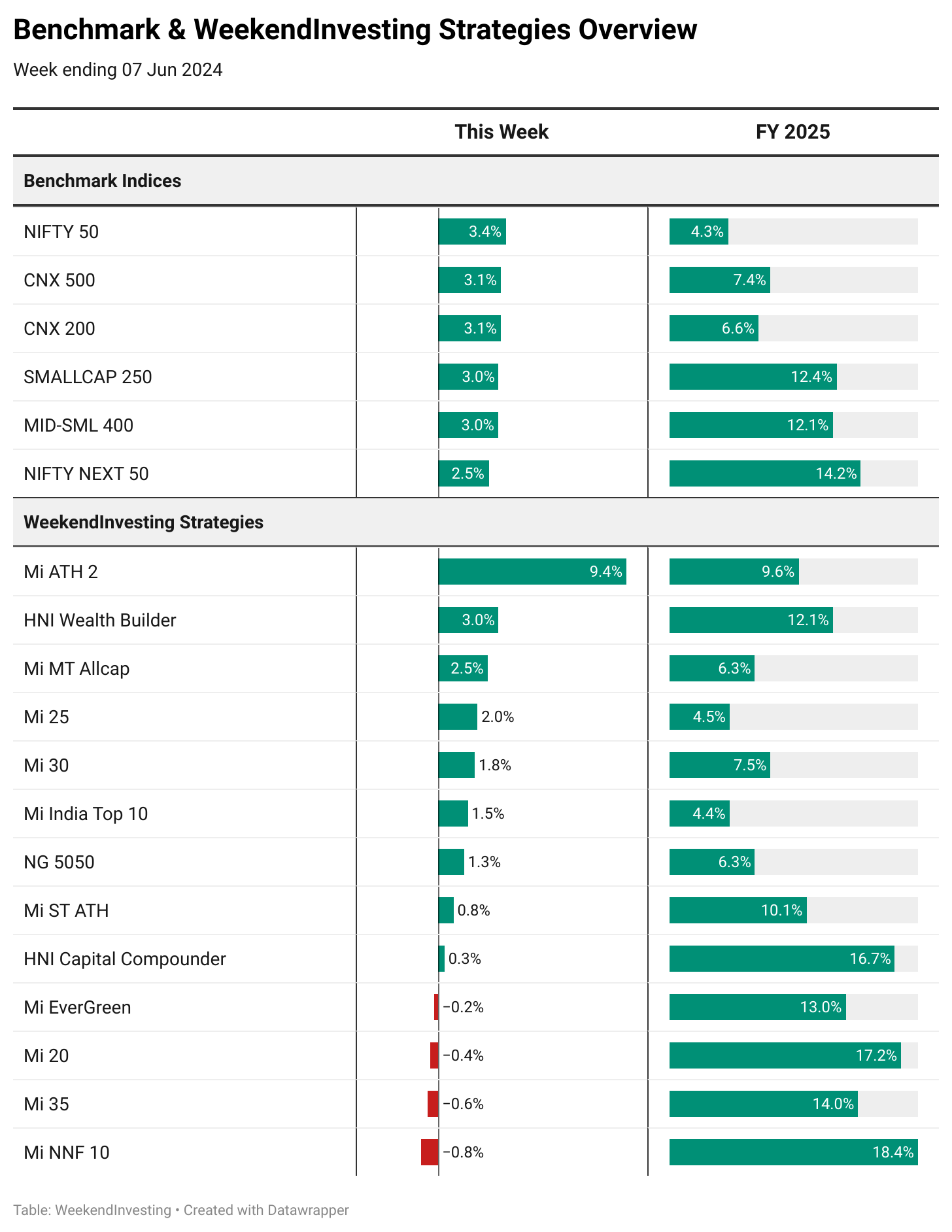

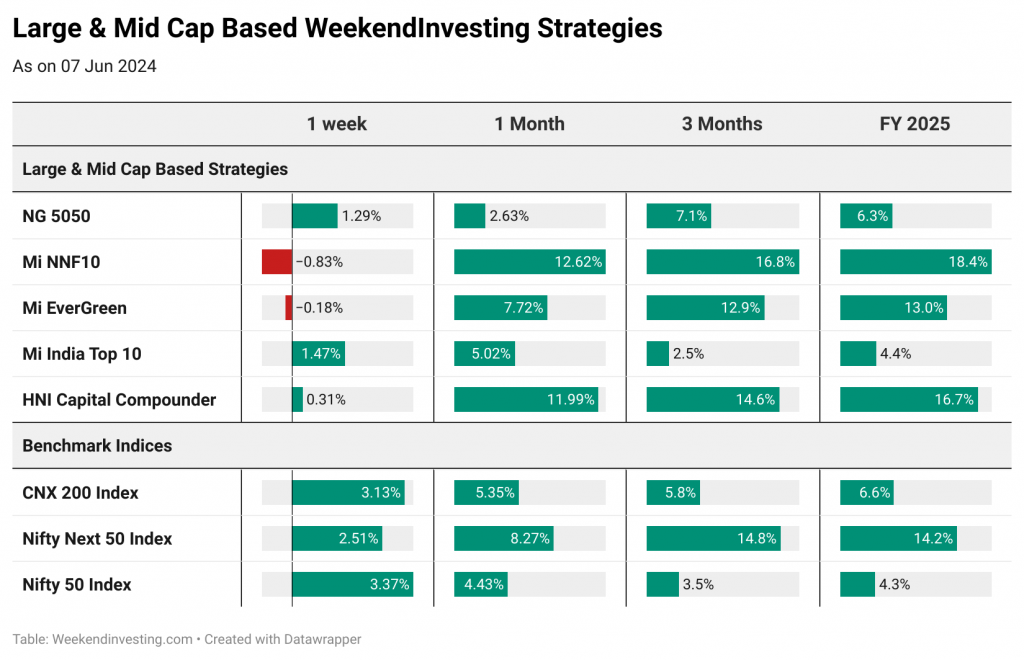

This week was remarkable for Nifty 50, which rose by 3.4%. For FY 25, Nifty 50 has already gained 4.3%, with most of this gain occurring this week. Other indices also saw significant gains, with the CNX 500 and CNX 200 both up by 3%. Gains ranged between 2.5% to 3.4% across various indices. Notably, the Nifty Next 50, composed of large-cap stocks, has achieved a substantial 14.2% gain in FY 25 so far.

This week saw impressive performances in various weekend investing strategies:

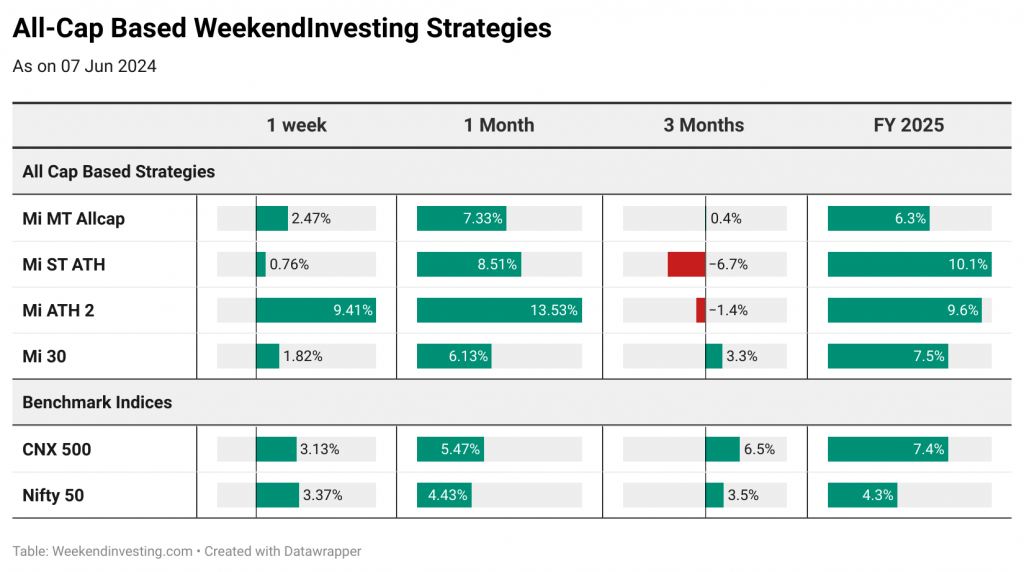

Mi ATH 2: Up 9.4% this week, contributing to a total gain of 9.6% for FY 25, with almost all gains occurring this week.

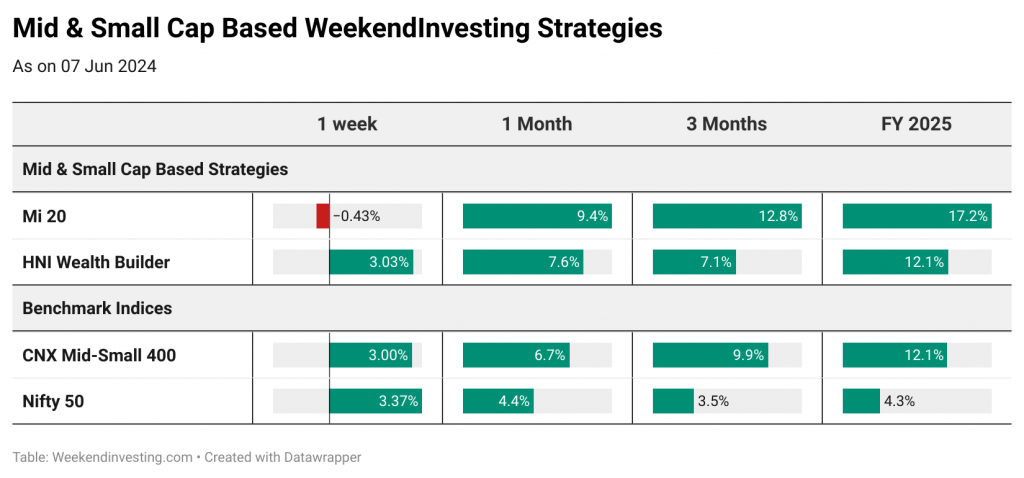

HNI Wealth Builder: Achieved a 12.1% gain for FY 25, with a 3% increase this week. Despite being highly diversified with up to 50 stocks, it has shown strong performance.

Mi MT Allcap: Up 6.3% for FY 25.

Mi ST ATH: Gained 0.8% this week, and is up 10.1% for FY 25, outperforming Mi ATH 2 on an FY 25 basis.

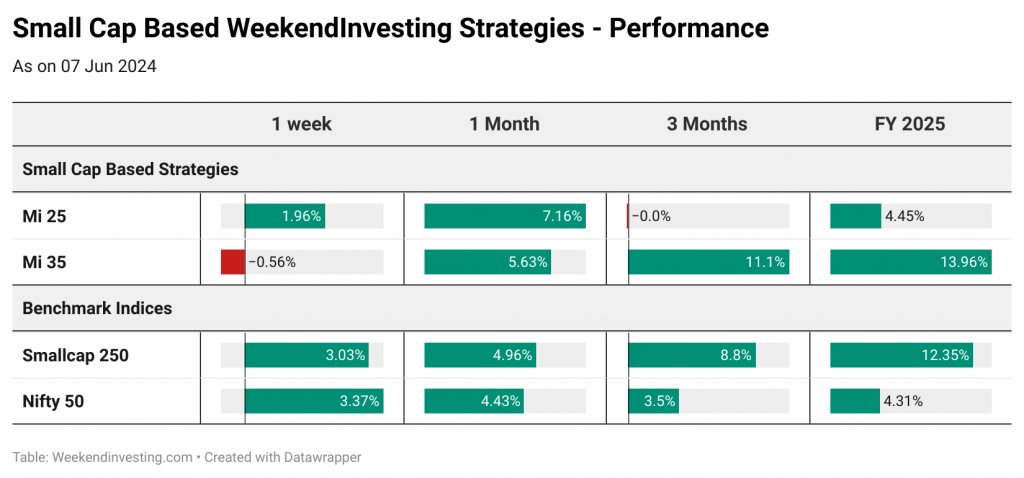

Mi Evergreen, Mi 20, and Mi 35: These took a backseat due to their high allocation towards public sector enterprises, defense stocks, and public sector banking stocks, which underperformed this week.

Mi NNF 10: Down 0.8% this week due to similar reasons, underperforming compared to the Nifty Next 50, which was up 2.51%. However, Mi NNF 10 still leads with an 18.4% gain for FY 25, outperforming the Nifty Junior Index, which is up 14.2%.

Sectoral Overview

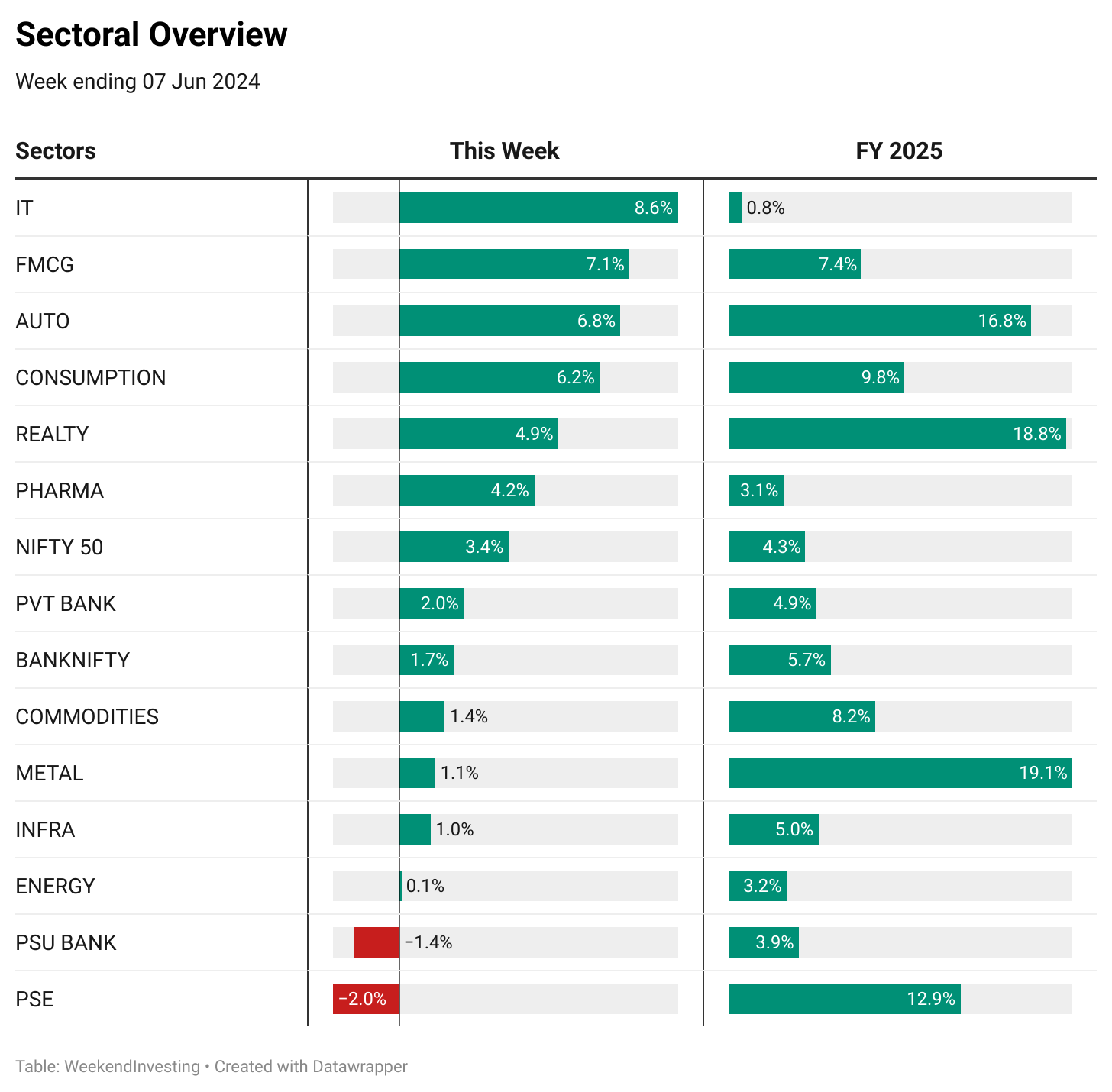

This week saw significant sectoral rotations in the market, with previously underperforming sectors leading the charge:

IT Sector: Up 8.6% this week, now up 0.8% for the financial year (FY 25). This sector made a significant comeback after trailing.

FMCG (Fast-Moving Consumer Goods): Increased by 7.1% this week, bringing its FY 25 performance to 7.4%. Most gains came this week.

Autos: Performed well with a 6.8% increase this week and a 16.8% rise for FY 25. Leading companies like Tata Motors, Maruti, and Mahindra contributed to this growth.

Consumption Stocks: Gained 6.2% this week.

Real Estate: Up 4.9% this week, with an 18.8% rise for FY 25. This sector had triple-digit gains last year.

Pharma: Made a comeback with a 4.2% increase this week, now up 3.1% for FY 25.

Metals: Although muted this week, metals have gained 19.1% for FY 25, making them the front runners for the year.

Underperforming sectors included:

Public Sector Enterprises and Banks: These sectors were the losers this week, affecting some portfolios negatively. Despite this, public sector enterprises have performed well on a yearly basis.

Energy Stocks: Remained flat this week with a 3.2% increase for FY 25, showing slowed momentum compared to last year.

Overall, the market experienced a natural rotation with significant comebacks in several sectors, influencing portfolio performances accordingly.

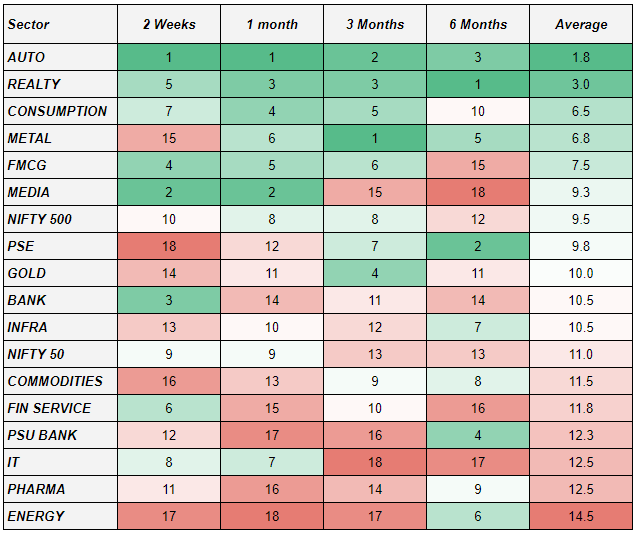

Public Sector Enterprises and Banks: Previously top-ranked over six and three-month periods, these sectors have now slipped to the bottom.

Metals: Also declined in recent rankings.

Consumption and Real Estate: Both have slowed down in ranking.

Autos: Remained consistently at the top across all periods (two weeks, one month, and three months), making it the best performing sector.

Other Top Sectors: After autos, the next best performers are real estate, consumption, metals, and FMCG.

Energy: Has been pushed down to the last stage in the rankings.

Overall, while some sectors like public sector enterprises, banks, metals, consumption, and real estate have seen declines, autos have consistently led the performance charts.

WeekendInvesting Strategy Spotlight

You Can’t Ignore This Index!

The Nifty Next 50 Index (Nifty Junior) is a crucial index that has significantly outperformed other indices since November 2023.

Key points about its performance and characteristics include:

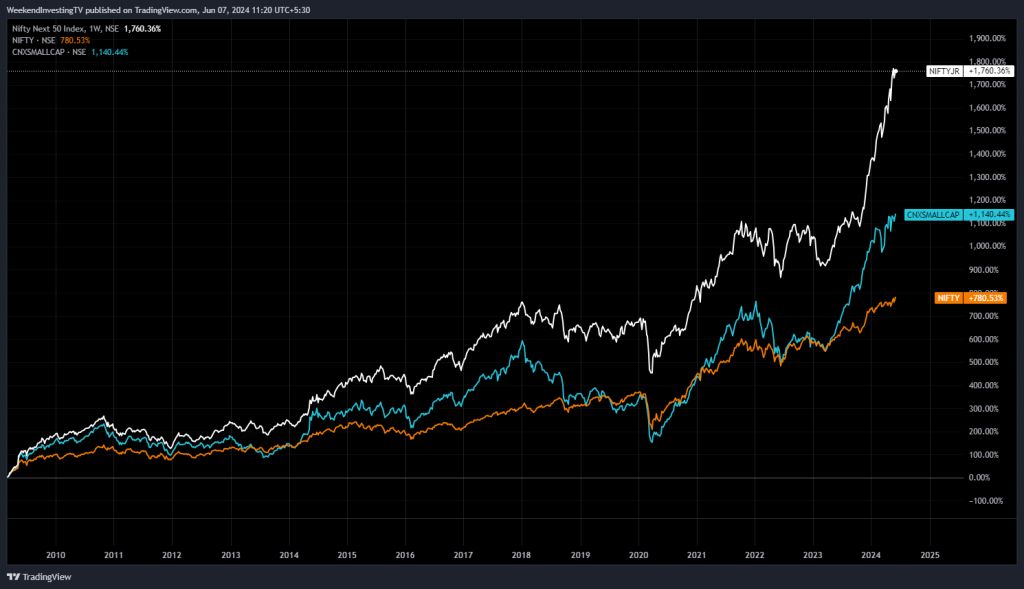

Long-Term Performance: From the 2008 GFC bottom, Nifty is up 780%, CNX Small Cap is up 1140%, but Nifty Junior has outperformed both, with a 1760% increase.

Recent Performance: Since November 2023, Nifty is up 22%, Nifty Small Cap is up 35%, Nifty Mid Cap is up 38%, but Nifty Junior has surged by 59.6%.

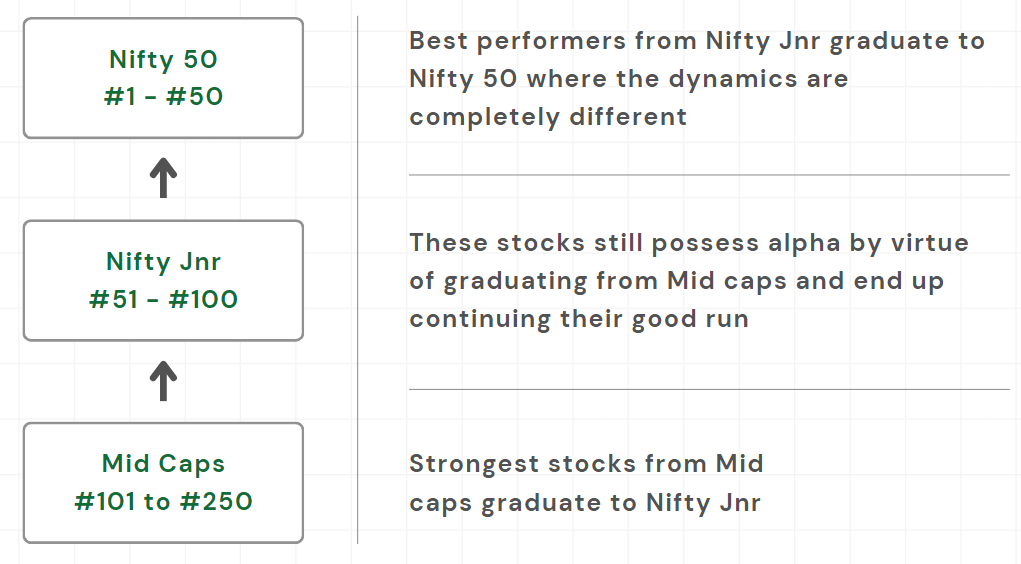

Nifty Junior includes the best-performing mid-cap stocks (ranked 101 to 250 by market cap). These stocks often rise into the Nifty Junior from the mid-cap segment and may graduate to the Nifty 50. However, they tend to perform best while in the Nifty Junior due to less exposure and over-research compared to when they move to the Nifty 50.

When Nifty 50 stocks drop into Nifty Junior, they often start performing well again as investors move out.

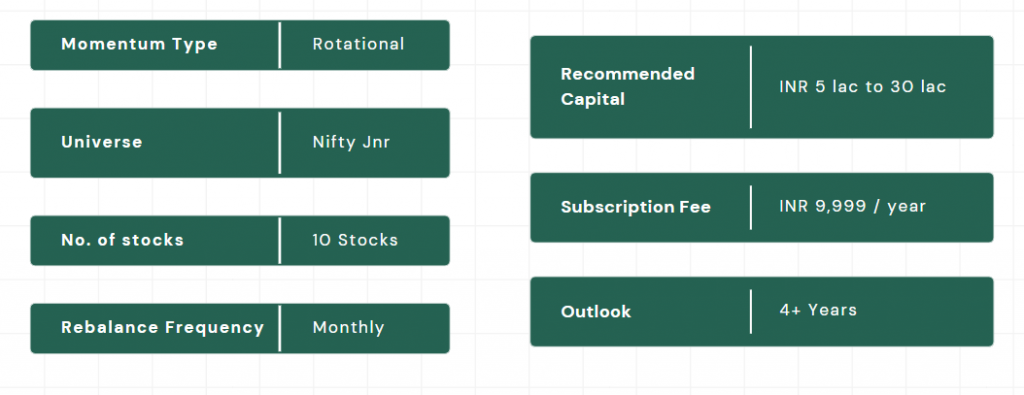

Mi NNF 10 strategy focuses on extracting alpha from the Nifty Junior while minimizing downside risk through a monthly rotational strategy. This involves replacing losing momentum stocks with stronger ones, leading to consistent outperformance over the years.

The Nifty Junior’s unique position and dynamic composition make it a prime index for capturing high growth potential with systematic risk management.

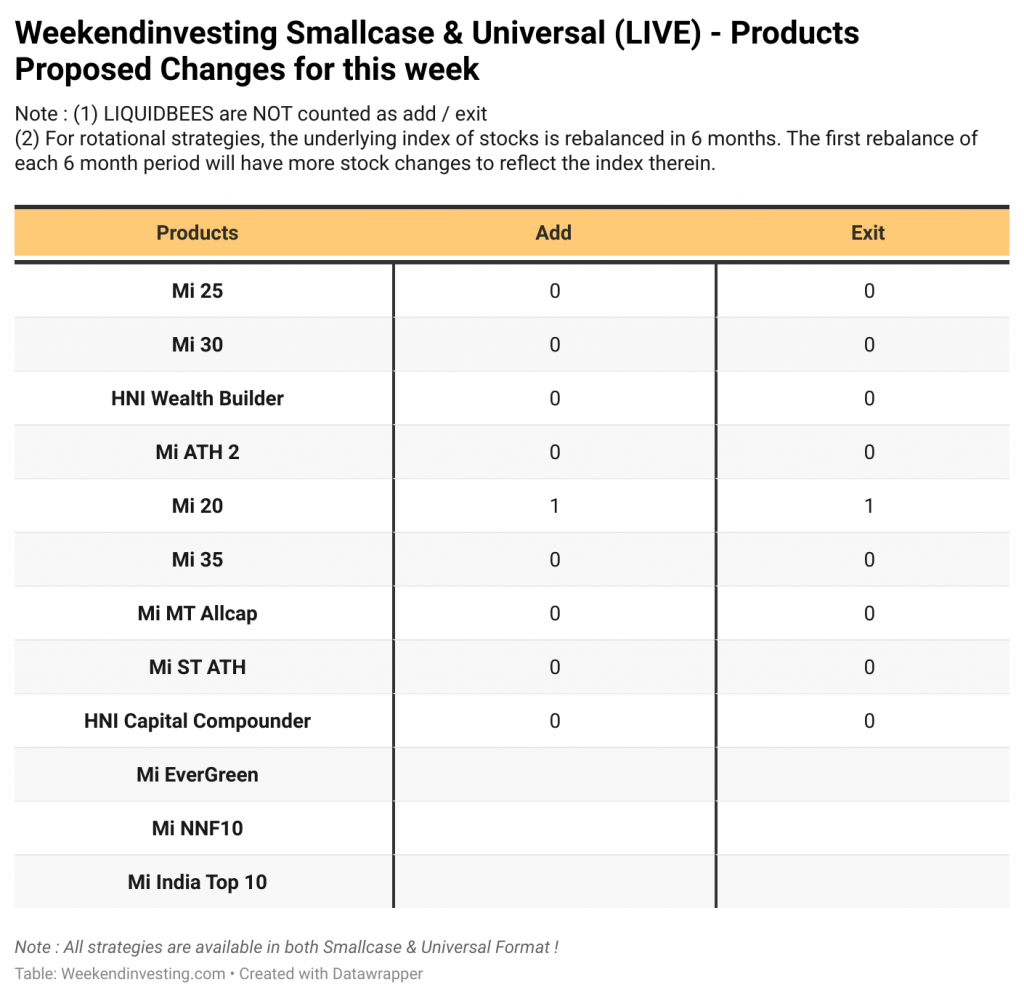

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

Introducing M Profit

That’s it for this week. See you in the next week’s review.